I'll follow the sun

“One day you'll look

To see I've gone

For tomorrow may rain

So I'll follow the sun”

Lennon - McCartney

I’ll follow the sun

Never underestimate the popularity of the Beatles. Long years of trending economies, interest rates, equity markets and real estate prices have quashed the inclination of most investors to believe in mean reversion. Following the sun, positive earnings, revision trends and stories which paint a picture of everlasting growth have been the winning strategies, and are not being cast aside lightly. The US equity market has trounced most global peers for many years. Within it, technology dominance has been ever more reinforced. Opening a map of S&P500 performance has all too often looked like the one below.

Surprisingly from our perspective, this behaviour has continued to prevail in the face of higher bond rates across much of the world, and despite early signs that reliance on China for the majority of global goods manufacture might entail some unintended risks. The bond market is signalling a change in the investing paradigm; equity markets are signalling more of the same.

A Hard Day’s Night

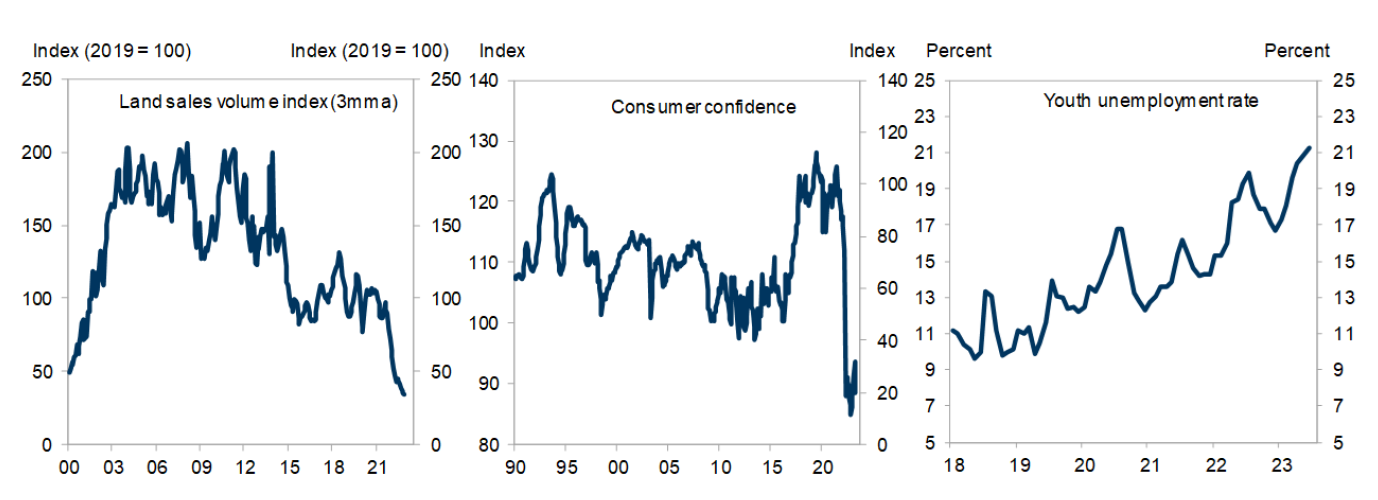

If you’re following the sun at the moment you’re not going to China. The combination of severe COVID lockdowns without the government largesse offered in the West and a property market struggling to digest years of booming property prices and overly aggressive construction make for a bleak picture. Consumer confidence has plummeted and youth unemployment is a severe social issue. As is often the case, it is reasonably easy for observers from afar to lob hand grenades, free economic advice and sermons on the wisdom of Western policies. Pessimism on the Chinese outlook is translating to pressure on commodity prices and most resource companies, given the obvious Chinese demand importance.

