Most tipped small caps up 26% YTD

Livewire Markets

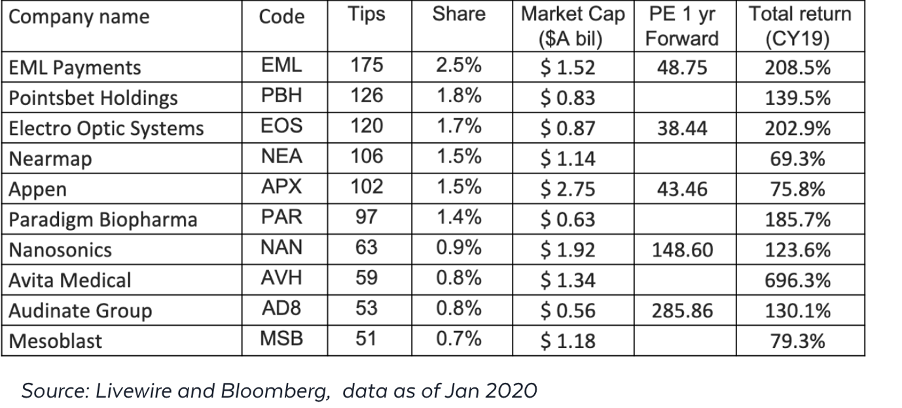

In December of 2019, when Livewire ran our annual Predictions and Top Picks survey, the bushfires consumed headlines and our worries as investors. In January, we released the ten most tipped small caps for 2020, picked by you, Livewire readers. The ten sizzling small caps were off to a cracker. If you’ve forgotten, here’s a list of what you picked.

In June, we provided an update on the most tipped small caps, and it's safe to say, the market climate had changed immensely. With a pandemic on our hands, and one of the biggest drawdowns in history, we updated you on the status of your small caps. You can access the June update here.

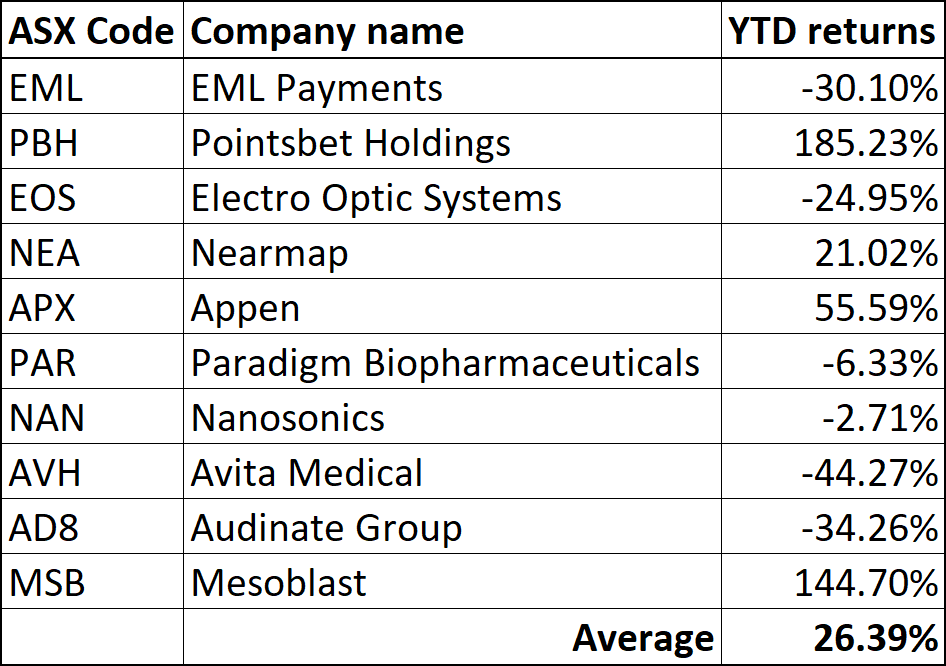

Finally, we’ve reached the end of FY20 reporting season has come to a close. From trade wars and bushfires, to pandemics and panic buying, this year has been straight out of a disaster movie. But one thing that hasn’t changed this financial year has been the ability for Livewire readers to pick stunning small cap stocks. The ten most tipped small caps are beating the market, up a whopping 26% since January. However, only four of these stocks are in positive territory, meaning they're doing some heavy lifting.

Source: Data from Sharesight

Throughout reporting season, we have provided updates on all our small caps which you can find here:

- EML Payments

- Pointsbet Holdings

- Electro Optic Systems

- Nearmap

- Appen

- Paradigm Biopharma

- Nanosonics

- Avita Therapeutics

- Audinate Group

- Mesoblast

Let's see what these fundies thought about your most tipped stocks throughout reporting season.

