6 ASX stocks to help ease investors' inflation pain

We’ve all felt the pinch since inflation started rising. And even if there are encouraging signs that goods prices are starting to fall, services inflation (what we pay for experiences, rather than for tangible objects) is still spiking.

.png)

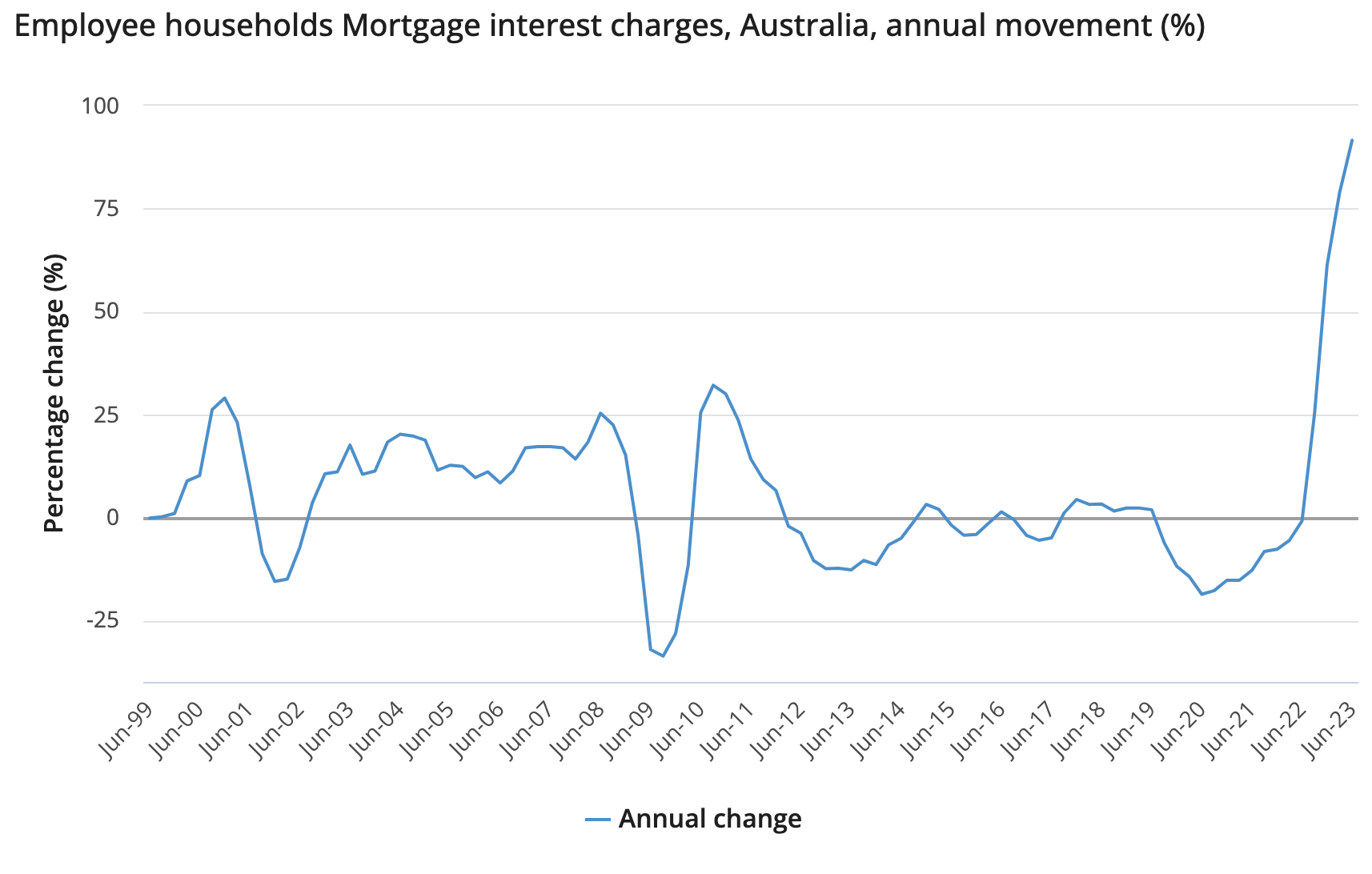

Looking beyond Australia’s primary measure of inflation, the consumer price index (CPI), the Australian Bureau of Statistics’ Living Cost Indexes (LCIs) measure the price change of goods and services, and how this affects selected household types.

Over the 12 months to the end of June, all five LCIs rose by between 6.3% and 9.6% (the ABS measure cost of living across different types of households including those whose primary source of income is wages and salaries; aged pension recipients; recipients of other government benefits; and self-funded retirees.

The costs across each of these rose over both the year and the most recent June quarter, with employee households affected the most, as shown in the table below.

The data series is also broken down across different goods and services. Across each household type, insurance and financial services showed the biggest cost increase, up a staggering 41.8% for employee households, 35.5% in other government benefit recipient households, and 25.7% in pensioner households.

Since inflation started picking up last year, there have been various articles – including here on Livewire Markets – about inflation hedging.

That’s a legitimate approach, usually employed by professional investors including those in multi-asset, real estate and other parts of the market. What I’m talking about here is something far more anecdotal, perhaps even more symbolic than anything.

But if you’re feeling ripped off by rising prices, an “if you can’t beat them, join them” mentality might (legitimately, or not) help ease that angst.

