UBS’ top nine ASX small caps for February reporting season

February reporting season begins in earnest this week, amid a tougher macro and earnings backdrop. The effects of rising interest rates, the changing narrative around consumer resilience, and supply chain backlogs will only really be known in the next few weeks when companies hand down their guidance statements. And while some sell-side analysts say these factors are yet to turn up in the numbers, leaving them in a more cautious position ahead of February, others are much rosier.

One of those “rosier” research houses is UBS. The firm covers 45 ASX small-cap stocks (known in-house as the “emerging companies”) in addition to the existing large cap universe. Of those 45, they have picked nine names as the top stocks to watch this February.

In this piece, I’ll share the nine names and the reasoning behind them.

Fast stats

January was a really good month for the ASX 200, clocking its best first month performance in nearly 30 years. A good month for the wider ASX is also generally great news for the smaller end of town. That was again the case this time with 24 stocks seeing P/E re-rates of 10%+ in the last four months, compared with only four names experiencing a negative P/E re-rate of greater than 10%.

On the nominal share prices front, the Small Ordinaries Index is up 8% since January 1st. Companies such as Kogan (ASX: KGN) and Adairs (ASX: ADH) saw gains of greater than 30%.

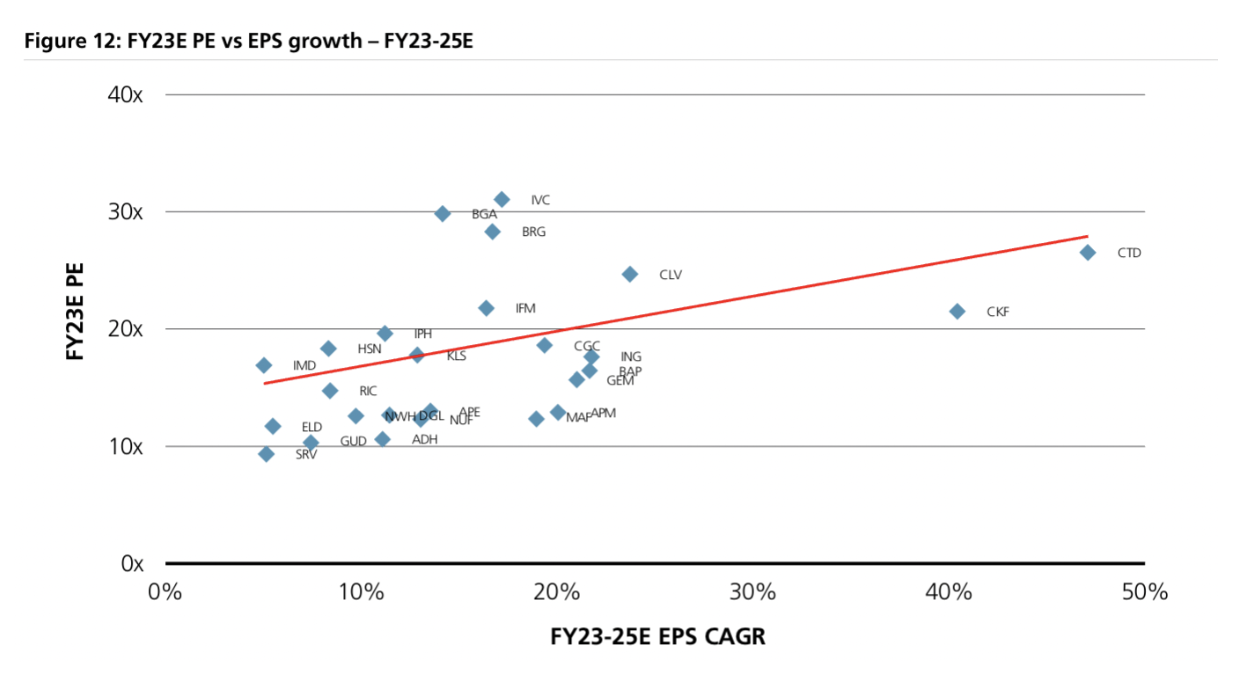

Then, there’s the matter of earnings growth potential. UBS’ team has put together a comprehensive chart of stocks in their universe pitting P/E ratios against companies’ ability to compound earnings. The trade-off is quite revealing, as this next chart shows:

The nine “key picks” (read: buys)

Breville Group (ASX: BRG)

The company has not given any earnings guidance prior to its result on February 14th, but there is hope on the analysts’ side that its appliances will continue to attract more discerning customers in new geographies.

