The Match Out: ASX slides as sellers ‘target’ the retailers, Aristocrat (ALL) delivers a strong 1H & rallies

After looking good yesterday the ASX has flipped on a dime and sold off hard today following a poor night overseas thanks largely to weakness amongst the retail stocks. That theme washed through the ASX today with a 1-2 of rising costs and weakening demand from US-listed Target enough to see local investors indiscriminately dump the sector.

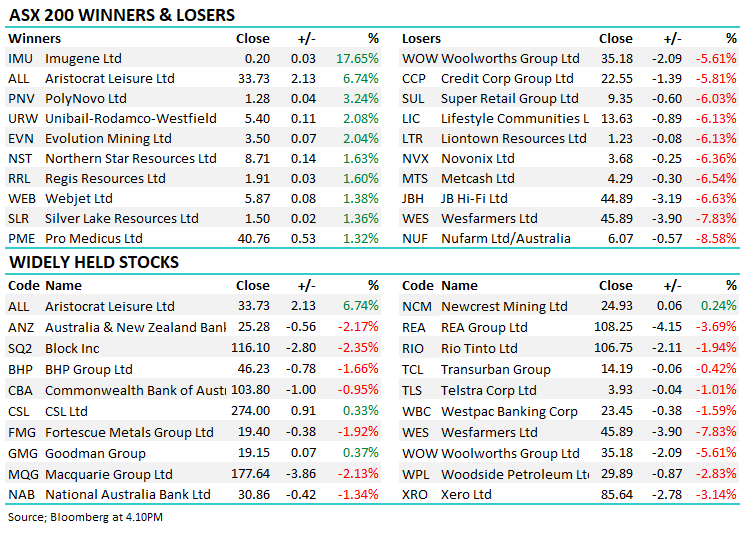

- The ASX 200 finished down -118pts/ -1.65% at 7064

- The Healthcare sector was best on ground (+0.13%) and the only sector to end higher while Utilities(-0.48%) & Industrials (-0.60%) were relative performers.

- Consumer Staples (-3.71%) and Consumer Discretionary (-3.10%) the weakest links – i.e. anything retail focussed.

- Aristocrat Leisure (ALL) +6.74% rallied on a good 1H22 update + they announced a $500m buyback.

- Target (US: TGT) -25% in the US fell hard as costs rise and sales taper off – more on that below.

- Woolies (WOW) -5.61% & Wesfarmers (WES) -7.83% collateral damage in a sector that was sold off very hard all day.

- JB Hi-Fi (JBH) -6.63% and Super Retail Group (SUL) -6.03% also in the eye of the storm.

- Webjet (WEB) +1.38% edged higher after reporting a smaller than expected loss and declaring that “travel is back baby”!!

- Iron Ore was flat in Asia

- Gold was down a touch to ~US$1814

- Asian stocks were mostly lower Hong Kong down -2.38%, Japan -1.8% while China was up +0.24%

- US Futures are all down, around 0.20%

ASX200

Aristocrat Leisure (ALL) $33.73

ALL +6.74%: A tough day to bring out a good set of results, however, that’s exactly what ALL did and they still managed a solid session despite the overall market weakness. For 1H22 they produced adjusted net profit after tax of $580.1 million which was up 42% year on year while they announced an interim dividend of 26 cents per share. The composition of the result was strong and was well ahead of market expectations across the board, in the vicinity of ~10%. They also announced a $500 million on-market share buy-back and talked about accelerating M&A options. The stock has been weak since November, a combination of factors to blame from the tech sell-off, their exposure in Russia to a failed takeover, however, ALL is a stock on 20x growing at 15% with upside potential – a classic GARP stock.

Target (US: TGT) $161.61

TGT US -25%: The big US retailer announced higher costs and weakening demand in an earnings update overnight that prompted a 25% drop in the shares which flowed through to weakness in our retail sector today. Their CEO Brian Cornell said that profit will amount to only about 6% of sales this year, 2 percentage points below the previous forecast, with the company’s first-quarter adjusted profit missing the lowest of 23 analyst estimates on Bloomberg. “We were less profitable than we expected to be, or intend to be over time,” - “Looking ahead, it’s clear that many of these cost pressures will persist in the near term.” We saw a similar trend from Walmart and that’s prompted some concern within our own retailers.

Woolworths (WOW) $35.18

WOW -5.61%: It’s not often we see ‘Woolies’ down nearly 6% however the negative sentiment flowing from Target’s result in the US prompted a significant sell-off right across the retail sector in Australia, and not even staples were spared. Rising costs are the main issue here however it’s important to note that WOW and other sector players like Wesfarmers (WES) have not enjoyed the strength that the likes of Target have in the US which has seen their shares rally 2.5x in the last 2 years.

Broker Moves

- Eagers Raised to Overweight at Wilsons; PT A$13.77

- Boral Cut to Underperform at Credit Suisse; PT A$2.60

- Boral Cut to Underweight at Morgan Stanley; PT A$2.80

- Integral Diagnostics Raised to Outperform at RBC; PT A$4.95

- OFX Rated New Underperform at Barclay Pearce Capital; PT A$2.44

Major movers today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

11 stocks mentioned