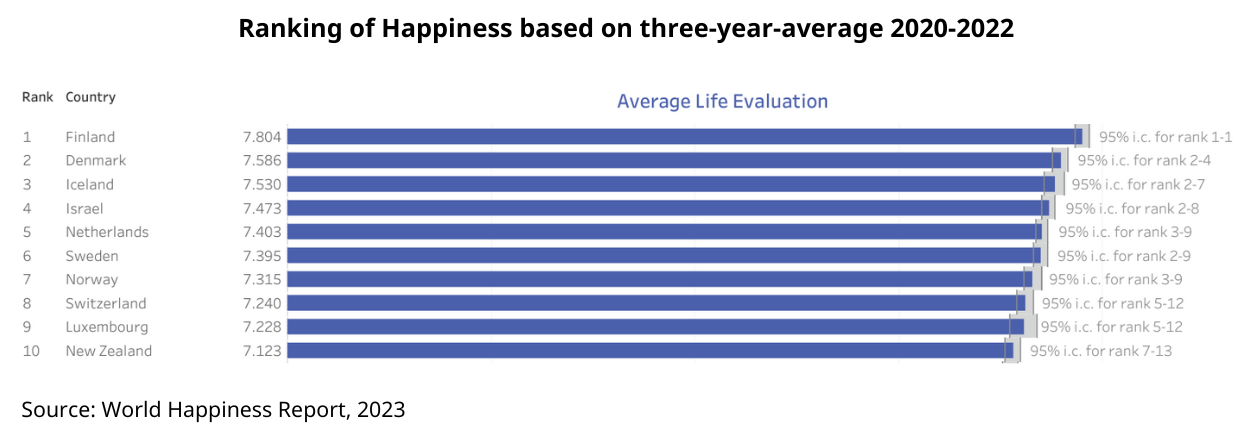

Our interpretation of the longer term outlook is a little more nuanced. Some problems, such as wealth and income inequality, together with the challenges of managing an ageing population, apply almost globally. In stark contrast, particularly versus Australia, China has plentiful housing (one of the reasons prices are falling), continues to build modern infrastructure and dominates manufacture across a vast array of goods. Its challenge has been developing a consumption and services economy. This challenge is complicated by the coincidence of managing a declining and ageing population with limited propensity to spend. Japan has provided insight into these issues over a long period. While its living standards remain high and per capita GDP growth (a better measure of living standards) has matched most peers (including Australia), many remain focused on the far less meaningful overall GDP growth measure. A cynical observer might observe how many of the business models of smaller, high living standard countries involve attracting offshore wealth to prop up their debt fuelled property and consumption driven economies. High population countries tend to have plenty of people wanting to leave for less populated shores. It is ironic nearly all the happiest countries are small, often with governments and companies determined to convince the people the route to prosperity is to get large. True sustainability is a tricky goal!

