RBA unlikely to taper stimulus given fragile forecasts

In the AFR this weekend I write that if the RBA’s powerful board was considering the possibility of pre-emptively tapering its monetary policy stimulus, recent economic data fails to provide a compelling case. This is because the central bank remains years away from securing its goal of getting annual wages growth well above 3% and, even more importantly, core inflation “sustainably” within its target 2% to 3% band.

This week the all-important wage price index lent weight to the RBA’s hypothesis that nationwide pay pressures remain extremely soft (despite the hyperbole on inflation). This is perhaps because employers remain scarred by the many savage shocks since, including the global financial crisis, which have made them resistant to boosting their fixed operating costs.

Private sector wages expanded by just 1.4% over the 12 months to March 2021, with public sector pay climbing at only a 1.5% pace. On a quarter-on-quarter basis, private sector wage growth actually decelerated slightly from 0.7% in December to 0.6% in March.

Ever since private wage growth peaked at 4.4% in June 2008, it has been in trend decline alongside public pay. Even if we annualise the overall quarterly 0.6% print to get a higher 2.4% outcome, this simply puts Aussie wage growth back where it was prior to the pandemic. That is, excessively weak and dragging down consumer price inflation such that it persistently undershoots the RBA’s target.

The bottom line is that wages growth is nowhere near the 3 to 4% pace the RBA requires to normalise inflation. And the only way it will get there is if the RBA can overcook the economy such that the jobless rate pushes through its natural, or full employment level.

The bad news on that front is that the jobs data this week reported a 30,600 decline in total employment in April compared to consensus forecasts for a 20,000 rise. March's unemployment rate was also revised upwards from 5.6 to 5.7%. The one bright light, which was a reduction in the jobless rate to 5.5% in April, was driven by discouraged workers leaving the labour force as JobKeeper expired, forcing the participation rate down.

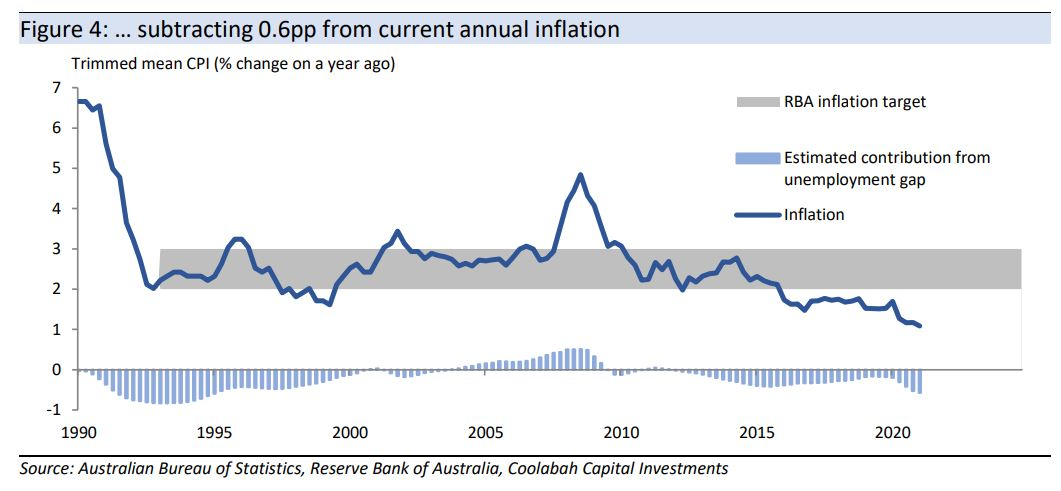

With wages growth near record lows, unemployment close to its GFC peak, and the RBA’s preferred trimmed mean inflation measure printing at merely 1.1 per cent over the year to March, it is very hard to rationalise tapering.

In June, the RBA’s $200 billion term funding facility expires, which means it will stop lending cheap money to banks. As the banks replace this with more expensive wholesale debt, they will gradually lift their fixed-rate mortgage costs, which will conveniently suck some wind out of the sails of the frothy housing market. This will thus serve as a de facto tightening of monetary policy at the same time as the federal government’s fiscal policy is subtracting from growth as it slowly works towards reducing the size of its budget deficits.

Both the RBA’s cash rate and its 3-year government bond yield target are floored at their 0.1% “lower bounds”, which means these tools are tapped out with regard to extra stimulus.

This leaves the RBA’s successful asset purchase program (aka “quantitative easing”) as the last remaining policy that has substantial untapped capacity. According to deputy governor Guy Debelle, QE has reduced Australia’s 10-year government bond yield by about 30 basis points. This has kept substantial downward pressure on the Aussie dollar, bailing out exporters wilting under the trade war with China and import-competing businesses.

In a recent speech, Debelle stressed that the total stock of bonds the RBA has acquired as a share of GDP should be the main measure of QE’s stimulus. And yet on this basis, Australia lags miles behind global peers at just over 10% of GDP compared to Canada (over 20%), New Zealand (over 20%), the US (circa 25%), the Euro area (over 30%), and the UK (about 38%).

So, it is no surprise that ANZ’s experienced economist, David Plank, released a new report this week that echoes Westpac in arguing that the RBA will likely announce a third, $100 billion round of QE at its July board meeting.

ANZ projects that this will be identical to the RBA’s first two rounds with the $100 billion invested in secondary markets over six months according to an 80:20 split between Commonwealth and state government bonds.

