7 things we learned this November

The Annual General Meeting (AGM) season in Australia is no longer just for procedural matters. It can really be considered a quasi 'third earnings reporting period' that investors can use to better understand companies and their drivers.

With most AGMs now complete for the season, we have attended (virtually) more than 120 meetings and met and engaged with almost 70 companies pre- and post-AGM. We have seen several important themes arising from these meetings, and similarly to last year, we are seeing the forum being used more and more by both companies and shareholders to push for action across the whole ESG agenda. The reopening is also fuelling an improved short-term outlook, but supply chain disruptions and higher costs remain.

In the following note, we have looked at the investment thematics arising from the AGMs, how these have guided our voting and engagements, and have used our top-down framework to judge the overall pulse of the market.

Remuneration increasingly being linked to sustainability

It is still early days for sustainability disclosure, but a key theme that we are seeing at many of this year’s AGMs is increasing pressure on companies to improve in this space and release better data. We are also starting to see more companies that have recognised the need for an emphasis on sustainability metrics and have improved their short- and long-term incentives (STI and LTI) remuneration (REM) measures.

This year we have seen several KPI hurdles based on non-financial sustainability targets, from companies such as Ansell (ASX: ANN), Flight Centre (ASX: FLT), Corporate Travel (ASX: CTD), Brambles (ASX: BXB), Amcor (ASX: AMC), A2 Milk (ASX: A2M), GUD Group (ASX: GUD), Goodman Group (ASX: GMG), Endeavour (ASX: EDV), BHP Group (ASX: BHP) and South32 (ASX: S32). These have included targets based on emissions reduction, recycling, and also modern slavery. Interestingly, these KPIs are appearing across REM for all levels of management, not just the Board.

Voting for inclusion of sustainability metrics by South32

Michael Slack, Head of Research

"We voted for the changes to FY22 STI REM to up-weight the Sustainability performance assessment to be equal with production and financial goals. For South32, Sustainability covers metrics such as Safety, Health, Risk Management & Community. This adjustment is consistent with the importance we, as shareholders, place on Sustainability. Climate change and portfolio management have also been added as strategic measures for LTI."

Board discretion and ‘deaf ears’ on show in REM votes

In terms of REM, we are also seeing companies using board discretion to better align with shareholders, but this is not universal, and several still do appear to have turned a ‘deaf ear’ to shareholder concerns.

For example, the BHP Group (ASX: BHP) Board adjusted management incentive awards down by 10% to reflect poor management in the treatment of women at their isolated mine sites. While the Board has assessed good progress on this since 2018, they agree more could be done. Fortescue Metals Group (ASX: FMG) management took a hit in recognition of the cost blowouts at Iron Bridge and were awarded zero STI and reduced vesting of LTI. Nine Entertainment (ASX: NEC) and CSL (ASX: CSL) boards are also getting tougher on REM hurdles, and Domain (ASX: DMG) has implemented tougher hurdles in response to the first strike last year. The Ansell(ASX: ANN) Board made adjustments to hurdles to account for one-off COVID-19 tailwinds.

On the flip side, those companies that appear to be less aware of their accountability to shareholders are being sent a message, though REM votes being used to show dissatisfaction about the board’s REM report and other issues. For example, Insurance Australia Group (ASX: IAG) received a strong down vote of their REM report after missing the mark on dealing with prior year failings. Dexus Property Group (ASX: DXS) received a first strike which was tied to poor communication of their funds management business plan. Transurban (ASX: TCL) also received a first strike after management were rewarded; despite poor shareholder returns.

Engagement with Transurban Group on REM report vote

Ashton Reid & Andrew Chambers, Portfolio Managers

"We had a meeting with the Chair of Transurban to discuss our vote against their recent REM report. In our view it is too early to reward management given shareholders are still wearing the pain from the pandemic, with the share price still trading below pre-COVID-19 levels.

The Chair noted that management have done very well with what they can control and suggested that the company would review the outcome of project delays over the coming years when they have more clarity around the true impact.

While we acknowledge that the Chair made some good points, we maintain the view that a generous incentive outcome is not yet warranted."

Director elections reflect sustainability and diversity concerns

AGMs are an opportunity to see board renewal and succession planning. We are seeing solid work by boards in improving their diversity across several aspects including gender, culture, geographic location, and skill sets.

