Too good to be true? Why private equity can outperform during uncertain times

Over the last two decades there has been a meteoric rise of private equity.

In Australia alone, there is some $77bn in private markets, with private equity and venture capital funds raising more than $5.6bn in 2020. Since 2010, assets under management in private equity has almost doubled, from just over $20bn to just under $40bn in 2021 (Preqin, 2021).

The rise of private equity follows a global trend of wealth flowing into private markets. At the end of 2020, private markets grew to more than US$7.4tn, with private equity accounting for nearly half of the total assets.

Now, with growing uncertainty in investment markets - and access to private equity slowly increasing for Australian investors – there is a renewed focus on the value of private equity. It is timely to consider how private equity works and why investors want access during uncertain times.

Diversification... the only free lunch

You cannot open a paper these days without seeing some headline about private equity, whether it be a superfund talking about increasing their exposure or a bid by a private equity firm for a major Australian company. What is it about private equity that has everyone so excited?

It is no secret that the world’s largest institutions, and the ultra-wealthy, have for years been turning to private equity to help strengthen their investment portfolios.

But, how has it ‘strengthened’ their portfolio? The answer is threefold, diversification, diversification, diversification. The breadth and depth of private markets, when compared to their public counterparts, helps institutions and the ultra-wealthy achieve diversification. A major component of diversification is finding investment opportunities that are uncorrelated to the typically large exposure to listed investments that are held by all investors (whether big or small).

It is not just the institutions or the ultra-wealthy who may benefit from greater diversification. Whether it be a buyout, growth or real asset (real estate, infrastructure) strategy, an investment in private equity - or perhaps more accurately, private markets - is more often than not, going to improve the diversification of a typical investor’s portfolio.

This is largely because of two reasons:

1. Concentrated asset allocation

First, the typical investor’s portfolio comprises just three types of assets, namely listed equities, potentially some fixed interest securities (i.e. bonds), and residential real estate.

In comparison to the breadth and depth of private markets, this looks fairly concentrated and, in many ways, highly correlated to each other. Finding an investment class that can act as a defensive anchor or inject potential outperformance is important for investors, regardless of the size of their investment portfolio

2. Size of Public vs Private Market

Secondly, there are just a lot more companies in private hands than public hands (i.e. listed on the ASX).

In other words, the universe of privately-owned businesses is significantly larger than the universe of listed businesses represented on listed equity markets (such as the ASX). As such, the investment opportunity set for private equity is much larger than listed equity markets and provides more diverse return drivers of investment performance.

To give a sense of the enormity of the difference, the Australian Bureau of Statistics (ABS) indicated that there were over 2.4 million actively trading, private businesses in Australia as at 30 June 2021. This compares to just 2,228 public companies listed on the ASX as at the same date. Although the vast majority of the privately-owned businesses in Australia are unlikely to be a target investment of a private equity firm (given they are just too small), there are an abundance of private market opportunities compared with public markets due to its sheer enormity.

The search for higher returns

However, it is not just that there are more companies in private hands, which can make private equity attractive, it is the set of skills brought by the fund manager to the task.

The value proposition of a skilful private equity manager is in their ability and expertise to identify and create value. How do they achieve this? By identifying and taking ownership in underachieving businesses and strengthening them by implementing operational improvements that lead to increased revenues and profitability. This requires more than just money, it requires a set of skills that can be brought to the business.

If you compare that with investments in public markets the strategy is different. Investors in public markets, whether they be mum and dad investors or listed equity managers, invest typically on the basis that they think the particular company will do better in the future than it is doing today. In one way or the other, they are making a bet that the market has simply undervalued the company and will eventually realise and correct that undervaluation.

Whether it is a mum and dad investor, or a listed equity manager, improving the operational processes of a business is highly unlikely to be on their list of things to do. In fact, for either, the ability to influence a businesses’ operations is likely to be limited. Perhaps the listed equity manager can gather enough votes to influence the Company’s board. Even then, that is generally only possible if the listed equity manager owns a significant proportion of that businesses’ equity.

