Why Emma Fisher is uncharacteristically 'glass half-empty' on the ASX

Airlie's Emma Fisher is normally a glass half-full investor. Given equity markets typically rise six out of every seven years in an average cycle, there is good reason to be. But this time is also different. Inflation remains stubbornly high throughout most of the world and central banks are only part of the way through a historic tightening cycle. And yet, equities have rallied hard since mid-June as traders bet that we've reached peak inflation globally.

But Fisher is not concerned about what peak inflation looks like. Rather, she argues there has to be more concern about what the roll-off looks like.

If it settles above 2-3% persistently, that's a very difficult world to be investing in ... That creeping back towards complacency has me leaning more towards the glass half-empty [outlook].

I recently sat down with Fisher, ahead of Airlie's upcoming national investor roadshow, for a conversation on market cycles, where Airlie is finding opportunities and a few of the high-conviction ideas that the firm is backing.

You can access the interview by clicking on the player or reading an edited transcript below.

Topics discussed

- 0:00 Introduction

- 0:39 - Reporting season - have expectations been beaten or missed?

- 1:54 - Opportunities emerging on the back of August results

- 4:07 - Two of Emma's favourite reports so far

- 5:37 - A cracking chart from Goldman Sachs on market cycles

- 8:39 - Contrarian opportunities on the ASX

- 11:38 - Why companies with great balance sheets are in focus

- 12:48 - Is Emma glass half-full or half-empty on this market?

- 15:26 - Emma updates her Mineral Resources call

- 16:14 - Which stock could be the next MinRes?

To get all of this and more, please access the video below or our edited transcript.

EDITED TRANSCRIPT

James Marlay:

Hi there, Livewire readers and viewers. It's James Marlay here, co-founder at Livewire. And today, I'm joined by Emma Fisher, Portfolio Manager at Airlie Funds Management, and we're coming to you in the midst of the August reporting season. It's a busy time. We're going to touch base with Emma to see what are some of the trends that she's picked up have been, and also get a broader view on what's been a really interesting time in equity. So Emma, thanks for your time. Great to see you.

Emma Fisher:

Thank you so much for having me.

James Marlay:

So Emma, what were your expectations coming into reporting season, and how have your expectations been met, or exceeded, or fallen short based on what you've seen so far?

Emma Fisher:

Yeah, I was actually quite excited coming into this reporting season in so far as you can be excited about a reporting season. It feels like it's been so long since we've been able to have a look at the underlying economics of the businesses that we're investing in because you've had COVID. So you've had JobKeeper or you've had these rolling lockdowns.

So the other thing that you've had recently has been all this stuff that we haven't seen in a very long time. You've seen cost inflation. You've seen wages go up. You've seen the cost of debt increase.

So when I pull all of that together, I didn't actually really know what to expect, but I think at an aggregate level, it's been better than feared. I think the market's breathing a sigh of relief.

I guess what makes me cautious looking forward is a lot of businesses haven't given guidance. And I think that's fair. There are a lot of moving parts out there, but that probably kicks the volatility a bit further down the road, and earnings expectations, particularly when you annualise a lot of these increases in the cost base of businesses, earnings expectations do look pretty high still. So better than feared, but probably still a ways to go yet.

James Marlay:

Okay, and is it too early to ask you if there are any themes that might give you a little bit of an indication of where opportunities might lie?

Emma Fisher:

I think the number one thing that's coming out of all the discussions that we're having with corporates is just this absolute war for talent and the difficulty that everyone's having in finding good people. You can see the unemployment rate and you see emails and charts and things like that. But when you're actually having conversations with businesses, it really brings it home how widespread this is.

And it doesn't really feel like there's any easy solution. And I think that has to be quite inflationary.

For example, this morning, I was having a conversation with a company and they hire engineers every year straight out of uni, and normally they pay them about $60,000 a year, and suddenly that's jumped to $90,000. So that's a huge jump to weather as a business.

So that's got us thinking obviously around businesses with pricing power, which I think everyone's singing from the same song sheet there, but also thinking about businesses that have cultures that can attract people, places that people want to work have something different going for them.