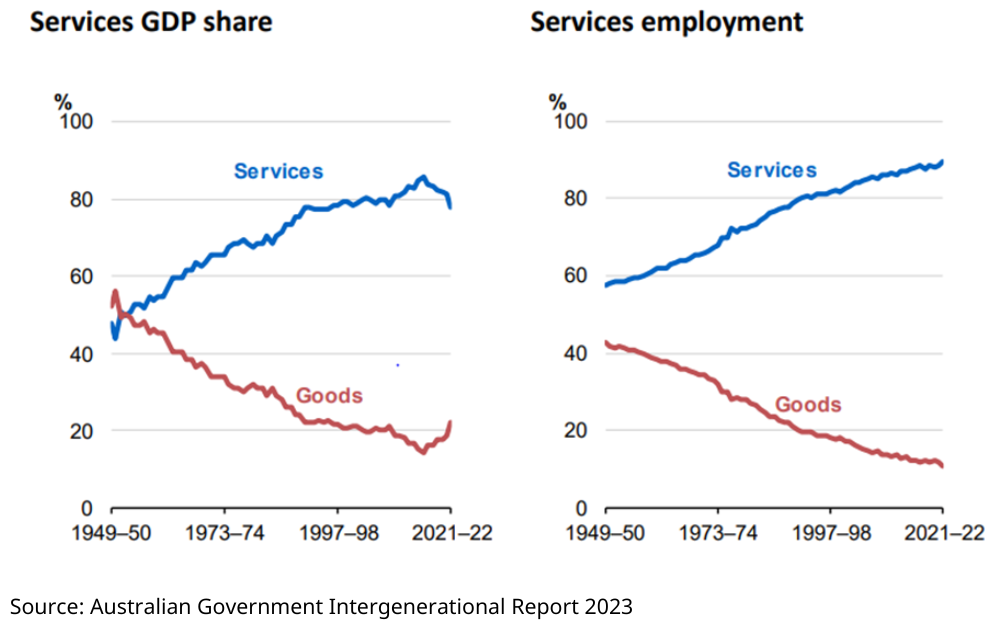

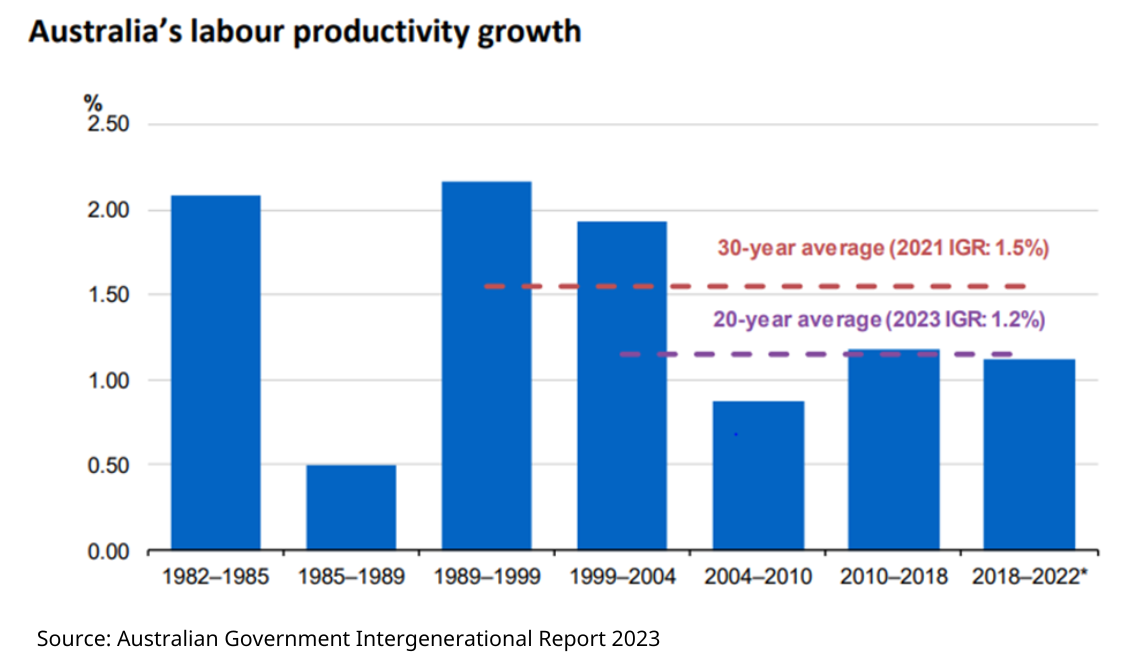

The Australian economy is undoubtedly at the opposite end of the spectrum. Despite bearish commentary, it remains incredibly strong. Employment remains close to the highest levels ever and resource and agriculture foundations remain solid. The headaches lie in the distribution. Increasing intergenerational inequity, an undersupplied and overvalued property market exacerbated by high immigration, and massive reliance on consumption and services present the challenges of the future. The recently released Intergenerational Report highlighted many of the headaches for government in funding an ageing population keen on high living standards and not keen on paying for them. Though recent decades coincided with remarkable technological advances, productivity gain in a services driven economy remains tough. Inflation has largely been supressed by productivity gain in goods produced elsewhere. This deflation may well be over, and somewhat frighteningly, if China decided to double the prices of a vast array of goods overnight, we’re not sure there is much the rest of the world could do about it. Government handouts such as those being adopted by the US under the Inflation Reduction Act always get companies excited; everyone loves a free lunch. Interestingly, on nearly all the data we can see, capital cost of these plants and investments should remain well above Chinese comparatives, even after deducting the government handouts, meaning profitability should be well below Chinese levels unless consumers are either happy or forced to pay higher prices. Polarised country business models pursuing both production and consumption to extremes are the obvious reason for trends towards deglobalisation. They are also the reason we are reluctant to embrace the extrapolation in equity market and economic conditions which remains popular.

