Central banks spook markets, biggest fall since 87 (COH, SGR, CGF)

Friday a distant memory as selling resumed on the ASX today, the index suffering its worst decline since 1987 as central banks hit the panic button, cutting interest rates and launching stimulus.

- New Zealand cut interest rates by 0.75% to 0.25

The US cut interest rates to near zero and launched a large asset purchase program

The Bank of Japan raised its ETF annual purchase target to 12 trillion yen and said it will take additional easing measures as / when needed

The RBA is expected to cut rates again this week, while the Australian Government is about to launch another round of stimulus

All this lead to a big decline in bond yields with US Treasury Yields on track for the biggest one day drop since 2009, risk assets (equities) were sold hard with just 3 stocks in the ASX 200 closing in the green, while 6 stocks in the top 200 closed down more than 20%. Also adding to the pressure was US Futures which were limit down (a decline greater than 4.77%) so they were halted before our market opened, meaning that selling was targeted into other markets, like our own.

Asian markets were weaker today, although in a relative sense were fairly calm, Japan off just 1.32% thanks to BOJ buying while Chinese stocks were off by around 2%.

In terms of sectors, Energy, Industrials & Financials down more than 11% a piece, that’s not something you see often.

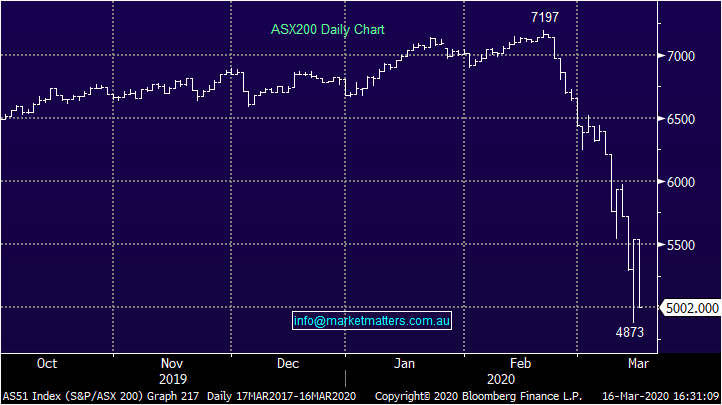

From the 7197 high set just 17 trading ago, the market closed today at 5002, down 2195pts / 30.5%

Overall, the ASX 200 fell -537pts / -9.70% today to close at 5002 - Dow Futures are trading down -1041pts/-4.53%, although that is limit down.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Stocks Moving: In a sell-off like this there’s very few safe havens and today was a clear example of that. Telstra (TLS) closed up, so did Dominoes (DMP) which makes sense with the country about to start working from home, elsewhere it was tough across the board, Cochlear (COH) hit hard -19.25% after scrapping guidance, the hearing implants provider expects a significant hit to sales from the coronavirus and has thrown away previous expectations.

Cochlear (COH) Chart

The Casino’s have also been hit hard, Crown (CWN) losing 11% today while Star Entertainment (SGR) was hit harder, down by 23.57% after rolling out further preventative measures, including the deactivation of every second gaming machine and electronic table game to create additional distance, reducing the capacity at table games, including increasing distancing at seated table games between players and restricting the total number of players at each stand up table game and restricting the number of patrons in food / drinking venues. This is an area hit very hard in recent times with the virus simply another major headwind.

Star Entertainment (SGR) Chart

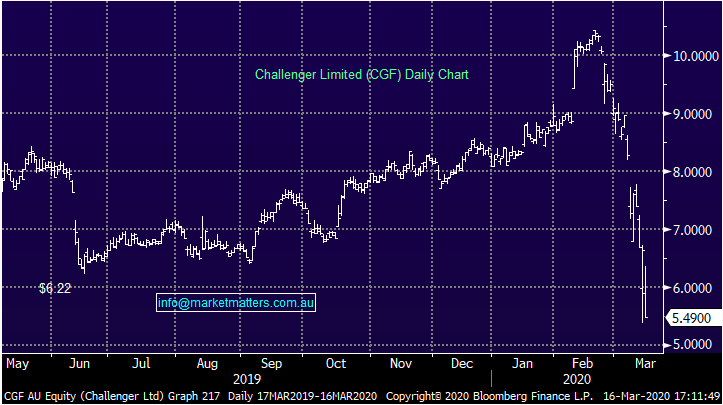

Challenger Group Financial (CGF) another company out today, along with many others that flagged an earnings hit, falling ~17%. CGF had recently upped full year guidance but have now pared that back - CGF is a complicated business with large exposures to a cross section of markets which underpin their annuities, hard not to see them hurting more in this sort of environment.

Challenger Group Financial (CGF) Chart

BROKER MOVES:

· NAB Raised to Overweight at Morgan Stanley; PT A$19.50

· Treasury Wine Raised to Buy at UBS; PT A$15.40

· APA Group Raised to Buy at UBS; PT A$11.40

· Santos Raised to Add at Morgans Financial Limited; PT A$7.97

· Boral Raised to Outperform at Credit Suisse; PT A$4.70

· Sydney Airport Raised to Neutral at Credit Suisse; PT A$6

· South32 Raised to Outperform at Macquarie; PT A$2.24

· JB Hi-Fi Raised to Overweight at JPMorgan; PT A$38

· Fortescue Raised to Buy at Bell Potter; PT A$9.10

· IPH Raised to Buy at Bell Potter; PT A$8.50

· Sonic Healthcare Raised to Buy at Jefferies; PT A$31.45

· Ansell Raised to Buy at Jefferies; PT A$31.45

· CSL Raised to Buy at Jefferies; PT A$315.95

Get regular market updates

Market Matters publishes daily market reports and sends SMS alerts when we transact on our portfolio. To get our latest market views and hear when we take new positions, trial Market Matters for 14 days at no cost by clicking the 'CONTACT' button below.

1 topic

18 stocks mentioned