The Coppo Report guide to tax loss selling and 13 ASX large cap stocks to watch in June

- If you have a big profit and then sell before June 30th, then you hit this tax year, meaning the tax is paid off in just nine months (i.e. finished off by 30th March 2022).

- In contrast, if you wait just 3 weeks and sell on July 1st, then it goes into next year’s tax year. That means the tax to be paid is now not due for 18 months - until 30th March 2023.

Many will hold off selling their winning stocks until the next financial year. However, if they have profits this year, they need to lower their tax bill by selling their stocks that bear a loss - hence tax-loss selling.

I have been watching the tax loss phenomena in the market closely for the last 30 years & time after time it’s the same script and I’m backing that the same results will spill out again this time.

Do what the institutional investors do

This can be a bittersweet time – but only if you sell in late May & buy back before July (assuming you want to buy back in). In the past, whenever we see tax-loss selling, it usually begins early, as the institutional investors move “ahead of the pack” and start their work in late May. Indeed, the more illiquid the stock, the greater its fall over June.

Conclusion? Any illiquid stocks you want to sell – do it early because everyone else comes in over June.

In May, you are not thinking about tax time, but come June you begin to think – "I’d better lock in those tax losses now before June 30". This year, in particular, there are plenty including the energy & resource sectors which are standouts.

Over the years, we tend to see many stocks (especially the illiquid ones) have really big falls that begin in late May & usually go until the middle of June.

Many of these stocks bottom around then and then start (in some cases) really big recoveries that go from mid/late June usually until the latter half of July before fizzling out again. This phenomenon is especially true for weak or "lower" quality stocks.

The tax loss stocks (aka biggest losers) are pushed by the brokers in early June and most investors like to make sure that they have sold them & received their cash well before the end of the financial year.

As a result, many sell their tax loss stocks over the first two weeks of June & sometimes into the third week of June – which sees these stocks really fall hard over the period.

The bounce-back: mid to late June

After big recoveries over the ensuing month, some will then sell off again while others can hold those gains and keep going. The critical point is that the huge gains made over the three-week window are (to some extent) a liquidity event, whereby the massive selling that was sitting on a stock for a long period of time ceases completely, and the stock spikes back.

But for the stock to kick on, its fundamentals must be supportive. If they are not, then the stock tends to resume its downtrend. Hence, if you are looking at a name and are not sure, play it a bit safer. I look only at the buy or neutral-rated stocks in this trade.

Over the last week of June, most of the tax loss stocks (except any real disaster stories that don’t recover) – then begin a bounce that tends to go from the last week in June to the second or even sometimes the third week in July. Over that time I have seen many stocks recover between 10% to 35% off their late June low.

While quant studies have shown that stocks that fall between 15% to 40%, end up tending to bounce back 13% to 20% over the ensuing months. Quant studies also show that the lower the market cap, the greater the recovery. In some stocks with market capitalisations below $100 million, the bounces have exceeded 30% vs $500 million market cap stocks that have bounced back 14%, and even larger-cap stocks bounce back 5%.

So the greatest returns also come from those with the greatest risk, the most illiquid & also the ones that have maybe just one broker covering them.

In the words of Nike - just do it!

If you are “thinking” of selling a stock for tax-loss purposes, then go early and get it done as early as possible before everyone else.

In fact, anyone who has sold in May is already a long way ahead. A stock at 90c now could well be 80c in early June then 70c by mid-June. If you don’t and hold back, the stock may fall a lot more than you thought meaning you then get sucked in at the worst time into exiting.

If you are intending to get back in, then wait until mid/late June – the chances of the stock being a lot higher are very low, but the chances that the stock will be a lot lower – are very high. So wait until mid-June when the stock looks like it’s in free fall and everyone then wonders “what is going on with that stock? Stay away!”

Ask yourself this question with every stock

There is one question I ask when someone asks “should I hold this stock – I’m losing on it? I say - ask yourself this question: would you right now, at this price buy this stock?

If the answer is no, then they are ‘hoping” it recovers. If you wouldn't buy it here and are losing money, sell it. Don’t “average down on a loser” – if that’s the main reason – because there is a good chance it will only get worse. Once it's out of your portfolio - I can guarantee your mental state gets better as well – because you don’t have to look at it anymore!