The Long and Winding Road

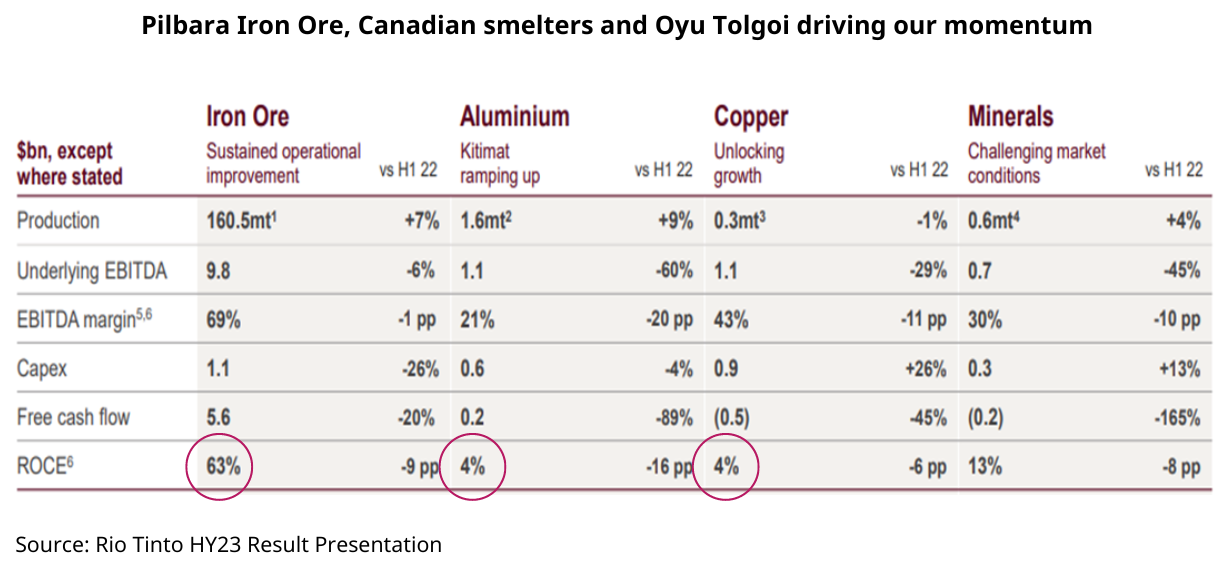

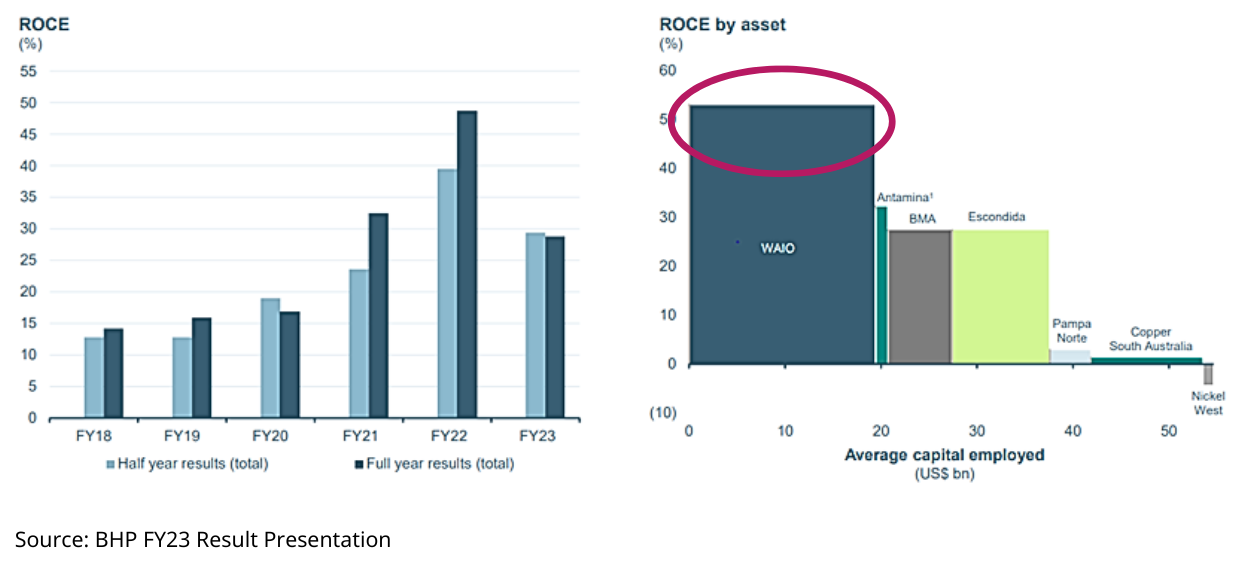

Those of us looking for evidence of some mean reversion through results season were left wanting. Polarisation remained far more common. Logic would suggest the travails of developers such as Evergrande and Country Garden in China and collapsing property activity would already be impacting steel, iron ore and metallurgical coal demand, not to mention price. Afraid not. Iron ore prices have remained north of US$100, powering the results of BHP (ASX: BHP) and Rio Tinto (ASX: RIO), the revolving doors and renewable crusades at Fortescue (ASX: FMG) and the legal fees to arbitrate a few arguments in the Hancock family. For all the talk of future facing metals, billionaires dig up iron ore while aluminium and copper remain the poor cousins.

Our tendency to support some mean reversion in this apparent commodity imbalance has been wholly unsuccessful to date. BHP and Rio Tinto, alongside many others, are aligning behind the expected demand imbalance in copper, as electrification and EV’s meet a dearth of large scale copper projects and declining grades in current major producers. Noting the obvious, if we do not discover more copper, the demand cannot be met. Supply deficit forecasts, should they transpire, serve only to demonstrate the need to find more, or available supply will go to those willing to pay the most; wealthier countries. As a substitute in some applications, we have remained resolute on the prospects for the alumina and aluminium market. As evidenced in the results of Rio Tinto, Alcoa and Alumina (ASX: AWC), nothing good has happened recently. Even the lowest cost and greenest producers are seen to be struggling. In the case of Alumina, a long standing and long painful portfolio position, tough market dynamics have combined with a controlling company (Alcoa) who seemingly adopt Murphy’s Law as their mission statement. Loss making operations in Spain which should have been shut down years ago, cost blowouts on the restart of operations at Alumar in Brazil and most importantly, mine planning and approval issues at the low cost WA refineries, have combined with depressed prices to cause an evaporation of profits. Environmental opposition is forcing the company to mine lower quality bauxite in WA, delivering more tailings and less production; yet another perverse outcome as the Western world demands more commodities to drive decarbonisation while simultaneously working hard to make mine approvals ever more difficult, costly and uneconomic. We remain hopeful these low emission and low cost operations can be quickly restored to more efficient production. Now trading far below replacement cost, it has been frustrating to see investors focus on the short-term problems rather than the potential. The length of time poor management at Alcoa has been allowed to continue unchecked is undoubtedly a large part of the problem.

