Westfield shareholders have little to fear and much to gain

APN Property Group

In December last year, Unibail-Rodamco (a major European listed property trust) made an offer to purchase Westfield Corporation. The offer to Westfield shareholders is based on a combination of cash and Unibail shares and Australian investors will be able to invest in the merged entity in the form of units listed on the ASX.

So, what is Unibail-Rodamco, what is its track record and will it be a good custodian of Westfield’s assets? These are important questions. Without answers to them, Westfield shareholders can’t make an informed decision about whether to hang on or sell out.

Unibail is a major, listed European commercial property investor, manager and developer with a portfolio of high quality assets. Listed on the Paris bourse since 1972, it is the largest listed REIT (real estate investment trust) in Europe and is well known to global property investors, including APN Property Group.

Our investigations reveal Unibail to be a manager with a long history of adding value, a sound strategy and an attractive portfolio of assets. This is a highly credible manager capable of assuming management of the Westfield portfolio and optimising the value of its assets.

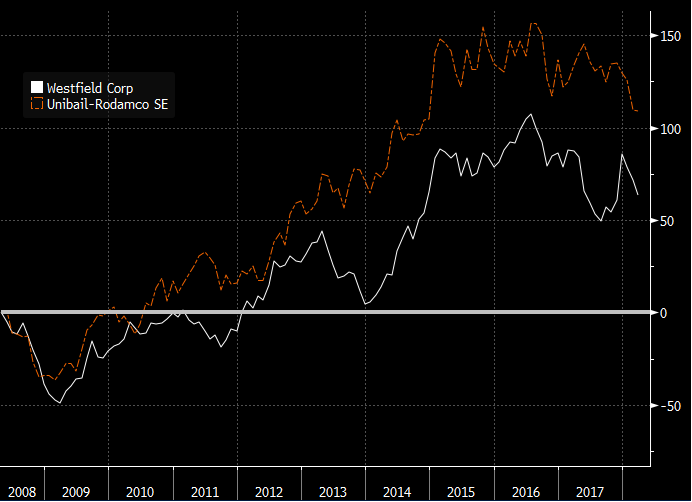

Westfield vs Unibail historical performance comparison

Source: Bloomberg as at December 2017; dividends reinvested

The company’s track record suggests as much. With high quality, disciplined management (both operational and financial), Unibail shareholders have enjoyed handsome returns over the long term. Of course, like many property trusts, it suffered in the aftermath of the global financial crisis. But unlike many it survived and has since prospered.

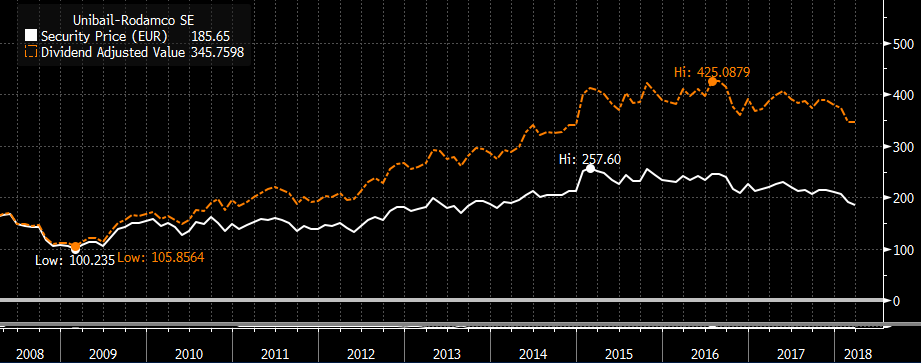

Source: Bloomberg as at March 2018

Source: Bloomberg as at March 2018

Unibail has delivered annualised stock market performance of 15% or higher in each of the past five, 10 and 15 years. This is well in excess of various European Union-listed property benchmarks. Given the context of the economic environment of the EU after the Global Financial Crisis, the returns further validate the quality of the portfolio and management’s ability to extract value.

Management’s credibility is confirmed with Standard & Poor’s “A” credit rating, plus the equivalent mark from Fitch. The company also enjoys some of the most impressive financial ratios in the industry, including 6.7x interest coverage ratio and a 33% loan-to-value ratio.

