US election: Polls, policies and portfolio positioning

We are tactically overweight risk, led by positions in domestic equities and international corporate credit. After sharp declines in Q2 growth, leading indicators overwhelmingly flag a sharp Q3 recovery ahead. While challenging equity valuations persist, company earnings estimates are starting to rise. Concern around a second wave of the virus has also risen, but our forecast for a gradual U-shaped economic recovery into 2021 remains in play.

This month, we take a look at the upcoming US election. It’s too early to be confident about the result or the policy outcomes. While the odds point to a Biden victory, whether Congress is divided or unified (and the state of the economy) will be key to how markets react. Given each side’s disparate policies, we expect equity sector impacts to dominate the direction of the broader index, with energy, tech and healthcare most exposed.

Elevated uncertainty argues against taking big bets

Recent data confirm a deep pandemic-led global recession for H1 2020, with the US and Europe recording consecutive and sharp declines in Q2 growth. Like Japan (which is already in recession), many other countries will soon reveal the extent of Q2’s collapse. While leading indicators signal a sharp Q3 recovery ahead, concerns about a second wave of the virus remain elevated.

Thankfully, recent weeks have seen some ‘flattening’ in the pace of new virus cases in the US and elsewhere. Positively, global fiscal measures have been extended to minimise the risks of a rapid retreat of stimulus; central banks have held their very dovish tones; and equity reporting seasons have started with modestly ‘less bad’ earnings trends. Still, given ongoing gains in risk assets, the potential for renewed volatility or drawdown in optimism remains.

With the 2020 financial year just ending, it is not without some measure of surprise that we find benchmark index returns, both balanced and growth, have delivered relatively flat results over the year, despite one of the sharpest equity and risk corrections in history earlier in the year. By implementing our tactical asset allocations and manager recommendations, portfolios invested for the full year should have protected capital and offset inflation.

At its core, 2020 has, to date, highlighted the benefit of maintaining discipline in one’s strategic asset allocation; of staying invested and avoiding attempts to time markets; and ensuring portfolios are appropriately diversified across both traditional and alternative assets.

Given uncertainty around the path of the virus, elevated geo-political tension, and challenging valuations, we see the next few months as a period where, again, we will be leaning on the benefits of diversification. While we remain overweight risk, elevated uncertainty means that we do not view the near term as amenable to engaging big tactical bets, either from a bullish or a bearish standpoint.

Who’s ahead in the US election race?

These are indeed turbulent times. And 2020 will already go down in history as a year that was less predictable than most, with a once-in-100-year health crisis, intense social unrest, and significant medium-term shifts in the geo-political complex. Adding to this, the US presidential election (in the first week of November) is approaching. The upcoming National Democratic Convention (17 August) and Republican National Conventions (24 August) will also likely focus the market’s attention on the election, particularly as the latest Q2 US equity reporting season draws to a close.

So, who is going to win? President Donald Trump and former Vice President Joe Biden are the two opponents.

If there’s one thing we’ve learned over the past decade, it’s that voting polls and betting markets’ ability to predict these types of outcomes is questionable at best.

But for what it’s worth, the chart below reveals that Biden commands a solid lead. As Société Générale notes, “Trump’s job approval score has been collapsing since early-April” and currently stands at 40.3% in late July against 45.4% in early April (right panel). Looking at Predictit data in the left panel (a platform which offers odds on events), Biden’s lead is arguably clearer.

Despite this, political analysts typically view the race as much closer, with BCA Research putting the odds of a Trump victory still at 45%. This relates to the complexity of the US electoral college system, and to the three key swing states of Wisconsin, Pennsylvania and Michigan. While Biden is leading in these (must-win) states, Clinton was also leading there in 2016, and lost them (and the election) on polling day. Of course, Biden’s lead is larger, giving him more of a ‘buffer’. And those arguing a Biden victory also highlight the state of the economy (elevated unemployment) and social unrest over the death of George Floyd as events that have materially changed the political landscape—and, therefore, the presidential race.

Latest polls and odds see Biden in the lead

“All models are wrong, the statistician George Box observed, but some are useful.” - Phillip Tetlock - Superforecasting

What are the key implications?

