The Match Out: Early optimism fades, ASX slides into the close

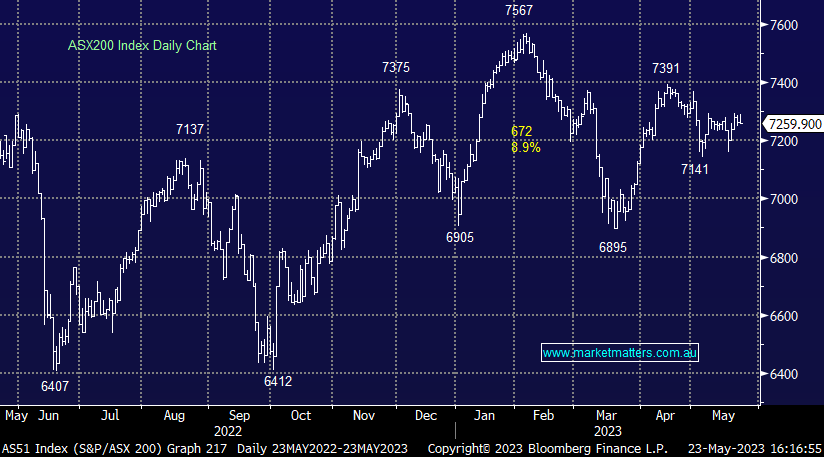

- The ASX 200 finished down -3pts/ -0.05% at 7256

- The Financials sector was best on ground (+0.77%) while Property (+0.57%) & Energy (+0.35%) were also strong.

- Consumer Discretionary (-1.04%), Staples (-0.83%) & Materials (-0.74%) the weakest links.

- Headlines this morning flashed that Biden and McCarthy agreed default is off the table – which saw US Futures supported before our open however the optimism was lethargic at best – and waned throughout the session.

- Retailers are looking weak here, particularly the ones that have been outperformers (Super Retail (ASX: SUL) & Wesfarmers (ASX: WES)) for example – we own the latter in the Income Portfolio and have trimmed it recently – but the sector is finally showing some vulnerability.

- Ramsay Healthcare (ASX: RHC) -1.55% has been a poor pick, and we’ve pretty much bought the recent high and gone downhill ever since. Our position in the Flagship Growth Portfolio now showing a loss of -14%. Today they pulled a bond deal due to lack of interest. They had planned to sell 5-year paper but after pounding the pavement for 2 weeks, they didn’t proceed, presumably the sticking point was around pricing. We’ll cover our updated thoughts on RHC tomorrow morning, and our plans for the position.

- Staying on Healthcare, UBS updated their views on the sector overnight - ResMed (ASX: RMD) +0.21% is a top pick saying, we think ResMed is priced for high-single-digit near-term top-line growth, but we see 12% as the market still underestimates the degree to which the company can capitalise on the absence of the other major player in sleep devices. MM owns RMD.

- WiseTech (ASX: WTC) -0.07% hit a record high of $74.46 intra-day is now up 7x since the Covid induced low, which is phenomenal – perhaps worth revisiting that short thesis!

- OFX +20.13% rallied hard on a slightly better FY23 result today with margins now heading in the right direction, they launched a buyback and FY24 EBITDA (underlying) guidance was ~8% above current consensus. It’s coming off a low base and most metrics turned up – this could continue to rally.

- Another one we’re looking at again (that has been hammered in recent years) is Catapult (ASX: CAT) +8.16%, which provides wearable sports technologies, FY23 results out today shows a progressive turnaround.

- Silk Laser (ASX: SLA) +12.3% up as EC Healthcare came from left field with an all-cash offer for SLA at $3.35, trumping Wesfarmers (ASX: WES) $3.15 bid.

- Qantas (ASX: QAN) -2.15% fell despite saying pre-tax profit will be $2.5 billion – about inline with current consensus.

- National Australia Bank (ASX: NAB) +0.38% is raising prices for new borrowers and removing cash back – a sign the banks are becoming more ‘rational’ following recent updates that flagged margin pressure. Good for shareholders, not so for consumers.

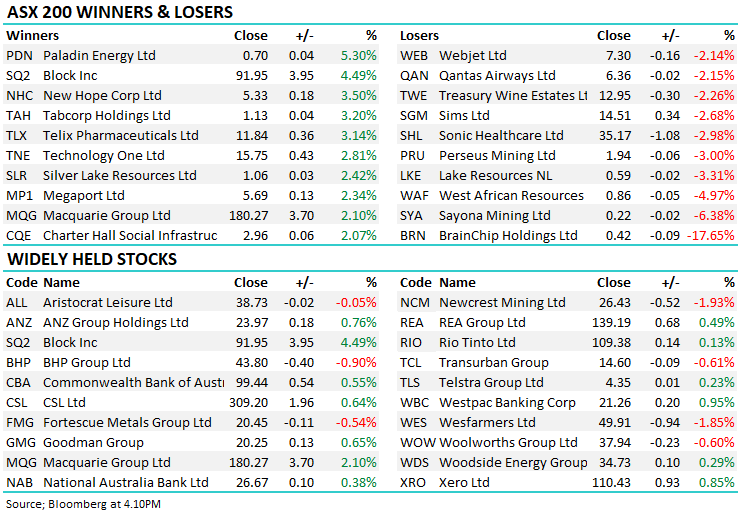

- Uranium stocks are moving – Paladin (ASX: PDN) +5.3% caught our eye today and looks good – we’re bullish the Uranium sector.

- Zip Co (ASX: Z1P) +12.73% + Block (ASX: SQ2) +4.49% rallied on the realisation that more regulation was a positive for the incumbent BNPL stocks.

- Sonic Healthcare (ASX: SHL) -2.98% fell on a UBS SELL call while Tabcorp (ASX: TAH) +3.20% enjoyed a Morgan Stanley upgrade

- Iron Ore was ~2% lower in Asia today, Coal prices edged higher.

- Gold was down -US$9 in Asian trade today, settled $US1962 at our close.

- Asian stocks turned lower, Hong Kong down -0.76%, Japan -0.58% while China was off -0.97%

- US Futures are largely down.

ASX200

Catapult Group (ASX: CAT) $0.795

CAT +8.16%: the sports tech company released their FY results last night, showing a strong turnaround from its disappointing HY result 6 months ago. The company, which develops tracking and analytic solutions for professional sports teams, saw its Annualized Contract Value (AC) grow slightly above its 20% target while the market enjoyed the focus on costs with benefits from the restructuring announced at the HY result being realized faster than originally thought.

Catapult Group (ASX: CAT)

Broker Moves

- Tabcorp Hits Almost 16-Year High After Morgan Stanley Upgrade

- Sonic Healthcare Rated New Sell at UBS

- Westpac Cut to Equal-Weight at Morgan Stanley; PT A$21

- NAB Cut to Underweight at Morgan Stanley; PT A$25.30

- Core Lithium Cut to Underweight at JPMorgan

- IGO Cut to Neutral at JPMorgan; PT A$16

- Charter Hall Social Infra Raised to Overweight at JPMorgan

- Webjet Cut to Sector Perform at RBC; PT A$7.50

- Tyro Payments Raised to Reduce at CLSA; PT A$1.40

Major Movers Today

Have a great night

The Market Matters Team

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

14 stocks mentioned