Off The Charts! AGL's 53% descent, $17.8 million insider trading, and the best and worst of stocks and super

Lockdowns across most major capital cities in Australia have effectively thrown a wet blanket over this end-of-financial year. But really, we have plenty to celebrate. A bumper year on the ASX has provided some of the highest overall market returns in about three decades.

So, we've got a recap of the best performers of 2021 so far, along with a bonus round of best and worst superannuation performers. In the spirit of comparisons, we've also got our hands on a chart comparing the top five stocks of the 1980s with those leading the pack now. See if you can spot the difference.

And while the market might be hot, there are a few companies that are not. We've got a rundown on AGL's wannabe split and the Nuix IPO that went from bad to worse to...well...maybe even criminal.

Let's jump in...

#1 IS AGL ALL OUT OF ENERGY?

If things weren’t tough enough for Australia’s second-largest energy provider AGL Energy (ASX: AGL), its share price tumbled 10% on Wednesday and dipped a further 2% on Thursday after announcing plans to split the company in two. Having watched the stock sell-off by more than 53% in FY21, CEO Graeme Hunt says the split aims to fund growth for the business.

SOURCE: YAHOO FINANCE

The company will be split into two different arms, one responsible for retail and clean energy and the other handling the dirtier side of power production. The existing AGL arm will concentrate on the former while the new business unit, Accel, will handle coal-fired power stations, deriving more than 90% of its earnings from fossil fuels. Talk about being dealt the bad hand.

ESG investors are quivering - I can feel it. And they should be.

While the AGL branch will likely be reconsidered by investors due to its renewable focus, Hunt gave no inkling of any further plans for environmental benefits. Additionally, poor Accel will be ignored by environmentally focused investors due to its ageing practices.

So will this split actually facilitate growth? Probably not, sadly. If the split goes ahead, AGL and Accel will be left carrying balance sheet debts of $2 billion and $800 million, respectively. It’s on this basis that analysts are betting that the combination of a weak balance sheet, declining earnings outlook and a failing sector will leave the company unable to fund this growth.

To make things even worse for investors, AGL has terminated its special dividend for 2022. Let’s hope it doesn’t get any worse than this…

#2 NUIX CFO ACCUSED OF INSIDER TRADING TO THE TUNE OF $17.8 MILLION

After it seemed the year couldn't get any worse for Nuix (ASX: NXL), the financial watchdog has sunk its teeth into a former executive.

The news that ASIC is investigating former CFO Stephen Doyle follows a disastrous year for the company once heralded as Australia's next unicorn. After a cracking start out of the gates, Nuix's long run of earnings revisions, poor culture and under-investment in key business areas soured its investor appeal. Five of the company's key executives departed in 2021 alone, including CEO Rod Vawdrey, all having served the company for 10 years.

ASIC claims the former CFO Doyle knew Nuix would fail to meet the favourable forecasts made in the firm's prospectus. Instead of disclosing this to the market as soon as possible, which was around December in ASIC's view, the company updated guidance on 26 February. This was just 12 days after his brother's company exited the shareholder registry with a tidy haul of $17.8 million. After the knocks Nuix stock has endured since then, those shares would today be worth just $5 million.

On one hand, ASIC's involvement is a positive for shareholders as no action is being taken against the firm itself and regulatory action may be the first step to getting the company back on track. On the other, if ASIC's allegations are true, it means shareholders have already been duped and left holding the bag.

# 3 The ASX winners and losers of fY21

It was a golden financial year for the Aussie market. The S&P/ASX 200 soared 24% in the 12 months to 30 June and notched up its best year since the index was formed in 2000. Over the same period, the broader All Ordinaries jumped 26.4% to deliver its finest performance since 1987.

The ASX 200 bounced 60% from the March 2020 COVID-19 crash, taking the value of the Australian share market to beyond $2 trillion for the first time in history. Woohoo! We’re all richer!

But there was a yawning gap between the winners and losers which made up the returns on the ASX.

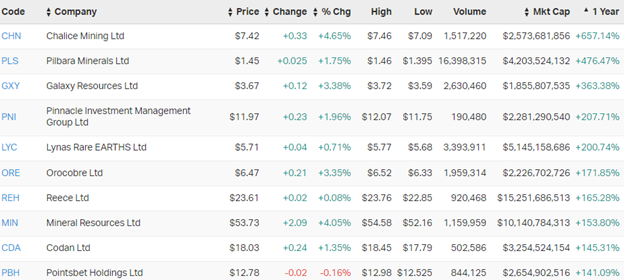

Eight of the best performers were mining stocks; plumbing and bathroom supplies retailer Reece (ASX: REH) soared on the DIY boom, while PointsBet (ASX: PBH) successfully convinced investors that legalised betting in the US would become bigger than Ben-Hur.

