The Match Out: Tech stocks lead ASX higher as the bears begin to wobble

While the ASX was only up ~0.5%, the session had a more bullish vibe to it with some big moves at the stock level as news flow heats up ahead of full-year results. The tech sector shone bright, and so too did the telco’s while the energy stocks struggled on weaker oil prices overnight and some confusion around Woodside’s guidance at their quarterly today.

- The S&P/ASX 200 added +35 points / +0.52% to close at 6794 - a very strong close which is a bullish sign.

- IT (+3.15%), Communications (+2.07%) and Healthcare (+1.62%) standouts on the upside

- Energy (-2.83%) and Property (-0.76%) the weakest links.

- Resmed (RMD) +2.49% had a good day and is tracking nicely towards our $35/6 target area.

- Telstra (TLS) +1.52% was also strong pushing back up through $4 – we continue to like the Telco space generally, holding TLS in our Income Portfolio, TPG Telecom (TPG) in our Growth Portfolio and Aussie Broadband (ABB) in our Emerging Companies strategy.

- ANZ +2.15% came back online following the institutional component of their capital raise, the shortfall was put into a bookbuild last night which cleared at $21.65.

- Woodside (WDS) -4.39% released quarterly production + full-year guidance for the combined entity and fell – some confusion in it which we nut out below.

- Ive Group (IGL) +13.51% rallied after a competitor appointed administrators.

- Zip Co (ZIP) +16.54% rallied on their quarterly which showed strong top-line growth and desire to simplify the business, although bad debts are still an issue.

- Qantas (QAN) -0.22% is under pressure for cutting flights, with 1 in 12 flights in Australia being axed last month as they can’t keep pace with demand. Typical of a recession (not!).

- Strandline (STA) +8.11% provided a further update on progress at the Coburn Mineral Sands project. The project remains on schedule and on budget and is now 80-85% complete.

- Link group (LNK) +12.63% is going to accept a lower offer from Dye & Durham of $4.57 a share, down from the original price of $5.50. The stock closed at $4.46

- Iron ore futures were flat in Asia - now trading ~US$100/tonne in Singapore

- Gold was down US$6 at US$1689/oz at our close.

- Asian markets were mixed, the Nikkei in Japan +0.36%, Hong Kong stocks fell -1.3% while China was off -0.97%

- US Futures are flat around our close.

ASX 200 Chart

Woodside Energy (WDS) $31.14

WDS -4.39%: Was sold down today following their quarterly update and weakness in energy prices overnight – with the blame for the drop split about 50/50. 2Q22 production was fine and they provided guidance for the combined entity for the first time (BHP-P and WPL). This is where some confusion seems to have set in. Anecdotally, it seemed that the market was interpreting the update as a production downgrade, however, our energy guru Michael Clark was more of the opinion that it was not a downgrade – it was simply a change in use of conversion factors. In fact, it could be argued it’s actually an upgrade! In Petroleum Engineering there is not one set of conversion factors that is considered ‘best practice’. Standardising between different fluid types depends on whether you convert units of energy or units of mass or units of volume. Choose your poison wisely!

In this quarterly, Woodside has effectively switched product conversion methodology from energy to volumetric. This has implications for the barrels of oil equivalent (boe) per tonne of LNG (less boe) and LPG (more boe). Despite the change, exactly the same amount of LNG / LPG product tonnes are being sold this year (i.e. no change to Revenue = Price x Volume). The only difference is ‘academically’ there are less boe of LNG and more boe of LPG reported.

While the other players in the space were down today, Santos (STO) -1.89% and Beach (BPT) -1.64%, Woodsides (WDS) -4.39% is out of kilter with what it should have done.