Emma Fisher:

So I think that's kind of that soft stuff that will really play out over a long time in terms of this war for talent. The other thing that I think is interesting is this cash flow deterioration that we're seeing. The market's really had this big kicker over the last few years with all this pent-up demand and COVID cash, and that's underpinned very good dividends and specials and capital management and everything like that. And I think that might be coming to an end now because you're seeing a lot of working capital build, investment in inventory, and CAPEX going up. So a lot of the cash conversion for companies hasn't been very good this reporting season.

It's not just about owning businesses with pricing power in an inflationary environment. It's also around businesses, for example, if you've got a really high maintenance CAPEX bill every year in an inflationary environment, you're just spending more money just to stand still. So we're thinking about those sorts of nuances when we are looking at businesses as well.

James Marlay:

Before we move off reporting season, are there a couple of companies that surprised you with the resilience or the quality of the reports that they delivered or any real standout numbers that you saw?

Emma Fisher:

Maybe I'll call out one that we own and one that we don't own. So one that we own that I thought was a really solid result that didn't get a huge amount of attention was Medibank Private (ASX: MPL). I think the market really wants to put that in a COVID beneficiary bucket, but actually, they've really provisioned for that very conservatively.

So they haven't just let it boost their earnings. And then meanwhile, pretty much every lever of the business is really going very, very well. And they're gaining a bit of share in their core Medibank brand and they've got a very strong capital position. So that was a business that we thought the result looked really solid.

One that we don't own, another insurer that we thought looked really solid was QBE Insurance (ASX: QBE). Now a good result for QBE is kind of the absence of bad news, but given that the stock's so cheap, expectations are always really low and it is a very opaque business, but it looks as though the turnaround that's going on there, it seems very sensible, get out of the stuff that you've got no edge in and just focus on the areas that you might have a bit of competitive advantage.

It looked like that is playing out. And obviously, they've got the kicker from higher rates as well. So I thought that was one that looked very good.

James Marlay:

Yeah, two pretty under-the-radar names, I would say, not up in lights. I know you are about to go on the road and present to investors and I've managed to get hold of one of the charts that you'd be talking to, which is around the different causes of market cycles. I was hoping if we bring that up on the screen for the viewers, you could talk us through what they're looking at on that chart and what it means in the context of the current market.

Emma Fisher:

