What we are buying and selling on the vaccine news

This is yesterday's Strategy podcast from Marcus at Marcus Today - this was our initial reaction to the Vaccine news - the podcast, which we do daily for Members, highlights the Australian opportunities and where someone that is fully invested (like us) is finding the cash to exploit them (what we are selling). We run $90m in a Growth SMA and an Income SMA. This podcast gives you a template for what to do on the vaccine news and what we are doing today - lots of ideas in here - (assuming the vaccine news is solid).

Here are some of the recovery stocks and sectors mentioned in the podcast - distilled by looking at the worst performers since the top in February - these are the main top 100 stocks:

Post-pandemic plays - recovery stocks and vaccine beneficiaries:

-

Travel - QAN, SYD

-

Transport - TCL, ALX, AIA

- REITs - URW, SCG, DXS, LLC, GPT, MGR

- Energy - OSH, WPL, ORG, STO, WOR

- Investment Banks - huge rises in the US - MQG our most obvious player

- Banks - WBC, ANZ, NAB, CBA (with WBC and NAB dividends going ex this week)

- Insurance - QBE (likes rising US bond yields), SUN, IAG

- Cyclicals - AWC, IPL, ORI, AZJ

Recovery stocks outside the ASX 100

- Travel - WEB, FLT (8.2% shorted), EVT, ALG, HLO, SLK, EXP, REX

- Education - IEL

-

Gambling - ALL, CWN, SKC, SGR

-

REITs - SCP, GOZ, CQR, COF, NSR, CMW, ABP, AVN, INA, WPR

-

Energy - BPT, COE, KAR, SXY, ZEL, GNE

- Banks - BOQ, BEN

-

Funds management - PTM, PPT

-

Insurance - IFL, GMA

- Financial - CGF, VUK, PDL IRE, LNK, CCP

-

Aged Care - EHE

-

Cyclicals - ILU, NUF, DOW, OML

-

Housing - AJL

Vaccine Victims - Stocks on the wrong end of a vaccine - the Pandemic beneficiaries:

-

Online specialty retail - DMP, HVN, BLX, JBH, PMV, AX1, NCK, KGN, BBN, RBL, BRG

-

Motor - ARB, APE, BAP

-

BNPL - APT, Z1P, SPT, PPH

-

Robinhood + stock market activity boom - SWF, HUB, NWL, PPS

-

MFG - Exposures to falling FAANGs and global technology

-

Gold - Risk-on loser

-

Technology stocks generally - Rotation to value/cyclicals from growth - no reason to sell

-

Specific Beneficiaries - GMG (Amazon warehouses), MMM (Marley Spoon)

-

Defensive - FPH, A2M, IVC, CNU, MTS

-

Consumer Staples - high performing in pandemic but boring when the market turns its focus to growth - COL, WES, WOW

We made a host of changes to our funds yesterday (Tuesday 10th November - day of the Pfizer news).

I see Morgans have downgraded their views on AX1, BBN, JBH, LOV, MTO, 4BLX, ADH and SUL today - calling the top on Specialty Retailers - the "nirvana moment" is over or as they say it - these stocks are likely to suffer from a return to some sense of normality and redirection of spend. Other stocks seeing more cautious research on the vaccine news from brokers include CSL and DMP with JBH, WOW and WES downgraded by Macquarie. There are upgrades on FLT and STO. Some of the brokers are reacting as we have. Thinking this is more than a one day change, it is the start of a number of new themes and the end of some recent ones.

What a fabulous week - Trump gone and now the vaccine news. As they say in Top Gun - "It doesn't get to look any better than this". This is not the time to look for something to worry about. This is a time to run with the bulls in the pandemic recovery stocks – until they stop running of course – but that's the stock market and you can deal with that when it happens.

