Bearish equities, very bearish property – here's what Livewire readers are saying about the year ahead

I distinctly remember one investor telling me how lonely he felt undertaking the task of running his super. Alone with lots of information and no one to speak with or use as a sounding board. I’d never really thought about it until this man described the challenges of making important decisions all on his own.

He was right. Investing can be lonely, and it is also a deeply private and sensitive activity. So with over 100,000 people accessing Livewire each month our annual investor survey offers a rare chance to gauge the mood of other investors. Below I’ve summarised the survey results on some big issues facing investors in 2019 and my colleague Alex Cowie will be publishing the ‘most tipped’ stocks in the next day or so.

Thanks to all our members that took part in the survey. I hope you a have a successful year in 2019.

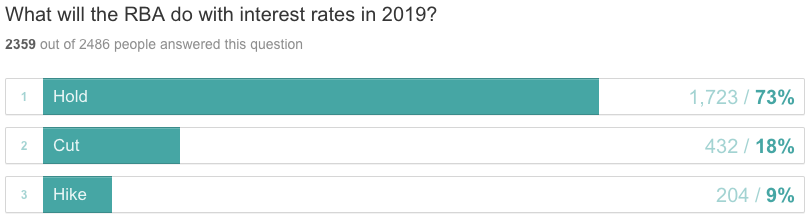

Rates

Rates have been static since August 2016 with the RBA holding firm at the record low, emergency setting of 1.50%. Most Livewire readers expect this pattern to hold for 2019. The latest official statement from the RBA indicated their view that low rates continued to support economic conditions in Australia.

Jonathan Rochford from Narrow Road Capital just published a provocative article arguing that the RBA is suffering ‘groupthink’ and has mismanaged official interest rates. (VIEW LINK)

As of January, the market is pricing in a very slight bias towards reducing interest rates with a ~15 bp cut out to June 2020.

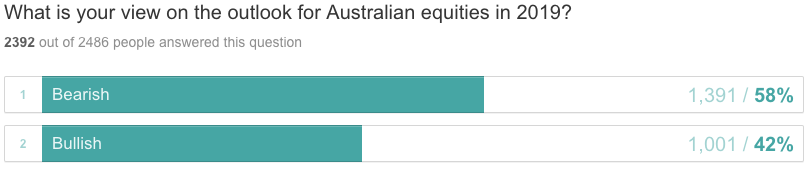

Equities

2018 was a hard year for equity investors with the ASX200 falling ~ 9.7%. Given the typically low allocation to defensive assets like bonds, most investors will be feeling the brunt of these declines. Add to that the price declines and bearish headlines on residential property and the backdrop at the time of the survey was quite negative.

58% of survey participants said they were bearish on the outlook for equities in 2019. I found the chart below interesting and while I’m sure you can be selective about the date ranges, I’m an optimist at heart and hope the market can bounce back in 2019.

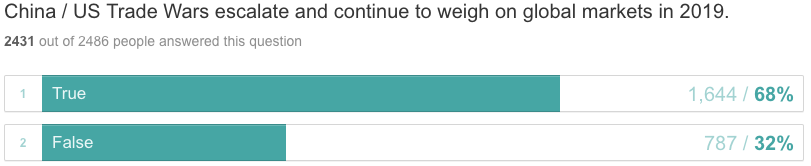

Trade War

US v China started 2018 as a murmur started to gain some momentum and by Q4 of 2018 this was the main game in town from a geopolitical perspective. When the world’s two largest economies go head to head it breeds uncertainty.

Livewire readers are not expecting a resolution anytime soon and if that is the case, I would expect this issue to remain a drag on growth assets in 2019.