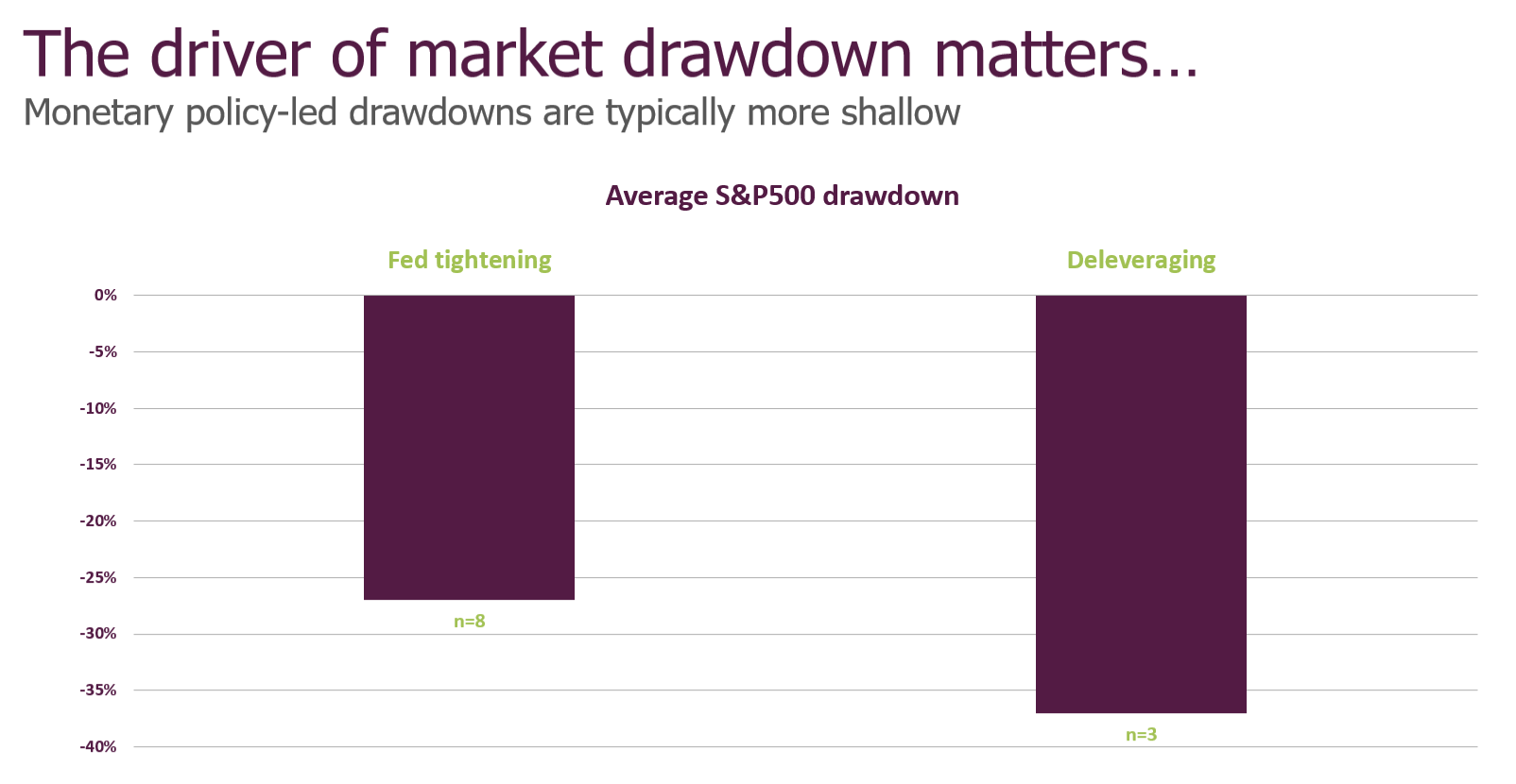

As I was just saying, when you're assessing where you are in the cycle, you have to place it against what markets are pricing in. So I thought Goldman Sachs did this really good study, having a look at the history of U.S. market drawdowns, I think for the last 70 years. And they basically said that the causes of those tend to fall into two buckets.

Either it's a typical monetary policy tightening cycle, so demand's running hard and the Fed raises rates and that brings things to an end, or it's a private sector-led sort of debt de-leveraging. And I guess the key takeaway from the chart is that the private sector-led debt de-leveraging cycles are much rarer, but they are much more severe in terms of their impact on equity markets. So I think when you're trying to figure out where you are in the cycle in terms of markets, you probably want to figure out which of these two buckets we're in if things are getting harder from here. And I think we're probably much more likely in a monetary policy tightening cycle.

When you look across the world for evidence of where the pockets of excess are in terms of debt, I think things look a lot healthier than they did heading into the GFC, for example, which is our last big debt-led blow-up. The U.S. consumer looks okay. U.S. corporate balance sheets look good.

Australian corporate balance sheets look absolutely fantastic. And even the Australian consumer, you might think that we're totally geared to the eyeballs judging by the headlines, but actually, we've all been given this gift in the form of lower interest rates and we've saved it. We've saved a lot of it.

While gearing levels are high, household balance sheets actually look quite good when you take into account offset accounts and deposit accounts. So we're just not seeing the level of debt that would make us think that we're in that bar chart on the right, not the left. So we think it's probably more likely to be a classic monetary policy tightening cycle.

And I guess the significance of that is that when the U.S. market fell 23% to where it bottomed in June and this chart would suggest that is what the typical end of a cycle looks like in terms of the market impact.

Now that's not suggesting it's all over and you can just pile back in. But I think the point is when you see a fall of that size, that's not the time to get peak bearish.

