3 fiery calls from Firetrail’s Blake Henricks

They’re making Qantas Airways (ASX:QAN) their largest portfolio position, snapping up shares in a sector whose fundamentals are being torpedoed, and underweighting banking stocks ahead of potentially massive dividend cuts. Blake Henricks and the team at Firetrail Investments are certainly living up to their fund’s high conviction label.

Henricks, one of the few managers in Livewire’s 2020 outlook series who predicted a bad year for equities (though a pandemic wasn’t the reason why), says for many companies “it’s about survival”.

"There is no real playbook for what is going on at the moment. Businesses aren’t set up to deal with environments where there is potentially no revenue."

Caption: Three big calls... Blake Henricks, Deputy Managing Director and Portfolio Manager, Firetrail Investments

That’s why when it comes to navigating the current environment, Henricks at a recent Firetrail webinar believes there are four key questions investors need to ask of their stock holdings:

- What’s their sensitivity to coronavirus from an earnings perspective?

- How long can they survive in this environment?

- Has there been any structural impact as a result of COVID-19 to the business or the sector it operates in?

- What’s priced in already?

When Firetrail's team overlays that to its investment universe, the results are split across the following key themes:

1. Cyclical leaders such as Qantas and Worley

"They’ve been heavily impacted by coronavirus, but they have much higher margins than all their competitors and are well-placed to take market share through what’s going to be a tough period. Importantly, believe the balance sheets are strong enough to withstand very tough scenarios."

2. Defensive leaders such as Amcor

Henricks believes some the market leadership is being underestimated by investors. Specifically, on Amcor, he was never too concerned about the demise of plastic.

"Our view was we wouldn’t see a sharp move away from plastics into other forms of package. It may happen at the margin, but we felt that to solve the problem there is a need to increase recycling. Interestingly, our channel checks have indicated demand has come back strongly especially for bottle water. Many of those headwinds Amcor is facing have moved temporarily to the side."

3. Unloved and deeply undervalued opportunities like Virgin Money UK and Nufarm

"Current market conditions have created exceptional opportunities. We’ve been increasing positions where there’s better value now than before, but reducing those which have held up like CSL and Transurban."

Calling Qantas's stock home

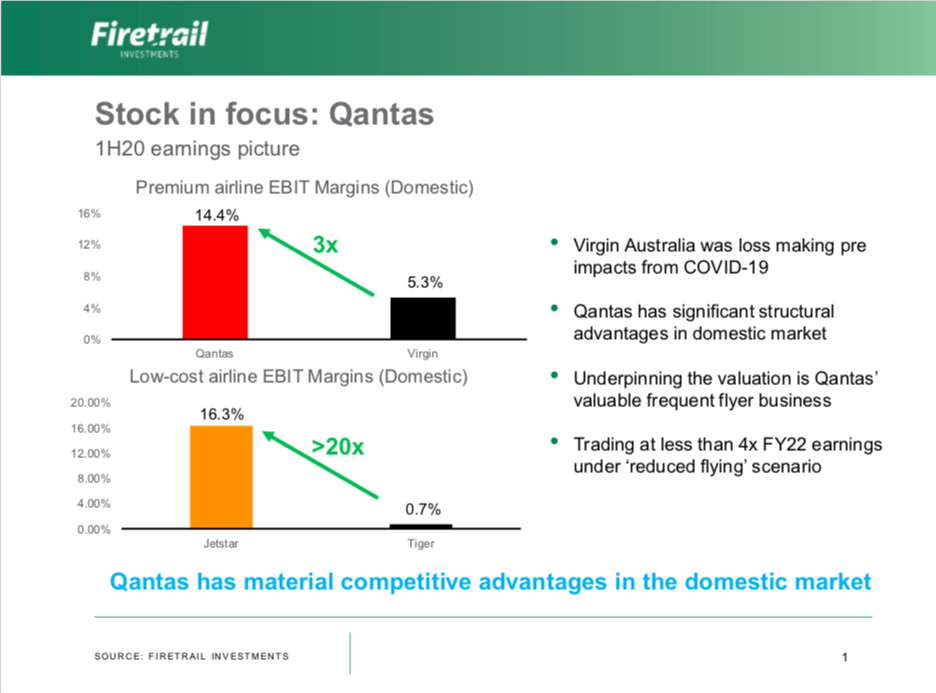

Henricks says Firetrail has been increasing its position in Qantas at prices “much lower than today” because of its structural advantages over Virgin Australia, which entered voluntary administration earlier this week, and the potential for a demand surge.