When things are uncertain, we all turn to what we know best. This is no different for investors. As investment markets grapple with the uncertainty of a potential global recession, investors in listed equity markets typically turn their attention to businesses that have a history of generating strong and stable revenues, rather than those with the potential to do so in the future. In this type of environment, the ability and expertise of a private equity manager to tangibly improve the revenues and profitability of a business becomes a truly differentiated source of investment performance when compared to the fear and uncertainty that listed markets can be faced by.

Historically, the performance figures support the private equity investment strategy rationale over its listed market counterpart. As you can see in the below chart, $1 invested into listed markets returned $1.53 by 2021. While this can be considered a strong return, $1 invested into private equity during the same period returned an impressive $2.36. For example:

(Historical performance is no indication of future performance)

However, this is clearly not a short-term anomaly. Dating back to 2001, private buyout funds, (which are one of the more prominent private market investing strategies) have consistently outperformed their Public Market Equivalents (PME) year on year as seen in the graph below:

Source: Hamilton Lane Data via Cobalt, Bloomberg (January 2022)

(Historical performance is no indication of future performance)

Lower return volatility and historically higher returns... too good to be true?

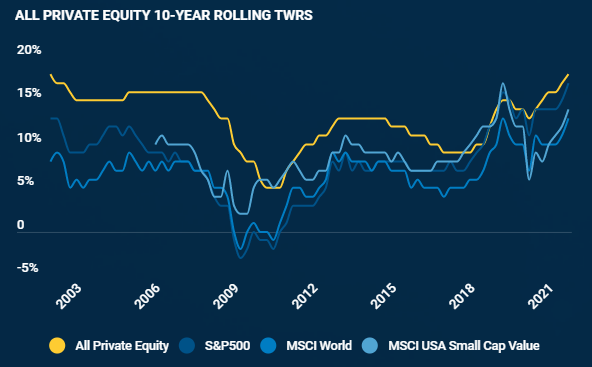

The chart below shows that private equity investments have historically exhibited lower return volatility (i.e. the variability of the value of the investment) than listed equity markets:

Source: Hamilton Lane Data via Cobalt, Bloomberg (January 2022)

(Historical performance is no indication of future performance)

We’re often told “if it’s too good to be true, then it probably is”. Does that mean the higher returns and lower return volatility of private equity is too good to be true? No!

The seemingly lower return volatility of private equity is a function of the difference between the ways that listed equity and private equity investments are valued. So, what is the difference?

The value of a listed company is determined by the market each day as the price that a buyer is willing to pay a seller of shares in that company. This can lead to significant volatility in the value of that company as the feelings (positive or negative) of investors towards that business can fluctuate from day to day.

In contrast, private equity investments are typically valued relatively infrequently by an independent valuer; at best every three months, however often even less frequently. Their values are therefore not subject to the daily fluctuations of investors’ feelings. Does this mean that private equity is less risky than listed equity? Again, no! It simply means that the way private equity is valued, is much smoother than the daily pricing of listed equity markets.

What are the implications of the pricing mechanism of private equity for investors during times of high market volatility? During a time of economic uncertainty the level of volatility exhibited by listed equity markets can increase dramatically. This heightened volatility can be disconcerting for investors, even for those that classify themselves as long term investors that should be able to stomach short term bouts of volatility. As such it makes sense for investors seeking to reduce the volatility of their portfolios without sacrificing investment returns (i.e. the holy grail of investing) to consider investing in private equity.

Private equity… now within Reach

Up until now, private equity has largely been the domain of institutions that have the capacity to meet the investment minimums of private equity managers (typically in excess of $10 million).

However, just as history has showed us, markets are often disrupted in the interest of their investors. We are currently seeing an intense focus on access to private equity. This has brought many fund managers to the table to consider how broadening access may be done responsibly.

This is a significant step forward. However, while investors should be excited about the growing access, they should also exercise caution and ensure they understand the differences in the way private equity works from traditional asset classes and the potential risks of investing in private equity.

3 topics