The tech and energy themes set to shine as inflation, COVID uncertainties remain

Livewire Markets

As COVID stubbornly continues and inflation fears mount, investors can expect to grapple with uncertainty (at least) for the first half of 2022.

But for all of the reasons to be fearful, GSFM and its fund manager partners Munro Partners, Tribeca Investment Partners and Redpoint Investment Management managed to pinpoint many bright opportunities for investors at this week's webinar, with certain sectors and thematics looking shiny.

Spanning numerous discussion points, the panel held many important takeaways:

- Inflation is out of the bottle, and current real yields are at their most negative since the 1970s

- 2022 predictions remain murky, but there are some clear trends to watch

- Currently, omicron-inspired avoidance is helping drive consumer behaviour while COVID trends stick and supply shortages make life difficult

- Dividend yield is strong in some sectors, but diversity and a focus on growth is key.

Diverse opportunities remain, plus the "fourth era" of computing is here

Munro Investment Partners chief investment officer and Munro Global Growth Fund manager, Nick Griffin, remains largely positive on global equities despite the removal of government stimulus measures and many unknowns.

While Griffin conceded it's perfectly normal in a cycle for people to get "overexcited", he offered a reminder that earnings growth is ultimately what drives stock prices.

And although he expects that growth will slow in 2022, there are clearly identifiable sustainable growth trends to look out for, with special mention going to decarbonisation, cloud computing and eCommerce stocks.

