What you can expect as rates rise

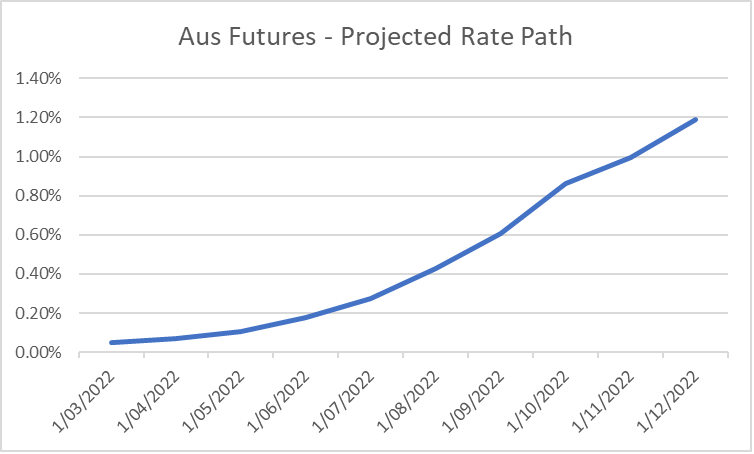

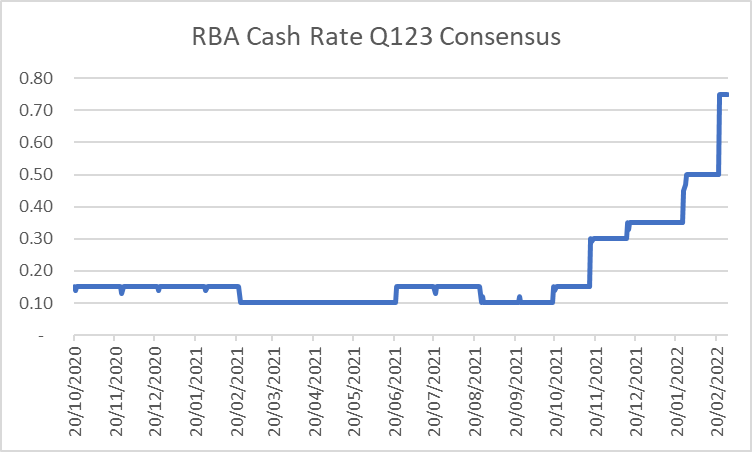

The market is projecting the Australian cash rate to rise to 1.20% by the end of the year, this implies that the RBA hikes 4.5 times on current numbers.

Interestingly, this is more than 20 basis points higher than some of the more bullish estimates, with median forecasts for the last quarter of 2022 currently predicting a cash rate of around 0.50%, while 10% of forecasters are calling for interest rates of 1.00% by year's time.

"This point is important, as it illustrates the potential for our cash path here in Australia to fall short of the very high market estimates," Realm Investment House's Andrew Papageorgiou said.

"However, more to the point, it speaks to a very aggressive tightening cycle being effectively priced in."

In this Q&A, Realm's managing partner and head of bank capital and corporate credit, Papageorgiou, outlines what investors can expect over the year ahead from the US Federal Reserve, the RBA and our biggest banks.

Plus, he also shares what a policy error from central banks could mean for investors (i.e. the risk that they do too much, but also if they do too little), as well as where he is currently finding attractive opportunities within credit markets.

Note: These responses were received on February 28th, 2022.

The US Federal Reserve is expected to raise rates at least four times (to a possible seven times) during 2022. With Australian policy likely to follow that of the Fed, what do you think investors should expect?

