Charts and caffeine: Macquarie and Bell Potter's two favoured ASX uranium plays

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session plus share the best of our insights to get you better set for the investing day ahead.

A reminder that the ASX is closed for the Queen's Birthday holiday on Monday so the next CnC will be on Tuesday.

MARKETS WRAP

- S&P 500 - 4,032 (-2.04%)

- NASDAQ - 12,313 (-2.4%)

- CBOE VIX - 26.23 (+6.2%)

Few stock moves to talk about overnight apart from Tesla (NAS:TSLA) which saw some buying following UBS' change in recommendation (neutral to buy).

- FTSE 100 - 7,476 (-1.54%)

- DAX - 14,199 (-1.71%)

- STOXX600 - 434.38 (-1.36%)

European stocks sank on the ECB's announcement and the press conference that followed from President Christine Lagarde. Yields in contrast soared with the Italian benchmark at one point up nearly 20 basis points (!!!) A full wrap is in "The Calendar".

- USD INDEX - 103.31 (+0.75%)

- US10YR - 3.047%

- GOLD - US$1850/oz

- WTI CRUDE - US$121.28/bbl

THE CALENDAR

The European Central Bank has flagged what traders thought might happen - the end of its long-running bond-buying program on 1 July. The statement also left the door open to rate hikes in the coming months - and possibly even a 50 basis point hike should it need it. Finally, the Bank slashed its GDP forecast for the rest of 2022, causing traders to be even more concerned about whether LaGarde and co. will have to hike into a slowing growth environment.

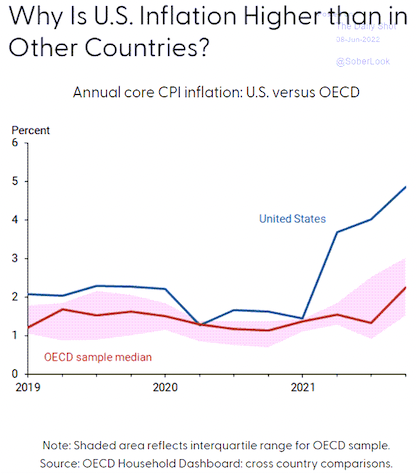

Tonight is US inflation night and the May figure is getting some debate on financial Twitter and in the economics notes that I read. Core inflation (that is, the headline number minus food and energy prices) is expected to fall a little. If that comes to fruition, then it will be the third monthly fall in a row (good news) but it's still far higher than the OECD average (bad news). The worse news is that headline inflation is tipped to remain steady - that is, everything but food and energy prices are cooling very slowly. That's not news people on holiday want to hear.

- Core rate consensus forecast: +5.9% (down from +6.2% in April)

- Headline rate consensus forecast: +8.3% (steady month-on-month)

Look at that disparity! Another great way to show the above point is this chart.

THE CHART

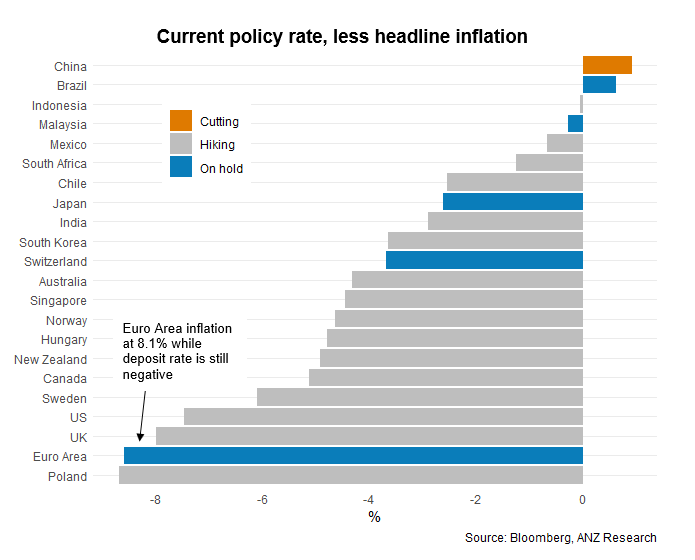

I agonised over picking a chart of the day but when push came to shove, I picked out this one from John Bromhead at ANZ. The countries that are hiking are in grey but it's that bottom blue line that counts. With the ECB staying the course while inflation continues to hit record highs, they really are on the back foot. Even Australia's moved up from what looked to be a back-of-the-race position.

China, of course, is its own special case.

THE STAT

$4.95/gallon - the average price of unleaded gasoline (petrol) in America (Source: CBS News)

I highlighted US CPI that's out tonight - so share this at the watercooler when you run into your colleagues today. 16/50 states now have $5/gallon petrol as normal while the national average has jumped 28 cents in a week. Hooley dooley.

THE TWEET

This one's for the retail day-traders out there who didn't take the cue and may have lost the lot. While it's never great to lose money (much less, your entire starting capital), it's an important lesson in heeding the warning signs. That's only something that comes with experience.

STOCKS TO WATCH

Speaking of the 2020 crowd, if there is one thing they know what to catch, it's a trendy investment. Given that the old-world oil and natural gas trade is already well worn, where else can people gain exposure to a similar trend? One of those answers appears to have been uranium stocks.

It's touted sometimes as “the next lithium” in reference to the massive rallies that ASX lithium stocks have enjoyed over the last 24 months. But is it the next big thing that will actually stick?

Macquarie certainly thinks so. In a recent note, analysts said they remain positive on the uranium market, given tailwinds from increased corporate activity, the global focus on energy security, and a forecast supply deficit set to hit in the next few years. The Biden administration has also been hot on the case - pushing support for a US$4 billion plan to buy enriched uranium directly from “friendly” producers (e.g. Australia) to wean the US off Russian imports.

The only problem? There are more than 30 uranium stocks on the ASX.

Luckily, the team has done the work for you - putting outperform ratings on just two of the sector's most well-known names - Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE). Why these two? Simply put - because it's got the projects to deliver.

Both companies' projects (Langer Heinrich and Honeymoon) are licensed, in known uranium jurisdictions and have a near-term path to market buoyed by a positive uranium outlook.

Both companies have share price upside projections of well over 20%.

Bell Potter agrees with the two picks made by Macquarie - arguing that while their conviction is "speculative", the fundamentals "couldn't be any better".

BEST READS IN BUSINESS NEWS

Only one thing can stop surging meat pie demand - gas prices (AFR): I love a good meat pie (cheese and bacon is a great-tasting variety sold at my local bakery) but the prices have definitely gone up. Now, one of the country's top manufacturers says it's being hit by the skilled labour shortage in addition to the global food crisis. Yikes!

Australian house prices to correct but not crash: WILSONS (Livewire): It's Friday so I thought I'd throw in a property projection here from David Cassidy at WILSONS Advisory. It's not lovely reading if you're looking to sell.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

3 stocks mentioned