The Match Out: ASX falls, Perpetual (PPT) cops bid, Dominoes (DMP) & Woolies (WOW) declare tough period

Some mixed messages came from the US Federal Reserve overnight as they raised interest rates by 0.75% as expected. Ultimately, they said rates will likely end higher but the increments of future hikes could be smaller. Overall markets took that as bearish and sold stocks aggressively after being initially up. That weakness filtered into a soft session locally with all sectors (bar Telco’s) down on the day.

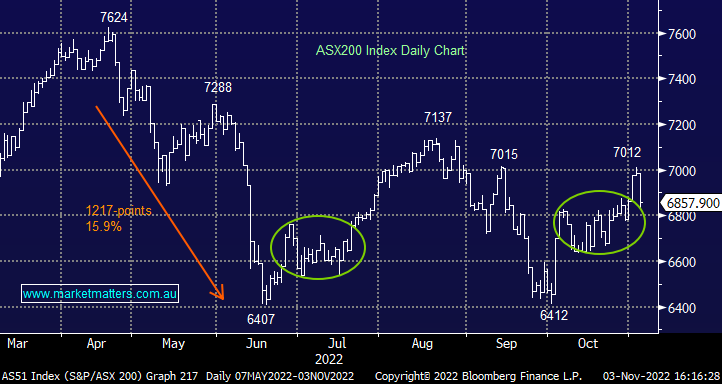

- The ASX 200 finished down -128pts/ -1.84% at 6857

- The Communications sector was best on ground (+0.14%) and only sector to finish higher while Industrials (-0.55%) outperformed a weak market.

- Materials (-2.96%) and Consumer Discretionary (-2.55%) the weakest links.

- AGL Energy (ASX: AGL) -2.07% is getting on the front foot prior to their AGM talking about the scale of the challenge ahead as we transition towards renewables.

- Perpetual (PPT) +7.14% copped a bid from Regal Partners (ASX: RPL) +4.48% throwing a spanner in the works in their aspirations to buy Pendal (ASX: PDL) -10.67%.

- Dominoes (ASX: DMP) -11.71% said trading has been tough to start FY23.

- Woolworths (ASX: WOW) -3.49% is grappling with multiple challenges, weak sales with rising costs, not a great combo.

- Iron Ore was ~1% higher in Asia today, while Citi cut its 3-month iron ore price target to $70/t from an earlier estimate of $95 on weakening demand from Chinese steelmakers.

- Gold was trading around ~US$1638 at out close, Coal Futures were flat

- Asian stocks were down, Hong Kong off -2.76%, Japan fell -1% while China fell -0.56%

- US Futures are all up, around +0.30%

ASX 200 Chart

.png)

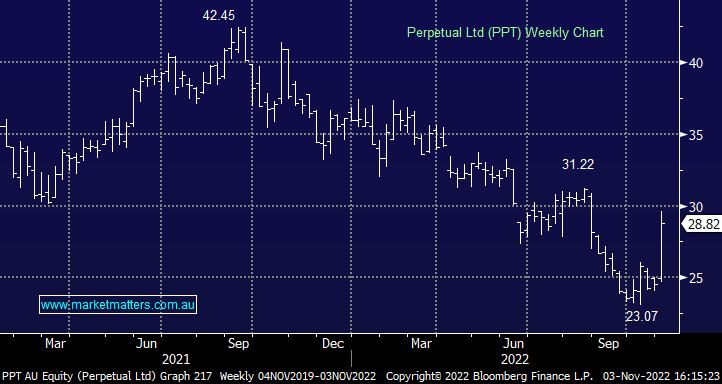

Perpetual (ASX: PPT) / Pendal (ASX: PDL) & Regal Partners (ASX: RPL)

PPT +7.14%, PDL -10.67%, RPL +4.48%: Perpetual (PPT) has a bid in play for rival fund manager Pendal (PDL) and today it was announced that Regal Partners (RPL), alongside a Private Equity firm have made a bid for Perpetual (PPT) at $30, a small 11.5% premium to their last traded price. This is interesting as the ‘go too’ trade in town for hedge funds was short Perpetual (PPT) and long Pendal (PDL) as a way of getting a cheap entry into the combined entity – an arbitrage in other words – obviously assuming the deal completes. That led to the short position in PPT moving from around 1% of the register, up to around 11% making PPT the 6th most shorted stock on the exchange. The risk in that trade was a bid for Perpetual (PPT) scuttling the agreed takeover of Pendal (PDL) and right on cue, the market-savvy Phil King has done just that, making a bid for 100% of PPT via a $30 all cash per share offer.