With that in mind, here are the worst stocks for the 2021/2022 financial year (until the end of May) - that is, the biggest falls will be under the most pressure.

ASX large-cap opportunities

- Dominos (ASX:DMP): down 43% this financial year and another near-30% until now

- Ansell (ASX:ANN): down 37% this financial year but is up in the last two months and down in June by 6%

- REA (ASX:REA): down 33% this financial year but also down 19% in the last two months and down in June by 3%

- Block (ASX:SQ2): down 28% this financial year but also down 37% in the last two months and down another 9% in June.

- Seek (ASX:SEK): down 27% this financial year but also down 22% in the last two months and down in June another 4%

- Soul Patts (ASX:SOL): down 24% this financial year but also down 11% in the last two months and down in June by another 2%

- Aristocrat (ASX:ALL): down 21% this financial year but also down 8% in the last 2 months but is up marginally in June

- James Hardie (ASX:JHX): down 20% this financial year but also down 16% in the last two months then down another 6% in June.

- A2Milk (ASX:A2M): down 20% this financial year but also down 11% in the last two months and down in June another 3%

- Wesfarmers (ASX:WES): down 17% until May but also down another 7% in the last 2 months & down in June another 1%.

- Bluescope (ASX:BSL): down 17% this financial year but also down 11% in the last two months and down in June another 2%.

- Wisetech (ASX:WTC): up 32% this financial year but has been hit recently - down 19% in the last 2 months is down 32% from its high and down in June another 1%

- Resmed (ASX:RMD): down 11% this financial year but also down 10% in the last two months and down in June another 4%

Small-cap stocks to watch

- Zip Co (ASX:ZIP): note this will bounce as it has been hammered and shorted. For the brave enough, I'd be out in mid-July after its initial bounce. Remember, it's also down 50% in the last two months & down in June another 18%. Or maybe it's just safer to just overlook this one.

- Pointsbet (ASX:PBH): down 76% this financial year but also down 32% in the last two months and down in June another 13%

- BWX (ASX:BWX): down 75% this financial year but also down 44% in the last two months and down in June another 9%

- Tyro Payments (ASX:TYR): note that this is being kicked out of the ASX 200 so we may see its low in June. Still down 71% this financial year but also down 47% in the last two months and down in June another 11%.

- Kogan (ASX:KGN): down 69% this financial year but also down 37% in the last two months and down another 1% in June.

- Megaport (ASX:MP1): If you have a two-year view, then this is one quality buy this June & hold going forward... down 60% this financial year but also down 56% in the last two months and down 16% more in June

- City Chic Collective (ASX:CCX): down 57% this financial year but also down another 36% in the last two months and down in June another 9%

- Adairs (ASX:ADH): down 45% this financial year but also down another 28% in the last two months and down in June another 6%

- Life 360 (ASX:360): down 44% this financial year but also down 46% in the last two months and then down another 14% in June

- Domain (ASX:DHG): down 38% this financial year but also down -23% in the last two months then down in June 6%

- Paradigm Biotech (ASX:PAR): down 41% this financial year and down another 34% in the last two months. Shares have fallen in June by another 6%.

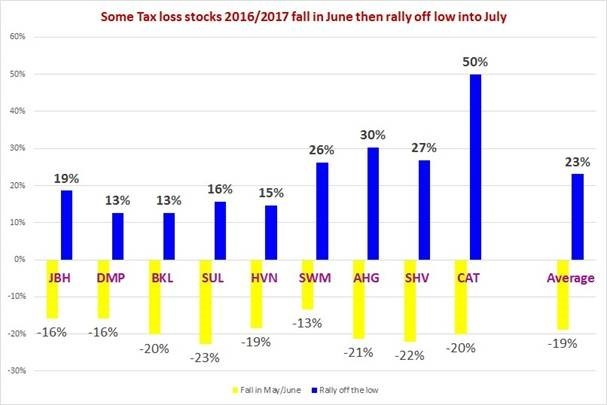

A chart to finish

To prove the point that this "sell, buy, rally" thematic has been in play for a long time, I point to this chart from June 2017. I watched a few names when they were sold off before working out how much they had recovered from those same lows. The result was quite remarkable.

Stay up to date with my latest insights

You can stay up to date with the latest news from me by hitting the 'follow' button below and you'll be notified every time I post a wire.

3 topics

24 stocks mentioned