ASX consumer discretionary stocks: Broker views and a fundie’s top pick

The Consumer Discretionary sector – which encompasses a broad basket of companies across the automotive, consumer apparel, retail, and services sectors – is often regarded as one of the most sensitive to rising inflation and slowing economic growth.

But we’ve seen a near-unique situation this time around, with pent-up demand and household savings built during COVID lockdowns partly offsetting fears, temporarily at least, around rising inflation and economic recession. At the same time, we’ve seen the employment rate at historic highs – but housing prices have also crumbled across Australia.

As mentioned at the top, this part of the economic cycle isn’t typically when such stocks outperform. But do conventional rules still hold in this environment?

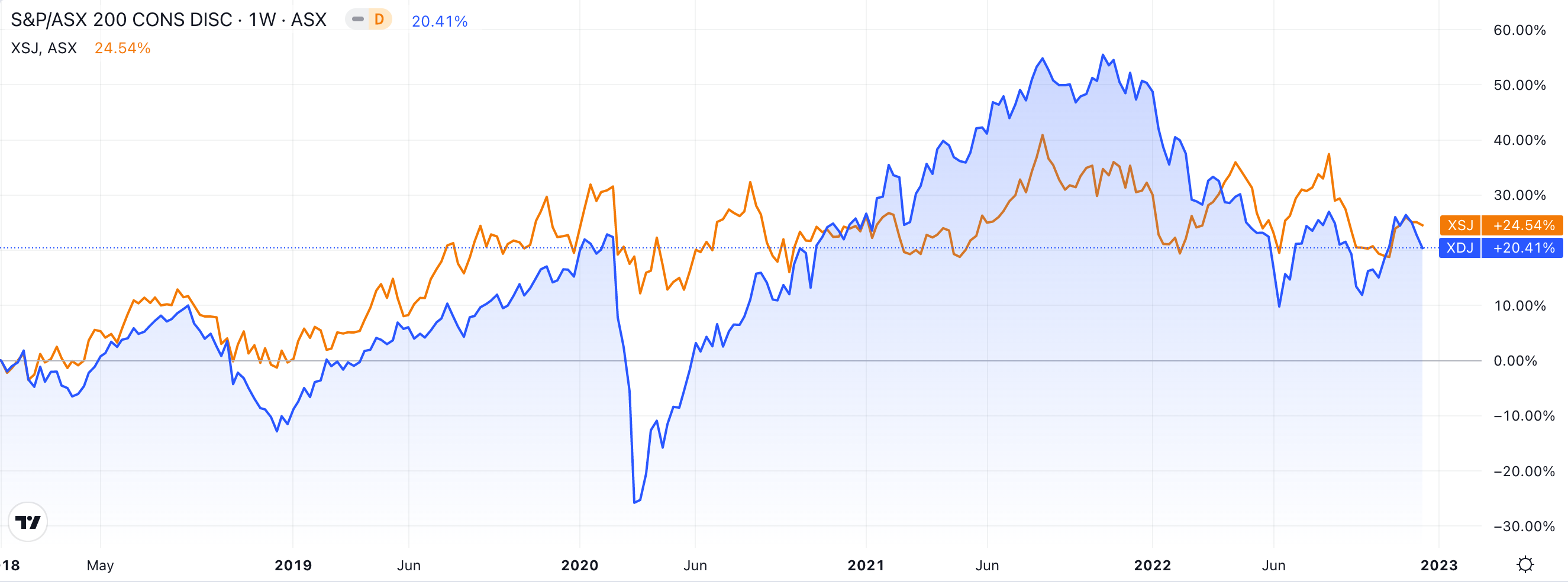

Consumer Discretionary versus Consumer Staples over five years

In this feature, I look at a couple of the biggest segments of Australian consumer discretionary – retail and consumer services – which between them comprise around 100 ASX-listed companies. Below, I’ve pulled together some of the notable broker rating changes made in the second half of 2022.

I also get a fund manager’s perspective on the sector from Sean Sequeira, CFA, chief investment officer at Australian Eagle Asset Management.

Discretionary retailers

Wesfarmers (ASX: WES)

A continuation of “robust retail trading conditions” was one of the key messages from the trading update delivered during the group’s AGM in late October.

