UBS: Own "recession-detached" stocks (and 4 sector examples)

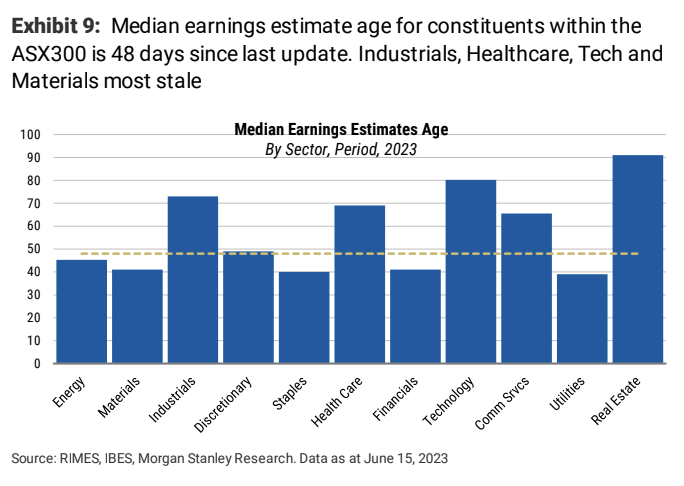

A recent data crunch by Morgan Stanley suggests a lot of companies have not handed down earnings updates for a long time. As of June 15th, the average earnings estimate age for ASX 300 companies was 48 days. Put another way, it's been 48 days since earnings guidance statements were revised on average.

In the case of companies like Metcash (ASX: MTS), the gap between the last earnings guidance forecast and the actual earnings was nearly six months. For the record, Metcash put in a record year for sales and earnings.

Fast forward one month from this paper and the companies handing down confession season guidance and actual earnings releases are providing some incredibly interesting reading for the Australian corporate landscape.

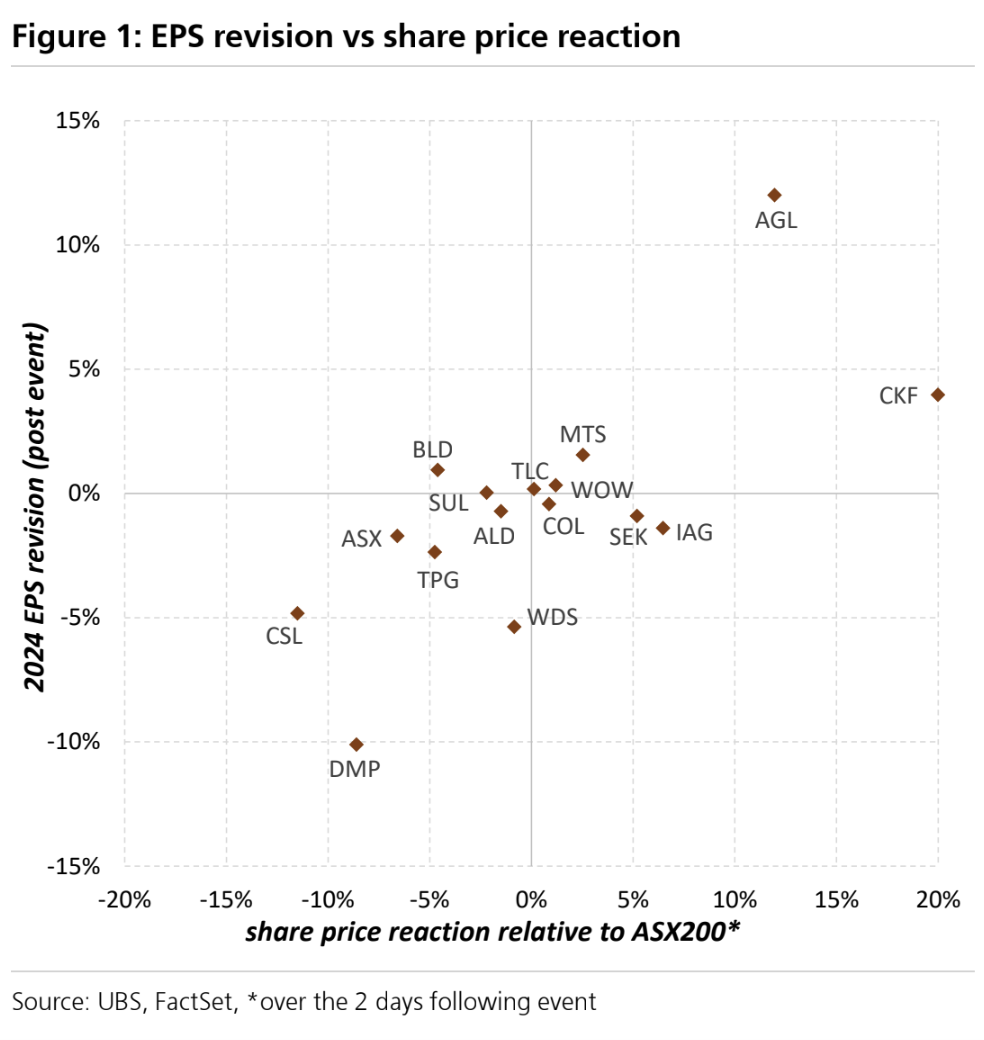

For instance, some companies like Collins Foods (ASX: CKF) have seen its share price increase 20% in the past month thanks to a comprehensive top and bottom-line beat. Others, like ASX Limited (ASX: ASX), have seen the share price more or less flat despite flagging that costs will most likely outstrip revenues. Finally, there's the total opposite end of the scale. Management at Aeris Resources (ASX: AIS) have learned the hard way how investors feel about a company that doesn't provide earnings guidance - its share price is down 18% over the last month.

UBS has compiled all of these nuts and bolts together and turned them into a research note. In this wire, I'll share the insights of that note and what it says about the stocks they say you should be owning heading into August.

The consensus has been disappointed

On UBS' numbers, forward earnings downgrades have been outnumbering upgrades slightly so far. But it's magnitude and not number that have been of most interest with downgrades from the likes of CSL (ASX: CSL) and Woodside Energy (ASX: WDS) taking 0.6% and 1.4% off the ASX200 forward earnings growth multiple for FY23 and FY24, respectively.

They also noticed material downgrades for companies like Dominos Pizza (ASX: DMP), which to them, reflects the economic environment and the macro deceleration which they had expected.

"Worryingly, we note that previous recession periods saw the Consumer Discretionary and Bank sectors post earnings growth reversals of more than 10% y/y," strategist Richard Schellbach wrote recently.

The sectors you want to own

UBS says you want to own sectors that are "detached" from recession risks. In other words, buy companies that are not exposed to the consumer slowdown and/or pay healthy dividends. Some of these sectors include but are not limited to:

- Infrastructure

- Utilities

- Technology

- Insurance (which in their eyes, can provide both)

UBS have two BUY-rated insurers: QBE (ASX: QBE) is their preferred general insurer and Suncorp (ASX: SUN) is their preferred domestic insurer. They also have a "modest" preference for the private health insurers - their preferred play is Medibank Private (ASX: MPL) which analysts say is the consensus is "underestimating the earnings outlook for both resident and non-resident segments".

If you want to read more of the Collins Foods vs Dominos Pizza battle, you can read this piece by our very own Glenn Freeman:

1 topic

10 stocks mentioned

1 contributor mentioned