Three ways to use ETFs for global thematic investment with URNM

Exchange Traded Products (ETP) are securities that can be bought and sold on a regular stock exchange to gain exposure to a portfolio of assets much like a regular managed fund.

Most readers will be familiar with the idea, especially with the strong market growth of branded products like the iShares series from Blackrock, the SPDR series from State Street, and local product offerings by homegrown firms like Betashares.

To follow up my last wire Is uranium in a structural bull market I will explore three different ways in which self-directed investors can use Exchange Traded Funds (ETFS):

- Buy the exchange traded product to gain exposure to the target investment theme.

- Use the easily obtained performance history of the product to analyse the theme.

- Study the disclosed holdings of the product to surface single-stock ideas.

There is nothing complicated about this approach, but you may find it useful to hear how a fund manager makes use of ETF products to short-cut their research process.

Why is global thematic investment difficult?

Glad you asked that question...

Thematic investors are those people who are not satisfied with fixed labels and categories.

In my case, I spent my early career developing quantitative investment strategies. This soon taught me that the very smartest people in the room are sometimes best left in that engine room while you go locate a lifeboat. Portfolio management teams often adhere to rigid standards on how they treat industries and sectors.

When is technology properly technology?

Is technology still technology if every advertiser uses the same search provider?

Is a search-driven advertising company like Alphabet NASDAQ: GOOGL defensive, because everyone needs it, don't you know? Or is it cyclical because advertising revenues are?

Is a semiconductor firm like Nvidia NASDAQ: NVDA cyclical because everyone knows that the corporate IT spend is tied to upgrade cycles? Or is it the new defensive because Generative AI models are getting a corporate plastic brain update every other month?

I may love the thematic approach to investment, but I am not stupid.

The groupings and categories of investment exposure that people are seeking are constantly changing. Humans are a dynamic species. We are uncomfortable with those changes we do not foresee, but even more uncomfortable with a world that does not change.

This leads me to my own take on thematic investment as a style:

Thematic investors adapt their categories to describe the world as it changes.

You can think of this as a naming exercise:

Once you tag, bag and name an investment trend you have tamed it.

This is how I think that most people actually operate, consciously, or otherwise.

Of course, when you put it that way, it should be obvious that this is a hard ask.

How could you, me, anybody, know what is the next cab off the rank?

Worse, how could we know if the risk of following any visible trend is warranted?

I won't pretend to know the answers to those questions, but I can provide a fairly simple set of procedures to help you navigate through a changing world.

Fortunately, there are profit-driven organisations that know this, and you can study what they are doing to get a sense of how the tea leaves are falling on collective behavior. Investment trends generally parallel developments in industry revenues and profits.

An example from the uranium market

If you speak to people in product development for financial services, you may detect a certain note of resignation to a very simple fact.

Product sales are driven by investor interest.

Since I have worked in product development, I do not wish to suggest that the industry has no higher purpose and is solely intent on flogging new products to make more money. That would be churlish, and not very honest, for someone who has practiced this dark art.

Actually, the challenges of a competitive industry require product managers to always be looking ahead, to see what is coming, but not so far ahead as to have no customers.

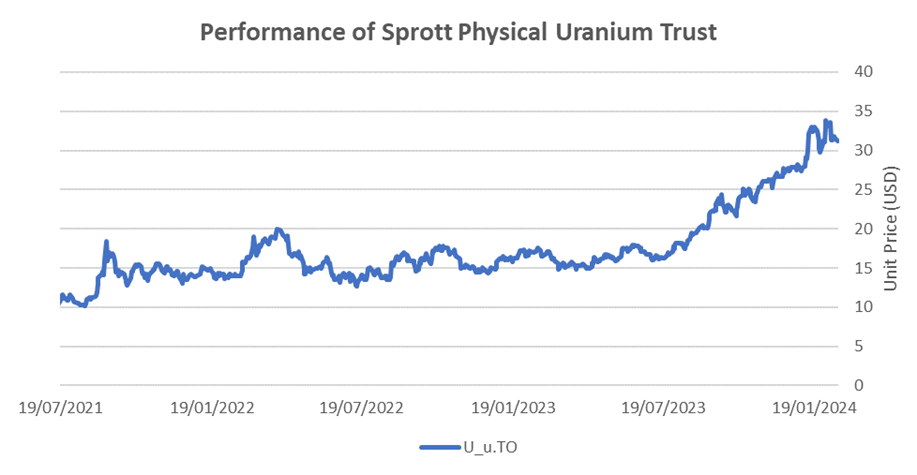

This can be well illustrated with the example of the Sprott Physical Uranium Trust.