The conglomerate behind brands such as hardware behemoth Bunnings and retailers Kmart and Target reported “pleasing” sales growth in the year up to 27 October. Management said the figures for Kmart and Target, in particular, were strong even when adjusted for the impact of lockdowns in prior periods.

But Anthony Gianotti, CFO, in late November emphasised the difficulty of his role in an environment of rising inflation, surging interest rates, and rising living costs, while presenting at the Australian Financial Review CFO Live Summit. He also cited the Federal Government’s changes to industrial relations laws – the first tranche of which passed parliament on 29 November – as a challenge.

CLSA, on 24 July, maintained its Outperform rating on Wesfarmers. But analyst Richard Barwick trimmed his price target to $50.20 from $54.90.

A month earlier, on 28 June, J.P. Morgan downgraded Wesfarmers to Underweight from Neutral. Analyst Bryan Raymond also cut his target price to $41.20 from $51.80.

The stock was trading at just over $46.46 at the close on Thursday, up around 8% since the latest trading update but down 22% since January.

JB Hi-Fi (ASX: JBH)

Credit Suisse downgraded the consumer electronics retailer to Neutral from Outperform on 14 December. Analyst Grant Saligari also cut around 17% from his price target, which was reduced to $45.73 from $55.11.

At the same time, UBS added the firm to its coverage list with a similar Equal-weight rating. But analyst Melinda Baxter set a lower price target of $42, which undercuts the FactSet consensus average of $46.

And J.P. Morgan, on 28 June, downgraded the stock to Neutral from Overweight. Analyst Bryan Raymond also wiped around 30% from his price target, which was dropped to $42 from $62.

JB Hi-Fi shares were priced at $42.56 at the market close on Thursday, down almost 13% for the year.

Premier Investments (ASX: PMV)

The clothing retailer, whose flagship brands include Just Jeans, peteralexander and portmans, was downgraded to Underperform from Outperform by CLSA on 28 November – suggesting the broker is less than glowing in its expectations for the Christmas trade. But the Solomon Lew-headed firm copped a slight increase to its target price, which CLSA analyst Mark Wade bumped to $26 from $25.50.

Citi also downgraded the stock in the back end of ‘22, reducing it to Neutral from Buy on 30 September. But again, PMV’s price target saw a slight increase, Citi’s analyst James Wang lifting this to $25.30 from $25.

Earlier, J.P. Morgan downgraded Premier Investments to Neutral from Overweight on 28 June. Analyst Bryan Raymond dropped his price target by almost 40%, to $20.50 from $33.40.

Premier Investments’ shares were trading at $25.24 at the close on Thursday, down around 18% since the start of January.

Consumer services

It was a similar story In the consumer services segment, with more downgrades than any other broker ratings changes in recent months.

Aristocrat Leisure (ASX: ALL)

A gaming content and technology company, Aristocrat manufactures and sells poker machines to pubs, clubs and casinos, with operations across Australia, North America and in most major countries.

On 16 November, Management reported $1.1 billion in net profits after tax and amortisation for the full year ended 30 September 2022 – up 27% on the previous year. Earnings of $1.9 billion were up 20% on the prior corresponding period.

The result was largely in line with what UBS anticipated, the broker noting some parts of the business were weaker but the Americas’ divisions beating expectations. An overall positive view on the business for the medium-term was underpinned by it being “affected by global macro less than other discretionary exposures,” wrote UBS Analyst Andre Fromyhr. He maintained his Buy rating but lowered his price target to $41.60 from $44.80

Macquarie also maintained its previous rating of Outperform, though described the result as “disappointing” amid cost inflation and the result of the firm’s mobile phone gaming division, Pixel United. But analyst David Fabris said the balance sheet remains robust, with scope for further buyback and M&A activity. He also left his price target unchanged at $43.

Echoing the above views, Credit Suisse described the results as broadly in line with its expectations. The broker believes ALL’s digital division will be unable to achieve strong growth due to challenging market conditions but anticipated a buyback announcement and a possible mid-size acquisition “to help bring earnings and value.” Credit Suisse maintained a Neutral rating for Aristrocrat Leisure and lowered its price target to $36.50 from $37.20.

ALL shares closed yesterday at $30.95, the price down almost 14% since the mid-November full-year result and 30% below where it opened on 4 January.

Domino’s Pizza Enterprises (ASX: DMP)

On 1 December, Macquarie downgraded Domino's Pizza to Underperform from Neutral, the share price target cut to $60 from A$61.90.