For example, BlueScope (ASX: BSL) has appointed two new directors; one from the US (female) and one from China. Perpetual(ASX: PPT) has also sought North America experience with their new appointment. Tech skills are proving hard to find, and this year Wesfarmers (ASX: WES) have focused on bringing in a director with digital skills, following on from BHP Group (ASX: BHP) who started that process last year. National Australia Bank (ASX: NAB) put up a new director, but he was removed due to poor feedback on skills.

Voting for Wesfarmers adding board tech skills

Jim Power, Research Analyst

"We voted for Anil Sabharwal being elected to the Wesfarmers Board to continue to help the firm focus on improving their digital/data innovation. Anil is Vice President of Product Management at Google and the company’s most senior product and engineering leader in Australia and New Zealand and was first appointed to the Board in February 2021.

BHP Group (ASX: BHP) retirements this year will see the company fall below its 1/3 female threshold, but our engagements with the company have highlighted that they are very conscious of working on their gender mix.

The focus on improving gender diversity is creating an issue in over-boarding, with female directors particularly in high demand. Fewer women than men in executive roles leads to a reduced pool of female candidates for board roles, especially given that company boards generally have a preference for appointing people with prior executive experience. Another board renewal issue that is becoming more widespread is that people with appropriate and in demand skill sets don’t want to take on board responsibility due to strict regulations. We have seen this in discussions with companies such as National Australia Bank and Stockland."

Climate change transition plans at the fore

Given the timing of COP26 in Glasgow, companies have also used their AGMs to discuss further their own net-zero carbon plans, and we have seen more action from Woolworths Group (ASX: WOW), Wesfarmers (ASX: WES) and Coles Group(ASX: COL).

The dirtiest companies have in fact been the most aggressive on climate change transition plans, particularly Fletcher Building Group (ASX: FBU), Boral (ASX: BLD), Fortescue Metals Group (ASX: FMG) and Woodside Petroleum (ASX: WDS), while other companies such as BHP Group and APA Group (ASX: APA) are looking to M&A to help transition their businesses.

Seeking external climate change transition options

Andrew Chambers, Portfolio Manager

"The APA Group takeover offer for AusNet Services highlights their lack of inhouse transition options with their gas pipeline assets and focus on the electrification of the Australian economy and need for sustainable and renewable energy.

As per last year, proposals on climate change clauses / run down of fossil fuels / changes to constitutions from small activist shareholder groups such as Market Forces and ACCR have been evident at many AGMs. As we have previously discussed, we see this as diverting company management’s time and energy towards narrow environmental and social causes that can be better explored through active ownership and purposeful engagement. A good example of this is Commonwealth Bank of Australia (ASX: CBA), who Market Forces were pushing to move completely out of fossil fuel funding (despite this amounting to less than 1.5% of their total loan book)." (1)

Engagement with Commonwealth Bank (CBA) on fossil fuels

Matt Davison, Senior Research Analyst

"We met with the CBA to discuss the Board’s climate change transition plans and the AGM’s shareholder resolution on exiting fossil fuel.

Management already expects to exit thermal coal by 2030 and are targeting A$70 billion of sustainable financing in the next 10 years, based on a ground up analysis of what each division of the bank can achieve. We discussed how CBA already disclose a lot; and a vote on the constitution will not change this in any way.

Furthermore, CBA has recently developed a new climate-lending strategy where the bank has recalibrated its lending policies to help lead customers to transition solutions and social improvements, rather than blanking them out. An example of this is the Indigenous employment target loan to Wesfarmers.

This new strategy has also changed the organisational framework to put accountability with CEO and increased rigour on ESG lending tools and explicit consideration of commitment to the Paris Agreement."

Reopening leading to improved short-term outlook

While not all companies have provided guidance, we are seeing some good trading updates for consumer and industrial sector names coming out of lockdown.

Management comments at AGMs and in post-AGM calls from tourism related companies such as Corporate Travel (ASX: CTD), Qantas (ASX: QAN) and Flight Centre (ASX: FLT) were very bullish towards reopening. Retailers such as JB Hi-Fi (ASX: JBH), Super Retail Group (ASX: SUL) and Endeavour Group (ASX: EDV) are expecting a strong Christmas/Cyber-Monday, but there is some uncertainty in the longer-term guidance.

