More trouble on the way?

This time last year we wrote on Livewire that inflation and volatility charts were the ones we were watching most closely. Following the recent surge in both measures, Livewire got in touch to ask what we expect from here, and what investors can do about it.

New themes adding fuel to our thesis

Our thesis that inflation and volatility would move higher in 2018 has played out as expected. That said, what has differed is that some new themes have emerged in relation to global growth and trade with the potential to give both inflation and volatility another leg up over the rest of this year.

The marked improvement in the outlook for global growth is significant for a small open economy such as Australia, as is the potential for increased volatility as global trade patterns adjust to a more fragmented global tariff regime. Strong global growth has historically helped to lift the tide for Australia, irrespective of how domestic conditions are tracking at home.

Moreover, at a practical level, the Australian dollar tends to rise during periods of global growth. This makes imports cheaper, and acts as a temporary buffer against rising inflation, at least until fundamental inflation drivers catch up.

This is why it makes more sense to us to position portfolios to protect against medium-term inflation risks, rather than focusing narrowly on inflation for this quarter or this year.

Inflation and volatility have got further to run

Our expectations are that inflation still has further to run.

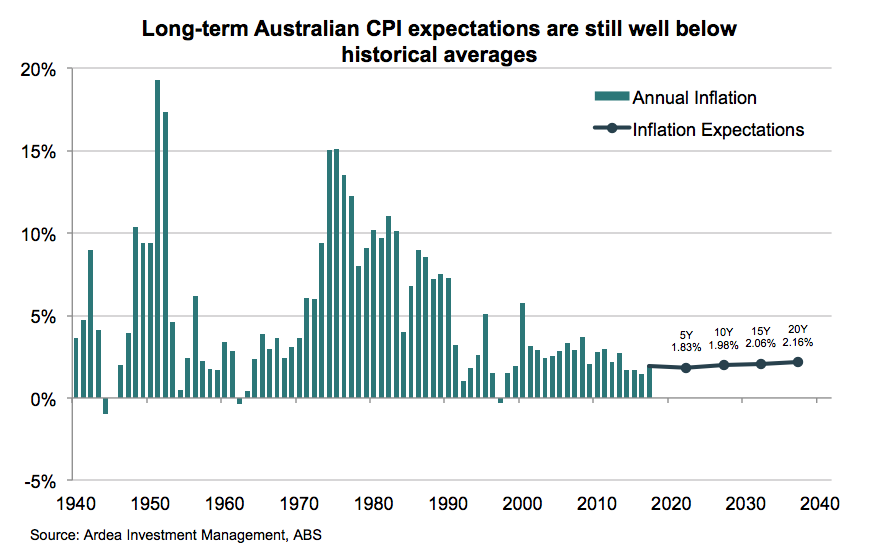

Although market awareness has been boosted by the mini-inflation scare of the past few months, in absolute terms inflation expectations are still low, and at the bottom end of the RBA target of 2-3%. Thus there is plenty of headroom above current levels.

Once we see signs of actual, realised inflation pressures in the economy, this would see inflation expectations surge higher again. Markets may also perceive that the RBA’s hands are tied, due to fear of tightening against an overleveraged housing market. This could also allow inflation fears to run for longer than they have previously.

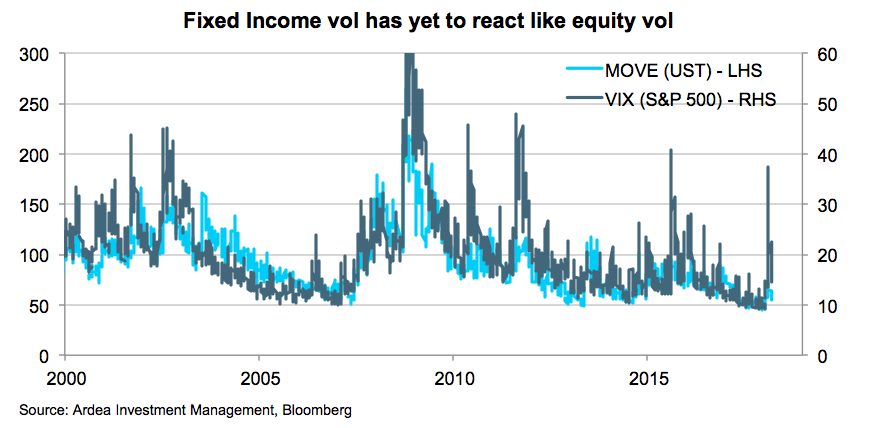

Volatility also has further to run. Although markets were punished by the long overdue surge in equity volatility, fixed income measures of volatility have barely moved. With years of low rates being part of the problem, we believe this has scope to correct further.

