The Match Out: Banks underpin a rebound for the ASX, UK inflation cools

It was a good day across the market with the banks keying off better than feared updates from Bank of America & Morgan Staley overnight to rally for a 2nd straight session, the “Big 4” accounting for over 50% of the day’s gains as the index pushed higher into the close, thanks in part to better inflation data from the UK that was released at 4pm our time.

- The ASX 200 finished up +40pts/ +0.55% at 7323

- The Energy sector was best on the ground (+1.7%) while Financials (+1.49%) & Property (+0.90%) were also strong.

- Materials (-0.56%) and Communications (-0.34%) were the weakest links.

- UK inflation data was released at 4pm our time and was lower than expected, Headline CPI for June +7.9% YoY v 8.2% Exp while Core Inflation printed 6.9% v 7.1% Exp.

- The MoM result of +0.1% (v 0.4% Exp) was down from 0.7% prior and is another sign that global inflation is cooling.

- Woodside (ASX: WDS) +1.41% released solid 2Q production numbers this morning, reconfirming FY guidance for both production & capex.

- Rio Tinto (ASX: RIO) -0.74% guided to Iron Ore production at the top end of FY guidance, although 2Q production in other commodities was weaker. High Iron Ore output is a negative for prices and another reason we maintain a cautious stance towards these bulks.

- Northern Star (ASX: NST) -5.83% stuttered as they guided to FY production at the lower end of the range..

- Lendlease (ASX: LLC) -2.34% down again after yesterday’s job cut news, with analysts saying the news is supportive of softer growth, not better profitability.

- Ampol (ASX: ALD) +4.36% rallied after reconfirming guidance for the 1H.

- Whitehaven (WHC) +2.79% traded back up through $7 and looks good, New Hope (NHC) +4.08% outperformed and is back up above $5.

- Commonwealth Bank (ASX: CBA) +2.03% was solid with UBS saying they are a good chance of beating on their NIM’s when they report on 9 August.

- Regal Partners (ASX: RPL) +0.77% inched higher on a solid update out overnight, passing their $1bn of new FUM target for the year while pocketing a nice $7m performance fee.

- Iron Ore was ~1% lower in Asia today weighing on the Iron Ore stocks, FMG cut to SELL at Citi didn’t help.

- Gold was down US$3 however remains firm at ~US$1975 at our close.

- Asian stocks were okay, Hong Kong was down -0.39%, Japan +1.85%, while China was flat.

- US Futures are just in the green.

ASX 200 chart

.png)

Woodside Energy (WDS) $36.05

WDS +1.41%: 2Q production results out this morning for the energy company we hold on the Flagship Growth Portfolio, with the high notes hitting the mark. Sales revenue for the three months to June 30 was $US3.08bn, in line with expectations although it was down 10% YoY given weaker realised prices. They reconfirmed FY production guidance of 180 to 190 million barrels of oil equivalent and still see capital expenditure of between $6 billion and $6.5 billion.

- A solid update from WDS today, which does not change our view on the stock.

.png)

Northern Star (NST) $12.59

NST -5.83%: when most gold stocks traded flat or higher, Northern Star struggled following a soft 4Q production update. Gold sales of 426koz in the last quarter, taking their FY23 total to 1.56moz, at the low end of guidance. Costs in the last 3 months were lower than the year’s average of $1,759/oz on an all-in-sustaining basis, though this was at the higher end of guidance. The result is a likely miss to EBITDA expectations when the company reports next month, with the company guiding to around $1,225mn on an underlying basis. Guidance was also at the lower end of expectations, expecting costs to be around flat into FY24, while sales are expected to climb marginally to 1.6-1.75moz while the company plans to spend $1.15-1.25b on capex. While it’s a disappointing update, Northern Star is a solid gold mining company earning reasonable margins at current prices while guidance looks on the conservative side. We would be interested in NST if it continues to underperform our current gold exposure in EVN and NCM.

Rio Tinto (RIO) $116.01

RIO -0.74%: the miner announced 2Q production numbers today, a mixed bag coming with small amendments to their guidance. Iron ore shipments were down marginally to 79.1Mt in the quarter, though the company pushed guidance for the year to the upper end of the previous range. Their iron ore pellets operations struggled in the period, -19% yoy, though this is a small contributor. Bauxite production was soft on planned outages and machinery downtime, -5% yoy, and guidance was unchanged. Mined copper was stable. though refined copper output was weak and guidance was cut 20% as a result while costs will be higher than previously expected as well. Overall, it was an ok half from a production standpoint, though minor downward revisions from analysts are likely.

.png)

Broker moves

- South32 Cut to Neutral at Citi; PT A$4.05

- Fortescue Cut to Sell at Citi; PT A$19.40

- New Hope Raised to Neutral at Citi; PT A$4.50

- Ansell Cut to Neutral at JPMorgan; PT A$25

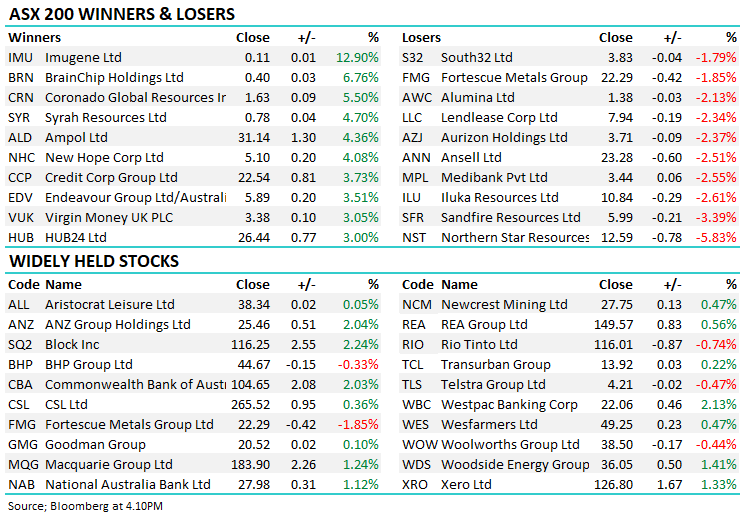

Major movers today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

7 stocks mentioned