The two ASX companies receiving rare post-earnings upgrades

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 4,274 (-0.72%)

- NASDAQ - 12,938 (-1.25%)

- CBOE VIX - 19.90

- FTSE 100 - 7,516 (-0.27%)

- STOXX 600 - 438.86 (-0.95%)

- US10YR - 2.902%

- USD INDEX - 106.65

- GOLD - US$1,779/oz

- WTI CRUDE - US$87.77/bbl

EARNINGS WRAP AND PREVIEW

If Tuesday was owned by the report of The Big Australian, Wednesday was owned by the report of The Big Australian Laboratory (ASX: CSL). Net profits fell slightly while revenues rose slightly. The guidance didn't pass the investors' test either and as a result, shares fell (taking the whole healthcare sector with it as well.) Nonetheless, there are still those who back the company's vision well into the future.

Further disappointments at Magellan (ASX: MFG) too, with a fall in net profits not doing the fund manager any favours. In just one year, FUM has fallen by nearly half but that's not stopping some from being optimistic about its revival.

In other news, if you thought in-line results aren't good enough anymore, spare a thought for Santos (ASX: STO) which reported a 300% jump in net profits but still copped an intraday fall. The good news for shareholders is at least one fundie who spoke to Livewire thinks there's 20% upside to come!

In better news, Brambles (ASX: BXB) saw net profits increase as well as its final dividend. But it was CEO Graham Chipchase's comments about passing on costs that probably gave shareholders a sigh of relief. Profits were also higher and enjoyed at Bapcor (ASX: BAP) and Super Retail Group (ASX: SUL).

If you were looking for some reprieve in this mad season, then I'm sorry to say you won't be getting it today. Among the highlights: ASX, Blackmores, Evolution Mining, Transurban, ProMedicus, Medibank, Origin Energy, and Treasury Wine Estates.

STOCKS TO WATCH

I've come with nothing but bad news from the brokers over the last week. Unless you count downgrades as good news in the sense that it could be a contrarian indicator.

But today, the good news returns. Hidden in a whirlwind of downgrades, there is one company getting a lot more love than some of the other names investors like to hang their hats on. Our first stock to watch today is Challenger Financial (ASX: CGF).

Both JP Morgan and Citi have elevated the company to neutral from underweight/sell statuses. The results highlighted some analysts' prior concerns about the company's earnings profile as well as a poor showing from its latest bank acquisition.

Citi viewed the FY23 guidance as disappointing (probably not helped by the following line):

It is becoming apparent the Bank is unlikely to realise the expected benefits in the time frame anticipated.

But the 10% fall in shares following the result, as well as a solid outlook statement may have provided the impetus to make the upgrade possible. JP Morgan had the same view - the stock price's savage fall was more enticing than the dour outlook.

The other stock worth watching is Seek (ASX: SEK). Following the 81% boost to its full-year profits, Morgans and UBS have both initiated add and buy ratings respectively. Morgans believes prices may need to be raised if necessary - and that it has the power to do so.

Even more amazing? Morgans thinks the dividend for Seek this time next year will be 42c/share! Now that's bullish.

ECONOMIC RECAP

The Federal Reserve's latest minutes gave some cause for relief for equity markets, after it flagged smaller rate hikes may be on the horizon. Even more of interest, the Fed admitted that there is a possibility that they could tighten more than they expected or need to. But this is the part that really got my attention. If inflation is public enemy number one, then inflation expectations are public enemy number 2:

Participants judged that a significant risk facing the committee was that elevated inflation could become entrenched if the public began to question the committee’s resolve to adjust the stance of policy sufficiently.

The next event for central bank watchers everywhere will be the Jackson Hole symposium, with the next Federal Reserve meeting not coming up until mid-September.

