The case for optimism: Inside our macro pivot this month

A core principle of our investment philosophy is to be willing to change our minds when the material facts change - even when that means revisiting our own calls. In our last note, we outlined a recessionary base case shaped by tightening fiscal policy and escalating trade tensions. But since early May, the ground has shifted. The Trump administration’s pivot away from austerity and confrontation has meaningfully altered the macro landscape. In this note, we walk through what’s changed - and why we’ve turned bullish.

The Recession Thesis Unravels

Our prior recession thesis was anchored on three main assumptions:

- A planned $1.5 trillion reduction in federal spending over ten years,

- Deep job cuts of at least 500,000 through the newly established Department of Government Efficiency (DOGE), and

- A rigidly hawkish approach to trade.

Yet in recent weeks, the administration, despite its characteristically hardline rhetoric, has revealed a more populist bent, walking back each of these policy pillars to varying degrees.

Russell Vought, the architect of Project 2025 and the Trump administration’s former OMB director, had outlined an aggressive fiscal consolidation agenda. Commerce Secretary Lutnick followed through by establishing DOGE, tasked with identifying $1 trillion in savings and restoring budget balance. Meanwhile, House Republicans, led by fiscal conservatives, had secured a commitment from Speaker Johnson to deliver $1.5 trillion in spending cuts during the reconciliation process. At face value, the policy framework appeared clearly contractionary. But the political execution now appears far less certain and potentially more accommodative than initially feared.

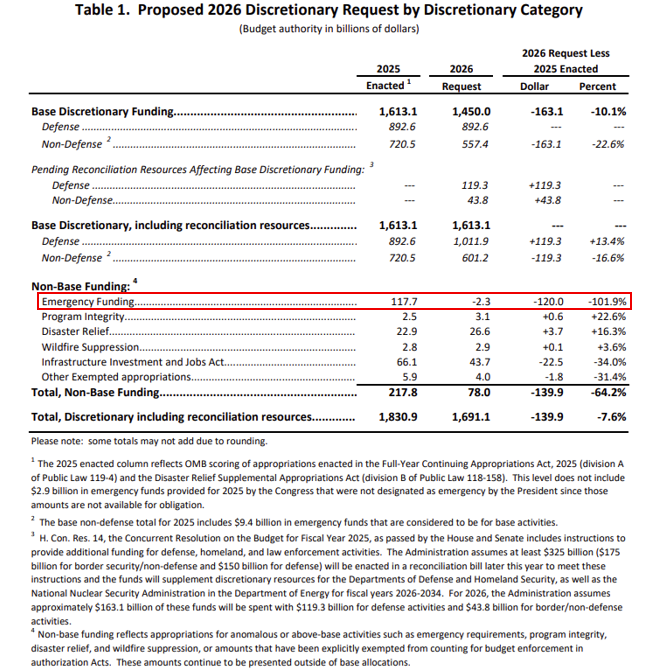

Despite the tough talk, the populist stripes of the administration were laid to bare when they released their discretionary spending request for 2026. Even Russell Vought, one of the most fiscally conservative voices in the Republican Party, submitted a budget proposal that was surprisingly expansionary in tone.

Source: Office of Management and Budget (OMB)

Policy Retreat: Fiscal, Labour, and Trade

What’s clear is that the administration’s proposed $140 billion in annual spending cuts outlined above are largely derived from reductions in emergency funding. This is money that has been previously provisioned under the Biden Administration for various programs that might need contingent funding but are rarely drawn upon. Rather than reflecting genuine austerity, the headline reduction appears to rely on an accounting gimmick to lower the deficit without delivering real spending cuts.

Secondly, DOGE’s original mandate was to radically streamline the federal workforce, effectively resetting headcount to the “essential” staffing levels defined during the COVID-19 pandemic. Commerce Secretary Lutnick, alongside Elon Musk, publicly argued that this essential core represented the true baseline required to run government operations. If implemented fully, the plan would have resulted in over one million job losses. In practice, the outcome has been far more restrained: approximately 280,000 cumulative job cuts have been announced across a broad range of agencies. With Musk now stepping away from the role to refocus on his business interests, DOGE’s contribution to spending restraint and workforce reduction has so far proven immaterial.

Third, we’ve observed a meaningful softening in the administration’s trade policy. This includes:

- A 90-day suspension of reciprocal tariffs following sharp bond market volatility,

- A trade agreement with the UK that reduces tariffs on cars, steel, and aluminium despite earlier pledges to hold the line, and

- A temporary deal with China restoring tariffs to pre–second term levels.

Collectively, these steps reflect a recognition that a recession would pose an existential risk to the political durability of Trump’s protectionist platform.

The administration’s eagerness to avoid a recession is evident on two fronts. First, it consistently pulls back from the brink just as policy measures begin to threaten economic stability. Second, its definition of that “brink” is evolving in real time as new developments emerge. This moving target reflects both Secretary Bessent’s skill economic forecasting, and the administration’s sensitivity to international reactions. Regardless of the driver, the frequent reassessment of tariff policy in response to macroeconomic signals suggests that the likelihood of a recession continues to diminish.

Learning from 2023: Consumers Stay Resilient

In light of the marked softening in both fiscal and trade policy, our base case has shifted, and we no longer expect a recession to materialise. Our outlook has turned more bullish on equities.

To contextualise this shift, we compare the current environment to the perceived economic shock of 2022-23. At that time, a sharp rise in living costs coupled with widespread layoffs across the tech sector, totalling 250,000 jobs, led many to forecast an imminent consumer-led recession. Expectations of demand destruction dominated market narratives.

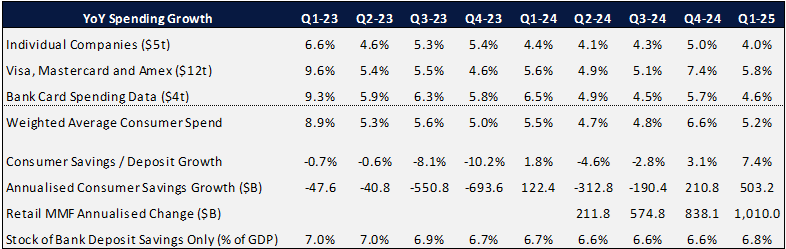

The table below shows what actually unfolded:

During the peak of the cost-of-living crisis in late 2023, consumer spending growth remained broadly steady. Rather than cutting back, households drew down on excess savings to sustain their consumption levels.

More recently, consumers have resumed saving, even as nominal spending continues to grow at an annual pace of around 5%. As a result, the excess savings buffer held in bank accounts has recovered to levels last seen at the start of the 2023 cost of living shock. Given that we estimate the current trade-related shock to be, at most, one-third the size of the 2023 episode, we hold considerable conviction that consumer spending will remain resilient.

In light of these developments, we have adopted an investment posture designed to benefit from continued economic expansion.

5 topics