Is Twitter a trump card?

Investsmart

If you weren’t aware of Twitter before the US Presidential race, then you surely are now. Provided you don’t use more than 140 characters, Twitter is a social media platform that largely lets you share any thought that crosses your mind with the entire world.

Barack Obama introduced Twitter to the White House, but Trump has used it with far more venom. From his first tweet in 2009 plugging his reality TV show, The Donald now has 24m followers waiting to see who he will castigate next.

Twitter has spawned a language all its own. Hashtags allow comments on popular topics to be linked together, creating a stream of comments and opinions from the world’s most famous people right on down to you and me.

Twitter certainly has its downfalls. Hate speech left by ‘trolls’ is an industry-wide issue, but the platform’s ability to rapidly share news and information between billions of people is virtually unrivalled.

Twitter the company

What’s less well known about Twitter is its financial and operating history as a listed company. Twitter has largely been left for dead, down 35% since its initial public offering at $26 on 7 November 2013, and 70% after reaching a high of $70 a month later. Discussions to sell the company last September amounted to nothing.

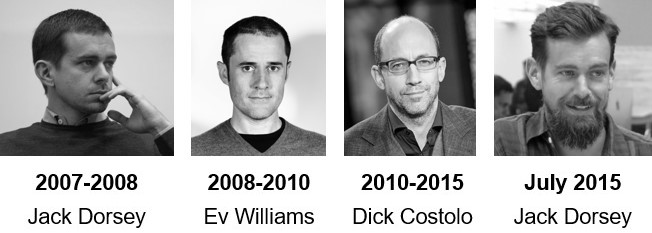

Twitter’s revolving door of CEOs

Source: Twitter

Twitter’s problems are many. First, the CEO’s office has been a revolving door starting with founder Jack Dorsey in 2007 and 2008, Ev Williams until 2010, Dick Costolo until 2015, and then back to Jack Dorsey (see above).

Further complicating matters, Dorsey remains the CEO of Square, which sells the funky modern equivalent of cash registers. Twitter has perhaps been best described by Facebook CEO Mark Zuckerberg, as ‘a clown car that drove into a gold mine and fell in.’

In 2007 and again in 2008, Facebook tried to buy Twitter but was turned down. Zuckerberg then replicated the best live features Twitter had, such as ‘following’ instead of ‘friending’, aggregating reactions to common stories and hyperlinking hashtags.

Despite management’s best efforts, it seems Twitter cannot be killed. The resilience of a business despite mismanagement is usually a clue that you’ve found a potentially great long-term investment.

Social media is considered a winner take all industry due to network effects i.e. the more people who join a social media platform, the more useful it becomes, in turn attracting more people. As Facebook has become more ubiquitous, however, some users are limiting what they post publicly.

This leaves the door open for others to create valuable niches, such as LinkedIn (used for professional relationships), Snapchat (which allows you to post a photo for 10 seconds before it disappears without a trace – particularly good for those regrettable Christmas party photos) and Twitter, which focuses on instant communication restricted to 140 characters.

Should Dorsey remove the 140 character limit?

Twitter’s self-imposed character limit has created an unrivalled ability for newsmakers and their followers to communicate. While it limits Twitter’s potential and leaves the door open to competition, changing it risks what makes Twitter great: the speed of communication and its consumption by a wide audience.

The potential solution is second level tweets, which would supplement the 140-character limit with a link to longer form content. This could greatly improve the company’s value to advertisers, as people spend more time on Twitter.

The company’s recent belated moves to silence trolls (the name given to people posting hate speech and other degenerate material) should also make it more attractive to advertisers that will continue to switch their marketing budgets away from linear TV, for example.

Twitter’s recent experiment streaming live National Football League matches is also gaining momentum, quickly increasing its audience from around 2m to 3m for matches.

Cost issues

Despite revenue growing rapidly over recent years and having multiple avenues for growth, the company must also cut costs. In 2015, $800m was spent on research and development, up from just $29m in 2010. Yet the user experience has barely changed and is littered with easy fixes users are crying out for.

If operating profit margins can approach 40% (still well below Facebook’s), the stock would be trading at under 13x pre-tax income, less than half of what Facebook currently trades on.

Should management botch things yet again, the company’s cash-rich balance sheet, absence of dual class share structure with super voting rights, and minuscule market value compared to other social media companies should eventually make it a takeover target, potentially limiting our downside. A classic case of heads we win, tails we shouldn't lose too much.

Nathan Bell is Head of Research at Peters MacGregor Capital Management.

Disclosure: Peters MacGregor Capital Management Limited holds a financial interest in Twitter through various mandates where it acts as investment manager.

6 topics

Nathan has over 20 years' investment experience. Before joining Peters MacGregor, he worked for 9 years at Intelligent Investor, including 4 years as a Portfolio Manager. Nathan is a CFA charterholder

Expertise

Nathan has over 20 years' investment experience. Before joining Peters MacGregor, he worked for 9 years at Intelligent Investor, including 4 years as a Portfolio Manager. Nathan is a CFA charterholder