Trending On Livewire: Weekend Edition - Saturday 24th May

Have you heard about the TACO trade? It stands for Trump Always Chickens Out. Investors embraced it for weeks as shares gained, although it’s the bond market forcing Trump to back-off his destructive trade wars.

This week government bond yields have been rising again, after Moody’s downgraded US government debt on concerns it’s spending far too much, with no serious plan to reign in its binge.

Shares traditionally fall when bond yields rise, so is a correction coming? Tough to know, but as Wall Street investor Peter Lynch said more money has been lost trying to anticipate share market corrections, than in the actual corrections themselves.

Lynch means if you sell because you’re worried about the future, you’ll probably end up losing more in foregone gains if the market doesn’t correct. So perhaps the TACO trade is the way to go, although if bond yields push higher next week investors will get nervous.

For now, enjoy the weekend and all the best to anyone caught in the east coast floods. Here’s to to some smooth sailing and capital gains ahead.

Tom Richardson, Senior Editor, Livewire Markets

Meet the CEO behind Catapult's stunning 260% rise in the last year

Catapult has experienced a remarkable 260% share price increase over the past year, driven by CEO Will Lopes' strategic transformation of the company into a SaaS-focused enterprise. Emphasising the 'Rule of 40' - a combined 40% revenue growth and profit margin target - Catapult achieved a score of 31 in its recent full year results, with an 18% increase in subscription revenue and a 13% profit margin. With Livewire's inaugural Growth Series upon us, it was fortunate timing to be able to talk to Lopes about the results of one of the more exciting growth stocks currently on the ASX.

Bulls vs bears: Which sectors are investors backing and bailing on?

Top 3 Wires this Week

Here are the weeks top viewed or liked wires by our subscribers:

Some of the best wires from our Contributors this week

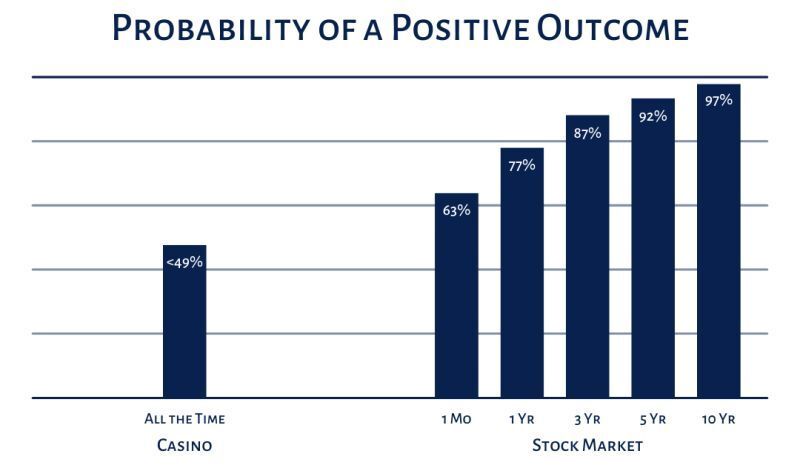

Chart of the Week: “The share market is a casino” - the data proves otherwise

I’m blessed to have great friends. They do everything in life right… except invest. Whenever I encourage them to start, they usually tell me: “I’d rather lose money at the casino.” But the market isn’t a gamble… at least not if you’re doing it right. A well-diversified portfolio held over time has historically been a rewarding bet. Over nearly every 10-year period, the market is up, as shown in our chart of the week. The S&P 500 has returned 14.45% annually over the past decade; the ASX 200, 7.56%. The real gamble isn’t investing, it’s staying out of the market and letting inflation quietly eat your savings.

Vishal Teckchandani, Senior Editor, Livewire Markets

Weekly Poll

It was a big week for markets. Did any of the following cause you to make any portfolio changes or your cash weighting?

a) RBA cuts rates to 3.85%

b) US bond yields top 5% amid deficit fears

c) Moody’s strips the Uncle Sam of its AAA credit rating

d) Bitcoin breaks US$110,000 as investors chase alternatives

e) No - I’m staying the course through the noise

LAST WEEKS POLL RESULTS

We asked "With U.S. tech once again defying gravity, many investors are leaning in. What’s your move?"

The poll shows 62% of respondents are holding steady, 17% were increasing their exposure, 15% were taking profits, and 7% were investing in discounted tech.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

2 contributors mentioned