Why high-yield ETFs are problematic

Over the past 20 years, the trend of investors seeking out lower cost investments that seek to match (rather than beat) the benchmark has exploded. As of March 2020, passive funds accounted for 41% of combined US mutual fund and exchange-traded fund (ETF) assets under management (AUM). This compares to shares of 14% in 2005 and 3% in 1995. While the trend has been more pronounced in US equities, with 48% of AUM now in passive funds, the fixed income allocation is also growing and meaningful at 30% of US AUM. 1

Growth of high yield ETFs

In the case of the US High Yield bond market, combined ETF assets make up only a fraction of the $1.5 trillion market. However, they have been quite successful in attracting marginal buyers over recent years, as well as capturing an increasing share of trading volumes in underlying bonds. These vehicles naturally attract fee-conscious investors who are perhaps frustrated with High Yield active managers’ inability to consistently beat the benchmark. And who can blame them? High Yield indices have indeed been difficult to beat over time. Liquidity constraints, cash drag, as well as volatile energy and distressed asset performance have left even many seasoned investors humbled.

Poor index-tracking performance

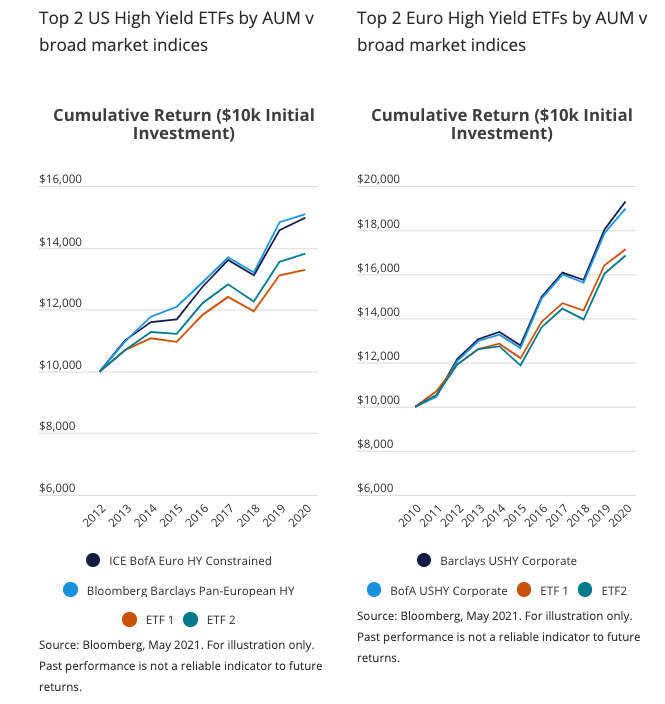

However, the alternative isn’t always the solution, and in the High Yield context, we think passive ETFs can be suboptimal in a number of ways. Perhaps the most fundamental issue relates to passive ETFs' (hereafter referred to as ETFs for simplicity) core objective of tracking indices. In the equity world, ETFs have generally been quite effective in this regard. However, the same is not true for high yield bonds – on the contrary, investors looking for high yield exposure consistent with the broad benchmarks have frequently been disappointed.

ETFs' generally poor track record relative to broader market indices is apparent in sizeable divergences in calendar year returns. For example, in the case of US High Yield ETFs, the top-two ETF products by AUM underperformed compared to the Bloomberg Barclays Corporate US High Yield index by an average -2.39% in 2020. Likewise, in the case of the European High Yield ETFs, in 2020, the top-two ETF products by AUM underperformed compared to the ICE Bank of America Euro High Yield Constrained Index, by an average -1.17%.2

Limitations of high yield index "optimisations"

What explains the historically poor tracking of High Yield indices by ETFs? An important distinction that is often overlooked with High Yield ETFs is practical limitations that prevent exposure to all issuers in the index. As a result, ETFs usually buy a subset of the index that is judged to give similar exposure to the overall index. However, such index ‘optimised’ portfolios often don’t match the index quite so well in practice.

Liquidity constraints

Closely related to this is a broader liquidity problem. More specifically, the underlying bonds of an index are normally constrained in terms of the amounts actually available to buy and sell. This means that there is a liquidity mismatch owing to the inherently constrained supply of underlying High Yield bonds compared to the kind of ‘on-demand’ liquidity promised by ETF structures. In short, while liquidity constraints are relevant for all investors in the High Yield context (including active investors), logically the concerns can only be bigger for approaches seeking to match broader indices.

Not as price-competitive as widely believed

Another important driver of performance variation between High Yield indices and ETFs is fees. Investors often mistakenly believe that these products always have very low fees. For example, in the case of the top-two US High Yield ETFs by AUM, the average expense ratio of 0.45% actually exceeds the fees of many active mandates for institutional clients. From a retail perspective, it is true that ETF fees have historically been more attractive versus active mutual funds. However, given the trend of fee compression in the active mutual fund space, that gap has also been closing substantially.

Fee considerations are justifiably a key part of all investment decision-making. However, if a low fee product offsets this benefit with marked underperformance, then the low fee advantage is clearly negated. This effectively sums up one of the key issues for High Yield ETFs: sustained lagging of the overall market by such margins (see below) that have dominated any claimed low-fee benefits.

Conceptual concern with market-cap-weighted fixed income indices

Finally, we think investors need to be aware of an important conceptual point when considering passive investing in the broader fixed income context. In market capitalisation indices, weightings are positively linked to the size of companies’ tradable equity/or bonds relative to the overall market – this might be manageable in the equity context, but is potentially much more problematic in the bond context, since increased bond issuance typically implies more leverage and therefore more credit risk.

In summary

It is clear that ETFs have been less successful in providing benchmark-like returns for the High Yield asset class. Furthermore, in our view, the drivers of consistent underperformance seem to be poorly understood and underappreciated. While some of ETFs’ oft-stated advantages of lower costs and on-demand liquidity are understandably appealing, they are also much more problematic in the specific High Yield bond context. Accordingly, for High Yield investors, we think an active investing approach can deliver significantly better investment outcomes.

References:

1 ‘The shift from Active to Passive Investing: Risks to Financial Stability’ - Federal Reserve Bank of Boston (May 2020)

2 Source: Bloomberg data

Never miss an insight

Keep up to date with Aberdeen Standards latest thinking by hitting the follow button below.

5 topics

.png)

.png)