REITs have been stronger than expected for those worst hit by COVID and we are seeing confidence from mall owners Vicinity Centres (ASX: VCX) and Scentre Group (ASX: SCG). Residential demand is remaining strong despite falling immigration demographics and macroprudential impacts.

Engagement with Flight Centre on reopening boost

Chris Schade, Research Analyst

"I had a call with Flight Centre’s Head of Americas to discuss the business outlook given the ongoing progression of the global reopening thematic.

A business slowdown in August due to the emergence of the COVID-19 Delta strain was quickly reversed, and the return of transatlantic routes in early November is expected to provide a further boost to business momentum.

The pandemic induced slowdown provided the opportunity to implement meaningful technology improvements, and pleasingly the corporate business has been winning new accounts.

Domestically, travel plans seem to be skewed toward visiting friends and family rather than holiday travel at present; given the latter is more important to Flight Centre’s business model the company is hoping to see this adjust going forward.

On the other hand, ASX-listed New Zealand companies, such as Spark NZ (ASX: SPK), are somewhat more pessimistic due to lack of a clear roadmap out of the COVID-19 lockdowns in New Zealand."

Engagement with Spark NZ on reopening pathway

Patrick Potts, Research Analyst

"While happy with how the business has been performing despite lock downs in New Zealand, when we met with the Spark NZ Chair, she expressed some concern around the reopening pathway for New Zealand given the latest COVID-19 outbreak; the lack of clarity regarding goals or targets to initiate a reopening. It is clearly impacting sentiment."

Supply chain disruptions, higher costs and ‘just in case’ inventory

Another key COVID-19-related theme is the supply chain disruptions to inventory, labour and input costs. We are seeing higher cost guidance from most companies, particularly in relation to energy costs.

There is some inability to pass higher costs on to the consumer, but we are also not seeing much complaint on the tougher margins. On the other hand, fresh food is seeing some price decreases.

Engagement with Amcor on supply chain issues

Chris Schade, Research Analyst

"At a recent meeting with Amcor, the Chair told us that the company had expected to see price normalisation for key inputs to their packaging during the calendar year, but it had in fact gotten worse and they are now expecting prolonged elevated prices and more rations from suppliers. However, it is being managed as everyone is facing the same challenge.

Shortages of materials and shipping issues are weighing on companies like Resmed (ASX: RMD), who are struggling to get electrical components. Brambles (ASX: BXB) are seeing wood shortages, which is meaning they are reducing allocations of pallets to clients such as Coles Group (ASX: COL). Companies are now holding higher inventory ‘just in case’ rather than ‘just in time’ to cover themselves for Christmas. This is a windfall for logistics companies.

Labour shortages continue to be a common theme, in particular access to tech talent, seasonal labour, and hospitability staff. Casino operator Star Entertainment Group (ASX: SGR) have been paying 80% of salaries to furloughed staff during lockdown just to keep them on the books, but that should somewhat alleviate the shortages post lockdown."

AGM analytics based on top-down framework (2)