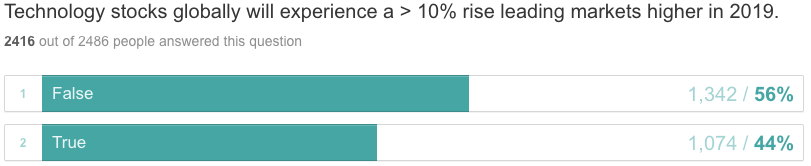

Tech Stocks

Last year we asked if tech stocks would fall more than 20% in 2018 (they did). This year we flipped the question to see if they could stage a recovery rally greater than 10%. Half way through January and the NASDAQ has already rallied ~5%.

The majority of Livewire readers felt that a recovery of that magnitude was not on the cards. Remember last year the headlines around regulation on companies like Facebook were pretty strong – perhaps some recency bias creeping in.

Lachlan MacGregor from Alphinity published a great wrap up on the year the tech giants stumbled. (VIEW LINK)

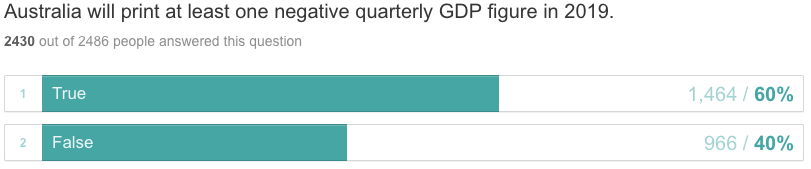

Australian GDP

This for me was the most interesting topic. Remember Australia has clocked up 27 years without recession (two consecutive quarters of negative GDP) so the record is exceptional. However, interest rates are at ‘emergency’ settings, wages growth is subdued, and private sector debt is high. With the negative returns in equities and potential flow on effects of a falling property market it doesn’t seem like that big of a stretch (in my very humble opinion.)

This for me was the most interesting topic. Remember Australia has clocked up 27 years without recession (two consecutive quarters of negative GDP) so the record is exceptional. However, interest rates are at ‘emergency’ settings, wages growth is subdued, and private sector debt is high. With the negative returns in equities and potential flow on effects of a falling property market it doesn’t seem like that big of a stretch (in my very humble opinion.)

Readers apparently share my sentiment with 60% voting that a quarter of negative GDP print is on the cards in 2019.

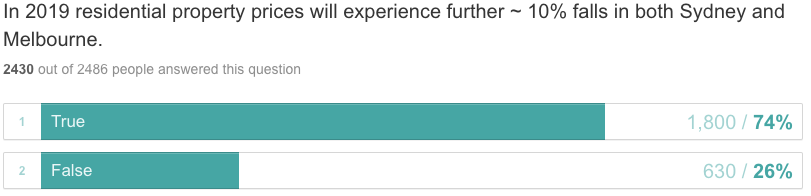

Residential Property

Who doesn’t have an opinion on residential property? The fall in residential property values must be one of the most celebrated topics in the country. I’ve never seen so many people so happy to see asset values decline and be so open in their views.

I own property and I have no doubt the paper value has fallen from 18 months ago. Even I raised my eyebrows at some of the sale prices being achieved in my area.

I have my own views; however, I would strongly encourage you to read this balanced and very well researched article from Phil Hofflin at Lazard Asset Management titled Residential Property Declines – The Lessons of History. (VIEW LINK)

Keeping account

At this time of year, you’ll undoubtedly have read numerous articles from people lambasting the futility of predictions and forecasts. Being ‘right’ is not the primary objective to this exercise, it’s interesting to gauge how people are feeling and it’s also a bit of fun to get the old grey matter thinking about a few topical issues.

Having run these surveys for a few years I find they are good at capturing sentiment at the time. This can provide clues as to where investors may be heavily biased by recent information.

We also make sure that we do a review of the results 12-months down the track and publish these on the Livewire website.

For what it's worth here are my views (not advice / recommendations)...

- Rates on hold

- Bulllish equities

- Trade War to hang around (but genuinely no idea)

- Tech stocks will rally > 10%

- Oz GDP will not print a negative quarter

- Residential property will fall further but not another 10%

6 topics