And of course, the headlines and the narrative tends to follow the share market down. So the headlines feel peak bearish and the commentary feels peak bearish. But I think in terms of positioning, that's the time definitely to lean into that fear and really start having a look at where the value is in the market.

James Marlay:

Well, that's exactly where I want to pick up because the selloff's been a doozy and it's been painful and there are those gut-wrenching moments where you think, "How bad is this going to get?", suggest that people were heavily positioned in one way and were caught by surprise. You talked about the opportunity to lean into some of that fear. What are some of the areas where Airlie and where you guys are finding opportunities to think a bit differently?

Emma Fisher:

Yeah, I think you've got to look at what cycles you're willing to take on. And I think a good example of that one opportunity that we think is outstanding at the moment is a business like James Hardie (ASX: JHX). When you look around the world for points where you are at, I guess more of a mid-cycle level of activity, if you're heading into a downturn, you want to be mid-cycle or below, not at peak levels of activity. If things fall, they've got less far to fall. And so when you're looking through that lens, I think the U.S. housing cycle is probably one of the safer places to be.

And I think there's an element of the market that always fights the last war. So there's a lot of noise around a U.S. recession right now. And the market sort of goes, "U.S. is going into recession." What happened last time we had a recession? The GFC was terrible for housing. So it was a sell-off for all the housing-related stocks. So I think James Hardie has been really caught up in that.

And yet most recessions aren't armageddon for housing in the way that the GFC was. The GFC really was unusual. And that was a U.S. housing-led recession. And you are going from building 2 million houses a year down to, I think they got down to about 500,000. So there was a 75% fall in activity levels.

So that was a very, very unusual cycle. And I think there's a bit of recency bias at play.

James Marlay:

It was also ground zero.

Emma Fisher:

Exactly. So there's this recency bias at play and it's giving you an opportunity to buy a business that's got some of the best economics over the last 20 years listed in the Aussie market. So I think that's the business where you really want to take on the cycle. Then the part of the market that I think has really, you've seen investors really flock to in the last six months, and I get it in terms of the uncertainty, has been businesses that have perceived lower earnings risk.

So these are your supermarkets, Endeavour (ASX: EDV), Amcor (ASX: AMC), Brambles (ASX: BXB), and Telstra (ASX: TLS). They've seen their share prices rise over the last six months where pretty much everything else has fallen. And I think that flight to safety, a lot of these businesses, they do sell staple products. So I think you have to be really careful about the price that you pay for that.

So I'm not saying that they're all sells or anything. I just think that pocket of the market, it's not very compelling value to us.

And then the final thing I call out is that usually in a downturn, you want to own businesses with great balance sheets. And normally, when the market falls, businesses with low levels of gearing dramatically outperform, but actually in the last six months, that hasn't been the case at all. And businesses that have higher levels of gearing have actually outperformed. And that to us just doesn't make sense.

Normally in a downturn, everyone gets very worried about levels of debt. So we're looking at businesses that have great balance sheets and that's something that we think could potentially be a source of upside to managing any downturn that comes, whether that be through capital management, special dividends, or things like that.

James Marlay:

And so what are some examples that fall into that bucket?

Emma Fisher:

So about a third of our funds are actually invested in businesses and in net cash businesses. So a lot of the minors for example have fantastic balance sheets. Some of the consumer stocks, Premier Investments (ASX: PMV), and Wesfarmers (ASX: WES) have got to be one of the biggest Aussie companies that have very little debt at all.

So businesses like that, I think have a natural resilience in terms of the quality of their business, but also some of that optionality that they've retained towards the bottom of the cycle. Normally with the minors, you see chequebooks out at the top, and then if they head into a downturn with a high level of gearing, all bets are off but they've had a lot of rationality at the top of the cycle. And now that commodity prices are rolling over, balance sheets are in great shape. You're seeing a little bit of that optionality be deployed. I mean, obviously Oz Minerals (ASX: OZL) and BHP (ASX: BHP), that's I think good examples of that.

James Marlay:

My team is always telling me that I'm too bullish and I look at where we are at the moment and I tend to be quite optimistic. I look at what's going around me, I guess that just tends to be my natural disposition. I'm keen to know at the moment, are you glass half full or glass half empty on the outlook?