You Never Give Me Your Money

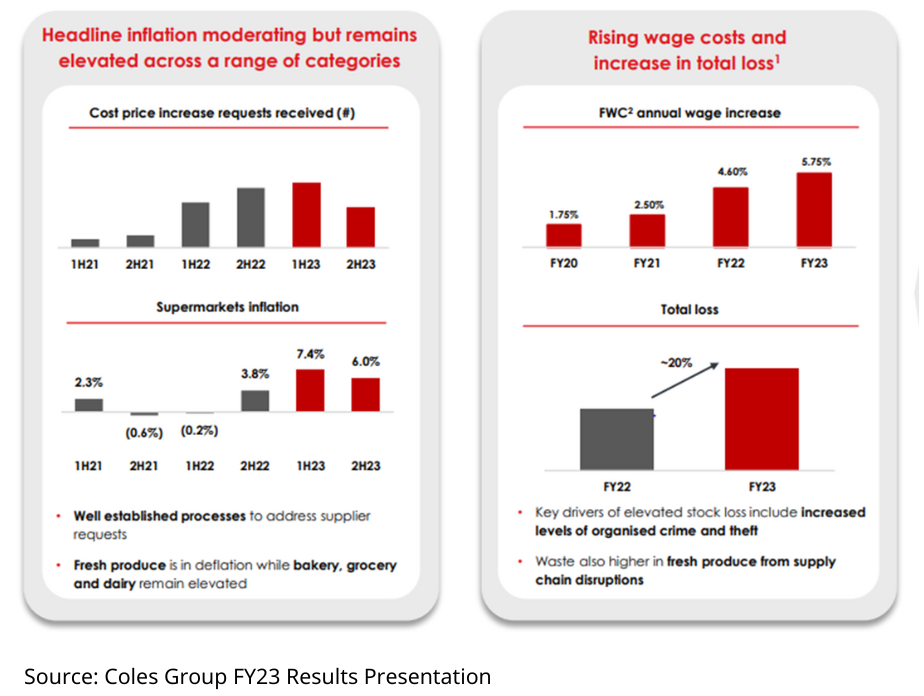

Across both supermarket and discretionary retailing, divergent outcomes were again evident. Highlighting the impact of interest rates in fuelling inequality in the economy, Coles (ASX: COL) raised the increasing prevalence of organised crime and theft. The technology around self-checkout has delivered significant efficiency through time (albeit primarily through using customers’ labour for free), however, it has also necessitated ongoing investment in technology to improve theft prevention. Woolworths’ (ASX: WOW) result indicated they had moved ahead of Coles in this regard, funnelling a greater proportion of theft and associated loss through Coles, widening the margin gap between the two in Woolworths’ favour. On the positive side, signs of abating inflation and normalising supply chains gave some hope of respite for customers in price increases, although the impact of wage increases across vast employee bases creates margin challenges for the future. As newspaper front pages evidence the brand damage inflicted on Qantas (ASX: QAN) through both management and government action, the value of management able to adeptly weigh the balance between looking after shareholders, customers and employees cannot be overstated. Whille arguably reflected in the share price, we always leave our post result meeting with Brad Banducci at Woolworths impressed by his passion, enthusiasm and sincerity. At a time when many companies are focused on how far they can push price and suppress wage demands, it is refreshing to listen to someone constantly agonising over maintaining the right balance and so immersed in business operations.