This product, launched by respected Candian resources specialist Sprott Asset Management, hit the Toronto board TSX: U_u back on 19-July-2021. You can see from the chart that they were a little early to that launch. The market did not pick up until the middle of last year.

However, the true picture is even more interesting.

Sprott created their product by buying the Uranium Participation Corporation TSX: UPC, which were out a little earlier with the idea of creating a physical uranium investment vehicle.

Now you can appreciate just why thematic investment is both a real thing, and a difficult thing to get right. You can be right years ahead of time, but still not realise product success.

The Sprott enterprise was clearly on a good track to launch their product, although they were too early by two years. UPC were also on the right track, but too earlier.

In thematic investment, people won't mind your crimes against language, if you make money. They won't be keen to adopt your view of the world, if it does not make current sense.

Once you understand this key point, monitoring the thematic product launch cycle can be really helpful. You don't have to buy the funds, but you can use them as proxy indices to conveniently track how things are doing.

This is what I do.

Since I get paid to do it, I go one step further and create my own thematic indices where there are no visible ones, but I think something might be worth following, out of interest.

I am doing this now for Non-State-Owned China Enterprise.

When I am done, I might share that.

A simple example of the value of a focused thematic ETF

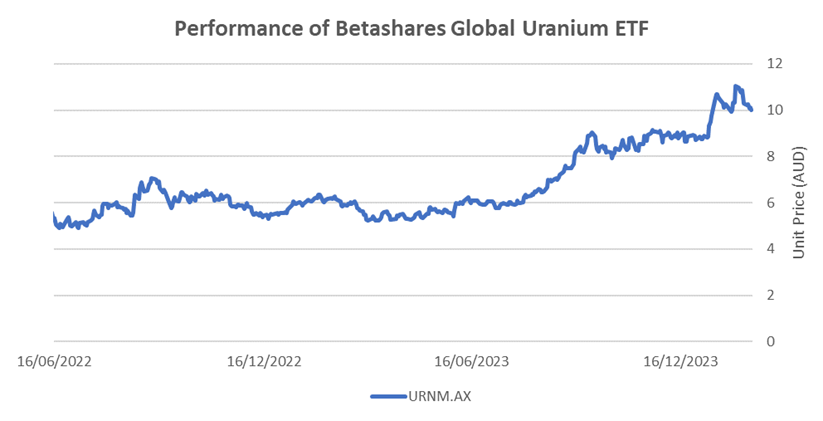

Since I wrote at length about opportunities in ASX-listed uranium stocks, but mentioned that the global industry is pretty concentrated, we can use this area as a further example. There is a locally listed product called the Betashares Global Uranium ETF ASX: URNM.

The Betashares Global Uranium ETF provides exposure to uranium and uranium mining. Source: LSEG.

Of course, that price chart is in AUD, not USD, but you get the picture.

Flattish, and then up and to the right.

Nobody should ever buy an investment product on the basis of analysis that shallow, but you can appreciate the key point. Not only can you use a listed ETF to invest, but you can also use the products to easily track how the investment idea is progressing.

These are the first two uses on my opening list.

But wait... there is one more.

In the time of the ancients, after the Pharaohs, but before Bitcoin, the hoi polloi, like you and me, could go look up the S&P/ASX 200 benchmark and see what was in it.

These days the lawyers made that opportunity go away, with the magic of licensing.

Now you, me, every slave on their off day, may not gaze at the Sun King without payment. They call this progress, but I find it personally vexing.

Call me peculiar but, as an investor, I like to know what I am actually buying.

I have one cardinal rule of ETF investment:

I only buy ETF instruments that publicly disclose their full holdings.

The Betashares URNM ETF ASX: URNM meets this requirement.

So does the Sprott Uranium Miners ETF NYSE: URNM.

This is great since I can then see how similar their holdings are.

If you look yourself, you will find that they are pretty similar.

However, the ASX listed one has a Managment Expense Ratio (MER) of 0.69% while the New York listed one has an MER of 0.19%.

