Why investing during an uncertain outlook can lead to substantial reward

Investors started the year full of optimism that the world would move beyond COVID-19 and enter a period of more normalised growth that was supported by accommodative interest rate policy. However, this optimism was short-lived as the reacceleration of inflation became the prime focus for central banks across the globe.

The impact of an unexpected tightening cycle hit capital markets as investors scrambled to reprice assets using a higher discount rate. As capital market participants sought shelter from losses, volatility moved higher and liquidity moved lower. This process exposed any corporate that required capital markets to fund their operations or were excessively geared.

As with all central bank induced slowdowns, the impact of rate rises flow through into the economy on a lagged basis. Investors are now pricing in a material slowdown in corporate earnings, which is expected to flow through in the coming quarters. Effectively, central banks have reset valuations, capital markets have tested balance sheets, and an economic slowdown will impact corporate earnings. The extent to which earnings will be impacted will only be known in due course.

This reset has now reached a level that has attracted financial investors and corporates who are looking past the slowdown and selectively taking advantage of depressed valuations.

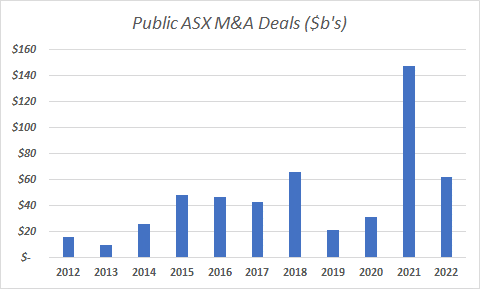

The emergence of corporate activity in Australia over the last three months is a strong endorsement of this. We see companies that boast a strong growth profile and/or are highly cash generative being targeted. Listed companies with healthy balance sheets are also deploying capital into value-accretive deals.

The local technology sector has experienced a surge in takeover activity recently with Nearmap Ltd (ASX: NEA), Nitro Software (ASX: NTO), Readytech Holdings (ASX: RDY), Tyro Payments (ASX: TYR) and Elmo Software (ASX: ELO) all confirming takeover approaches, the majority of which have come from US-based investors. The weakness in the Australian dollar could well have been the catalyst for the recent flurry of deals, but ultimately the opportunity to invest into businesses that have a long runway for growth at attractive valuations ultimately proved too compelling. The LSN Emerging Companies Fund held both ELO and RDY, and while we do not invest on the basis that corporate activity will generate a return, we are optimistic on local technology companies that have a clear path to profitability and attractive cashflow outlook. We remain wary of companies that do not have the funding to sustain current operations.

Corporate activity outside the technology sector has also emerged. Canadian giant Brookfield Asset Management and US-based EIG launched an $18b takeover for Origin Energy (ASX: ORG), Perpetual Ltd (ASX: PPT) received an offer from their competitor Regal Partners (RPL) and the former founder of Pacific Smiles Group (ASX: PSQ) emerged with 12% of the company and is agitating to implement a management restructure. The common thread across all these businesses is that despite each currently facing headwinds, their earning potential is perceived to be much greater than what is currently being priced. Smartgroup (ASX: SIQ) and Capitol Health (ASX: CAJ) are both companies that have appealing long-term investment attributes. They operate in attractive industries, are underearning relative to their long-term potential, and generate strong cash flows. For private investors, who can absorb short-term earnings volatility, the market is providing the opportunity to acquire businesses at valuations that should deliver excellent returns over the long term.

Source: Dealogic as at 10 November 2022. Notes; (1) Announced M&A for Australian targets between 1 January 2012 and 10 November 2022, minimum transaction size A$50m; (2) Announced M&A in 2022 for Australian targets, including withdrawn transactions. Excludes real estate.

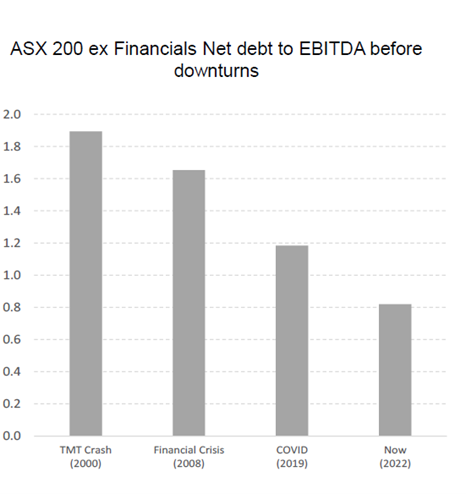

Balance sheet deployment has also been a feature for listed companies with sufficient liquidity and supportive shareholders. EQT Holdings (ASX: EQT) and IPH Ltd (ASX: IPH) have both embarked on accretive acquisitions which are expected to deliver strong returns for shareholders. With corporate balance sheets entering the downturn in a better position than previous downturns and valuations back to more attractive levels, the prospect of acquisitions from listed companies is high. Hansen Technology (ASX: HSN) has an excellent track record of acquiring businesses and with substantial balance sheet capacity, we would anticipate the company will take advantage of any value-accretive deals which may arise in the period ahead. OFX Group Ltd (ASX: OFX) holds a small, but growing, share of the highly fragmented foreign exchange payments industry. Many of their competitors are reliant on external funding for growth, and given the market for accessing capital is difficult, this puts OFX in an enviable position to leverage its balance sheet to execute strategic acquisitions.

The drawdown in equity markets has been savage, but with discounted valuations and a lower Australian dollar, we are seeing corporate and financial investors deploy capital into businesses that they believe can deliver compelling returns over the long term. When confidence returns and capital markets fully re-open, we will likely see some of these assets re-list onto equity markets, rewarding those investors who risked their capital during an uncertain outlook.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.