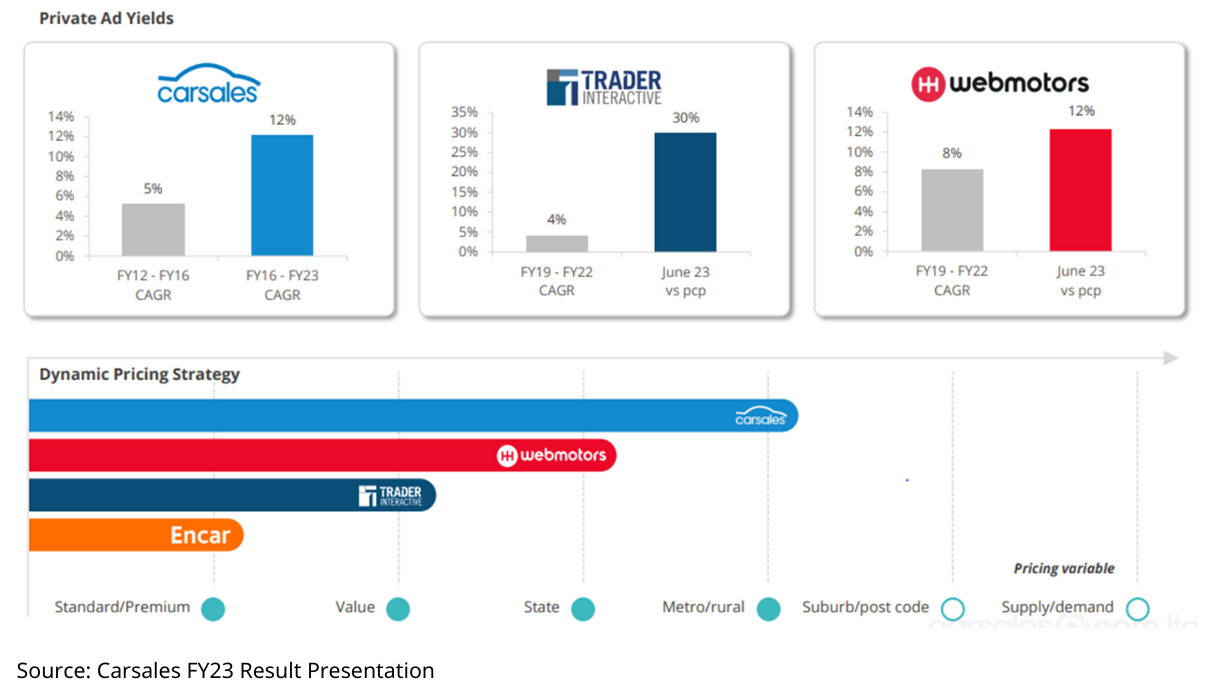

At a time when many customers are hurting, we remain a little surprised there is not more questioning of the extent to which customers are being gouged, courtesy of market positions which have been allowed to become dominant through years of lax competition regulation, particularly in the US. Technology giant profitability remains exceptional and most are continuing to push price aggressively. Payments processing, cloud and software are among the myriad of areas in which customers have little choice but to ‘suck it up’ when it comes to price increases. The current furore over government protection of Qantas through refusing capacity addition requests from Qatar Airways, massive COVID subsidies not repaid and egregious airfare pricing, is likely to have significant ramifications for both the government and Qantas. The line between earning profits for delivering customers a reasonable value proposition and gouging isn’t always obvious. Companies such as REA (ASX: REA) and Carsales (ASX: CAR) were applauded during results season for profits which reflect the benefits of aggressive pricing strategies. When prices for an identical service start changing based on your postcode, the gouging line may well be fairly close. Like Chinese property prices, reversing trajectory when things start going the wrong way can be tough.

Brambles (ASX: BXB), James Hardie (ASX: JHX) and Boral (ASX: BLD) all saw results showing the benefit of pricing discipline and resilient demand. While industries such as building materials have been better known for their ability to quickly abandon price discipline in the face of any demand deterioration – meaning history has not been kind to shareholders – pricing momentum remains a powerful short-term share price indicator. The addition of operating excellence is an even more powerful cocktail, and the divergence of intra-sector performance was perhaps more stark than normal on this front. While Boral, James Hardie and Reece (ASX: REH)are at varying stages of business improvement and operational excellence, the contrast with players such as Fletcher Building (ASX: FBU), less keen to leave the starting line and more keen to embrace financial engineering, was substantial. Woolworths versus Coles and JB HiFi (ASX: JBH) versus Harvey Norman (ASX: HVN) were similar examples.