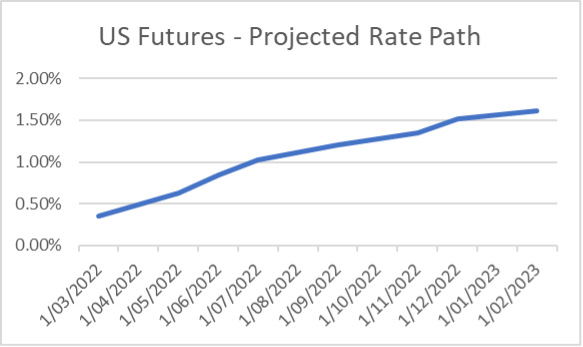

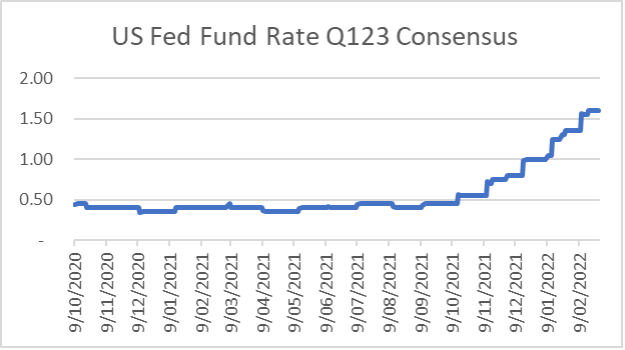

The US overnight indexed swap and futures market implies six rate hikes and a US Federal Reserve cash rate of 1.6% by February 2023. This is now "in the price," according to interest rate markets.

Cash rate hikes that are "priced-in" in the US.

What is more, the market’s assessment of the rate path seems to be entirely consistent with forecast estimates, indicating that markets and forecasters are in broad agreement around the rate trajectory.

Similarly, Australian rate curves are implying a steep trajectory for rate hikes, with futures estimating 4.5 rises and a year-end cash rate of 1.20%.

Cash rate hikes that are "priced-in" in Australia.

However, unlike the US, our inflation outcomes contradict market positioning as does the commentary out of our central bank. Interestingly the median forecasts for Q1 2023 is for a cash rate of 0.50%, with the high end forecasters calling for a 1.00% cash rate.

As such, the market is pricing in a year-end rate that is approximately 20 basis points higher than the high side forecast estimates.

This point is important as it illustrates the potential for our cash path here in Australia to fall short of the very high market estimates. However more to the point, it speaks to a very aggressive tightening cycle being effectively priced in.

So what do higher near term rates mean for investors? The base effect is of course that the risk-free rate on savings will rise, taking some of the pressure off retirees and savers. This will be a welcome relief to the risk-averse as it will begin to reduce the punitive impact of zero rates.

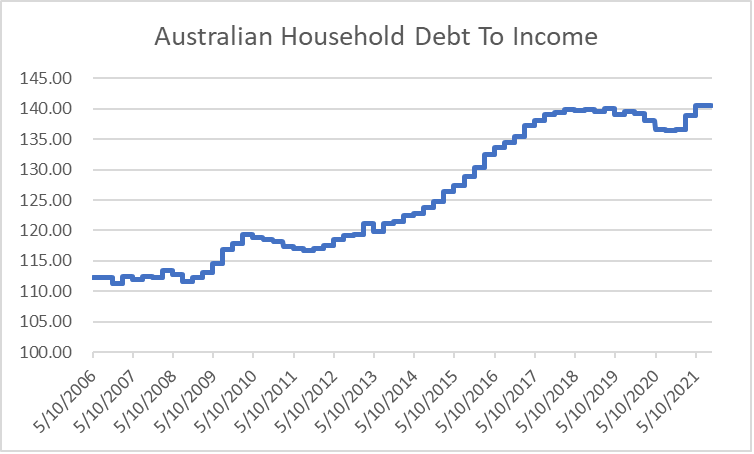

The other obvious impact will be on the household P&L and net borrowers more broadly. Australian Household debt to income currently sits at 140.5%. This means that a 1% rise in interest expense effectively equates to 1.4% of total income.

