Actively manage bond maturities to improve returns

Returns on bonds can be further increased when bonds approaching their maturity or call dates are reinvested ahead of time. We look at the benefits of actively managing maturities and early redemptions to get the most out of fixed income portfolios.

Background

There are many benefits to fixed income investors reviewing upcoming maturities on their bond portfolio, which is another way a higher return can be achieved. By awaiting the maturity date of a bond when the principal is repaid, investors could be limiting their reinvestment opportunities to those bond investments available at maturity. This is known as reinvestment risk and can result in returned funds yielding lower returns while held in cash, as investors await a suitable investment option.

When the demand for a bond outweighs the available supply, yields typically move lower on strong demand (and prices higher). This is exacerbated when a bond matures or is called and depending on the size of the issue can result in up to AUD200m or more of matured funds looking to reinvest at the same time often pushing prices higher.

Another key reason to reinvest positions ahead of upcoming maturity dates is to ensure the return isn’t eroded as the bond price pulls to par the closer it nears maturity. Pulling to par refers to the price of the bond gravitating back to a final value of $100, which is repaid at maturity. This plays into one of the basic principles of bond investing - term risk premium - which we further discuss below.

Term risk premium

The concept of time value of money plays an important role in fixed income investing, which refers to shorter maturities typically having less time premium and hence lower yields, compared to securities with longer dated maturities. As the time until the maturity date decreases, so too does the return as there is less perceived risk and hence less compensation.

When a bond is originally issued, the credit spread paid over the risk-free rate is usually higher the longer the bond has until maturity. This is due to there being more credit risk (risk of default) associated with lending for longer periods, compared to shorter periods of time, and for the optionality of redeploying funds being lost.

Likewise, a normal shaped risk-free yield curve will also offer higher risk-free rates (yields) the further out to maturity. This is evident looking at the Australian Government yield curve. Remember the credit spread and the risk-free rate together make up the yield of a corporate bond.

Over the life of the bond, as the length of time to maturity gradually shortens, the credit spread and risk-free rate both decrease (all things being equal) as duration and credit risk are gradually priced out. With this, the bond’s original yield moves lower, causing the bond price to rally. The investor has been rewarded for taking both duration and credit risk, as we demonstrate using the Stockland 4.5% Nov 2022 bond as a real-life example.

Increasing returns

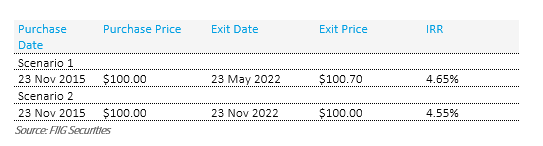

In the below chart we show the internal rate of return (IRR) for the Stockland Nov 2022 fixed coupon bond, which currently has less than a year until maturity, but was issued with a seven-year tenor. In both scenarios we have assumed that the bond was purchased at primary issuance for $100. The first scenario calculates IRR of this investment assuming the bond is sold now, following its May coupon payment while the second scenario assumes the bond is held until maturity in November 2022.

The second scenario, where the Stockland 2022 bond was held until maturity has a lower IRR than the first scenario where the bond can be exited at a price above the final redemption amount of $100, locking in a capital price gain of ~$0.70. By holding on to the bond for an extra 6-months, investors are not getting rewarded with additional returns; rather investors will be exposed to the risk that there may not be attractive investment options at the time of maturity.

Internal rate of return (IRR) for the Stockland Nov 2022 fixed coupon bond

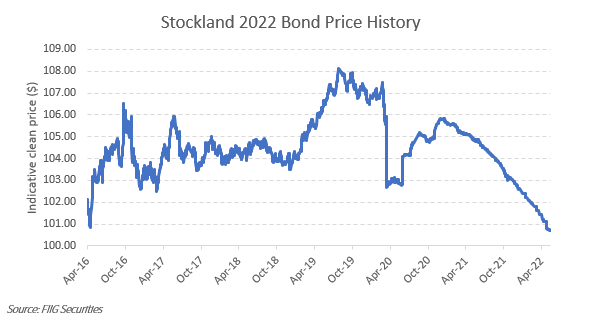

As shown in the below chart, the price of the Stockland 2022 bond peaked at over $108.00 in 2019 and has been gradually moving lower since then as the bond moves closer to maturity.

As illustrated with the Stockland 2022 example above, the return is far more attractive when upcoming maturities are actively managed and reinvested ahead of maturity dates, than to allow the deterioration in the capital price.

Conclusion

In actively managing upcoming maturities, fixed income investors are able to improve their returns, and mitigate reinvestment risk. This isn’t a feature that is available to all asset classes and is more unique to fixed income portfolios. In working out the best strategy for actively managing reinvestment of those positions due to redeem shortly, an investor is able to maximise their portfolio returns.

4 topics