As for the worst stocks, gold was notable, though it’s fair to say much of the underperformance here is down to the shiny metal's diving prices. So much for an inflation hedge! Meanwhile, plenty of companies shot themselves in the foot even in a good year, and we at Livewire look forward to discussing them in the coming months.

Top 10 ASX 200 performers in FY 2021

Click to enlarge image

SOURCE: MARKETINDEX

#4 ARE AUSSIE STOCKS DIVERSE ENOUGH?

A recent report from the Business Council of Australia (BCA), Living on borrowed time: Australia’s economic future, looks at our productivity problems.

"Australians would be $10,000 better off over a decade if we fixed our productivity problem and stopped it acting as a handbrake on the economy," said chief executive Jennifer Westacott.

But one thing that stood out was this:

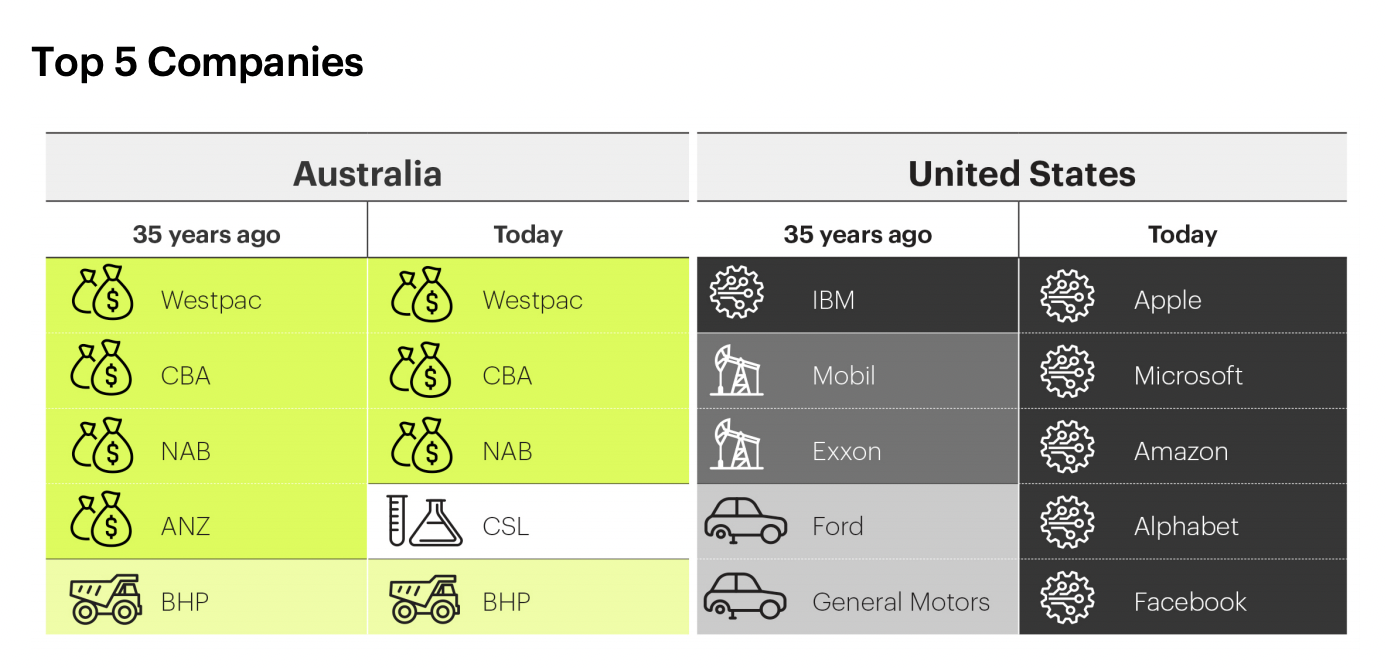

Source: Business Council of Australia, Living on borrowed time report.

Over the past 35 years, the Aussie Top 5 has changed by...not much at all. Banking and mining lead the ASX and only one stock, CSL Limited (ASX: CSL), has managed to creep into the top five.

What does this mean? BCA thinks this lack of industry diversity is a productivity killer.

"The implication of this is that there have been fewer new opportunities for investment in the Australian economy outside of mining. With less investment, we have seen our productivity performance slow down. This means that less money is being put into new or existing businesses to add value to those businesses," said the report.

