Where T. Rowe Price sees value as “the biggest global fiscal fade” approaches

Companies in the healthcare, consumer staples and utility sectors hold the strongest appeal for calendar 2022, while Aussie banks are on the nose, according to the T. Rowe Price Australian equities team.

Of the four broad buckets across which the global investment firm divides equities – defensive growth, cyclical growth, extreme growth, and recovery – it has been piling into the first of these since the back end of last year.

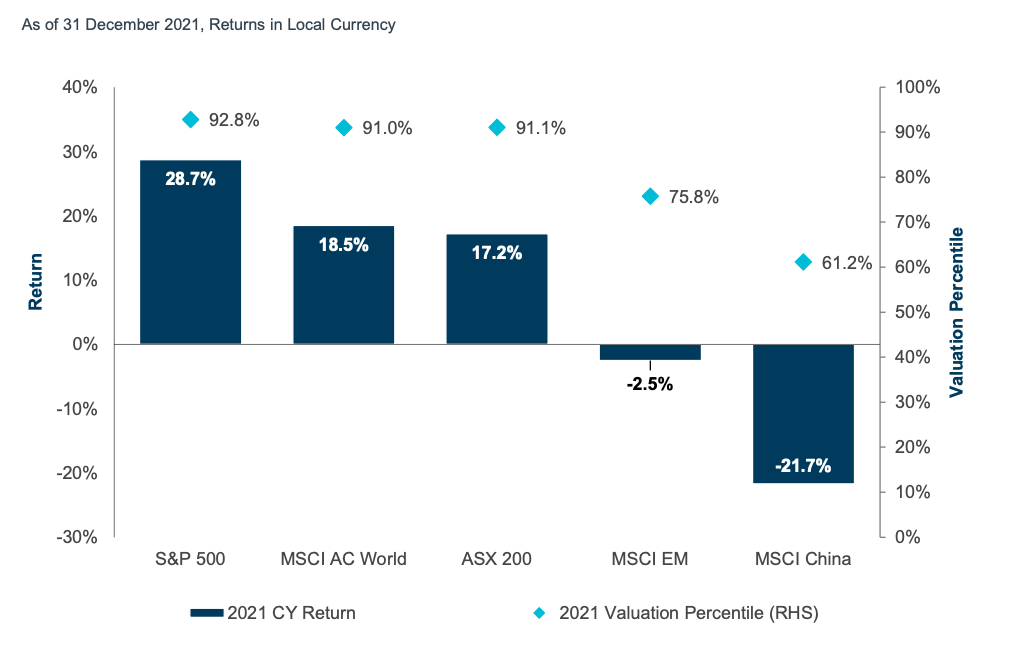

At a time when stock valuations across global markets remain elevated, north of the 90th percentile – with China the only outlier, “tailwinds are now becoming headwinds,” said T. Rowe Price’s head of Australian equities Randal Jenneke during a webinar on Thursday.

2021 was an exceptional year for markets...except China

Source: MSCI, S&P, Financial data and analytics provider FactSet. Copyright 2022. FactSet. All Rights Reserved. All Returns are calculated in USD except S&P/ASX 200 which is in AUD.

“We’re going to see one of the biggest fiscal fades globally this year, after one of the biggest fiscal expansions in 2020 and 2021.”

Alluding to the RBA’s announcement this week that its bond-buying would end on 10 February, following similar moves from the US Fed and other central banks in recent months, Jenneke noted the rising expectations of interest rate rises. In his latest speech the RBA Governor Philip Lowe, for the first time, conceded rates could “plausibly” lift this year. And as many as five or six rate hikes are expected in the US during 2022.

What really matters to markets

And while the market currently remains fixated on inflation, it’s company earnings growth that is really going to matter this year. Specifically, Jenneke expects a fall in earnings growth that will be most pronounced in the second half of 2022.

“When you think about some of the risks this year, valuations have very little room to disappoint. I think you’re going to find that during this reporting season, companies that disappoint on their numbers are going to be treated quite harshly,” he said.

“Normalisation of company earnings is going to be one of the key topics of this year; the real question is how much are they going to slow.”

A sector to underweight, for now

So, what should your investment portfolio look like in this environment? If you’re all-in on Australia’s banks, you might want to think about trimming some of these exposures. That’s what Jenneke and his Australian equities team, which includes financials analyst Nick Vidale, have done.

For the last six months or so, they’ve been dialling back their holdings of financials and pushing some of this capital into healthcare, utilities, and consumer staples.

This negative stance on banks, at least for the shorter term, might be surprising considering the common perception that rising interest rates favour such companies.

As Vidale explained, banks’ headline earnings and price-to-earnings multiples are now mostly recovered from their lows of the first quarter of 2020.

“Superficially, this looks good, but the headline earnings disguise the changing composition of earnings over the last two years, which is one of the reasons we’re cautious on banks,” he said

As a rule of thumb, every 25 basis point increase in the RBA cash rate increases major banks' earnings by between 2% and 5%. This assumption held pre-COVID when just 15% to 20% of the mortgages were fixed-rate and around 80% were variable rate. It means that, traditionally, when interest rates rise, banks can reprice the bulk of their mortgages.

“But the mortgage portfolio of banks has changed shape during COVID,” Vidale said.

