What Mattered Today; Kogan under fire on insider sales (sort of!)

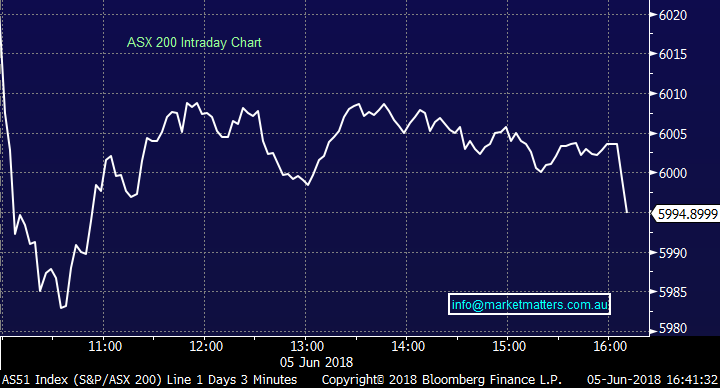

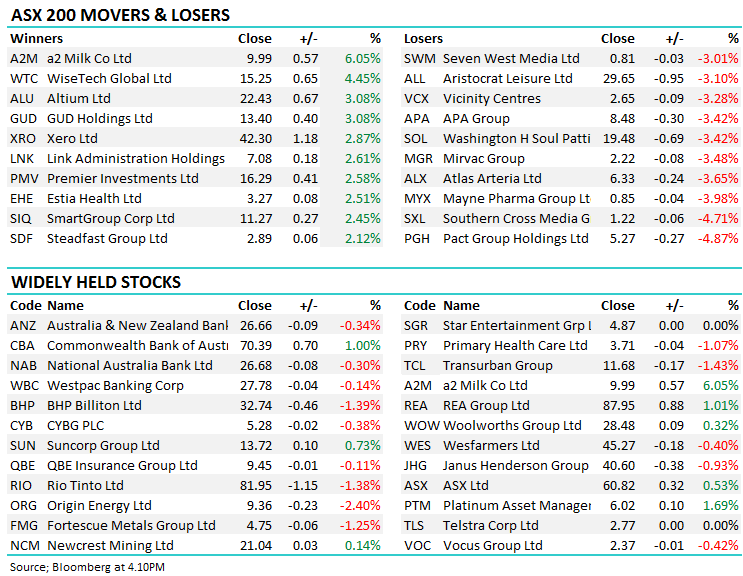

Despite the Nasdaq reaching new highs on a close basis overnight + most indices rallying, local futures were pointing lower today and that’s where the market headed, quickly erasing yesterday’s relief before rebounding somewhat and settling around the 6000 level. The market dipped back below this level at the end of trade thanks to a big line of futures done on the close. Resources were the main culprit with material & energy names both weaker as most commodities fell overnight. The Aussie dollar rallied above $0.765 which saw overseas earners weaker today. A2 Milk found a supporter in Blackrock which was announced today as a new substantial holder – the market likes a big cornerstone investor like Blackrock taking a stake, and A2M rallied 6.05% on the news. CBA also strong following yesterday’s settlement with AUSTRAC running 1% on the day (we like it here), however it spent much of the day ~0.5% higher before large selling on the close saw it fall 30c in the match.

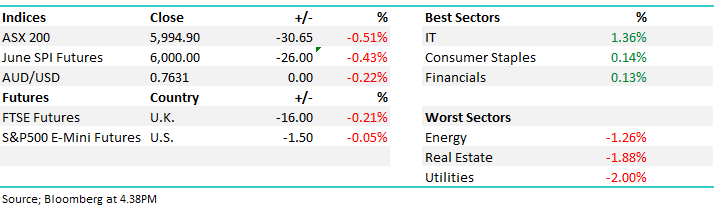

Overall the ASX 200 index fell -0.51%, or 30points to 5994 – some decent selling on the close played out. US FUTURES are down a touch (-18pts for the Dow Jones)

CATCHING OUR EYE

Broker Moves; Ramsay Healthcare was particularly weak today with Credit Suisse downgrading their rating after a review into private hospitals. We discussed the issues facing RHC in this morning’s note and Credit Suisse echoed our view that rising insurance costs and falling public sector prices would provide headwinds for the private industry. In saying that, Ramsay is beginning to look interesting, now trading on 18.9x forward vs an average of 29x over the past 5 years – i.e a very big discount to recent history - clearly looking cheap from this perspective. Compare this to Healthscope which now trades on 23.1x FY19, 15% above their two year average and is under takeover…

A quick look v historical metrics….the blue dots are now, the red diamonds are the 5 year average. It’s cheap, an opportunity we think, we just need a SP catalyst to change current momentum. One to watch

Elsewhere….