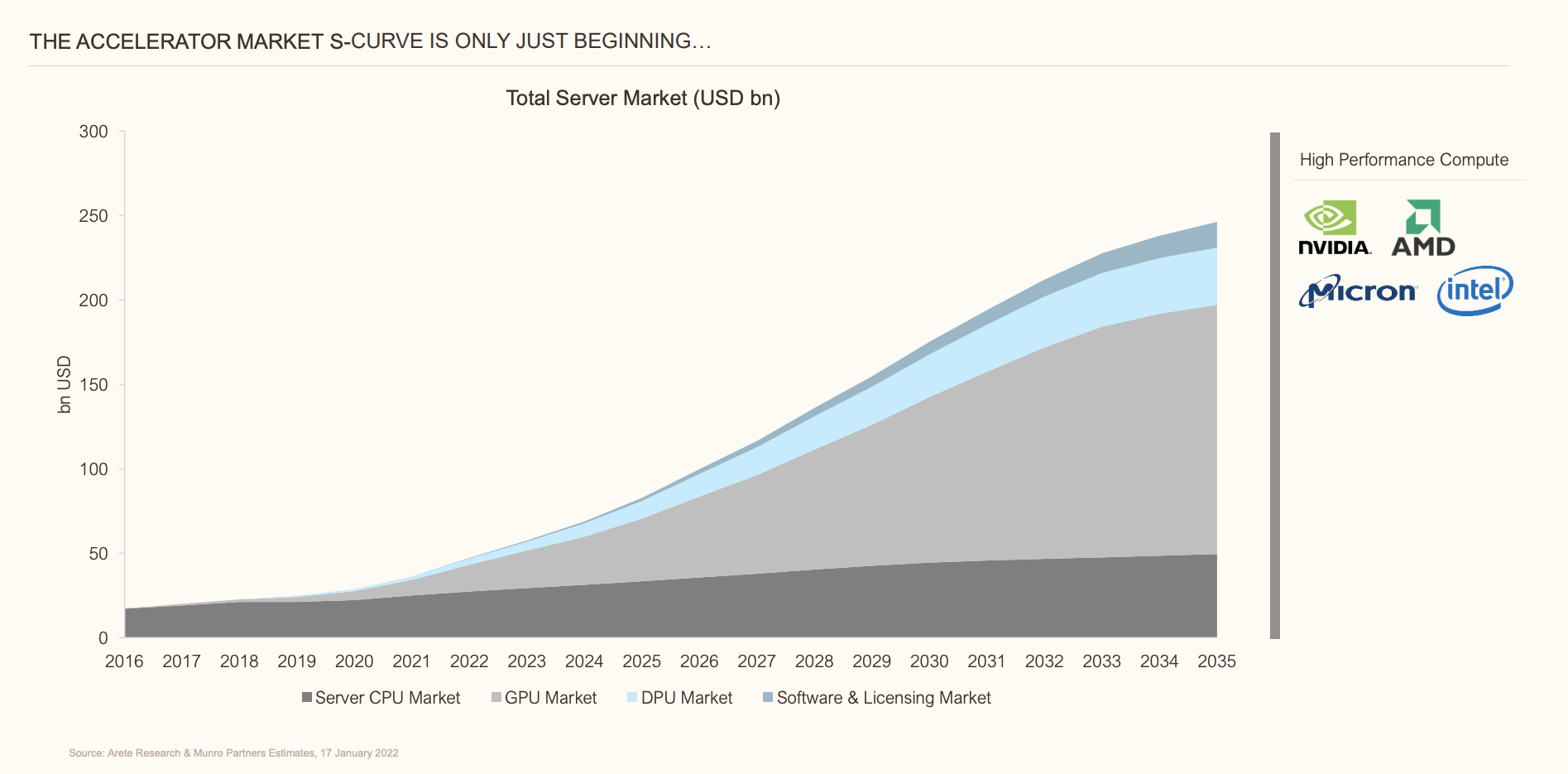

As much as climate is effecting big structural change, high performance computing remains a key focus for Griffin and Munro on the grounds that every organisation will strive to harness the power of artificial intelligence (AI) - which could also lead to stunning growth in the semiconductor industry.

4th era computing will unleash a torrent of silicon demand that should lead to exponential growth for the key players in the semiconductor industry.

A clear winner in the accelerated/high performance computing sector is Nvidia (NASDAQ:NVDA), which for Griffin is the "key AI enabler."

It is the classic hardware and software model, it's the one we're talking about. And if this trend comes true for the market globally, Nvidia has dibs on being (potentially) the biggest company in the world one day."

Perhaps most importantly, such structural changes are what will give "boring companies" a strong earnings headwind.

