Handling the downside risk from Trump's tariffs

Vega Capital

Over the past few weeks, you may have noticed President Trump’s rhetoric has centred around trade and resulted in the escalation of tensions between the US and other economic powers of the world. Many investors are wondering what downside risk they might be exposed to and whether a recession is imminent. Today’s wire is focussed on bringing some numbers to the discussion and considering the real implications for investors.

Trade and the Deficit

According to Census.gov, the total value of US imported goods and services in 2017 was $2.9 trillion. Of this, Chinese exports to the US were circa $500 billion. Meanwhile, US exports of goods and services to China are valued at circa $120 billion which means there is an approximate $380 billion trade deficit in favour of China.

The Trump Administration is threatening tariffs on all Chinese exports to the US (approximately 17 per cent of total US imports) due to what the President views as unfair trade and monetary practices. But is this policy work? In our view, no.

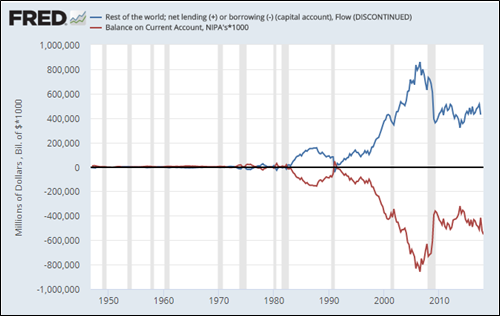

The deficit is actually structural and not easily adjusted. To see this, let’s review a very basic principal in economics – the Balance of Payments. Clearly if the US is running a trade deficit, it must be importing capital from other countries to pay for it – i.e. running a capital account surplus.

Why do other countries send all this capital to the US? Because of its deep, secure and lucrative investment opportunities.

This means that because the world wishes to send so much of its savings to the US, then total investment must exceed domestic savings invested locally. Hence the US has a capital account surplus and by definition, there must be a trade deficit to match. This is easily shown in the below graph produced with data from the Federal Reserve.

Trump's tariffs

What the President is trying to do is reduce imports to lower the trade deficit through tariffs. But the capital account surplus will only fall if foreigners regard the US as a less desirable place to send their savings since it’s the capital account surplus driving the trade deficit.

And since the source of the US capital account surplus has not been addressed, by default, its current account deficit will remain. As a result, we have difficulty seeing as to how the President is going to achieve his objectives.

These views aren’t particularly new and are similar to that of Michael Pettis, Megan Greene and many other economists.

The risks

We are concerned that the tariffs may create unemployment and this would have real negative consequences. The Trade Partnership for example estimates that from steel and aluminium tariffs, the US steel/aluminium industry would gain a little over 26,000 jobs but the rest of the US economy would lose over 430,000 jobs.

And those tariffs are only a small fraction of the total proposed (steel & aluminium imports from major trading partners was circa $35b in 2017). One wonders how significant the losses may be when we’re talking about tariffs across more than 17% of US imports (i.e. >$500b in tariffed goods and services)?

Exactly how much unemployment is impossible to answer, since each tariffed good/service has its own unique multiplier, but it doesn’t appear positive.

So, how could this issue be resolved?

The most sensible option at this point would be for China and the US to meet, curb tensions and have both sides walk away declaring victory. However unlikely this scenario seems at this hour, its eventuation wouldn’t surprise me. I imagine that the President’s sabre rattling last Thursday (being “ready to go to 500” billion of tariffs) was an attempt to prod China towards those discussions.

Conclusion

For now, global investors should expect tariffs to create more volatility than positive outcomes. At The Vega Fund, our algorithms have us positioned with a good number of hedges in place to take advantage of higher volatility.

10 topics

Scott has seven years of experience in investment and risk management, was previously an analyst at Montgomery Investment Management, and holds a degree Economics from the UWA as well as a Master’s degree in Financial Mathematics from UNSW.

Expertise

Scott has seven years of experience in investment and risk management, was previously an analyst at Montgomery Investment Management, and holds a degree Economics from the UWA as well as a Master’s degree in Financial Mathematics from UNSW.