The strongest thematics in small caps today

Small caps have put in more than 12-months’ worth of typical performance so far this financial year, and show no signs of stopping. However, the small end is far more diverse than the big end. So to help shortlist the strongest thematics, we asked the experts.

Mining and construction rising from cyclical low

David Allingham, Eley Griffiths Group

Companies that are exposed to investment in mining and construction are very well positioned to deliver earnings growth into FY19. Australian businesses took a 5-year capital expenditure holiday from 2012, but it is now clear intentions have changed.

A good data point supporting this view was the October NAB Business Conditions Survey which showed business conditions rose 7 points to +21 in October, the highest level since the survey began in 1997.

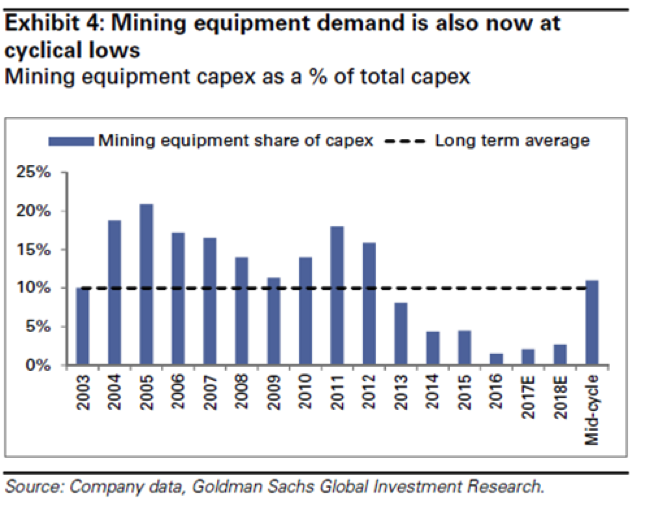

The strong survey data was led by mining and construction. The chart below also highlights how depressed mining equipment capex is, and provides some insight to where mid-cycle spend could be in 2020.

A multi-decade thematic still in its infancy

Romano Sala Tenna, Katana Asset Management

It is important for investors to recognise that 2017 will go down as the year that vehicle manufacturers’ commitment to EV’s transitioned from niche to mainstream.

In 2017, vehicle manufacturers from BMW to Volvo drew a line in the sand and irreversibly committed to a new paradigm. This will take time to play out, but this thematic will run for 30+ years.

Yes, 30+ years… Rarely do we ever get a thematic of that magnitude.

The main EV and battery ingredients – graphite, lithium, copper, nickel and cobalt – cobalt is the rarest in terms of commercially viable deposits.

Of the 3 ‘new age’ minerals, graphite is in abundant existence and lithium whilst a little rarer is still widely distributed. In time we will hence see ample supplies of both graphite and lithium meet the market.

But cobalt is somewhat different. At the current level of production, there is just over 50 years of known reserves available. And with the rise of EV’s, the demand for cobalt will grow at strong rates. If we assume a particularly conservative growth rate of 10% per annum, that’s a doubling of demand approximately every 7 years. On that trajectory, the known reserves will be consumed in less than 19 years. If demand grows at 15% per annum, existing reserves will be consumed in just 15 years.

Another factor that makes the cobalt play even more compelling is that currently 60-65% of all production is sourced from the Democratic Republic of the Congo (DRC). For China the issue is even more pronounced given that 93% of their supply is from the DRC.

Sexy stories need the fundamentals to back them

Chris Prunty, QVG

There are several themes that have taken the market’s fancy. Dominant themes include:

- Electric Vehicle Commodities

- East Coast Infrastructure

- Mining Services Recovery

- Milk to China and

- Globally Focused Fund Managers

It’s hard to fault the themes themselves and they’re all captivating the market because they all contain a kernel of truth at their core. For example, Chinese consumers love ‘clean green Australian dairy products’, but does this make every company in this space compelling? We’re not so sure.

Call us old-fashioned, but we can think of one ‘milk to China’ company on 140x trailing revenue and fail to see how this is a good bet. You could probably throw a few of the medical marijuana stocks in with this lot; long on promise and short on revenue and cash flow.

We’re boring bastards, so we spend almost no time on pre-earnings stocks. Sexy stories only excite us when they’re backed with some meaningful numbers!

Look for quality exposure to China and cobalt

Matt Langsford, Terra Capital

There are two themes that may have been around for some time, but we think still have merit.

The first is businesses with exposure to the Chinese consumer. By now everyone in the market has seen what can be achieved if companies can get access to the right markets in China. We think this theme will continue to play out for many years.

The second is the battery-related commodity thematic and in particular, cobalt. Importantly though, investors must be specific about what type of cobalt projects they’re investing in. For small-cap investors, ideally, you want to be buying a sulphide ore project, which will generally have higher grades and far lower capex.

In contrast, lateritic cobalt projects will have lower grades, high reliance on by-product ores and will have a capex figure approaching $1B meaning that the vast majority of these projects will simply not get into production. In addition, you would ideally have your project in a first world location. Companies with the characteristics I have described will be in significant demand in the years ahead.

Beware the hot money in tech

Dean Fergie, Cyan IM

Technology is dramatically changing the way we live. From transportation, logistics, media, communication, security, finance, and retail, almost every sector has been impacted by technology.

However, the hype surrounding this sector is reminiscent of the tech bubble of the late 90’s. There are countless ASX listed companies with market capitalisations in excess of $100m that are not even close to producing $1m in revenue, let alone a profit.

Even though early investors have done well to date from these companies, I would think very carefully before allocating ‘hot’ capital into these stocks. The current expectations implied by these valuations just appear too optimistic.

What’s driving the stellar run in small caps?

In the first part of this series, our contributors discussed the reasons for the surge in performance of small caps so far this financial year: (VIEW LINK)

4 stocks mentioned

4 contributors mentioned