Ultimately, it’s too early to be confident about the election result or the policy outcomes. Moreover, progress around containing COVID-19, the state of the economy, and the outcome in the US Congress (united or divided) has just as much potential (and potentially more) to influence the environment post-election as to who sits in the Oval Office (Trump or Biden).

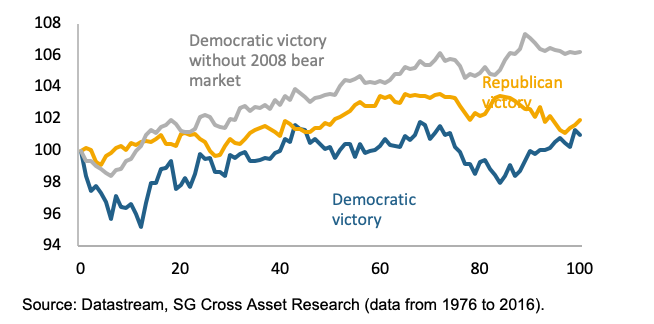

“One hundred days after the election, a Republican victory tended to be less positive for the equity market than a Democratic win, if we exclude Barack Obama’s first election, which happened during the 2008 financial crisis.” - Société Générale, US Equity Strategy, July 2020

Indeed, while analysis from Société Générale shows that “ten days after the election, a Democratic president was not great for the S&P 500”, that same analysis (in the chart below) suggests that 100 days post the election, equity markets were higher on average with either a Republican or Democratic victory. Moreover, excluding the 2008 GFC bear market, the market was higher 100 days on average following a Democratic victory. That said, several key factors are likely to combine to make this an important election to maintain a focus on:

Firstly, higher equity indexes, on average, in the months post an election likely partly mirror analysis showing US markets tend to perform poorly in the lead-up to elections. UBS shows “in presidential election years, the S&P 500 has, on average, been flattish through the summer before falling an average of about 2% from late September until right before the election.”

S&P 500—100 days following the election of Democratic president

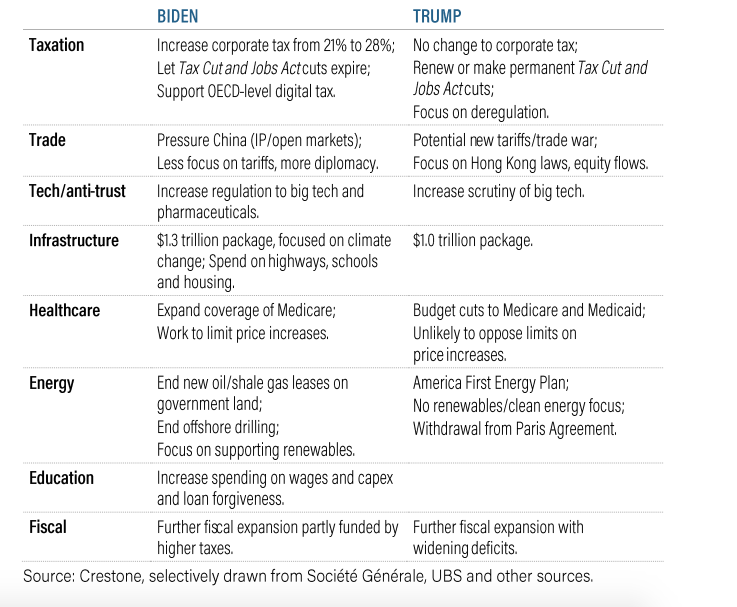

Secondly, Trump and Biden have quite divergent economic and fiscal policy platforms (summarised in the table below). Trump is likely to maintain his focus on ‘America first’ in trade and energy policy, while domestically seek to lower taxes and reduce regulation. In contrast, Biden will most likely focus spending on healthcare coverage and mitigating climate risk. He is likely to partly fund this through increased personal and corporate taxes. Generally, both agree on the need for more infrastructure spending.

Finally, given the divergent nature of both sides’ policies, whether the US Government is unified (and policies can be implemented) or divided (creating grid-lock and minimum change) will be critical. This could potentially have quite divergent impacts on the relevant equity and credit market sectors.