The ASX 200 chart (Heikin Ashi version) - It has taken five months but finally we have broken out of the sideways trading range. When a "break" like this occurs, technically you are supposed to "chase the break" - we are on it already:

VACCINE NEWS DAY 2

Strategy Podcast - CLICK HERE

It is the day after the vaccine news and here is what happened. Here are some of the price movements on the day of the vaccine news - some extraordinary price movements that confirmed the thematic thinking above. For instance:

- The online specialty retailers fell - 17% fall in Kogan, with RBL down 20%, Adairs down 15.2%, Temple & Webster down 20.6%.

- Other retail COVID beneficiaries fell including Nick Scali down 10.3%, JB Hi-Fi down 7.4%, Domino’s Pizza down 11.2%, HVN down 4.3%. GMG (a REIT that owns warehouses used by Amazon) fell 8.4%.

- BNPL stocks which have flourished in a locked down world, saw APT down 10.9% and Z1P down 9.2%.

- Defensive stocks that outperformed as the market fell also reversed with Fisher & Paykel Healthcare down 12.1%, Ansell down 9.5%, SHL down 5.9%, WOW down 4.6%, COL down 5.3%, MTS down 6.9%.

- The motor sector took it in the neck. The sector has flourished during the pandemic on the expectation is that public transport was dead forever. Not so. Yesterday CAR fell 4.7%, APE fell 11.8%, SUL fell 11.5%, ARB fell 12.8%, GUD fell 4.5%.

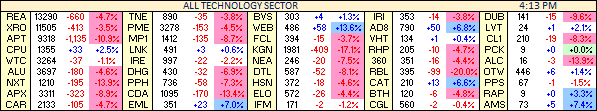

- And technology in general saw the ALL TECH index down 5.4% - here are the constituent movements yesterday:

And on the flipside the vaccine beneficiaries saw:

- Energy stocks bounce - WPL up 7.3%, STO up 12.2%, ORG up 8.3%, OSH up 16.6%, WOR up 7.7%, ALD up 5.4%, BPT up 14.8%, COE up 10.9%, KAR up 9.4%.

-

REITS - hard hit by doubts over office and shopping centre valuations rebounded sharply - URW up 43.6%, SCG up 14.5%, DXS up 8.1%, MGR up 11.1%, GPT up 9.8%, VCX up 14.5%.

- Developers also up – LLC up 7.7%, CIM up 5.4%.

- The banks in anticipation of higher interest rates, a healthy housing market and a faster than expected return to “dividend normalisation” saw CBA up 3.0%, WBC up 5.2%, ANZ up 5.1%, NAB up 7.6%, BEN up 4.2%, BOQ you up 2.8%. Macquarie was up 2.0%.

- Travel stocks popped - they still have a long way to go to get back to the February highs. QAN up 8.3%, FLT up 9.3%, WEB up 13.6%, EVT up 21.4% CTD up 15.8%, ALG up 6.6%, HLO up 19.2%, EXP up 8.3%.

- Transport stocks followed - TCL up 3.7%, SYD up 9.6%, ALX up 8.1%, AIA up 5.6%, QAN up 8.3%.

- Aged Care stocks (missed that theme) – REG up 8.8%, EHE up 3.4%, JHC up 11.3%, IVC up 3.4%.

- Media stocks (they are cyclical) – VRL (cinemas) up 6.4%, OML up 12.3%, SXL up 4.5%.

- Interest rate sensitive stocks – CGF up 5.9% (Bond yields likely to rise on economic optimism).

- Insurance – QBE up 6.7%, SUN up 6.8%, IAG up 3.6%, GMA up 11.4%.

All these movements will, if the “pandemic over” theme develops, turn from one day pops into trends. That’s what we are banking on. Yesterday's stock movements gave us the template for what might happen in the next six months.

The main risk in making our portfolio changes yesterday was that the vaccine news was quickly qualified. We are glad to see the themes continued to play out today. For now. (Wednesday - our market up 80 first thing)

We have made our bed and we will lie in it today and reassess it every morning…as always.

4 topics

25 stocks mentioned