All my loving

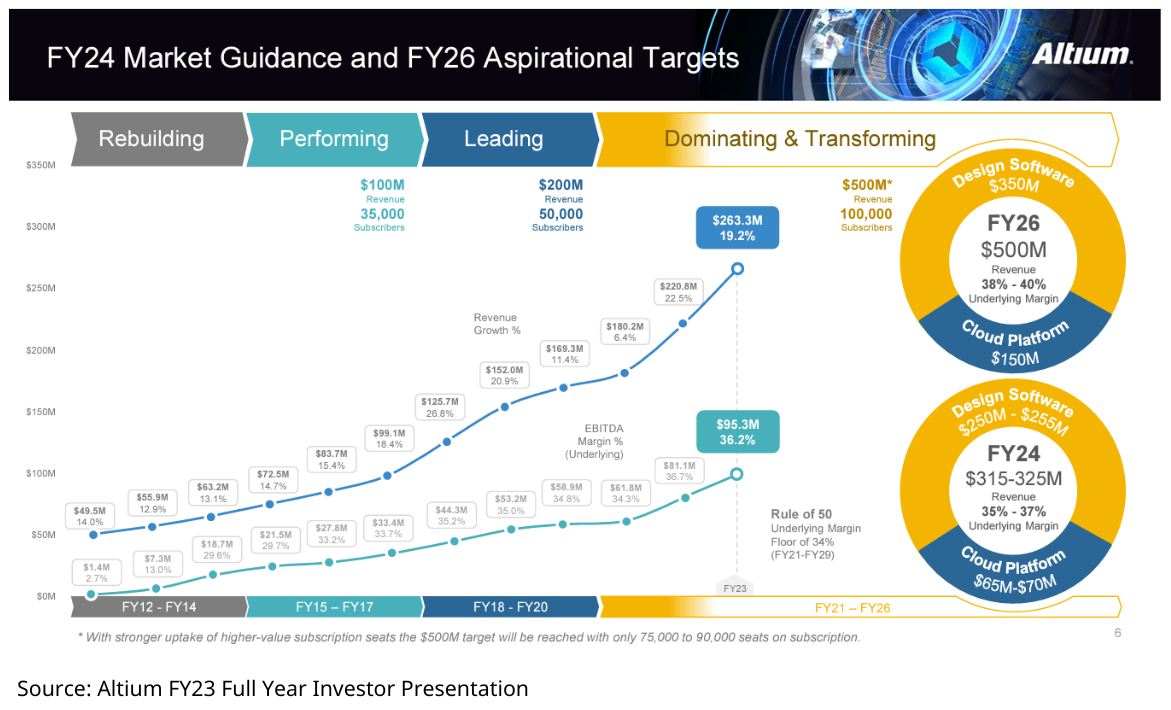

Perhaps more powerful again were the companies able to incite animal spirits and optimism on a long term stairway to heaven. Only then, in our opinion, can one truly release the valuation shackles. Industrial property, data centres and potential technology leadership delivered the biggest gains as AI enthusiasm continued to weave its magic. Altium managed to grow its market cap by some $2bn over the month, a gain of around 5 times its annual revenue for 2023 and a valuation of more than 40 times EBITDA. When others are happy with the ‘Rule of 40’, the way to higher valuation should be obvious. Adopt the ‘Rule of 50’. As Spinal Tap put it, “Most amps only go up to ten”. “If we need that extra push over the cliff, you know what we do? Put it up to eleven?”

None of this is meant to detract from the excellent job many of these businesses are doing in capitalising on either a supportive operating environment or strong market positions, however, in many cases the paradigm being applied to valuation bears no resemblance to almost identical activities in sectors with fewer tailwinds. Goodman Group (ASX: GMG) have done an amazing job in industrial property development, however, property development entails risk and has few obvious benefits of scale. The quantum of development which Goodman Group now needs to successfully execute to deliver profit growth on a now very large business is daunting; risks we believe are not captured in valuation. Lend Lease (ASX: LLC), Stockland (ASX: SGP) and Mirvac (ASX: MGR) have demonstrated the difficulty in sustaining growth as size increases and while outliers will always exist, remaining an outlier at an ever increasing size is tough. Mean reversion may not be popular, however, there are economic reasons why trees do not normally grow to the sky. While the US equity market has a number of giant redwoods surrounded by equity market peers which look increasingly like seedlings, history suggests this is not a normal state of affairs.

We Can Work It Out

Equity markets and debt markets have diverged markedly in their expectations for the future. Bonds at 4%+ in both the US and Australia are offering a degree of compensation for an extended period, should inflation be contained anywhere near the targets set by central banks. Equity and real estate markets have seen far less valuation adjustment and almost no change in market leadership. Polarisation remains the order of the day. Mortgage belt residential is starting to struggle, the high end seems fine. Industrial property and data centres are flavour of the month, office is not. Technology and high growth valuations are perceived to be bulletproof, perceived cyclicality and earnings risk is shot on sight. Following the sun remains the dominant investor behaviour, unsurprising given long years of rarely interrupted success. While there will always be sectors and situations in which the winners keep winning and the losers keep losing, we remain extremely cautious in extrapolating ever higher profits for winners and oblivion for the losers. Monetary and government policy have been instrumental in creating these extremes. They also provide the tools to find a more comfortable equilibrium. Companies will profess outrage when excessive levels of profitability (to which they were accustomed through licenses, government lobbying and protection or unwise and unjustifiable levels of market power and industry consolidation) are unwound. Some will have valid complaints, others will have mistaken extremely artificial operating conditions for a free market. One way or the other, we believe it unwise to extrapolate these extremes into the distant future. Tomorrow may rain.

Learn more about investing in Schroders' Australian Equities

20 stocks mentioned

2 funds mentioned