“In US presidential election years, the S&P 500 has, on average, been flattish through the summer before falling an average of about 2% from late September until right before the election.” - UBS Equity Strategy, July 2020

Brief summary of Biden and Trump policy positioning

What are the implications for markets?

Either a blue wave (Biden wins and Democrats sweep Congress) or a red wave (Trump wins and Republicans sweep Congress) appears unlikely to impact markets more than COVID-19, or arguably 2019’s trade war. But based on the table above, it will likely create winners and losers at the sector level.

A blue wave (Biden wins and Democrats sweep Congress)

Biden’s policies would be pursued, including the partial reversal of prior tax cuts. However, this could be delayed until 2022, subject to the state of the economy. Trade policy would still challenge China’s rise, though likely in a more diplomatic and less aggressive manner. Regulatory pressure would increase, particularly around climate change, with additional spending directed to infrastructure, healthcare and education.

For markets, consensus is spread between a Biden victory being neutral to moderately negative for equities (circa. 2-5% weaker). Tax hikes would drag on company earnings, as would increasing regulation, which is also a negative for corporate credit. But fiscal spending would be partly funded, limiting a rise in bond yields expected under either Congress ‘sweep’ scenarios. Less risk of a trade war re-escalation could see the US dollar weaken post-election.

Sectors most likely to garner positive momentum with a Biden victory are renewable energy, infrastructure (including tech), transport and construction. In contrast, big tech, old energy and healthcare face the greatest pressures.

A red wave (Trump wins and Republicans sweep Congress)

There would be an intensified pursuit of Trump’s pro-growth policies, focused on minimising taxes, reducing regulation, as well as boosting infrastructure spending. Arguably, further increases in fiscal spending could add additional deficit pressure, subject to a growth pay-off. Trade policy would continue to be more aggressive and there would be a higher risk of a renewed trade war with China or others.

For markets, lower regulation and the avoidance of higher taxes would likely be positive for equities (and credit markets), though less so than the post-2016 cuts, and tempered by increased trade war risks. Strong growth, together with rising fiscal deficits, could see inflation expectations rise and steepen the interest rate curve (potentially more than under a Biden victory). Trade war risks (and higher rates) could support the US dollar higher.

Sectors most likely to garner positive momentum with a Trump victory are energy, financials, healthcare and infrastructure. In contrast, big tech and ‘green’ sectors face the greatest pressures.

Divided US Congress remains

If a Trump victory left Congress divided, there would be a continuation of the status quo. Risk markets could view this positively via the avoidance of expected higher taxes and higher regulation under Biden. To a large degree, a bipartisan focus on restraining China, boosting infrastructure and anti-trust scrutiny of big tech would be expected to continue.

In some sense, risk markets could respond most positively to a Biden victory with a divided Congress. This would lean toward the status quo for fiscal policy (tax and regulation), but ease fears of an ongoing hostile international trade environment. However, the Republican Senate would likely need to work with the president (given some mandate was delivered) for fear of being dislodged at the 2022 mid-terms. As such, sectors such as renewables would still likely benefit (and the US dollar likely weaken).

Summary

The US presidential election is an uncertain event. While predictive markets mostly favour a ‘blue wave’, pre-emptively positioning portfolios for a singular outcome is akin to the pitfalls of trying to time markets. This, however, does not abdicate the need to prepare for outcomes that increase in probability as the election draws nearer, or ensuring that portfolios are not overly exposed to the sector winners and losers. In terms of key conclusions, we note:

- Equity markets tend to underperform in the lead-up to a presidential election and are typically higher several months later.

- It is not certain that either a Democratic or Republican victory is more beneficial for equity markets, with the economy and Congress just as key.

- Either a blue or red wave would be most important, as it would facilitate implementation of each side’s divergent fiscal policy platforms.

- Given each side’s disparate policies, we expect equity sector movements to dominate the direction of the broader index.

- Absent a red wave, a Biden victory and split Congress is among the least priced results, combining Trump fiscal policy and Biden diplomacy.

- Finally, if the election is close, this may further enhance volatility if it leads to a delay in the announcement of the result.

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offer one of the most comprehensive and global product and service offerings in Australian wealth management. Click 'contact' below to find out more.

2 topics

1 contributor mentioned