Can a recession be predicted? My data might surprise you.

Vega Capital

Let’s start by defining what a recession actually is. Google’s dictionary defines it as ‘a period of temporary economic decline during which trading and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters’. In short, we’re looking for some sustained contraction in GDP. So what is GDP?

GDP (gross domestic product) is defined by the same dictionary as ‘the total value of goods produced and services produced in a country during one year’. So already we have a big clue here. If production falls on a sustained basis (either because of the lack of ability to produce or through lower consumption) then we’ll be in a recession.

Likewise, we can also see what causes an expansion for a country. If consumption rises, production must have also risen (unless the goods are being imported from another country). But generally increases in demand will put upward pressure on both domestic and foreign production.

This increase in demand could be generated by;

- Individuals and businesses having more income to spend.

- Individuals and businesses borrowing money and using it to spend.

Hence whether we’re in a contractionary or expansionary state really depends on the consumption patterns of individuals and businesses. By looking for times when these patterns are changing significantly, we can get some idea on where the economy is going.

At Vega Capital, I use a model which draws in data from various economic and financial sources which helps The Fund to know when to have a bullish or bearish bias. The categories that the different data sets fall into can loosely be described as interest rate stress, employment levels, systemic liquidity and financial market momentum.

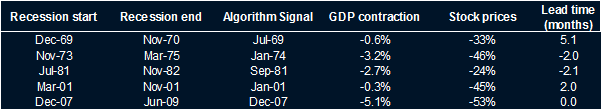

In the table below, I’ve put the five worst recessions for stock markets over the past 50 years as well as the date when our model would’ve provided a warning signal. I’ve also put the associated lead time of the model in the final column to show how effective it is in identifying recessions before the majority of stock market impacts are felt.

Note that recessions are usually identified retrospectively by economists so these results are very strong.

With that, I’ll now provide a summary of each variable and rationale for why it’s monitored.

Systemic liquidity

Systemic liquidity is a term used to describe the volume of capital in the financial system. This capital is used to make loans, provide collateral for banks and conduct general business.

It makes sense that as capital becomes scarcer, fewer loans are able to be made (and those which are made are done so at a higher price). Since a loan is made in order to finance consumption, if we contract growth of loans in the system, consumption growth must also contract – putting downside pressure on production and thus GDP.

As an addition to this, a short class in Economics 101 will tell you that as money becomes scarce, the price of other assets such as stocks should fall to restore some fair equilibrium between the two.

We can hence understand why keeping tabs on systemic liquidity would result in us understanding both where the economy is and why downside pressure may be placed on stock prices.

Employment levels

Given our model’s dependence on consumer and business spending, employment will obviously be a prime factor for us to monitor. An employed individual has spending power, but it also means that there’s a business which has been willing to employ her (which also implies that that business has customers who are spending).

Growing employment is bullish for an economy. More employment creates more spending (demand) which puts upward pressure on production which begets more employment and thus demand etc etc etc.

Clearly, however, when individuals become unemployed this is a particularly poor sign for an economy. Firing an employee will often cause them to stop spending which impacts the revenue of businesses and reduces the employment prospects of their employees. If the contraction in spending is sufficient, more employees will lose jobs, reduce consumption further and put other jobs at risk.

As Keynes once said ‘We’re all in this together’. And when it comes to employment, it’s certainly true.

So clearly, all this downward pressure on consumption (and thus GDP) and can cause a recession if it's significant enough.

Interest rate stress

If you’re a business with some debt and interest rates rise – all else equal, your ability to spend must reduce as a function of the change in rates. Hence higher interest rates can reduce consumption. The same idea applies to consumers.

(There’s one big caveat to the above, which is a wildly bullish economy in which higher rates are offset by strong consumer spending (enabled by either increasing incomes or the willingness of lenders to lend).)

Some businesses and consumers may default on their debt if rates are raised beyond their means to pay. The business may be put into administration, causing its redundant employees to stop spending (which as we’ve seen, has flow-on effects for other businesses in the economy). Consumers may not be able to take out further debt which reduces their rate of spending.

What we’re essentially looking for here is when high-interest rates become to cause problems production/consumption problems in the economy.

The Federal Reserve typically has the most control over this category for the US economy.

Market momentum

There’s an old saying that investors shouldn’t try to catch falling knives when buying stocks with a price which is falling. I’ve always disagreed with this statement because it implies that you know that prices will continue to fall..when you don’t. Prices could rise and leave you having missed out on a rare investment opportunity.

Perhaps some backtest could show this works but I'd wonder how stable such a result is.

When it comes to recessions, however, I’ve found that the model tends to do better by waiting for the market’s bubbliness to fade out before going short.

Don’t the markets move before recessions occur?

I think that this is a fair comment and is backed up by some academic studies. However, those studies tend to obfuscate the data and leave many questions unanswered.

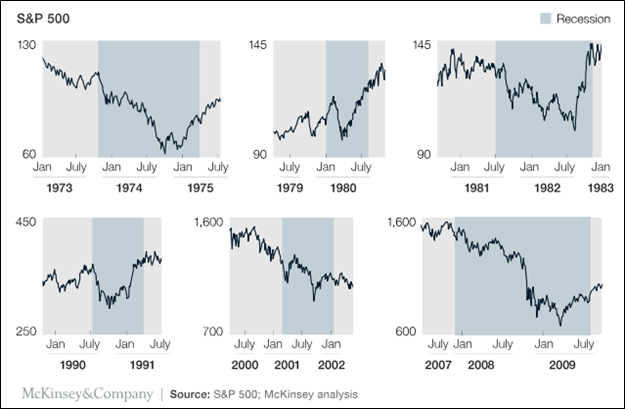

McKinsey conducted a study recently and found it’s quite easy to see that a recession begins before the market moves down.

To sum it up

I think that 2019 is shaping up to be a very interesting year for the variables I've discussed here – and I am wondering whether a recession will actually rear it's head.

I can’t say yet whether The Fund will go short, but this year is looking to be the most likely since the GFC.

9 topics

Scott has seven years of experience in investment and risk management, was previously an analyst at Montgomery Investment Management, and holds a degree Economics from the UWA as well as a Master’s degree in Financial Mathematics from UNSW.

Expertise

Scott has seven years of experience in investment and risk management, was previously an analyst at Montgomery Investment Management, and holds a degree Economics from the UWA as well as a Master’s degree in Financial Mathematics from UNSW.