#5 The super and not-so-super of superannuation funds

With the new financial year comes a suite of changes that are far from superfluous.

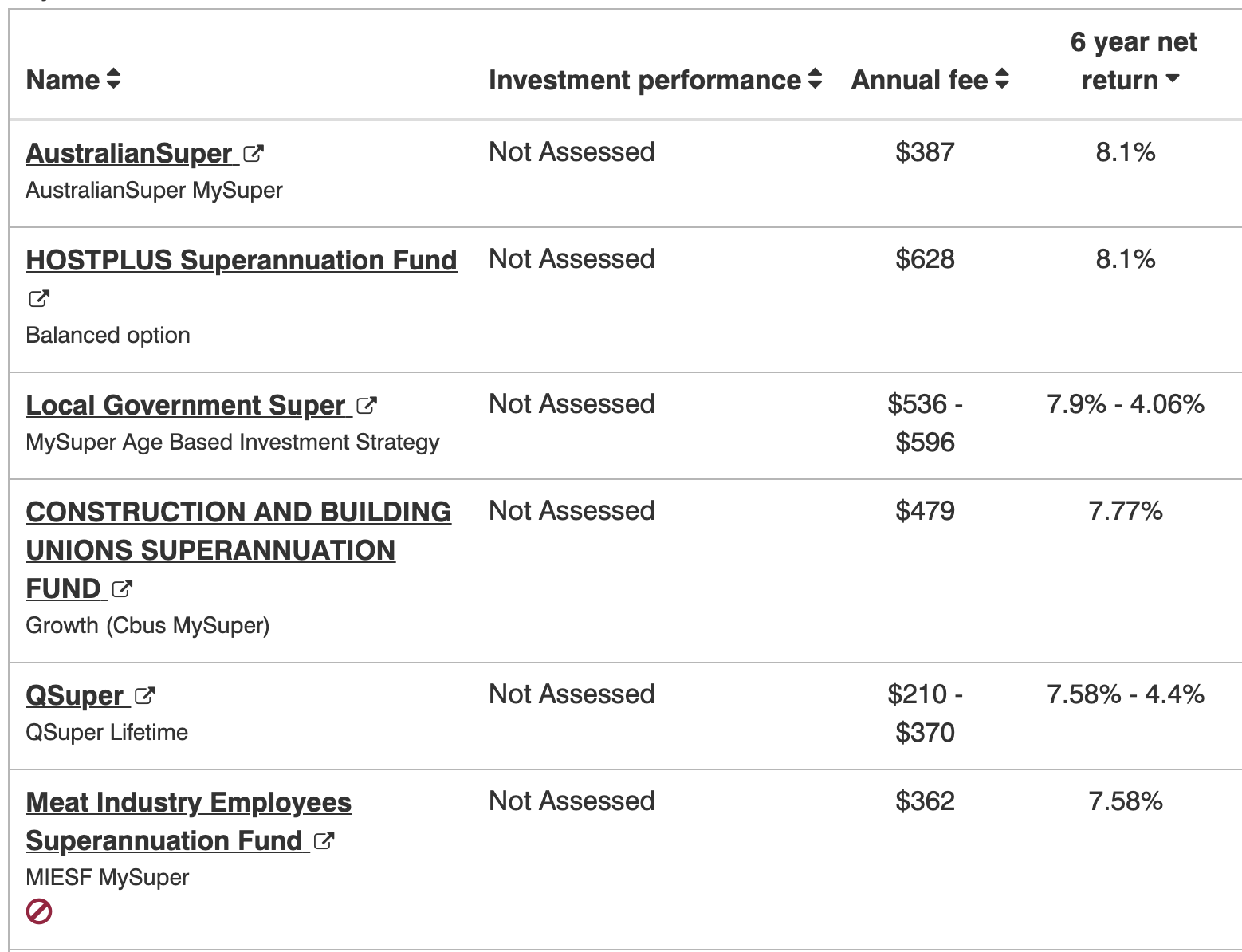

Yesterday, the Government launched a new tool allowing users to compare superannuation funds based on returns and fees. Superannuation has been under the microscope since the banking royal commission concluded in early 2019. Among the raft of broader finance sector misdeeds it uncovered, the inquiry found a lack of transparency at many super funds. The YourSuper platform is one of the primary ways the industry has sought to address this.

Looking at the top five, Australia’s largest superannuation fund AustralianSuper delivered equal highest returns with HOSTPLUS at 8.1% per annum over the past six years, but with much lower fees.

At the moment it includes 80 “default MySuper products,” that is, a set of funds that employers will automatically pay super into unless you specify otherwise. The government is pushing to expand this and have 90% of APRA-regulated superannuation assets listed on YourSuper by July 2022.