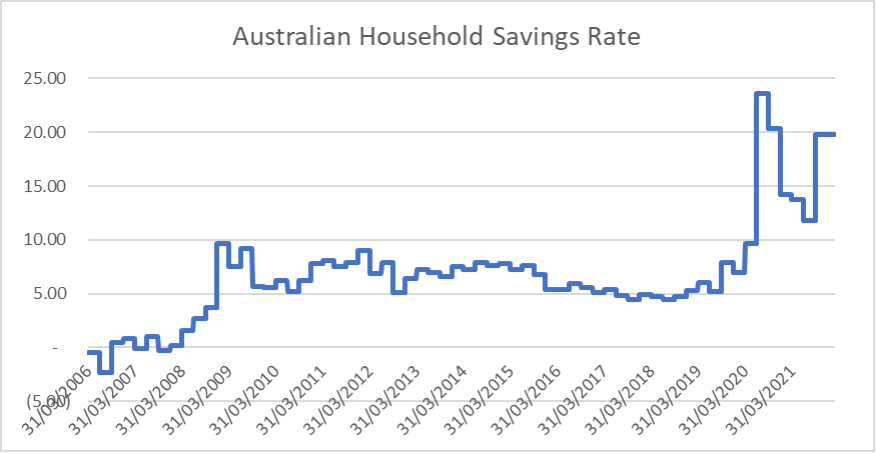

The Australian household savings rate sits at close to 20%, however, this is anomalous and a function of lockdowns and a steep rise in government transfer payments. In the period between the GFC and pre-COVID, household savings rates have sat closer to 6.4% on average.

Put into this context, a 1.5% rise in interest rates roughly equates to 2% as a percentage of household income. Put another way, that is a little under a third of the average rate of household saving ( for the period between GFC to COVID).

This leads to the next great question within interest rate markets, being. At what point do interest rates start to make the economy contract? Put another way, what is the neutral rate of interest?

Forecasters are currently pointing to a median cash rate of 1.5% by mid-2024. The high estimate is closer to 2%. If we put that into terms of household savings we are effectively talking about a number that could reduce average household savings by anywhere up to 50%.

As has been mentioned by many forecasters and pundits alike, the very high levels of household debt make Australian families extremely susceptible to rises in the cost of servicing, absent material wage rises. This may in turn make it more likely that cash rates peak at a level that could be considered low by the standards of the post-GFC market environment.

This is where the question around inflation becomes somewhat critical. As things stand the bond markets are implying a quick tightening path followed by a plateau in rates. This pre-supposes that inflation will peak in the current year.

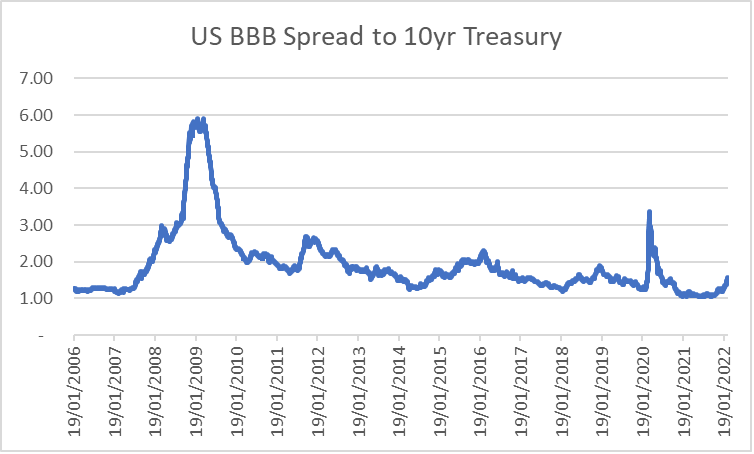

This is what is "in the price” and markets for their part are already adjusting to this new narrative, with some of the exuberance coming out of the equity market and the credit market experiencing a normalization of sorts from very tight credit spreads.

For example, credit markets have seen a widening of around 50 basis points from their very tights in 2021, this equates to a negative capital movement of around 4.5-5% for longer-dated Investment Grade paper. However, even this move leaves credit some 30 basis points below the post-GFC average.

This illustrates that markets are softening from very exuberant levels, however, given that we still find ourselves inside of long-term average spreads, this could hardly be framed as a crash or a crisis. As such, it is reasonable to assert that credit and risk markets will continue to experience some weakness and volatility through a period of interest rate, fiscal and central bank normalization.

This is not a dire forecast, but rather, a view around a normalization of market levels that occurs in a reasonably controlled manner. The widening as stated above would move markets back towards the post-GFC average and perhaps slightly above. We believe that this would be the modal (or most likely outcome).

All of that being said, when looking forward, there is a risk that inflation ends up surprising markets to the upside. In such a scenario it is entirely plausible that both short term and long term rates rise higher than what is currently being projected by markets.

In such a scenario, credit markets could gap meaningfully wider. In addition, very high rates could also prove problematic for households and corporations, which would in turn drive markets to soften further still.