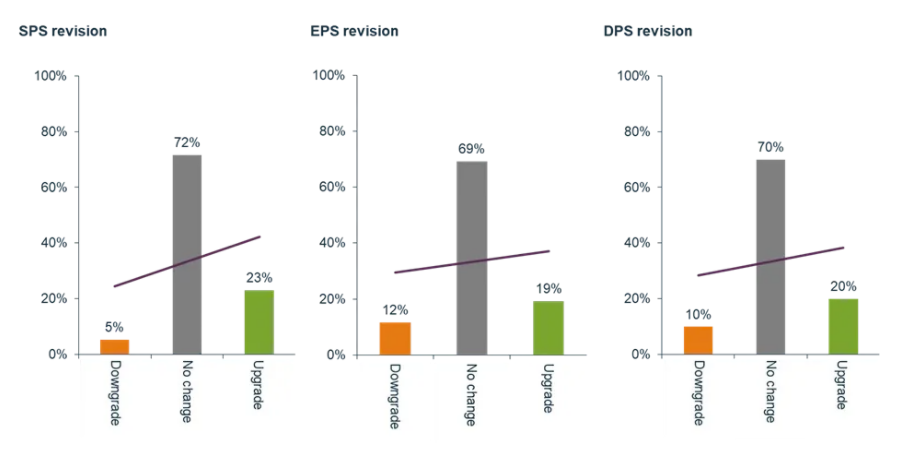

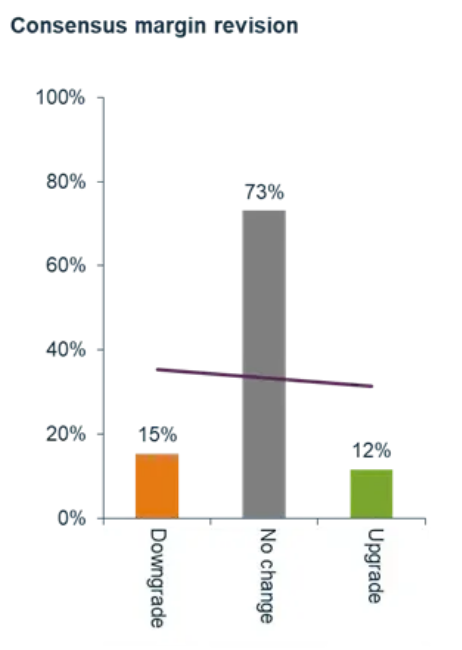

While there is less revision activity from brokers occurring during AGM season compared to reporting season, we can use the same top-down analytical framework that we use in reporting season to judge what the street is thinking and doing. We have specifically reviewed consensus revisions and the subsequent price reactions from the start of AGM season on 22 September through to the end of November 2021.

Revisions continued to be positive over AGM season, with more upgrades than downgrades across sales per share (SPS), earnings per share (EPS), and dividends per share (DPS).

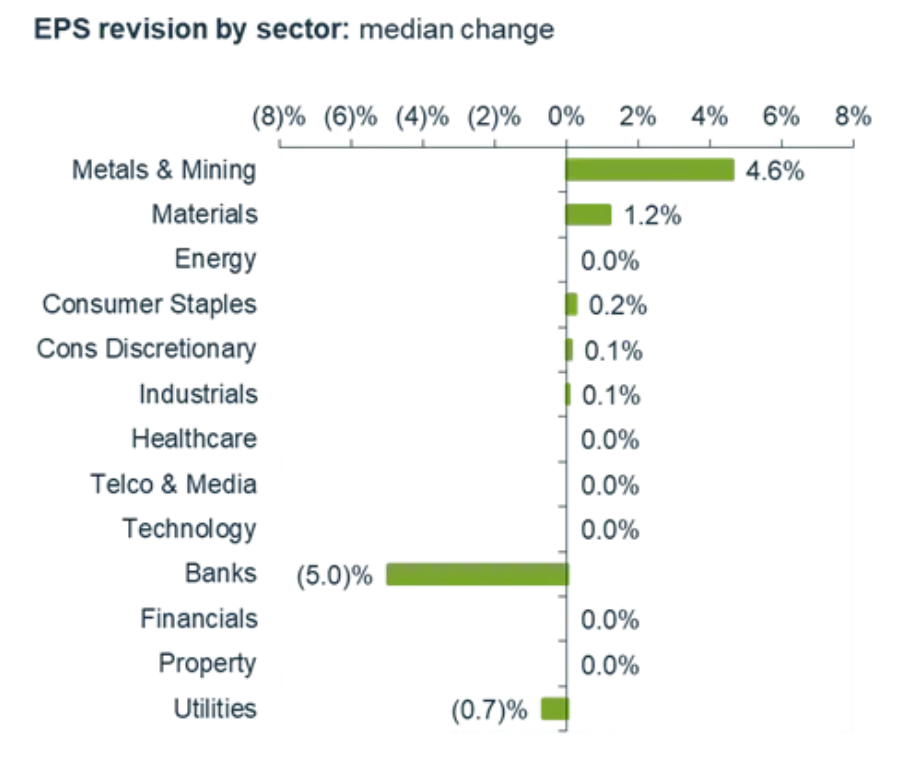

Commodities, agriculture, and consumer companies had the strongest revenue lines, reflecting the inflationary environment. In contrast, lockdown exposed stocks suffered revenue setbacks, and the banks suffered revenue downgrades on mortgage completion pressure.