Emma Fisher:

It's a good question. I think it's good to be naturally optimistic in investing. I feel like I am the same and I always come back to that statistic that markets tend to rise six out of seven years. So I think having an optimistic bent in markets isn't a bad thing. So you can take that back to your colleagues.

James Marlay:

Yeah, I'll give them a good stat.

Emma Fisher:

But I think it's a little bit tricky now that you've had this big market rally from the bottom in June. I think we are at peak bearishness in June. I think now we're heading back towards complacency and what's really interesting is the stuff that had us tearing our hair out like it's an existential crisis in June hasn't really changed. It hasn't really resolved itself.

Everyone's expecting now with commodity prices rolling off and some of these inflationary items rolling off that the Fed's going to have to pivot. I've got no idea, but I don't think any of these Fed members want to be the ones that let the genie out of the bottle.

And I think yes, we're clearly at peak inflation right now. I don't think anyone's expecting 7% or 8% or 9% inflation next year, but if it settles above 2% to 3% persistently, that's a very difficult world to be investing in.

I keep coming back and saying, "I don't know. I don't know. I don't know." And that's the reality of it, but you've got to balance that in against what a market's pricing is. And that creeping back towards complacency is kind of what has me maybe leaning towards the glass half empty.

The one other thing that's bubbling away in my mind and making me feel quite uneasy is this energy transition. The more I read about it and I really haven't made up my mind, about what way I think this is going to play out, but the more I read about it, the more I realise I don't know what's going to happen. And it feels as though politically, maybe we've got some sort of resolution now, but this is the point where the rubber's going to really start having to hit the road.

We're going to have to see a lot of investment. It's going to touch every single industry. It's going to touch every single person. And I don't really think people are really talking or thinking about that. And I don't know that it's really reflected that much in valuations. So I think it's going to be a really bumpy decade.

James Marlay:

In November last year, you published an article saying, "Is this the cheapest lithium stock on the market?" And you're talking about Mineral Resources (ASX: MIN). It got widely read, nearly 25,000 times on our website, which is a big number for us.

And my team will ask me if I could ask Emma for her next big idea. So that was a high conviction call. The stock did really well post that. Was just wondering if you've got anything in the portfolio that you're banging the table on at the moment that you could share with us.

Emma Fisher:

Yeah, that's a really good question. I'd hate to be really boring and say it might actually be the same stock, but using that lens of comparing Mineral Resources to all of its lithium peers, basically, the whole market cap is justified by their lithium business. And then what do you get with the rest of it?

No one wants exposure to a high-cost iron ore business, but the value of that isn't zero. We made $2 billion out of iron ore a year ago. And then you've got a mining services business that's very, very high quality that's making $500 million in EBITDA. And again, the value of that business isn't zero.

So I think as they move further down this road of potentially decoupling the lithium earnings of the business from the rest of it, then the value of the lithium assets will go up in line with their peers and you'll make a lot of money.

Emma Fisher:

So I would say that's one that even though it's had a good run, probably still looks interesting on a two-year view. And clearly, because I've mentioned it quite a few times, the other one I'd be banging the table on is James Hardie (ASX: JHX). I think everyone knows this is a very high-quality business.

I think if you peruse Livewire, which everyone should be because it's such a great website, you'd be hard-pressed to find an Aussie fund manager that doesn't seem like they love the company. And yet the share price is nearly halved. So I think this is an instance where the cycle is giving you an opportunity to buy a really, really great business for a very attractive multiple.

So it is time, I guess, to lean into that fear and buy a good business.

James Marlay:

Okay, great. Well, Emma, I know it's a busy time during August. Thanks very much for making the time for me today.

Emma Fisher:

Thank you so much for having me.

Learn more about Airlie Funds Management

Airlie seeks to identify Australian companies based on their financial strength, attractive durable business characteristics and the quality of their management teams.

You can learn more by visiting the Airlie website.

3 topics

15 stocks mentioned

1 contributor mentioned