This scenario (however unlikely) is one that could drive disorderly outcomes for markets and could challenge the status quo, to the point of shaking market confidence in the concept of central bank primacy. It is important to remember that this doesn’t need to actually materialize to roil markets, it is sufficient for the narrative to become ascendant and a higher probability than that which is currently assigned.

Leaving the more severe scenarios aside, the volatility we are seeing should be welcomed, as it speaks to normalization in the level of compensation received by investors for risk. This increased volatility also highlights why investors should be proactively managing their portfolio risks in real-time. After all, it was only last year that credit spreads were testing record tights with a benign outlook for both credit spreads and bond yields.

What do higher rates mean for bank funding costs and mortgage rates?

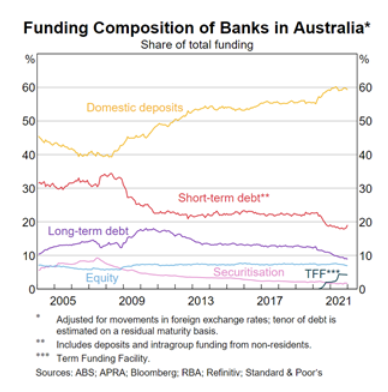

Through the COVID crisis, household savings have skyrocketed, buoyed by heightened government support, a decline in household spending and record low-interest rates. In addition, the Reserve Bank’s Term Funding Facility (TFF) has added more than $200 billion in liquidity to the banking system.

All of that said, this "goldilocks environment" for Australian Banks will reverse over the next year. This has less to do with interest rates rising and more to do with the need for banks to plan for the repayment of the TFF as well as a change in regulations relating to how banks can hold liquidity.

This is also expected to coincide with the moderation of excess household deposits as Australians get back to spending and travelling. That said, the trend in deposit funding has been moving higher as interest rates decline for a decade now, so a wholesale reversal of this trend is unlikely.

This dynamic is not likely to create any kind of liquidity crunch, however, it will lead to our banks once again becoming active issuers into Australian fixed income markets after what was almost an 18-month hiatus through 2020/21. This technical (supply side) factor can be anticipated to push Australian major bank credit spreads wider by year-end and back closer to the 5-year average. Again, this speaks to modest further weakness off a very low base.

In terms of what it means for borrowers, clearly the rate on variable mortgages will rise as rates increase. Many would have also noticed that 2 and 3 year fixed rates have already risen as the market and swap curve have run ahead of cash rate projections. It is arguable that fixed rates at the shorter end of the curve have already peaked, given the disconnect between forecasts and market implied rates.

How do rising yields impact the credit market?

The question might be better phrased as, 'Will an increase in rates or bond yields lead to volatility in the credit market?' Historically, correlated sell-offs in bonds and credit have occurred, however, this is an infrequent occurrence.

Periods of strong correlation are not the standard. Periods of strong positive correlations, which coincide with a sell-off in both markets are rarer still.

That said, the correlation between bond markets and credit spreads has turned strongly positive over the last two quarters or so.

As such it is fair to suggest that credit market outcomes are now being heavily impacted by rate normalization. This is because total yields have been at record lows, and real corporate yields are negative all over the world.

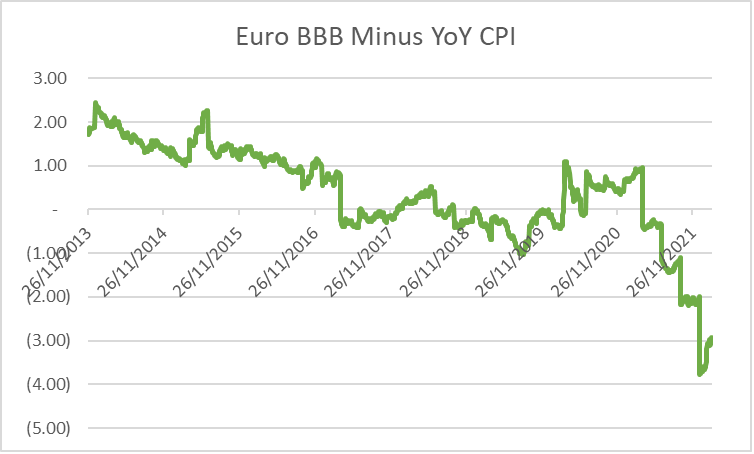

The chart below illustrates the difference between Euro BBB 10 year yields and year on year CPI.