Transitory or not, there are some inconvenient parallels

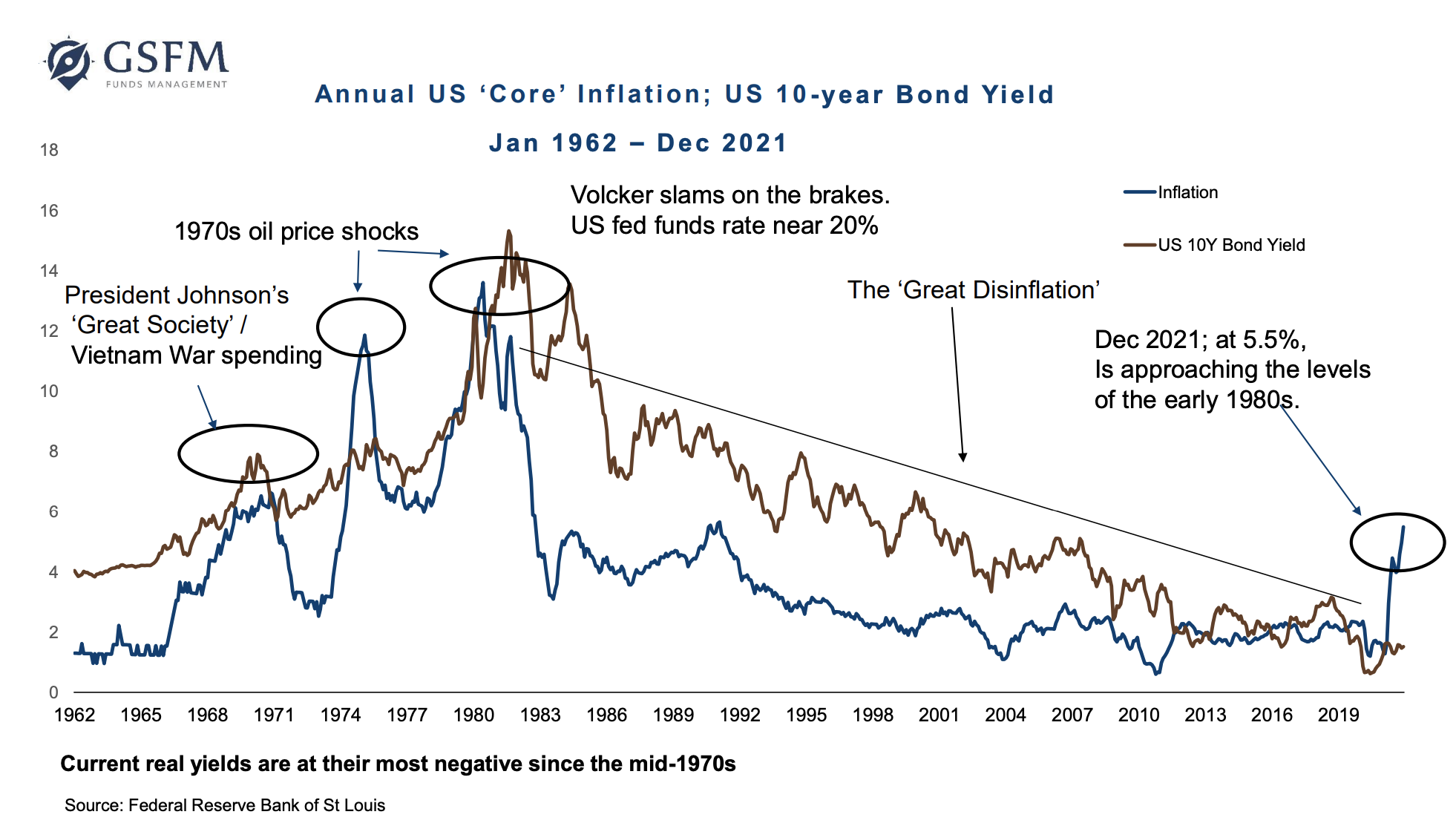

Meanwhile, GSFM's investment strategist, Stephen Miller, says that bond yields have started the year under pressure, and that could continue if current central bank policy is left unchecked.

While "bond yields are still close to historic lows", says Miller, "core inflation is on the way up. The gap between core inflation and the 10-year bond yield is as high as its been since February 1975."

As a self-described "inflation obsessive", Miller maintained that the rapid scaling back of monetary accommodation and central bank purchases could contribute to this gap.

"Central banks are learning - and they resisted this at the start - that if supply shocks manifest themselves in higher inflation expectations, that will have an impact on purchasing behaviour."

While not a comforting scenario, Miller pointed out that there is a more positive (or benign) scenario ready to play out - if central banks are able to get on top of inflation quickly.

"Monetary policy does have a role to play in supply shocks, even if the initial judgement is that inflation is transitory, because it needs to stop that vicious circle."

Inflation, rates and COVID worries will linger (for a while)

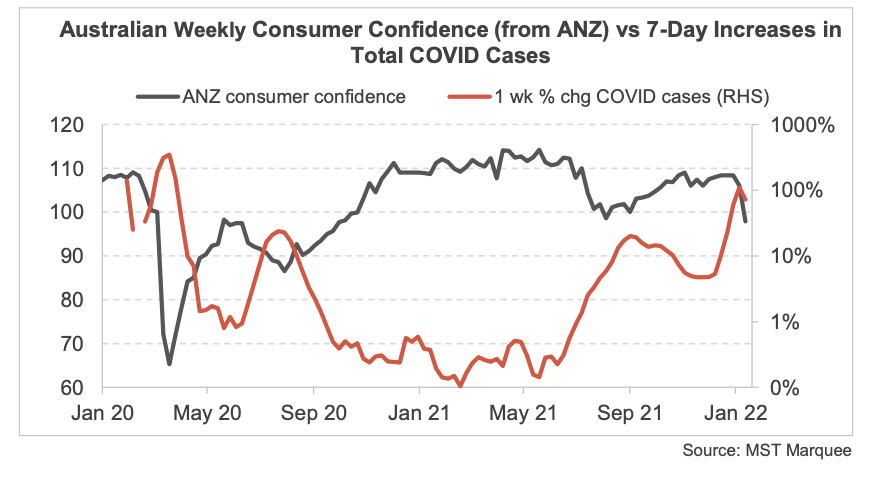

More locally, Tribeca Investment Partners portfolio manager, David Aylward, said that inflation worries and high COVID cases will continue to create uncertainty, at least for the first quarter of 2022.

As Omicron continues, this time there is no government stimulus to support their spending in the economy.

Pointing out that omicron could "decouple us from the broader economy for a time", a big focus for Aylward is the retail and consumer staples sectors, which could face a tricky time as a result of self-imposed lockdowns, diminished online spending and supply chain bottlenecks.

"We've seen big names like JB Hi-Fi (ASX:JBH) build-up inventories to deal with supply chain issues. This will be difficult (to content with) if the consumer is not there."

On the flip side, he sees real tailwinds for the resources sector as the electrification of the economy creates a new commodities supercycle.

“The energy transition is going to be hugely inflationary. When you combine that with the likely stimulus program coming out of China over the next six months, we could be locking in a supercycle round two for commodities. This will have significant ramifications for markets."

Aside from exposure in the mid-cap resources sector, small caps could also benefit - but difficulties in new metals supply will mean such a cycle will need to be navigated at a stock-specific level.

Aylward's take is backed up by the mid and small cap picks in Tribeca's Smaller Australian Companies Fund, with Top 5 holdings in Life360, Mineral Resources, Nickle Mines, Senex Energy and Eclipx Group.

Dividends are back, but don't limit your options

Redpoint's CEO and senior portfolio manager, Max Cappetta, provided his commentary on something investors won't be sorry to hear about - dividends.