With the Fed on track to increase the Fed funds rate by up to 8 times over this year and next, and other countries tightening as well, an increase in bond volatility seems inevitable.

Inflation pricing is still low enough to be attractive, and bond volatility remains very cheap, so there is plenty of scope to deploy defensive strategies to protect returns in a rising rate environment.

Full scope of a potential unwind yet to be felt

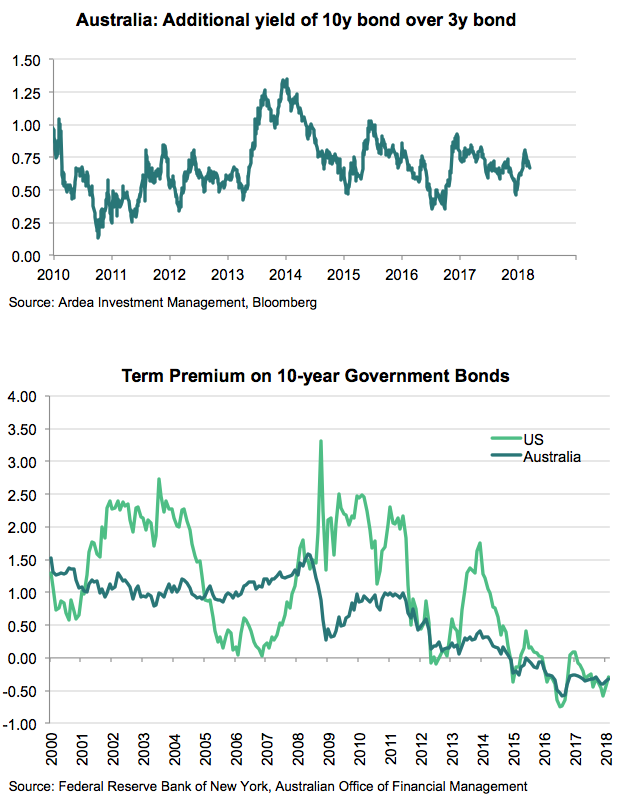

The inflation charts and volatility charts are some of our favourites, but what’s been interesting this year is that compensation received by investors for taking term risk has barely moved, despite the increase in volatility.

Compensation for term risk can be measured in a few different ways. The first is simply the additional compensation of long-term bonds (10 years) over short-term bonds (3 years). While this measure has risen off its lows earlier this year, buying and holding 10 year bonds still offers poor value relative to what was available in the past.

A more sophisticated measure of compensation for term risk aims to strip out the cyclical element of yields, and isolate the additional compensation offered by 10 year bonds relative to the expected path of the cash rate over the same period - known as the ‘term premium.’ This measure too is extremely low relative to history, confirming the poor value on offer.

Long-term bonds are an important asset class in their own right. However their role in determining discount rates is critical, as long-term bond rates drive valuations on a wide range of assets, from equities through to property and infrastructure.

Putting all the pieces together, the outlook for inflation and volatility this year, and the poor compensation on offer for term risk, suggest that the full scope of a potential unwind in markets has not yet been felt.

Investing with a view to managing these risks will thus prove crucial to portfolio outcomes.

--

Ardea Investment Management is a specialist fixed income investment boutique with a focus on delivering consistent alpha to clients through an investment process supported by a highly intuitive risk system. For further information please click here.

--

Disclaimer: The information in this article has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client’s objectives, financial situation and needs. Any information provided or conclusions made in this article, whether express or implied, including the case studies, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Ardea Investment Management (“Ardea”) (ABN 50 132 902 722, AFSL 329 828), Fidante Partners Limited (“FPL”)(ABN 94 002 835 592, AFSL 234668) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, neither Ardea nor FPL nor any of their directors, officers, employees or agents accepts any liability (whether in negligence or otherwise) for any errors or omissions contained in this article.

4 topics