For the first time in market history, the real yield of market bond curves in most developed markets are negative. Let that sink in for a moment. The real return for 10 years after inflation for putting your money at risk within corporate credit in Europe is -3% p.a.

Needless to say, this hardly qualifies as an attractive proposition. What is more, it illustrates the risk that yields could rise materially if inflation does not moderate from current levels. Given the low yield on offer and the rising risks around capital volatility, it is no surprise that fund flows are driving credit spreads wider and presenting a very challenging environment.

If rates rise further than what is presently anticipated, it is likely that the high positive correlation between bonds and credit will hold, seeing yields move higher and credit spreads widen further. In such an environment credit markets will start to present attractive opportunities to patient investors who are willing to absorb the nearer term volatility.

Where are you finding opportunities within the current environment?

The sell-off in credit markets over the month has impacted some markets more than others.

We are, for the first time in a very long time, starting to see some real value emerge in a range of asset types.

For example, we are seeing hybrids issued by Australian banks in USD trading between 0.7% to 0.8% higher in yield than equivalent ASX listed hybrids. Put another way these securities are trading almost 4% cheaper.

In bank subordinated debt, the Euro market is also starting to look interesting. EURO issued tier 2 debt from major Aussie banks trade at close to 2.3% above the risk-free rate, compare that with equivalent AUD floating-rate securities that are trading at 1.6% above the 90-day BBSW rate.

Aussie names in Euro more broadly are starting to trade at a higher spread to other currencies. The lower real yields in European credit have made these markets more vulnerable to inflation outcomes in total return terms.

The volatility brought on by higher rates, higher inflation and geopolitical tension is providing welcome relief from the hum-drum of ever-tightening spreads and lower yields.

In many ways, this is a very welcome sell-off that will provide those who have been appropriately positioned the opportunity to add risk at good prices and set up portfolio outcomes for the next 1 to 3 years.

Do you believe we are likely to return to a disinflationary environment later this year?

When facing these questions it is more appropriate to think probabilistically and connect the probabilities back to what is reflected within the price, rather than being focused on a modal bias (or positioning yourself for what you think the most likely event is going to be).

What we can say is that this prevailing view is certainly being priced in at the long end of the curve, when you consider that 10-year government bonds all over the developed world are trading at negative real yields.

The evidence many would use to support a more benign long term inflationary outlook would be based on the assumption that CPI is being driven by more temporary supply-side factors, there would also be a view that the bigger structural wheels are for the most part deflationary in nature (e.g technology and demographics).

It’s important to understand that at the long end of the curve this view is being priced. The movement in nearer-term rates is simply expressing that a highly accommodative policy needs to be unwound, as a failure to do so could in fact create solid demand drivers for higher inflation.

The risk to credit and bond markets is that the longer-term disinflationary thesis buckles. In such a scenario it is reasonable to assert that risk markets would need to adjust their outlook, which could deliver a jolt to risk assets more generally.

Is there a risk of policy error as central banks move to quash high levels of inflation? What would this mean for investors?

There is a risk that central banks might do too much and then again there is also a risk that they don’t do enough. If they do too much, the risk is that inflation and real wage outcomes are squashed, resulting in a weakening of economic outcomes.

Perversely this won’t necessarily be a negative for rates and credit markets. The narrative of low inflation and softer outcomes for labour is a well-worn path and generally supports a lower rate outlook which in turn acts to support asset valuations.

On the other hand, if central banks don’t do enough there is a risk that higher than anticipated inflation drives disorderly outcomes which could create a very problematic outlook for bonds and risk markets more generally.

This is the more unlikely of the two scenarios, however, it is the one that has the potential to be very disruptive.

If you had to describe the next 12 months for fixed income markets in just one word - what would it be?

Opportunity.

Realm is your partner

Our clients are our lifeblood. With deep experience investing in Australian credit and fixed income markets, Realm is results-oriented in being always focused on delivering client outcomes. Click the 'CONTACT' button below to get in touch.

5 topics

1 fund mentioned

1 contributor mentioned