Despite the positive revision environment, we did continue to see a strong top-line offset to some extent by margin contraction. This is further evidence of the inflationary impacts we are currently seeing, and the varied ability for companies to pass on these costs.

Companies most exposed to margin pressures were consumer discretionary and staples retailers and P&C insurers, whilst the resource stocks benefitted from margin expansion on strong commodity prices such as steel and aluminium. On the other hand, iron ore margins fell on lower prices.

The ability to ‘hold margin’ was the strongest determinant of EPS revision upgrades, with more primary producers benefiting, consumer stocks more neutral and banks suffering on Net Interest Margin (NIM) downgrades and high ongoing regulatory costs.

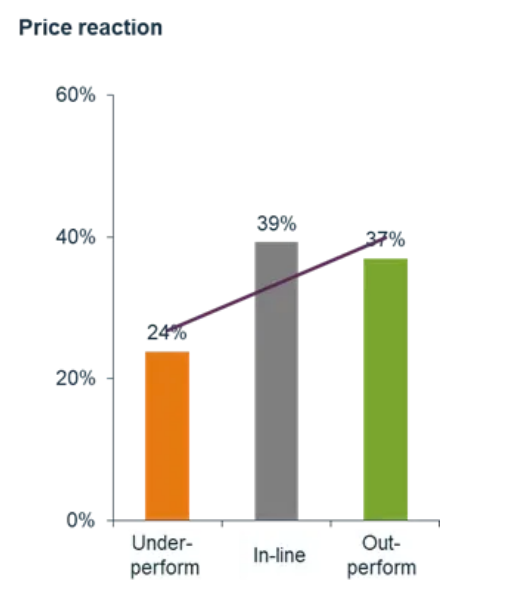

Looking at how the market has reacted to the AGMs, by comparing the share price movement over the two days post each company’s AGM, 37% companies outperformed in the days post their AGM given the generally positive trading updates, while 39% were in-line.

The market was most negatively surprised by the pressure suffered by consumer staples such as Inghams Group (ASX: ING), Treasury Wine Estates (ASX: TWE) and Woolworths Group (ASX: WOW), bank margin pressures, and tech downgrades from Nearmap (ASX: NEA). Conversely, the health Insurers Medibank Private (ASX: MPL) and NIB Holdings (ASX: NHF) had positive reactions to trading updates as did the upstream resource and energy stocks.

Summary and outlook

To us, what we are seeing in both the AGM themes and top-down analytics continues to be pleasing.

Ultimately, we believe that ESG factors create risks and opportunities for investors and that it is important to consider these when making an investment in a company, and for the companies themselves to manage these appropriately. We integrate ESG insights into the investment process for all investment decisions made for MCA strategies. As such, we welcome the increased focus on ESG by both companies and investors at AGMs.

The more upbeat tone to consensus revisions, the muted price reaction to bottom of cycle earnings data, and the positive outlooks from companies themselves is in keeping with our positive outlook for the Australian market.

All in all, performance of the Australian stock market has been flat during the November 2021 AGM season, but it is true that AGMs provide less market sensitive information than reporting seasons and thus has less impact on price reaction. Instead, the Omicron variant of COVID-19 has added a new risk factor, and triggered the market sell off late in November, wiping out any earlier gains.

Despite this, we still expect a positive outlook for Australia and Australian equities, and in particular the Value and Income-style stocks that we invest in. The high prices being paid for Growth-style stocks versus Value are still being driven by low rates and the weak local economy, but we see this as unsustainable in the recovery from the COVID-19 recession.

As virus transmission is brought under control via the high vaccination rates and we see the end of lockdowns, we expect that this will drive strong Value-style performance going forward. The yield gap between high-quality income payers and other income asset class options available today is still wide, supporting valuations of high-quality companies.

Investing for the long term

Our stock-focused approach is driven by in-depth fundamental research and skilled portfolio construction. We invest for the long term to capture equity growth, but only when high-quality opportunities are identified at sensible valuations. Learn more here

Footnotes

(1) Source: CBA.

(2) Source for all section charts: Martin Currie Australia, FactSet; as of 30 November 2021. Please see additional disclaimers at end of document.

Past performance is not a guide to future returns.

2 topics

26 stocks mentioned