Difficult times coming, but VanEck’s Chesler says Christmas isn’t cancelled… yet

If it feels painfully early to be talking about Christmas, mostly because it’s still 96 days away. That said, retailers, as usual, are already starting to display Christmas wares – Big W (Woolworths (ASX: WOW)) and Target (Wesfarmers (ASX: WES)) just two of the many with festive themed clothing displays or marketing discussing toy layby's for Christmas.

But one space where it’s really not too early to be discussing Christmas is from an investment perspective. If that sounds strange, you’ll need to hear me out.

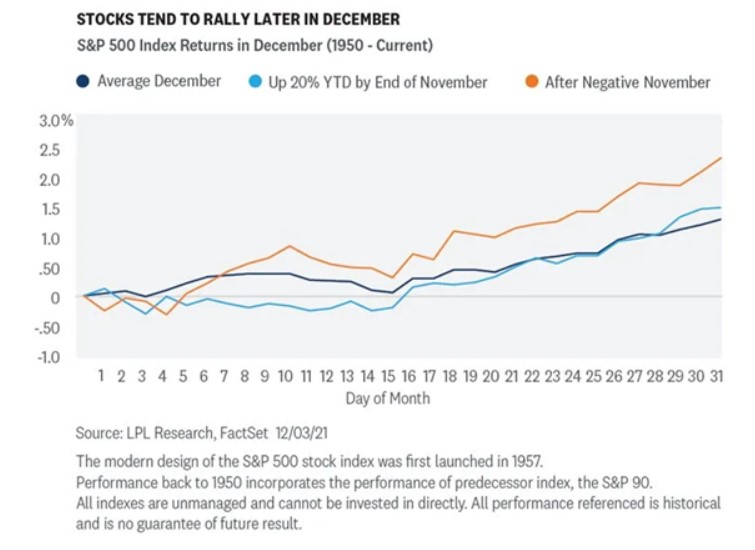

Christmas matters because of a popular calendar effect known as the Santa Rally, where typically stock prices rise heading into the end of the year. Technically, it covers a seven day period starting just before Christmas and into the end of the year, but it can start to build in the months leading up to the holiday season.

It’s traditionally responsible for a positive end to the year, although that’s not always the case. The end of 2022 was a case in point where the share markets finished the year in a bloodbath.

There are just over three months to the end of the year and we’re seeing shifting patterns in behaviour. Interest rates and the cost-of-living pressures are finally biting. It could be a very difficult end to the year.

In light of that, Russel Chesler, head of investments and capital markets for VanEck, shared his outlook for the Christmas countdown. Santa isn’t cancelled yet, but investors should think very carefully about where to put their spend.

A challenging end to a challenging year

2023 has been a volatile year so far. While there have been bright points, such as the rally in tech stocks fuelled by AI, it’s also been a year of earnings downgrades. The recent reporting season was muted and while some sectors, like consumer discretionary, held up better than expected, it was a signal that a tougher consumer environment was in train.

Retailers discussed changing spending patterns – movement from premium purchases to own brands in staples companies like Woolworths and Coles (ASX: COL), increased spend in budget department stores like Kmart and Big W compared to reduced spend in the likes of Myer (ASX: MYR) and David Jones.

It’s a trend set to continue. While inflation is finally showing some signs of a decline, the sharp pace of rate hikes has finally come to roost and consumers are starting to cut back.

“Following local and US markets recent moves upwards there is a risk of a pullback before Christmas. We expect markets will remain volatile in the short term. Should the Fed upset the apple cart and raise rates on Thursday we expect US and Australian markets will trend lower in response,” says Chesler.

This will also hit the Australian dollar, with Chesler expecting it to trade sideways or possibly down in the next few months. It’s not always bad news though for our dollar to fall, as it can encourage tourism from those countries like US or China with a higher valued currency or encourage trade.

The winners and losers in the Christmas countdown

In difficult times, certain sectors perform better than others. This time, it’s no different.

Consumer discretionary will be in an interesting position in the final months of the year. On one hand, consumers have been reducing spend. On the other, certain companies will be winners from a switch from more expensive to cheaper products.

“A perfect storm is brewing for consumer discretionary companies this Christmas with a further interest rate rise possible before the end of the year. Another rate rise combined with still elevated inflation will see consumers pullback further on non-essential spending.

We think shoppers will shun big ticket, appliance, TV and technology purchases, instead opting for Christmas mainstays of clothes, beauty items and toys,” says Chesler.

He expects retailers like Harvey Norman (ASX: HVN), JB Hi-Fi (ASX: JBH) and home-furnishing companies like Adairs (ASX: ADH) to come under pressure.

Chesler also believes the environment could actually spell bargain wins for consumer as retailers head into a discount spiral to entice shoppers.

He favours consumer staples over consumer discretionary.

“We expect food and alcohol sales to remain strong as families and friends stock up to gather at home and celebrate the Christmas period. Coles and Woolies should continue to shine while alcohol retailers such as Endeavour Group (ASX: EDV) and Treasury Wines (ASX: TWE) should also receive a boost to their bottom lines as consumers charge their glasses and cheer in the New Year,” he says.

Another sector Chesler sees positively is resources, which he notes has been resilient despite weakened Chinese demand.

“Higher oil prices should keep the share prices of energy companies Woodside Energy (ASX: WDS) and Santos (ASX: STO) elevated in the lead up to Christmas, while stronger iron ore prices are boosting the likes of Fortescue Metals (ASX: FMG), BHP (ASX: BHP) and Rio Tinto (ASX: RIO),” Chesler says.

He also argues that Australian REITs are poised for a comeback given use as an inflation hedge in many portfolios.

“We favour office and retail REITs as both sub-sectors are trading at significant discounts to book value while macro indicators highlight the potential for upside fundamentals surprise,” he says.

Morgan Stanley also see silver linings for REITs and you can read more about their picks in this wire.

Is Christmas cancelled?

Though tougher times are coming, there’s much to suggest consumers will still try to celebrate – but where they focus their spend may look different. From an investment perspective, that means thinking carefully about which areas consumers will consider necessary to spend on beyond the basic essentials.

And as for a Santa Rally? It’s anyone’s guess. After last year though, most would be hoping for a return to regular form.

Invest in ETFs

Unlock opportunities with VanEck's investment strategies that are designed to give you unequalled access to markets, sectors and intelligent investment ideas. Find out more.

4 topics

14 stocks mentioned

1 contributor mentioned