Unibail also features a staunch income focus, paying an attractive dividend due to a policy of paying out 85% to 95% of recurring earnings per share as dividends.

What about Unibail’s portfolio? Worth €43.1 billion in gross assets, it consists of 89 assets located in 16 cities in 11 countries, offering tremendous geographical diversification, certainly beyond that currently available to Westfield investors.

The company’s retail portfolio consists of 67 centres in total, 39 of which are premium or flagship assets. Of the total number of centres, 57 receive more than 6 million visits per year.

Having met with CEO Christophe Cuvillier and CFO Jaap Tonckens, the company’s long term returns do not surprise us. This is an impressive duo with a clearly enunciated strategy and a €7.9 billion development pipeline, supported by a formidable management structure driving a team of over 2,000 employees.

This shows up in our analysis of the company’s debt structure and costs. Unibail has a large, diverse debt book with a relatively low weighted average cost of debt, high interest cover ratio, long duration of debt facilities and a high credit rating. This implies lower debt servicing costs, reflecting the company’s excellent capital management skills.

Australian investors may be unfamiliar with Unibail but this should not detract from its long term track record and future prospects. This is a well managed business, keenly aware of its unique strengths, with a sensible strategy to capitalise on them. Unibail plans on Westfield being a big part of that strategy, and to us it looks like a good fit.

Let’s now look at different components of the company’s assets, starting with the retail portfolio.

Last year, Unibail’s retail portfolio delivered like-for-like rental growth of about 4.3%. The company’s active management credentials are on display through an 11% “rotation rate” – the rate at which tenancies are re-let to new concepts.

This implies that over a 10-year period more than 100% of the portfolio’s tenancies will be swapped out for newer offers. This exceeds any other comparable portfolios we know of, indicating a management team dedicated to achieving an optimum tenancy mix by removing weaker tenants.

Unibail is not just about retail, however. The company’s diversified portfolio includes large office buildings at prime locations in the Paris central business district and La Défense (a prime office market in Paris). Like-for-like rental growth from this portfolio was 13.5% in 2017 while the portfolio’s vacancy rate is just 3.3%, following a record leasing year.

Unibail is also a world leader in convention and exhibition activities, managing a portfolio of 10 world-class venues in Paris and its surrounds. Although this segment was the weakest in the group last year with a recurring net operating income growth of -2.1%, it remains an impressive business. Unibail’s overall portfolio is typified by assets with high barriers to entry and, in retail, well-curated, experiential offers that reflect the adaptive qualities of modern, omni-channel retailers. These assets in particular should deliver superior long-term rental growth as high demand leads to relatively low vacancies, making it easier for landlords to increase rents.

That’s certainly been the case for Unibail thus far. Income is the lowest risk component of total returns (the capital growth component tends to be more volatile) but on this measure the company scores well.

As of 12 April, Unibail delivers an attractive distribution yield of 5.7% and has an admirable recent history of Dividend Per Unit (DPU) growth of about 5% p.a. or more. Consensus distribution forecasts, meanwhile, indicate this kind of growth should continue.

We’d agree, although this is but one reason why we endorse the bid for Westfield by Unibail. With first rate asset management, portfolio management and balance sheet skills, Unibail should be an excellent future custodian of Westfield’s assets.

With a track record of expertise evident in the income Unibail shareholders have received over the years, and the capital growth the company has delivered, Unibail should be highly attractive to investors seeking long-term, secure cash-flows.

Westfield shareholders, however, have one further question to ask: are they getting a fair price for their shares, a subject we’ll get to in the next few days. Watch out for it.

Did you enjoy that?

Check out the blog for more articles covering a range of real estate investment topics.

Sources: Unibail Rodmco 2017 Full Year Results presentation & Website: entity history; portfolio, financial, development, returns and management details. Distribution rate: 5.7% as at 12/4/18 (E10.80 Div / E189 price); DPU growth forecast: Bloomberg.

Note: Past performance is no indicator of future performance

4 topics

Michael is highly regarded in the real estate funds industry, with 31 years experience. He's held various senior roles specialising in real estate valuation, consultancy and funds management

Michael is highly regarded in the real estate funds industry, with 31 years experience. He's held various senior roles specialising in real estate valuation, consultancy and funds management