Charts and caffeine: Three charts and three different takes on the recession debate

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

Note: US equity, bond, and commodity markets are closed for the inaugural Juneteenth public holiday.

- FTSE 100 - 7,122 (+1.5%)

- STOXX 600 - 406.81 (+0.88%)

- UK10YR - 2.604% (+10bp)

- EURUSD - 1.0507

- GOLD - US$1841/oz

- BRENT CRUDE - US$114.13/bbl

THE CALENDAR

Because the US is on holiday, central bank speakers decided to move their public appearances forward. The highlight was Cleveland Fed President Loretta Mester. At first, she said she wasn't predicting a recession. Ten minutes later, she admitted the risks for one are increasing.

There will be even more central bank speeches to enjoy when European Central Bank President Christine Lagarde addresses the European Parliament tonight. St Louis Fed President James Bullard is also speaking.

For those not in the know, Bullard is best known as the original outlier at the Federal Reserve. He has been calling for outsized rate hikes as far back as October last year. At one point, he also offered a public view that a 100 basis point rate hike was necessary to temper inflation.

Here at home, it's all about the Reserve Bank's meeting minutes for June - the one where they hiked rates by 50 basis points. It will be interesting to see how Governor Philip Lowe and the board process the reality of full employment and rampant inflation.

THE CHARTS

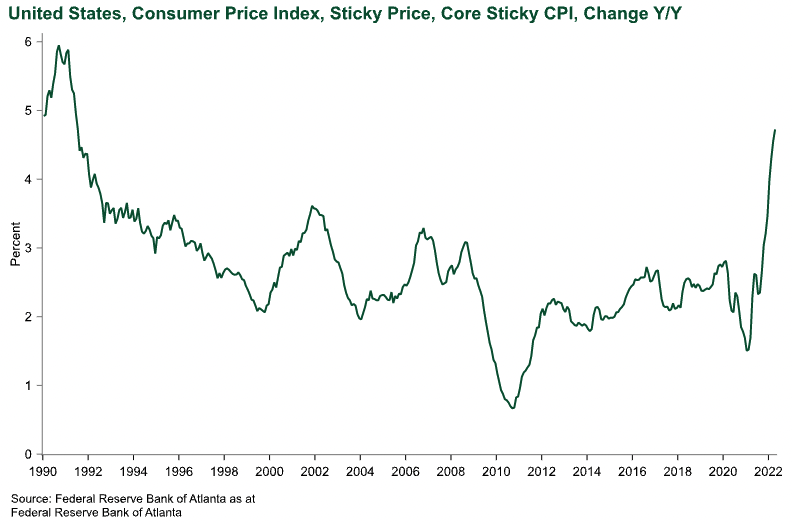

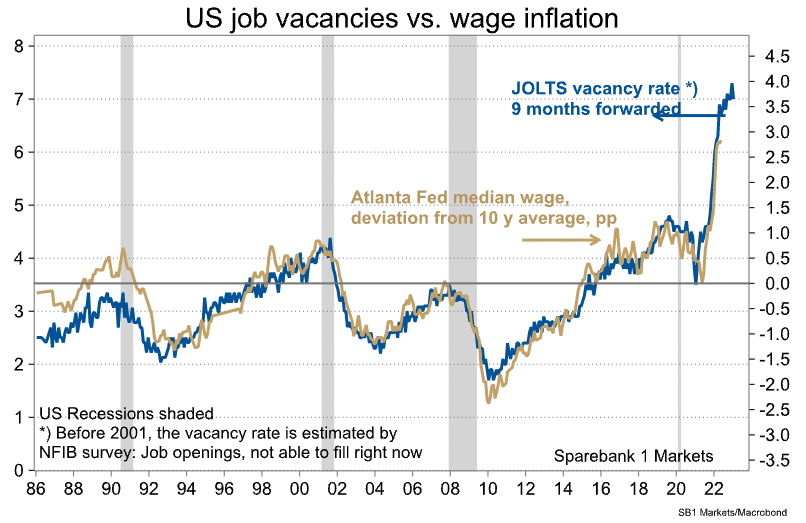

Today, I thought we'd take a look at three different views on the risk of a global recession. While all see some probability of a global downturn, each of these charts blames the problem for a different reason. All these charts are thanks to the team at Macrobond Financial and their second-half outlook.

THE QUOTE

The only way for markets to recover quickly now is for a recession to be definitively avoided. (David Bailin, Citi Global Wealth CIO)

Related to all the above charts, David had this quote in his weekend note. To me, it tells the whole story. His team has raised the forecast of a US recession in 2023 to 40% from 35%.

STOCKS TO WATCH

In today's stocks to watch, I thought I'd take a look at two stocks with milk in their pipelines - namely Bubs Australia (ASX:BUB) and Bega Cheese (ASX:BGA). Although both companies have the good stuff at their heart, each is facing a different future.

Bega is facing headwinds from cost pressures. Although agriculture has been a big boom sector in the last six months (think Elders, Nufarm, Graincorp), Bega has the opposite problem. Costs are on the up - and are affecting everything from milk supply to packaging and freight costs. UBS' Evan Karatzas also noted that the company recently hiked its FY23 farmgate milk price for the third time this year. He thinks the hike could add more than $200 million in costs. Unsurprisingly, the company has been downgraded to a neutral with a price target of $4.75.

For Bubs, everything is looking up as it secures major contracts in the US due to that country's baby formula shortage. Citi has upgraded the company from a high-risk buy to a (regular) buy. In fact, the company is now the top pick in the small-cap space for the broker. It also helps that the full-year sales guidance has been hiked by a lazy 35%. Bell Potter has the company at a hold - but a speculative one at best. It wants to see proof that it can break into the US market and develop consistent margins in the country.

BEST READS IN BUSINESS NEWS

Why China equities warrant a look in (Livewire): VanEck's Alice Shen is taking on the most controversial topic in markets - whether China is investable or not. She argues now is the time for consideration but her thesis is still worth delving into.

Why this Wall Street billionaire just bought into an ASX minnow (AFR): One of the co-founders of US options firm Susquehanna International Group has just backed one of the ASX's most famous pump-and-dump stocks. Why? It's compelling reading, to say the least.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

2 stocks mentioned