Source: MySuper.

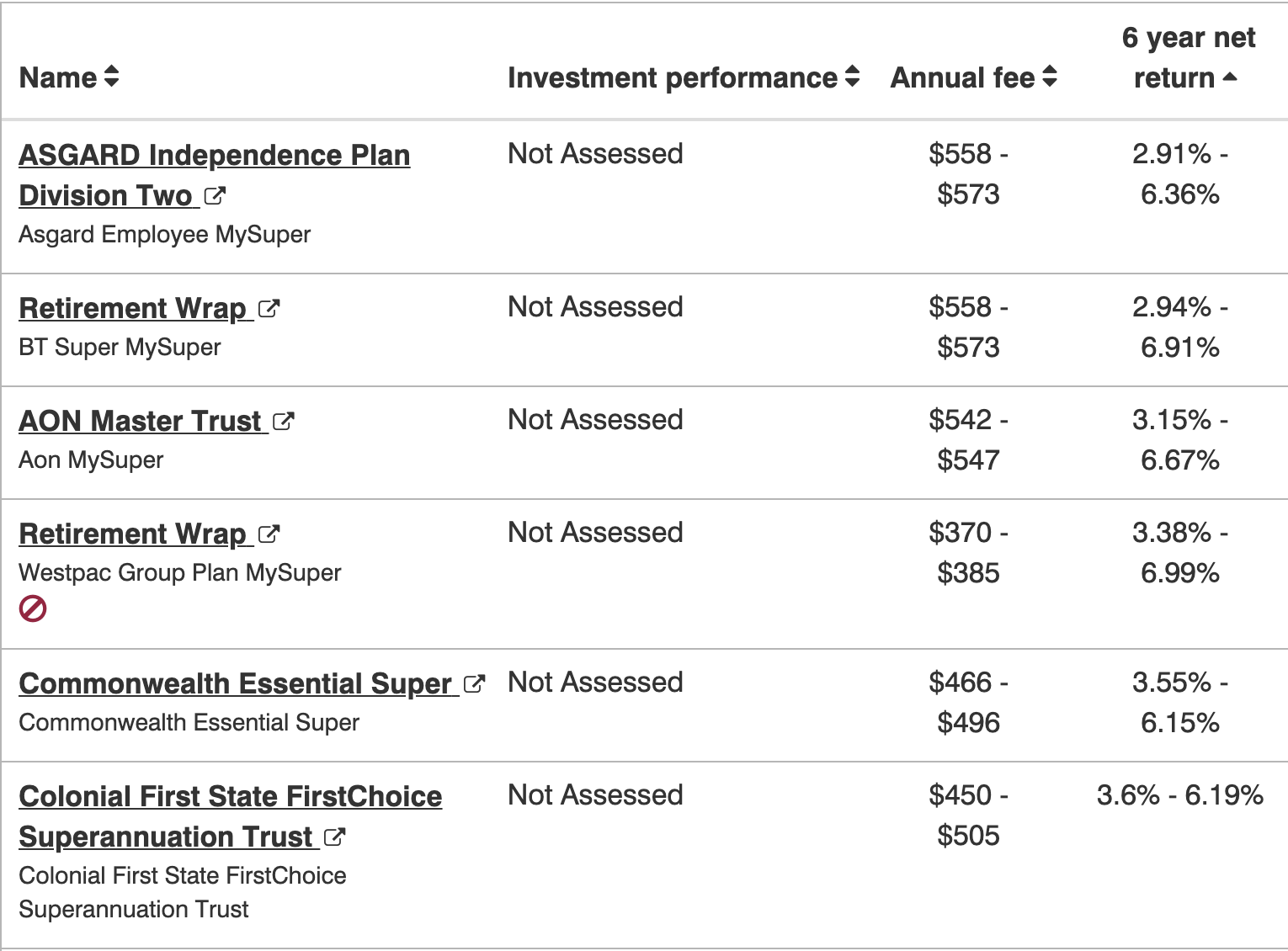

On the other side of the spectrum were funds that service employees from the likes of Commonwealth Bank, Qantas, the public sector and energy companies.

Source: MySuper.

