"Inflation fighters" - What are they and where can you find them?

The local market’s response to the latest wave of lockdowns has been similar to last year, when the worst of the selloff quickly reversed and investors “looked through” volatility, says Perpetual’s Deputy Head of Equities Vince Pezzullo.

“It’s like a mini-version of the cycle we had last year. Investors are happy to buy stocks that are lockdown beneficiaries, which provides an opportunity, because they’re throwing out everything that isn’t," he says.

One of the senior stock pickers in Perpetual’s Australian equities team, Pezzullo recently spoke with Livewire about how his portfolio is currently positioned.

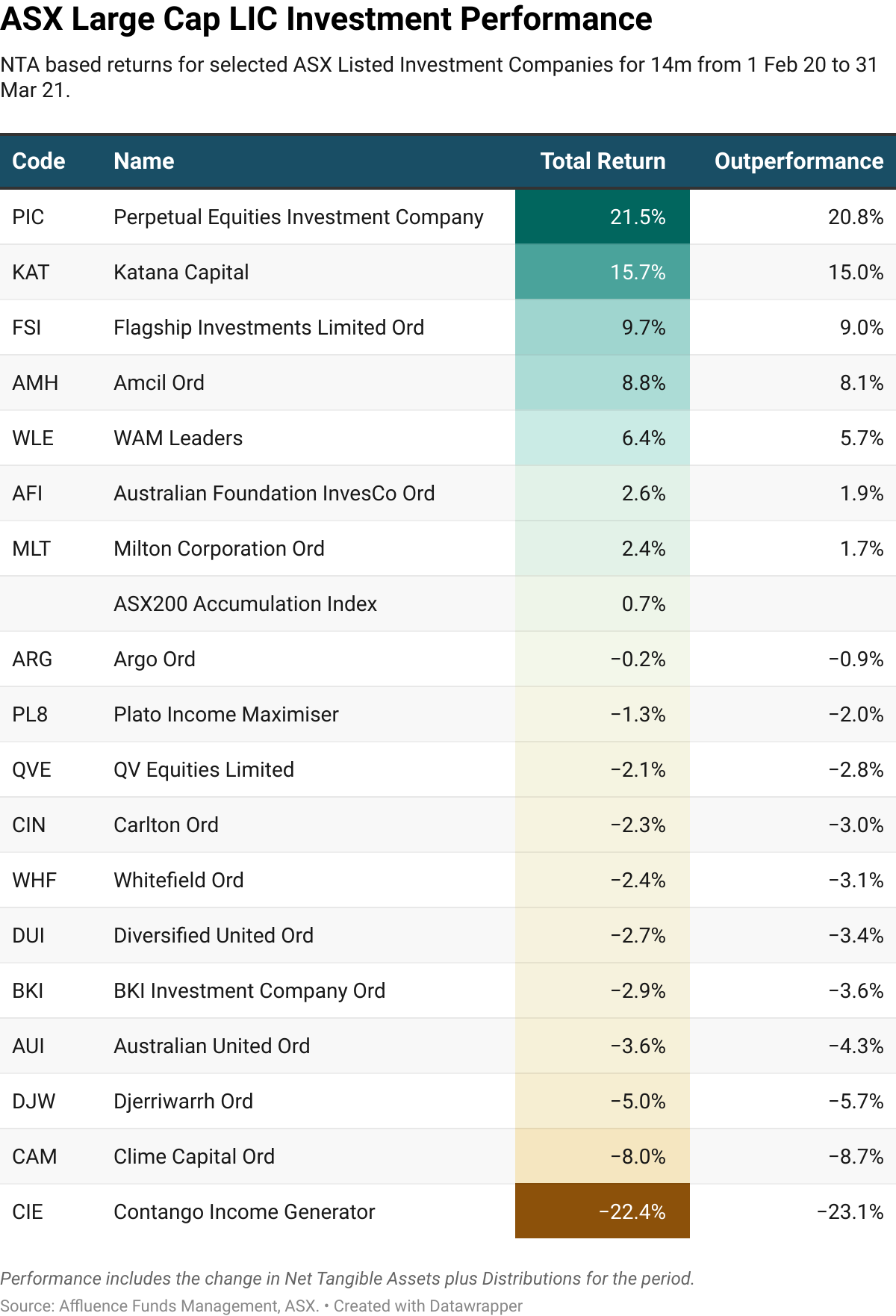

One of the vehicles he manages is the Perpetual Equity Investment Company, Australia's top-performing Australian equity LIC over the 14-month period from 31 January 2020 to 31 March 2021.

"Nothing blew our socks off"

As the August reporting season enters its final days, Pezzullo seems to be broadly underwhelmed – he’s not disappointed, but isn’t singing from the rooftops, either.

“Versus expectations, it’s hard to find anything that really blew the markets’ socks off,” he says.

“This is because the market was already trading close to its highest point over 52-weeks or longer and it’s hard to keep that going without the market being stupidly inefficient – which it wasn’t.

“Most of the results were well-flagged, so there’s been nothing outstanding in the sense that it was unexpected,” Pezzullo says.

Looking across some of the biggest sectors in the local market – financials and resources – he notes that bank results have been “okay”.

“I bought quite a bit of Commonwealth Bank (ASX: CBA) and Westpac (ASX: WBC) earlier, having held onto those before starting to rotate them into some of the insurers, because the relative valuation was good,” Pezzullo says.

“Banks still have a little bit more left in them, but I suspect not a lot more, because balance sheet growth will get much harder for them.”

And in miners, his portfolio is underweight metals producers OzMinerals (ASX: OZL), Deterra (ASX: DRR) and Iluka (ASX: ILU). Fortescue (ASX: FMG) is the only iron ore miner in which PIC is overweight, with a 3.5% holding.