Some stocks to offset "rising premium" pain

Insurance premiums have risen across the board, by as much as 20% among home insurers (including IAG) and up to 4% among health insurers.

This ability to pass costs onto consumers is one of the reasons we’ve heard from multiple fund managers about the appeal of ASX-listed insurance companies.

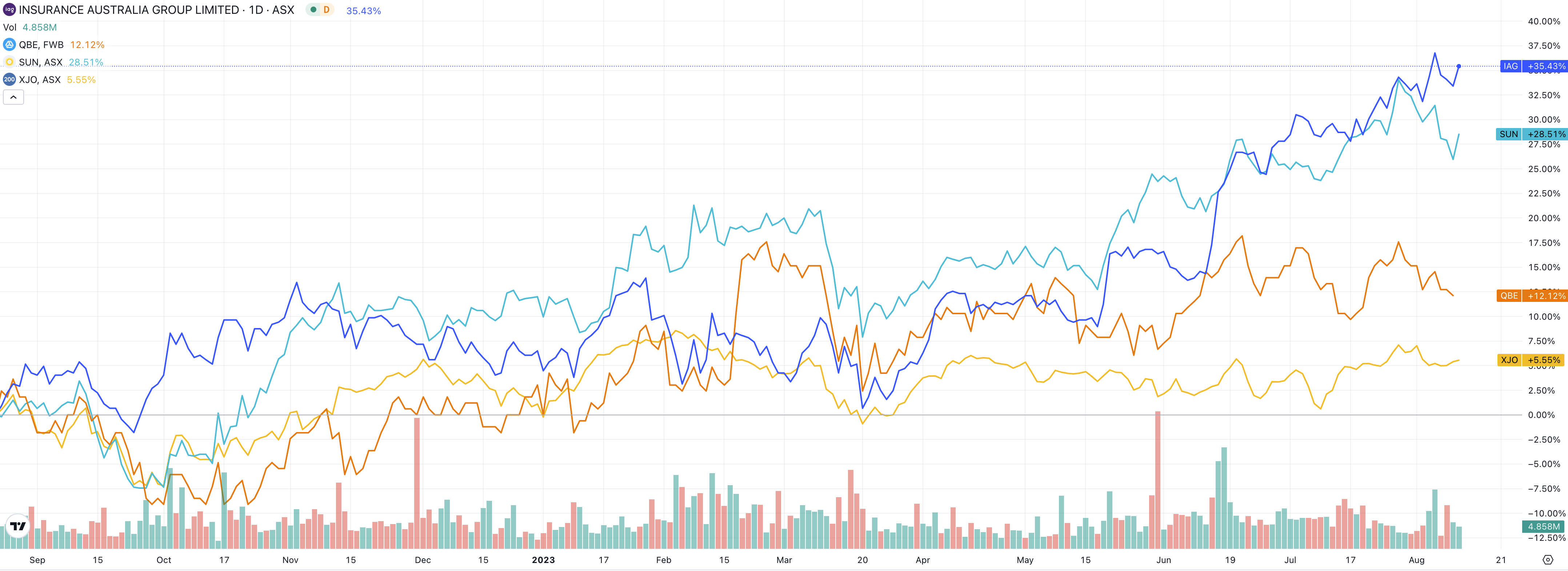

For example, Aaron Binsted from Lazard Asset Management recently spoke about the appeal of insurance companies Suncorp Group (ASX: SUN), Insurance Australia Group (ASX: IAG), and QBE Insurance (ASX: QBE).

For each of these companies, their share price growth in the last 12 months has outstripped the S&P/ASX 200 by a considerable margin (the index is represented by the yellow line in the chart below).

IAG, Suncorp and QBE 12-month returns versus the S&P/ASX 200

How to manage power price pain?

Though they’re not mentioned explicitly in the ABS data above, higher power prices are another of the most noticeable effects of inflation for many of us.

AGL Energy (ASX: AGL)

Energy costs rose as much as 25% since 1 July, according to data from the Australian Energy Regulator. Just today, Australian power generation company AGL Energy delivered a mixed FY23 earnings result, but Market Matters’ James Gerrish remains upbeat on his outlook for the company.

Back in February, Gerrish elaborated on some of his reasons for liking the company: “You’ve got an asset base there, you’ve got someone on the register who thinks there’s more value than the market’s ascribing to it. And they’ve got this decarbonisation push,” he said.

“And it’s a business that in 2024 and 2025 will see its earnings improving a lot, and will see better times than it has in the last couple of years.”

Origin Energy (ASX: ORG)

Investment bank Morgan Stanley earlier this month also explained its attraction to another utility, Origin Energy, anticipating it will benefit from the same energy price tailwinds that AGL is catching.

Morgan Stanley anticipates that energy markets will recover in the near term as retail repricing occurs, and also highlights the company’s “steady progress on new energy initiatives". This includes $70 million in Federal Government funding for the proposed Hunter Valley Hydrogen Hub, as well as the acquisition of a NSW Wind Farm site.

Origin will deliver its FY23 earnings results on Thursday 17 August 2023.

Woodside Energy (ASX: WDS)

Another company in this space, but in a different part – oil and gas – is Woodside Energy (AX: WDS).

Woodside was held up as an example of a great commodity company in a Q&A with Daniel Sullivan, Janus Henderson’s head of global natural resources.

2 topics

6 stocks mentioned

4 contributors mentioned