Consumer wallets have been slowly tightening. All those 2020 coffee machine, blenders, and air fryer purchases don’t need to be replaced so quickly.

Inventory levels, a problem which was first highlighted by US counterparts Target and Walmart just a few months ago. Elevated inventory levels will further demonstrate the disparity between actual consumer demand and what companies thought consumer demand would be like at this point.

FX forecasting: being in more foreign markets requires a lot of currency adjustment. Tough at the best of times, even moreso in a recessionary environment.

Corporate Travel (ASX: CTD)

When it reports on February 15th, analysts and investors will be looking to see if the company has been able to achieve its 80% pre-COVID revenue recovery target. The company has forecast $265 million in underlying EBITDA for FY24.

China’s reopening is a big positive, but the stalling US market may offset some of those positives especially in the business travel sector where CTD makes its money.

Data points have been mixed - UK rail passenger volumes continue to hold up but domestic corporate bookings stateside appear to have plateaued.

What will be the earnings impact of the company’s acquisition of Helloworld Travel?

Hansen (ASX: HSN)

When it reports on February 22nd, analysts and investors will be looking to see if the company was able to grow revenues by three to five percent as forecast.

Defensive and recurring revenues from loyal customers are a good place to be if the recession materialises

An attractive M&A pipeline could also be good for the company’s share price

If there is an earnings decline, it may very well be limited to the first half because CPI-linked price increases have only just started to come through.

IDP Education (ASX: IEL)

The company has not given any earnings guidance prior to its result on February 23rd, but it will no doubt be hoping that international students return in droves after three years of being locked out due to COVID-19.

Australian markets are recovering - but if Chinese students come back, it may only show up in the FY24 results.

The Canadian and Indian markets, in contrast, may be under some pressure due to ongoing bottlenecks.

Nonetheless, it has market leadership, exposure to structural tailwinds, and a strong earnings track record.

IPH (ASX: IPH)

This company has also not handed down prior earnings guidance ahead of its February 16th result, but UBS is forecasting a lazy currency tailwind of $5 million. Now that’s punchy.

Defensive and in a market due for consolidation

Growth and acquisition opportunities in Asia and Canada, with M&A likely to be crucial to the company’s future trajectory

Kelsian (ASX: KLS)

No guidance provided either for this travel company, with its results due February 23rd. UBS wonders if the headwinds facing travel companies have finally become tailwinds - and it’s just not in the price yet.

Labour availability has been a challenge for its Northern Territory and Queensland operations but this is easing, says the broker.

Domestic tourism remained strong through most of the pandemic, which gives Kelsian a big leg-up through its Captain Cook Cruises business.

Ridley Corporation (ASX: RIC)

In what must be the simplest earnings guidance summary of all time, Ridley simply said that its first half result on February 16th will be “above prior corresponding period”. But in the competitive agriculture sector, UBS believes Ridley has a few things going for it:

Products which are resilient to earnings cyclicality

Capital management optionality, aided by a cheap valuation

Supply chains are healing, but this is an industry-wide trend

The only downside to its next earnings report may come from stockfeed sales which will likely fall due to wet weather events.

Webjet (ASX: WEB)

With business-to-business and business-to-consumer travel healing, UBS thinks this company could deliver as much as an extra $117 million boost come May 24th when it hands down its full-year report.

The big themes are the same as they were for Corporate Travel and Kelsian Group - China’s reopening is a huge and necessary uplift for the industry will likely need to compete against weakening consumer demand. But there is an upside to all this:

“We see Leisure travel less affected than Corporate and short-haul less impacted than long-haul, which positions WEB favourably. On the whole, the outlook relative to market expectations as at December 2022 is arguably "less bad" and in our view more than incorporated in the share prices.” - UBS Analysts wrote.

Nufarm (ASX: NUF)

No earnings from this company but it does have its AGM tomorrow where it may give earnings guidance. The company is buy-rated at the broker simply because it’s on a low price-to-earnings ratio and it has prime access to an investing megatrend (agriculture and food security).

Never miss an insight

If you're not an existing Livewire subscriber, you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics

11 stocks mentioned