Referring to another favourite of local shareholders, Telstra (ASX: TLS), he notes its result was decent. “But you also need to remember that Telstra relies heavily on its mobile business,” Pezzullo says.

Speaking more broadly about the mobile business within telecommunications, he points to TPG (ASX: TPM) and Vodafone – who merged last May – as an example. He suggests they may try to win back some market share in this part of the local telco market.

“They’re struggling a bit in mobile, both on the subscriber side and in ARPU (average revenue per user), and one follows the other eventually,” he says.

How PIC is positioned now

Comparing the portfolio now to 12 months ago, when we last spoke to him, Pezzullo has adjusted the exposure to cyclicals – the miners, builders and financials.

“It’s now more balanced, and we’ve even bought one or two healthcare names in the last couple of months - we’re buying things with sensible values, reasonable prospects and good balance sheet and management,” says Pezzullo.

Remaining mindful of where we are in the market cycle, he emphasises the shift from the steepening yield curve toward the tapering of stimulus that has grabbed so much attention in recent months.

Pezzullo suggests the COVID Delta variant may slow the tapering slightly, “People in some markets are ‘self-locking’ themselves down in anticipation of formal lockdowns, changing their behaviour very quickly.

“That might slightly push out the willingness of the central banks to take the punch bowl away,” says Pezzullo. At the same time, he notes that the reporting season both here and in the US have shown some quite reasonable results.

“But a lot of the basic industries haven’t added capacity and that’s a big issue. The basic industries, like commodities and manufacturing, have to make returns through the cycle, which means they’re hitting capacity when things get really hot".

“That’s what’s happening in the US steel industry, where we’re seeing significant changes in the ownership structures.

“In commodities, we’ve currently got four names controlling between 70% and 80% of the industry – if you look back 30 years, it was spread across many more names.”

In the current environment, he emphasises that miners aren’t doing much exploration for new deposits and are also being affected, over the longer term, by the push for decarbonisation.

“I suspect these bottlenecks (in the supply of basic materials) are going to extend the transitory inflation cycle for longer than we expected

“And if you look at the discipline of manufacturers, it doesn’t sound like many of them are announcing enormous CAPEX plans, either. Not everyone’s out there rushing to build capacity now.”

The “inflation fighters”

Typically, stock funds would look to consumer staples as a way to hedge against rising inflation. Pezzullo points to Australia’s supermarket duopoly stocks, Coles (ASX: COL) and Woolworths (ASX: WOW) as examples here.

“They’re great inflation fighters because they can pass those costs straight through to their customers, given their dominant market positions," he says.

"But you’re paying about 30-times PE for them, particularly for Woolworths and Wesfarmers (ASX: WES) (which owns Bunnings), where you pay significant multiples. Their earnings compensate slightly, but if you look at market estimates, these aren’t going up much."

This is where PIC’s ability to look offshore – its mandate allows for a 35% allocation to international stocks – is very handy.

“The market is in lockdown in Australia, whereas the rest of the world is opening up. We can add a bit of defensiveness domestically, but you’re paying a lot for that,” Pezzullo says

A US healthcare company that’s been added to the book in recent months – one of those alluded to earlier – is one way PIC is hedging inflation, though he stops short of naming the firm, noting it will be publicly noted in the next monthly report.

“We bought quite a bit of the stock, which looked very cheap having underperformed for six months. As everyone rotated into cyclicals, defensives became quite cheap,” Pezzullo says.

The PIC portfolio still has some exposure to cyclicals, particularly given his team’s view that the higher inflation environment – while transitory – will continue longer than many think. But the emphasis has shifted to increase holdings in companies with stronger structural benefits within their industries.

“Looking down the road, you need to keep an eye on when the yield curve goes the other way because at some point the Fed will continue to withdraw support,” Pezzullo says.

“Whether the fiscal policy will stay there forever, I’m not too sure. That means markets will start pricing in some sort of slowdown, which means your positioning has to be very different.”

An "inflation fighter" riding tailwinds

Perpetual is taking a stock-by-stock approach to building out the portfolio instead of chasing any particular themes, but insurance is one of the local sectors Pezzullo is more bullish on.

Alongside four global names he’s added to the portfolio in deploying part of the fund’s recent $30 million capital raise, he’s also increased exposure to Insurance Australia Group (ASX: IAG), Suncorp (ASX: SUN) and AusBrokers (ASX: AUB)

Insurance is another sector Pezzullo regards as an inflation fighter, particularly because of tailwinds that are allowing many companies in the space to increase their prices for the first time in a while.

“They’ve had a tough year in fires, floods and the potential for business interruption insurance issues. So, they’re going to be resetting their books pretty hard,” he says.

“And when you look at things such as used-car prices and vehicle repairers, you’ve got embedded inflation in everything. Insurers need to get ahead, and that’s why you’re seeing strong pricing tailwinds.”

In this environment, Pezzullo regards insurers as well-capitalised with high provisioning in their balance sheets.

"The banks are all probably 'match fit' now and will start competing, which usually leads to pricing risks at some point. But insurers have pricing going up and are all benefiting from it, and their balance sheets are in pretty good shape.”

He spotlights Suncorp (ASX: SUN), a Brisbane-based financial company behind the AAMI and GIO insurance brands, as the standout in the sector. In mid-August, management reported a 42% rise in full-year cash profit to $1.06 billion for fiscal 2021. The company’s statutory profit rose just over 13% to $1.03 billion.

“Management has been focusing on the business, is trying to modernise the IT infrastructure, and made the decision about 18 months ago to set its reinsurance cover at the right level."

“It was a good insurance result and on banking, they’re starting to turn the ship around, in what was a reasonably impressive result. And you can tell from the market reaction that investors quite liked it.”

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

13 stocks mentioned

2 contributors mentioned