These days, our regulators insist that you need a degree to manage money. I have two, but I don't need them to figure this one out.

Other things being equal, I would buy the one in the USA.

However, you would need a US brokerage account and a tax adviser who can help you deal with the end of year tax reporting in more than one currency.

This is doable, but maybe not worth it for 0.50% of smaller amounts of money.

The value of ETF products to target research.

This brings me to the final point of my "three uses" for a good ETF.

Remember, my cardinal rule. I must know what is in the biscuit tin before I buy it.

This matters greatly.

Any ETF is properly an assortment of delicacies, possibly mixed with poison.

You may have some allergies.

You may not want, at this time, a global ETF that has Russian stocks in it. There again, you may be okay with a small amount of poison, just so long as it is not too much.

You make these decisions because we live in a free country.

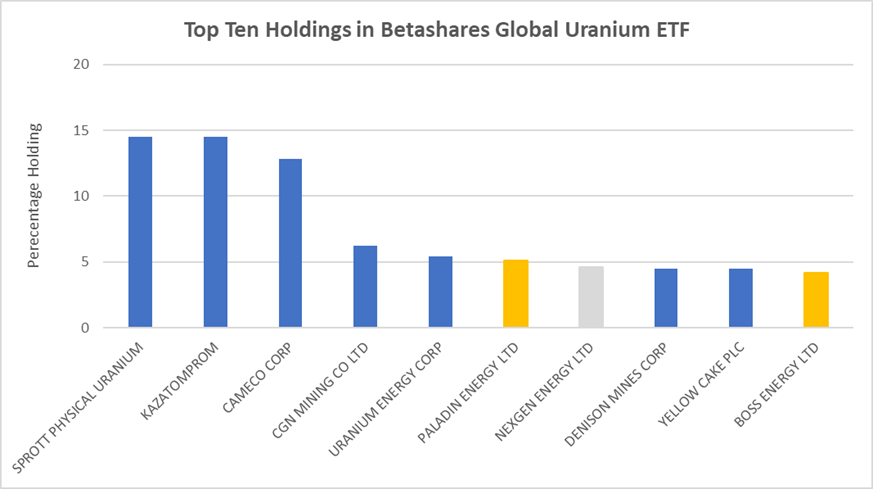

Let's open that URNM Uranium ETF tin. It looks similar, whether here or in the USA.

Top ten holdings of Betashares Global Uranium ETF. Source: Betashares and LSEG.

Notice that the biggest holding, at 14.5% is our friend the Sprott Physical Uranium Trust.

Congratulations! You now own high purity uranium oxide, also known as "yellow cake".

I think this is a good thing. I would like some of that, and this is not gold bars.

I cannot stick 10 drums of yellow cake on my Canberra apartment balcony.

Look at Kazatomprom. You now own the leading global uranium producer.

They are in Kazakhstan, but that is not Russia.

You also own my favourite the Canadian uranium and fuel service giant Cameco NYSE: CCJ.

Then we get into a listed subsidiary of the Chinese player CGN Group HKG: 1184.

Without belabouring the rest, you can see the two ASX names I mentioned in my previous wire on uranium Paladin Energy ASX: PDN and Boss Energy ASX: BOE.

There is also an interesting dual-listed Canadian developer in the high-grade Athabasca Basin named Nexgen Energy ASX: NXG. You get that, as well, so there is a nice spread.

Since I am not you and have access to buy more than one of these securities, I would likely junk half of them, and just go with the Sprott Physical Uranium Trust, less of the Kazakh firm, made up with more of Cameco, and throw in Paladin Energy, Boss Energy and Nexgen Energy. That is before I went and got a good update in the progress of Denison Mines.

Several CEOs prior I had a fine dinner with the leader of Denison at the expense of a friendly Canadian broker who was visiting Sydney with his client.

These events can warp your judgment.

I would have a look at Denison also.

However, that is just me talking. The benefit of well targeted and transparent ETF product is that the public disclosures give you a good leg up on your own research.

I don't only rely on this source of information.

Sometimes I get a free lunch or dinner.

You won't suffer that handicap so your judgment will remain unclouded.

Don't worry, the yellow cake is in some French speaking province somewhere.

It can't hurt you now.

Happy investing!

Photo by Andrea Lightfoot on Unsplash. Cropped. Yellow Cake.

3 topics

8 stocks mentioned

1 fund mentioned