Plank says the RBA has explicitly linked ongoing QE, and notably not an extension of its 3-year yield target from April to November 2024, with its priority of returning the economy to full employment, which “seems to make an extension of the QE program inevitable”.

And with the Commonwealth and states saying they will continue to pump out record volumes of debt issuance over the years ahead, Plank says there is no risk of the RBA crowding out private investors.

“We think the RBA will extend QE as is, reflecting its judgement on the functioning of the bond market and, most critically, its desire to get to full employment sooner rather than later,” Plank says.

There has been some talk of the RBA following Canada’s lead in tapering QE. Here Plank counters that although the Canadian taper did not materially impact their 10-year government bond yields, “the Canadian dollar has rallied against the US dollar and the Aussie dollar since the announcement”, which is important considering the “weight the RBA puts on the exchange rate channel in describing the ways QE impacts the economy”.

“We also note that the Bank of Canada thinks the Canadian economy is much closer to full employment than the RBA believes is the case for Australia,” Plank says. “And, critically, the stock of Canada’s QE purchases is much larger as a share of GDP than the RBA’s.”

Plank believes that “announcing an explicit reduction in QE represents too aggressive a winding-back of policy at this stage, on top of not rolling the yield target and ending the term funding facility”.

He further asserts that any change to the QE program, such as a more flexible, open-ended arrangement, will “send confusing signals about the duration of the RBA’s policy commitment”. Other strategies have similarly warned that tapering QE will be treated by the market as a tightening of monetary policy.

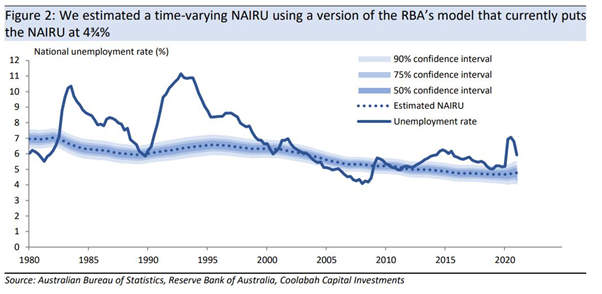

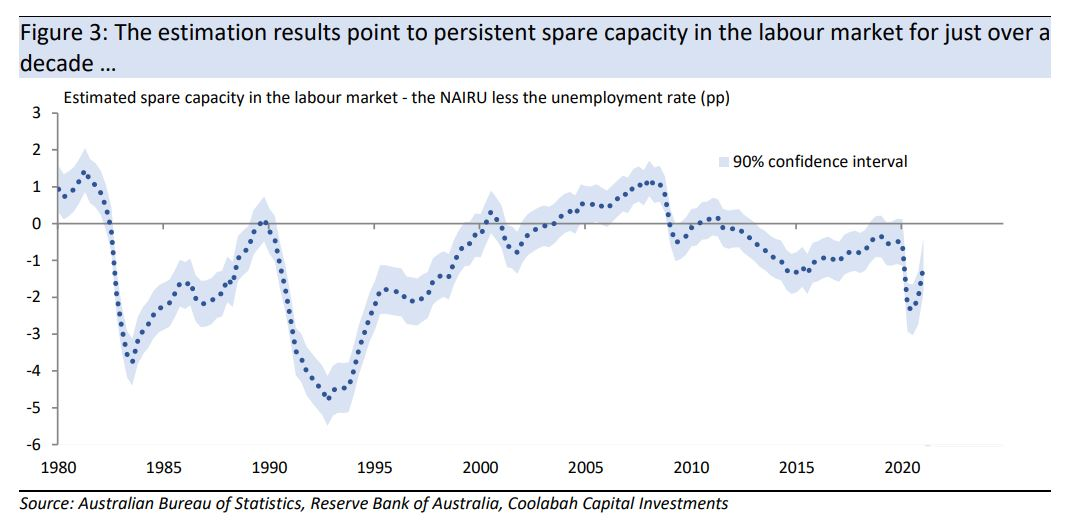

In a new research paper, our chief macro strategist, Kieran Davies, has updated and refined the RBA’s in-house model for estimating full employment, or the “non-accelerating inflation rate of unemployment” (NAIRU), which he confirms is currently between 4% and 5.25%. He also estimates a real-time NAIRU and individual state NAIRUs that corroborate his conclusions.

Davies finds that Australia’s actual jobless rate has been above the NAIRU for 10 years, which has subtracted 0.6 percentage points from current annual inflation. He further shows that the NAIRU has been trending down over time with the increase in the pension age and the difficulty of saving for retirement in a low interest rate encouraging older workers to stay in the labour force for longer.

Ultimately, Davies concludes that given historical evidence in Australia and the US that real wages growth has not started emerging until the jobless rate has hit or passed through 4.0 per cent, and the need to sustain such wages growth, the RBA is correct in targeting a NAIRU in the low 4s to high 3s.

Here the market would be wise to reflect on what the RBA means by getting actual inflation “sustainably” within the target range. That almost certainly implies six to nine months of solid data to confirm the case. And with the RBA’s shift away from forecasting to “nowcasting”, that means the RBA still has a great deal of heavy lifting to do to secure its employment and inflation goals. It is as a consequence likely to disappoint economists at CBA and NAB, and pundits, such as Terry McCrann, who in contrast to ANZ and Westpac are calling for a pre-emptive taper of the RBA’s stimulus on the back of their forecasts of the future.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $6 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 13 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

4 topics