The stock was also downgraded by Citi in the month prior, analyst Sam Teeger reducing Domino’s rating to Neutral from Buy on 4 November. His price target was reduced by 20% to $66.60, from $84.40.

On the other hand, Goldman Sachs latest ratings shift for the pizza-maker was an upgrade on 14 September, analyst Lisa Deng bumping it to Neutral from Sell. She also lifted the price target to $62.90, from $60.90.

Domino’s shares were trading at $65.86 at the close on Thursday, down only around 3% since 1 July but 46% below the $122.36 price it opened at on 4 January.

IDP Education (ASX: IEL)

An international education company, IDP Education offers student placements in Australia, New Zealand, the US, UK, Republic of Ireland and Canada. Its biggest revenue centres are in English language testing, student placement, digital marketing and events, and English language teaching.

After being severely disrupted during COVID lockdowns and travel restrictions, operations have since rebounded, with management in August reporting the following for FY 2022.

- Net profit after tax of $106.6 million

- Revenue of $793.3 million

- Earnings before interest and taxes of $163.2 million.

On 2 December, broker Morgans downgraded IDP Education to Hold from Add, analyst Scott Murdoch cutting the share price target to $30.75 from $31.10.

CLSA initiated coverage of the company on 5 October, starting with a Buy rating and a price target of $38.

On 28 July, J.P. Morgan initiated coverage of IDP Education with an Overweight rating and a $30.50 price target.

IDP Education shares were trading at $27.41 when markets closed on Thursday, up 11% since 1 July but down just over 20% since the start of the calendar year.

Consumer stocks are cheap, but…

There’s a good reason that some stocks in the consumer discretionary sector currently look cheap, explains Australian Eagle Asset Management’s Sean Sequeira.

“So far, earnings have mostly held up but some of these stocks are cycling very strong previous year results. This is reflected in the performance of the stock prices, particularly over the last year,” he says.

This is a point Sequeira emphasised throughout our recent chat: that the share prices of many of these stocks now don’t align with where they’ll sit four, six or 12 months from now.

That’s because of the lagging effect of price inflation and the interest rate rises central banks have been deploying to combat this.

Referring specifically to the stocks listed above – many of which are entirely domestic-focused and mature companies – he says some are trading on cheap PE multiples versus history. For example, JB Hi-Fi is trading on a forward PE multiple of around 10 times earnings.

“It may seem cheap, but the reason it’s not being heavily sought at that price is because the market’s waiting to see how interest rate rises will affect its earnings,” Sequeira says.

“Historically, it’s taken four to six months to be reflected in the economy, so we still have some time before those most recent rises show up in economic activity or in the earnings of companies in this sector.”

What’s ahead for consumer cyclicals in 2023?

“You’d expect volatility in some of these stocks for a while. That said, the sector may offer certain opportunities as we go through the year, where good quality stocks might present as long-term investments, as that volatility of earnings starts to manifest,” Sequeira says.

He notes some companies in the sector have proven more resilient. One that he singles out in this regard is Lovisa (ASX: LOV), which sells fashion jewellery and operates in multiple countries, with plenty of opportunity to further boost its addressable market.

Sequeira believes another reason earnings have remained resilient for the company is because the price point of its products is quite low. Sometimes referred to as “the lipstick effect,” it’s a phenomenon where consumers, in periods where they have less buying power, increase their purchases of smaller items as “treats” in place of larger options. It was discussed by my colleague Sara Allen earlier this year.

.jpg)

A top pick in the sector

Sequeira names Corporate Travel Management (ASX: CTD) as his preferred consumer discretionary stock. Casting back to the COVID environment, he notes that unlike many of its peers, CTD raised capital only to expand its operations, not as a lifeline.

“The business is larger now than it was pre-COVID and so has the largest available opportunity. But the share price hasn’t reflected that relative to some other travel stocks,” he says, pointing to Webjet as an example.

In an immediate sense, Sequeira says CTD is suffering because of the persistent reduction in corporate travel: “But when interest rate rises start to at least halt, if not decline, there will be an opportunity to turn that around."

Never miss an insight

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors. And while I ask the questions of some of Australia’s best strategists, economists and portfolio managers, if you’ve questions of your own, flick me an email on content@livewiremarkets.com.

2 topics

8 stocks mentioned

2 contributors mentioned