"I can’t be any more clear about this: Virgin has not been a well-run business. Since 2006 they have lost $1.8 billion of cash. This is pre COVID19. Over the same period Qantas has generated $5.8 billion of cash so it’s a pretty significant differential."

On Firetrail’s analysis, it appears Virgin was headed for trouble anyway given Qantas and its subsidiary Jetstar generated commanded a revenue premium, superior passenger yields and at a lower operating cost (see slide below).

Henricks reckons anyone who takes over Virgin would need to make a difficult decision on whether to operate it as a low-cost airline or a premium carrier. He reckons it will likely emerge as a slimmed-down domestic-focused carrier.

Qantas is also well-positioned in Firetrail’s base case of a sharp demand rebound in flights and tourism when the domestic economy opens up again, but international travel is expected to remain anaemic. All the while, the Flying Kangaroo is only traded on an FY22 P/E of 4x.

Energy prices set for an upside shock

Another sector Henricks is wading into is energy, naming services company WorleyParsons as his preferred pick.

The oil market has experienced something of an alternative universe moment with futures nosediving and plunging through $0 for the first time this week as companies are now paying traders to take the oversupplied commodity off their hands, but Henricks such low prices are unsustainable.

“We saw prices go negative because we’re seeing such oversupply; we estimate that around 25% of supply is uneconomic at current prices – the issue is not OPEC, it’s not what they can do, the issue is demand. Right now demand is down 30% and there are no amount of production cuts that will make the market balance at the current minute.”

But there’s a case for the oil price to rocket back up to US$50 if the global economy experiences a demand surge as lockdowns are lifted but production has been stepped down due to output cuts from OPEC and high-cost marginal operators.

This frames the opportunity in WorleyParsons, which is well-positioned to service the energy industry when capex recovers. But Hendricks also notes Worley is now better diversified than in 2014, when its ~85% of its total business was exposed to hydrocarbons, compared to around 40% today. Furthermore, management have improved its working capital structure so that cash is generated quicker.

Don’t bank on dividends of yesteryear

One part of the market Henricks doesn’t have much conviction is banks. Firetrail is “maximum underweight” towards the sector for two reasons.

Expect a 50% cut in dividends?

While Australian lenders are well-capitalised, the rapidly evolving situation and APRA’s stern guidance to banks and insurers on capital management means that material cuts are coming.

"Reading between the lines our base case would be a 50% dividend cut at the next payment dates and then refreshing from there."

As a side note, Henricks mentioned that bank dividends are a valuable cash source in the economy for consumers. So if they reduce, then that could implicate whether the economy sees a U-shaped or V-shaped recovery.

Bad debts

The other reason he’s wary of banks is that this time around, bad and doubtful debts are going to be treated far differently from the GFC, when lenders dragged their heels on recognising soured loans. But to add a spanner in the works, how will debts such as six-month payment deferrals be treated in upcoming reports?

"Compared to 2009, banks now have to take all the provisions that they think need to be taken in the first available reporting period. So if that’s the case, you could see a huge build up in BD&Ds – there’s a lot of discussion on what the right level of provisions."

His preferred exposure in the sector is Virgin Money (ASX:VUK) which is being priced by the market at only ~20% of its book value. Over 80% of Virgin’s business is mortgages and the company has a capital buffer three percentage points above the regulatory minimum, so Henricks reckons the probability of severe capital difficulty is very low yet the share price is beaten up.

COVID-19 won’t last forever

While there’s no doubt that risk levels remain elevated, so does the attractiveness of current opportunities, Henricks reminds investors.

COVID-19 impacts should not be extrapolated forever, and investors shouldn’t be lulled into paying a high price for businesses that haven’t been impacted by the pandemic as they won't receive the all-important margin of safety.

"But our strong view is the best allocation of capital right now is buying good businesses, that have been sold off on short term headwinds, and are most likely to emerge in a stronger position on the other side. It is as simple as that."

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

23 stocks mentioned

2 contributors mentioned