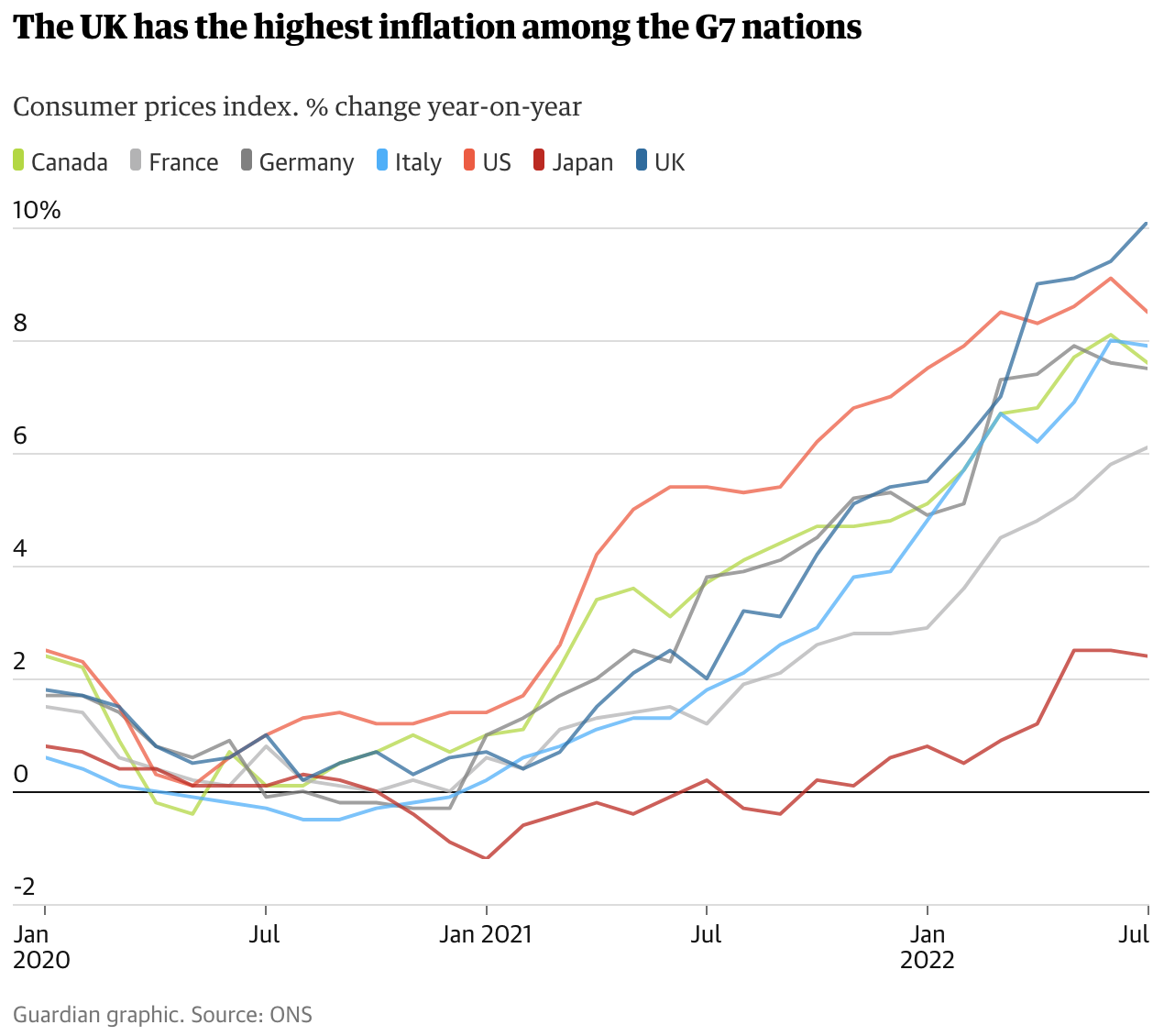

Meanwhile, inflation has unfortunately clocked up a 10-handle in the UK. UK consumer prices increased 10.1% year-on-year in July as food and fuel prices continued to soar. Some economic commentators also say the 10-handle from last month also makes the Bank of England's 13% inflation forecast look more optimistic rather than a worst-case scenario. Yikes.

And just to show the challenge that will be coming for Boris Johnson's successor, The Guardian has put this chart together of inflation in the G7.

THE CHARTS

The next edition of Signal or Noise (our new macro and economics-centric series) is due soon. One of the topics we are going to be chatting about in that episode is featured in our favourite charts segment today - the veracity of recession chatter.

Enter the Bank of America Fund Manager Survey, which seems to suggest that recession (as a surveyed issue) is back at near April 2020 and March 2009 levels. With a 2s/10s curve at -40 basis points, there's a lot of merit in this fear. But understandably, everyone's pretty sick of the discussion too.

I wonder what that says about professionals vs retail investors in this environment...

THE QUOTE

In the past, the massive imbalance between China’s healthy exports and weak imports was a drag on the global economy, depriving workers elsewhere of the incomes they would have earned selling goods and services to Chinese customers. But now that inflation and commodity shortages are bigger concerns than underemployment, China’s troubles may be just what the rest of the world needs.

Matthew Klein of the Financial Times wrote this piece for Markets Insight and it really got my attention. While I have no doubt the zero-COVID measures are a fascinating approach to handling these crazy times, it is slowly creating a trade surplus that the rest of the world may benefit from. Having said all this, never doubt the power of the People's Bank of China to pump up the stimulus when the rest of the world is doing the opposite.

One additional note - Matt mentioned the underemployment problem that China has, but I suspect that an even bigger problem for the Xi administration will be youth unemployment. When one out of every five 18-24 year olds don't have a job right now, that doesn't bode for good reading.

THE TWEET

Today's report was written by Hans Lee.

GET THE WRAP

If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

3 stocks mentioned

1 contributor mentioned