While PPT’s board was quick to say the offer is uncertain & conditional etc, and significantly undervalues the group, which is hard to argue, the damage to those with big long positions in PDL offset by large shorts in PPT will be painful. Thinking more broadly about the deal, we suspect the bid would result in a break-up play with Perpetuals Trustee business either taken by the PE firm or spun out, with Regal taking on the fund management capability. However, the size of the deal is big for RPL which currently has~$5.5Bn in Assets under management and a current market cap of ~$680m compared to PPTs market cap of $1.5bn.

.png)

AGL Energy (ASX: AGL) $7.08

AGL -2.07% AGL is getting on the front foot ahead of their AGM next week talking about the scale of the task to phase out Coal-fired power in the time frames being discussed. ‘Our modelling shows that a 1.5-degree ambition would mean closing our coal-fired power stations by at least FY29, and all coal-fired power stations across the NEM by no later than FY31. This would mean that 98 GW of new capacity would need to be delivered by 2030 to keep the lights on. To put it in perspective, over the last five years the average amount of new capacity built in the NEM has been 2.2 GW. Simply put – we do not consider that the replacement renewable generation, firming and supporting transmission can be built quickly enough and this would put unacceptable pressure on energy security and affordability.’

There are two important implications for investors:

- Coal is actually going to be around for a lot longer than people think – and probably at very high prices. We are more successfully blocking new coal mines from being built than turning off coal demand, implying that as investors we should stay long fossil fuels.

- The raw materials needed for the transition to renewable are going to be in short supply – copper, nickel, lithium cobalt, graphite, zinc etc fit this bill, and remain long here makes sense over the coming decade.

.png)

Dominoes (DMP) $52.98

DMP -11.71% held their AGM and provided a trading update for the 1st 17wks of 1H23. Network sales were down -1.8% with FX headwinds to blame, however stripping that out they are still only +4.7% up versus +8% this time last year. They provided guidance saying that 1H23 expected earnings to be materially lower before bouncing back strongly in the 2H23, although the caveat being that trading remains uncertain! Downgrades will flow for this and there is simply too many unknowns to get excited about DMP here + opportunities elsewhere into current weakness.

.png)

Woolworths (WOW) $32.05

WOW -3.49%%: the supermarket owner struggled today as sales slowed, reiterating the issues that Coles flagged in their quarterly update as they cycle out of COVID-boosted sales. Their first quarter update showed Australian food sales fell on a like-for-like basis by -1.1% while inflation ran at 7.3%. NZ was hit harder, down 3.3% for the period, though inflation was a little softer at 5.3%. The company noted customers had started to show signs of shifting behaviour, trading down to cheaper substitutes. They also flagged ongoing supply chain risk and the chance for another wet summer to add to costs. One positive out of the announcement was the improving performance of Big W, seeing 30% LFL sales growth, though this remains a small contributor to overall performance.

.png)

Broker Moves

- Imdex Reinstated Buy at Bell Potter; PT A$2.80

- Domino's Pizza Enterprises Cut to Neutral at Citi; PT A$66.60

- NEC AU Rated New Positive at Evans & Partners Pty Ltd; PT A$3.42

- Nearmap Cut to Neutral at Evans & Partners Pty Ltd; PT A$4.11

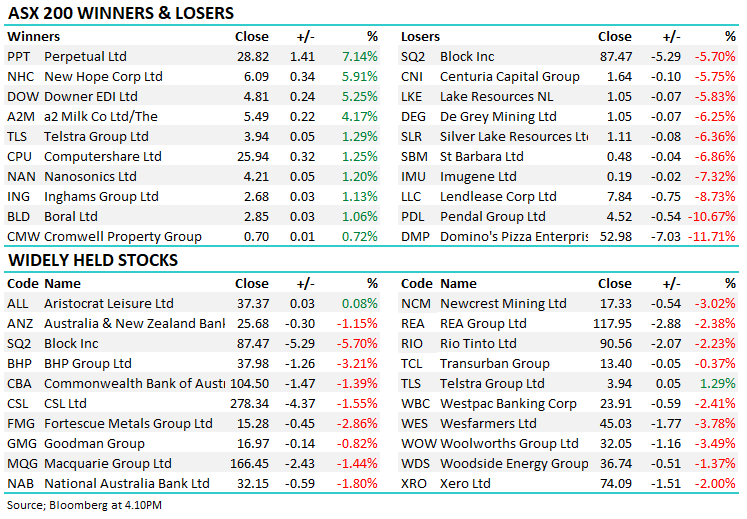

Major Movers Today

.png)

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

6 stocks mentioned