Three wires that caught my eye

Get the best of Livewire in your inbox each Saturday morning. Sign up for the Livewire Weekly here: (VIEW LINK)

Investment implications of the US election

The US election is looming large over the share market currently, with investors on both sides of politics looking hesitant in the lead-up. The latest ‘Now-cast’ from fivethirtyeight.com (VIEW LINK) Trump's chances of winning have risen to 34.5% from around 9% just a few weeks ago. With so much riding on the outcome, Shane Oliver, Chief Economist at AMP Capital, has covered all the key points for investors to consider. (VIEW LINK)

[Election.PNG]

Image source: fivethirtyeight.com

5 ways to filter stock ideas

Few (if any) investors have time to be wasted analysing stocks that are unlikely to ultimately form a part of their portfolio. Spending just 15 minutes analysing each of the stocks in the official ASX list, working eight hours per day, five days per week, it’d take about three months to finish the list. Such a task is obviously unachievable, so finding a way to narrow the list is essential. We recently reached out to five contributors for insights into how they filter through ideas to ensure they spend their time on the best ones. (VIEW LINK)

Will Ingham’s be the next Dick Smith?

After a number of high-profile private equity blow-ups in recent years (Dick Smith, Spotless, Myer, et al.), investors are understandably sceptical about these offers. While there are no doubt a plethora of differences between Ingham’s and Dick Smith, these cosmetic similarities catch investors’ attention. Forager Funds’ Daniel Mueller sees a lot of differences, but that doesn’t make it an attractive investment. In the article below, he explains why valuation and a lack of pricing power have kept them away from this float. (VIEW LINK)

Chart of the week

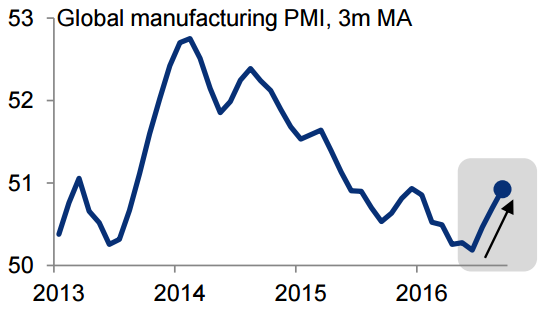

Global manufacturing starts to pick up

Purchasing Managers Indexes (PMIs) around the world have been picking up in recent months. These indexes are an important gauge of the health of manufacturing and are seen as a leading indicator for GDP.

Get the best of Livewire in your inbox each Saturday morning. Sign up for the Livewire Weekly here: (VIEW LINK)

5 topics