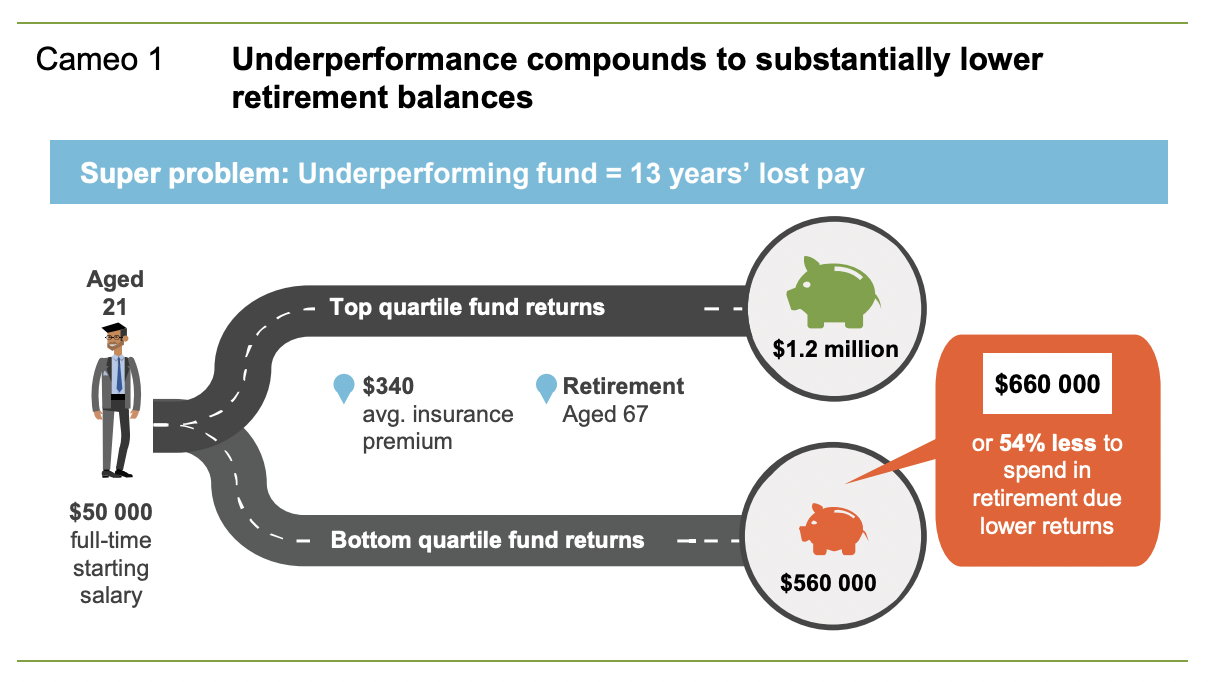

While small in terms of percentage points, choosing a consistently high performer can make an immense difference, in the long run, thanks to the power of compound interest:

Analysis from the Productivity Commission shows a huge gap between the lowest and highest quartile performers, with gains of up to $660,000 for switching.

Source: Superannuation: Assessing Efficiency and Competitiveness, Productivity Commission Inquiry report 2018.

Fingers crossed the system will be able to handle the inevitable wave of interest amongst Australians on this enthralling topic.

Contributor stories of the week

- First up, Livewire-legend Marcus Padley expands on his previous idea of the "one stock portfolio" and details the story of one subscriber who did just that in The 12 million dollar man.

- Small-cap expert Roger Montgomery lays out some high conviction picks with 3 top small-cap ideas.

- Morgan Stanley's Nathan Lim asks the question Do you have enough QUALITY in your portfolio? Laying out why the current conditions are ripe for Quality.

- Leading Australian economist Shane Oliver fills us in on 4 key investor impacts of the latest lockdown and what they mean for investors going forward.

- And finally, income aficionado Peter Gardner lets us in on his latest dividend play with Retirees benefit as Metcash buy-back boosts income and total returns.

Coming up next week...

- Next week on Buy Hold Sell, we will be reviewing the best and worst-performing stocks and ETFs from the past financial year.

- Octopus Investments is launching a new fund and Glenn Freeman wants to know this new way to play the investing thematic that’s on everyone’s lips. Glenn will be covering the launch event of the Octopus Australia Renewable Energy Opportunities Fund (wholesale).

- Keep an ear out for Rules of Investing with Patrick Poke. Next week's podcast will feature Richard Ivers from Prime Value Asset Management.

- Our Top Stock Picks 2021 series continues, with a check-in on the first-half results for our Reader's Most-Tipped small-caps, large-caps and global stocks funds. You can see the first two articles below.

- Our fundies are back with their Top Stock Picks 2021, as we find out which fundie is top of the leaderboard after the end of the financial year.

Related articles:

What did we miss?

- Mia Kwok, Vishal Teckchandani, Bella Kidman, Angus Kennedy, Nicholas Plessas.

2 topics

4 stocks mentioned

11 contributors mentioned