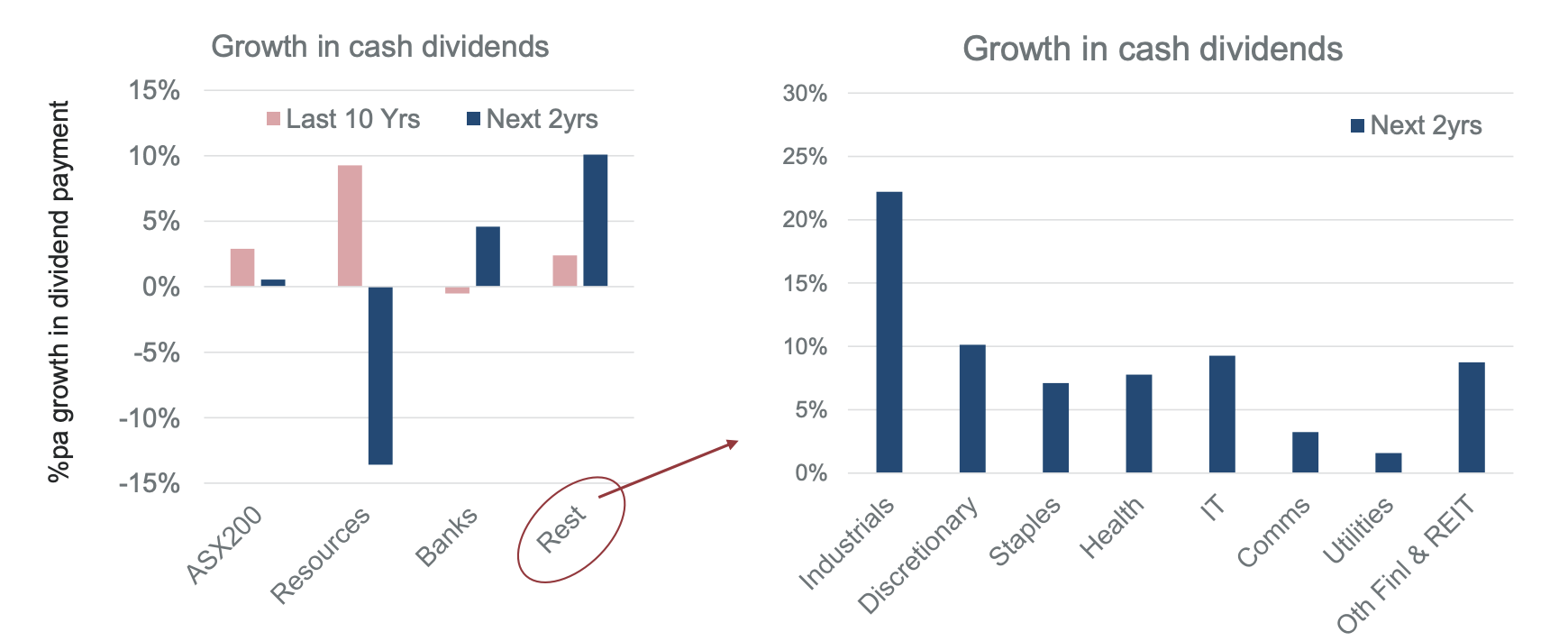

With 130 dividend announcements expected in the coming reporting season suggesting a mixed-bag of winners and losers, Cappetta says it's essential that investors look beyond current yields to future growth across the market.

"If you only focus on yields, you end up concentrating down on the investible universe to 25% of the market cap, and only 40% of the 200 companies. Even worse than that: you actually end up avoiding a range of very attractive sectors such as healthcare or IT."

A case in point is the mining sector, which had a record aggregate dividend payment year in 2021. Over the next two years, that growth in cash dividends is expected to soften (especially iron ore and energy metals) owing to decarbonisation theme upheavals.

Source: Redpoint, ASX, IHSMarkit

Expected dividend growth in resources and financials compared to other sectors.

Cappetta sees room for growth in industrials, consumer, staples and healthcare, noting that diagnostic services firms like Healius (ASX:HLS) and Sonic (ASX:SHL) are contenders for higher revenue and profit growth in a lower-yield area.

And as omicron continues to put the brakes on customer movement, consumer stocks such as JB Hi-Fi, pump equipment manufacturer GUD (ASX:GUD) and auto retailer Eagers (ASX:APE) are likely to deliver strong dividends in February.

"With increasing economic uncertainty, being able to invest more broadly and gain a range of opportunities is more important than ever."

Never miss an update

Enjoy this wire?

Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

5 topics

9 stocks mentioned

1 fund mentioned

2 contributors mentioned

Meg Kerr (she/her) is a Content Editor at Livewire Markets with experience writing for financial publications, including Stocks Down Under and Fat Tail Media. She has a passion for content creation, especially in the resources and commodities space.

Expertise

Meg Kerr (she/her) is a Content Editor at Livewire Markets with experience writing for financial publications, including Stocks Down Under and Fat Tail Media. She has a passion for content creation, especially in the resources and commodities space.