Jumbo Interactive (JIN AU): Cut to Hold at Morgans Financial; PT A$4.81

MYOB (MYO AU): Downgraded to Hold at Ord Minnett; PT A$2.94

Ramsay Health (RHC AU): Cut to Underperform at Credit Suisse; PT A$56.50

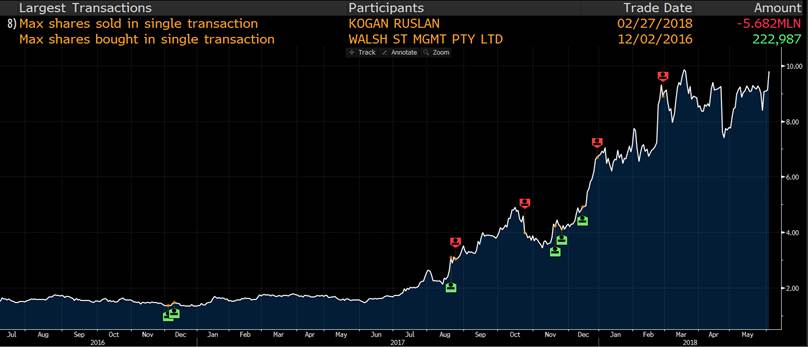

Kogan (KGN) $8.58 / -12.45%; We often talk about insider selling as a red flag however Kogan have taken that up a notch overnight with both Ruslan Kogan and David Shafer – the founders of the company trying to offload $100m worth of stock but failing. The stock came back online this morning without an announcement about it – before they halted and updated the market. We mentioned KGN late last week thinking the stock looked a good short, today that played out with the shares down sharply. Clearly, these guys are in sell mode but what has a bigger smell about it is the announcement yesterday the company was going into the whitegoods segment. A positive announcement with ‘more financial detail to come’ just before the founders try to offload stock – about 10m shares if reports are correct – their biggest line yet.

Here’s a look at past insider sales relative to SP.

…and focussing just on Ruslan Kogan.

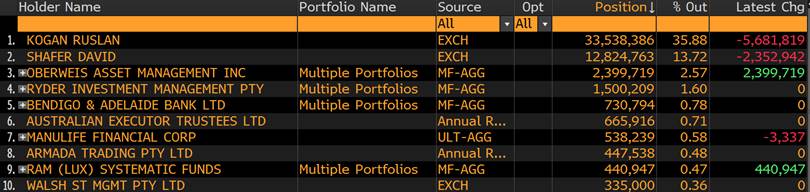

And now the broader top 10 shareholders – Kogan and Shafer are clearly sellers in volume – about 10m shares for sale if we use what happened overnight as a guide. If the proposed sale was proportioned relative to current holdings for Kogan & Shafer, Kogan is a seller of 7.5m shares or ~20% of his current holding. At listing he had 47m shares, now has 33.5m shares with 7.5m for sale we could assume.

Top 10 share holders

KGN Shares going lower in our view…

Kogan (KGN) Chart

Mortgage Choice (MOC) $1.48 / -21.69%; another day, and another franchise model comes under attack. The mortgage broker has come under fire for remuneration agreements that place undue stress on the franchisees with many being forced to work long hours and take on many roles to ensure their business remains afloat (sounds like a typical small business to me!). It was reported that around 170 of the 450+ franchisees were considering legal action 6 months ago before Mortgage Choice offered to review the relationship. The company did announce a review into the remuneration agreement yesterday but made no mention of the agreement, or of the $200,000 committed to the rebelling franchisees if the demands were not met. The story smells similar to the Retail Food Group issues of late which has seen their share price fall over 80% since December. We wrote about MOC as an option from the income portfolio last year, concluding that risk was too high:

MOC is a mortgage broker that looks attractive from an historical valuation perspective trading on a discount of ~15% to its long term PE – currently around 14.5x. with a yield of 6.3%, paying a forecasted half year dividend of 7.5c FF. Mortgage Choice would seemingly be a great choice for the income portfolio, however the company is facing considerable headwinds. The mortgage broking industry has been facing scrutiny around unethical practices and many are pushing for reform that would shake up the commission based fees. Even the most basic of reforms, such as a push to pivot commissions where broker compensation is increased as the LVR falls, would significantly hit Mortgage Choice’s profits and valuation. Clearly this is an income opportunity that carries too high a risk to capital for the income portfolio. (VIEW LINK)

Mortgage Choice (MOC) Daily Chart

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

1 stock mentioned