In the last two years, borrowers have capitalised on very low interest rates, seeing fixed-rate mortgages surge to now comprise around 55% of banks’ total mortgage books. This creates two problems:

- It reduces banks’ capacity to benefit from rising rates and

- Potentially creates more “churn” between banks when customers come to refinance mortgages in two to three years’ time.

So, what stocks should you own?

Jenneke is most positive on businesses that are well-placed to weather the environment of rising interest rates and higher inflation. Such “Quality defensive” stocks – those with healthy balance sheets, high return on equity and good cash flow – have pricing power and are better able to maintain their margins.

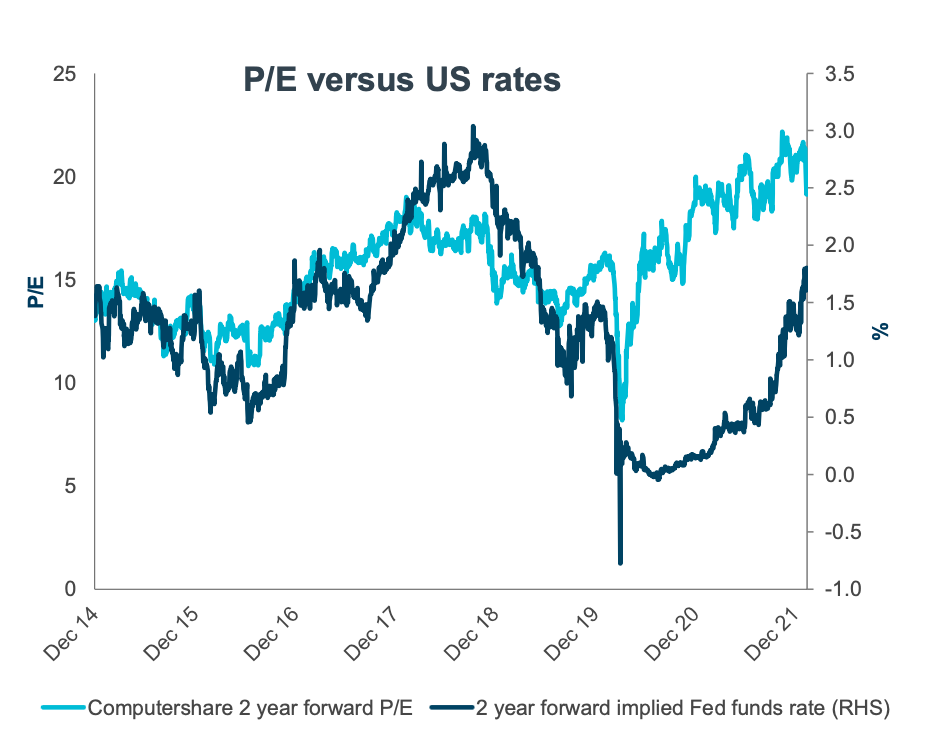

Computershare (ASX: CPU), which provides corporate trust, stock transfer and employee share plan services across multiple markets including Australia, is one such company he’s added to the portfolio.

Source: T. Rowe Price, Bloomberg L.P.

“We believe it’s very well positioned for rising interest rates, particularly in the US where half its business is based,” Jenneke says.

This is because the company collects cash from the many businesses it owns before paying profits out to investors, cash it then invests in money markets. With rates rising, Computershare can also start to generate interest income from that pool of assets.

The company also completed a $1 billion acquisition of Wells Fargo Corporate Trust Services in late 2021, the benefits of which should flow through from 2023, explained Jenneke.

Other areas where T. Rowe Price sees value in Australian stocks have been highlighted by the sharp selloff in growth stocks, particularly US tech firms such as Meta Group (Facebook). For example, Meta’s share price has dropped by 23% in after-hours trading following its latest quarterly earnings report. This follows a decline of almost 15% in the company’s share price since the end of December.

“Really big selloffs like this tell you a few things, one is that there’s a recalibration occurring and the market’s adjusting to something, in this case, that interest rates are going up.

“There’s also a lot of collateral damage that occurs, as the market struggles to differentiate between what should’ve been sold of because valuations were too stretched versus those that are better positioned or have ongoing strong fundamentals.”

Some examples of stocks Jenneke believes have been oversold are:

Domino’s Pizza (ASX: DMP)

He concedes the share price became stretched in 2021, which saw T. Rowe Price take some profits on the position. “But right now, with the share price down about 25% in the space of a month, we think the market’s gone too far,” Jenneke said.

Xero Limited (ASX: XRO)

He also calls out the New Zealand-founded, ASX-listed firm that is now the number two cloud accounting software firm globally, alongside competitor Intuit. With Xero’s share price also down around 25% in the last month Jenneke still sees “enormous growth to come.”

China is another thematic he’s enthusiastic about into 2022 and beyond, “especially given the country is stimulating its economy at a time when the rest of the world is trying to do the reverse,” he said.

Iron ore is the way T. Rowe Price is choosing to get exposure here, having recently added Rio Tinto (ASX: RIO) to the Australian equities portfolio.

“The valuations for some of the big miners are quite cheap relative to their history,” Jenneke said, also indicating the fund has added to its position in BHP Group (ASX: BHP).

“We’ve probably added about an additional 3% or 4% to our iron ore exposure over the last two months.”

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

5 stocks mentioned

2 contributors mentioned