Ive Group (IGL) $2.10

IGL +13.51%: The integrated marketing business stormed higher today after their largest competitor appointed administrators. Ovato (OVT) has been under pressure for a while now and ongoing supply chain issues, volatile trading conditions and a high-cost base finally took their toll. OVT is predominantly a catalogues business generating ~$500m+ in annual revenues, and their demise, while tough for OVT will be a benefit to IGL, who recently came out and hit guidance showing great management in a very tough environment. Consensus remains conservative implying no growth in FY23 and now we see potential for price rises and accretive acquisitions to buoy earnings in the near term. This is a very good business we have held in the past, it’s cheap with good management and a huge FF dividend yield ~8%.

Zip Co (ZIP) 77.5c

ZIP +16.54%: shares in Zip surged to 6-week highs today after showing signs of improvement at the 4th quarter update. We hosted co-founder Peter Gray today who was keen to talk up the turnaround in the business which saw revenue grow 27% year on year, and transaction volume growth of 20%. Margins remained more or less stable in the final quarter and while the loss rate fell in the US business to 2.7% for the quarter, it still remains above the group cash margin of 2.4%. Management has now firmly stepped away from the growth for the sake of growth plans. The Sezzle deal fell over last week, and Zip is now looking to cut their losses in Singapore along with other non-core geographies, essentially anything other than the US, Australia or New Zealand. Overall, a solid update showing signs of improvement but still a lot of work to be done to make it profitable.

Strandline (STA) 40c

STA +8.11%: another positive update from Strandline as they approach first production at their Coburn mineral sands project. The company announced the Wet Concentration Plant (WCP) build is coming along rapidly, raising hopes of production kick-starting this quarter. The project is now 85% built and on budget with Strandline looking to take advantage of a strong mineral sands market. In Iluka’s quarterly yesterday, they noted zircon prices were running 25% ahead of last half which was already well up on the prior 6 months. Strandline said prices are currently 35% above feasibility assumption numbers.

Broker Moves

- RPMGlobal Rated New Buy at Moelis & Company; PT A$1.94

- Megaport Raised to Buy at Canaccord; PT A$11

- Cooper Energy Raised to Equal-Weight at Morgan Stanley

- Corporate Travel Raised to Overweight at JPMorgan; PT A$25

- Atlas Arteria Cut to Equal-Weight at Morgan Stanley; PT A$8.08

- Nib Cut to Sell at Citi; PT A$6.95

- Perseus Raised to Buy at Cormark Securities; PT A$1.97

- Qube Cut to Neutral at Evans & Partners Pty Ltd; PT A$3.14

- Charter Hall Long WALE Cut to Neutral at Citi; PT A$4.70

- Charter Hall Group Cut to Neutral at Citi; PT A$12.60

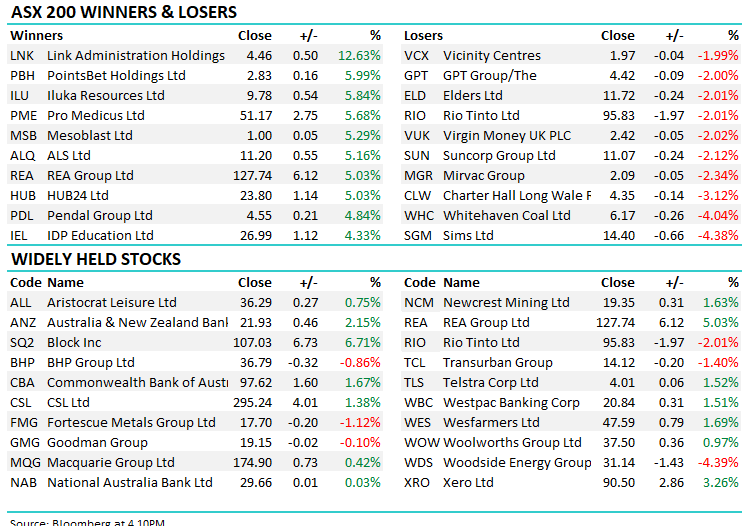

Major Movers Today

Enjoy your night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

9 stocks mentioned