Sunset Strip > Trading Day Wrap From Blue Ocean 20170407

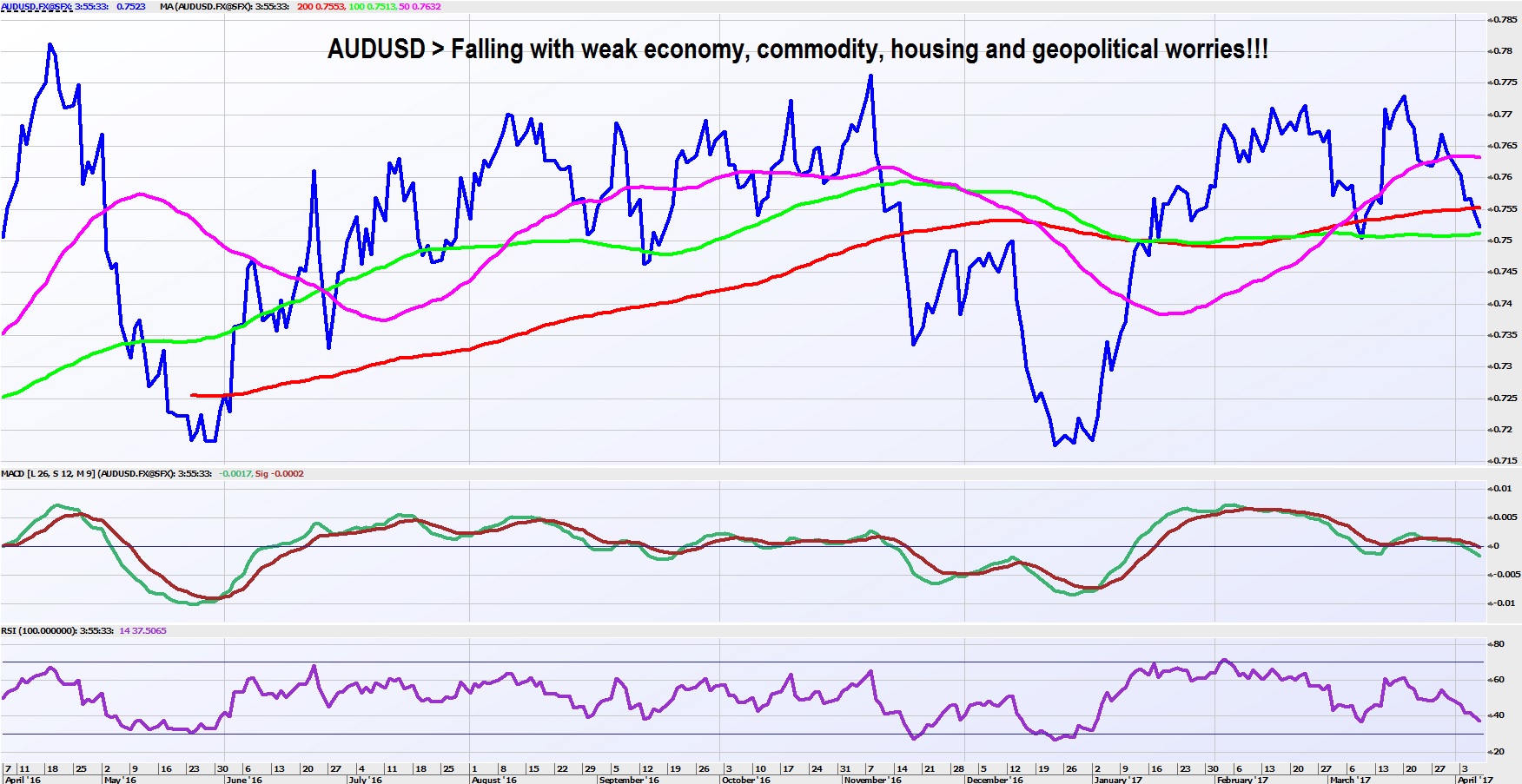

Local market fell on US strike on Syria after opening positive…and then recovered into the close to slight positive. Spot gold bounced and bond yields fell as market ran to safety with rising geo political risks adding existing global macro risks. Gold, Energy and Utilities were the best performers while Telcos, Staples and IT were the worst performers. TRS delivered another downgrade to support our negative view on consumer spending facing stocks…TRS share price down 35% today….TRS had already fallen nearly 50% from the previous 12mth high before today’s belting. Solid ADP employment data in the US points to a strong non-farm payroll tonight…but nothing is for certain…any weakness will see the market flop from the premiums. US strike on Syria raises more questions than solutions.

Click here for the full report...

8 topics

10 stocks mentioned