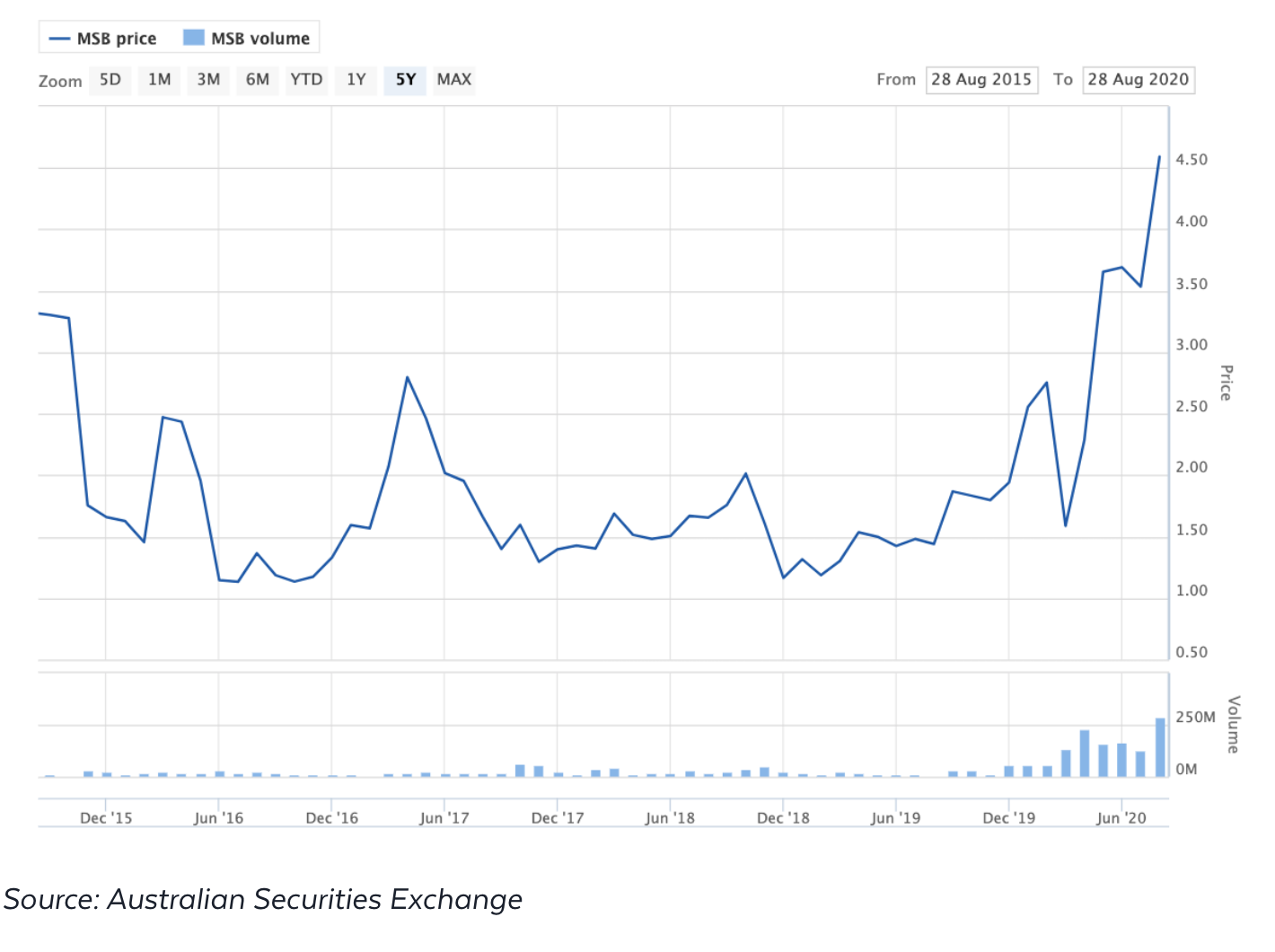

Game changing potential for loss-making Mesoblast

On a recent episode of Buy Hold Sell, Eleanor Swanson of Firetrail Investments labelled Mesoblast as the stock everyone should have in their portfolio. Post the release of their results, her mind hasn’t changed.

“we’re expecting a material rerating in the share price…because these are blockbuster drugs,”

The Melbourne-based biotech Mesoblast seek to provide treatments for inflammatory ailments, cardiovascular disease and chronic back pain. True to its volatile nature, the share price dropped 4% over the release of the company’s results, but has experienced a strong bounce back since, and continues to be a better performer in the most tipped stocks list.

Audinate: It’s not cheap, and it’s not growing

Down 36% year to date, Audinate is the list’s second-worst performer. Whilst the IT company has had a shocker this year in terms of share price performance, Audinate’s lead product Dante is estimated to have eight times the market penetration of the nearest competitor product. Additionally, the management team believe that Dante currently has 7% penetration of the billion-dollar total addressable market.

James Marlay spoke with three fund managers, who all hold varying views on Audinate, including the impact of COVID-19, the expensive valuation, and the prospect for long term growth.

Avita Therapeutics: A bright future, and 50% off to boot

Avita Therapeutics, the medtech company that specialises in 'spray-on' skin, have had a turbulent year. From the onset of COVID-19, to being redomiciled to the United States with a secondary listing on the NASDAQ, Avita is the worst performer on our list of small caps, down nearly 50%.

Does that mean it's time to start thinking about owning the company? John Hester, senior analyst at Bell Potter, shares the key takeaways of the recent results of the company, and shares Bell Potter's latest price target.

A miss from Nanosonics... is it time to buy?

One of our laggards on the 10 most-tipped list, down ~3% since the start of the year, NAN is one of the most popular stocks amongst both fundies and retail investors. At the end of 2019, two of our fundies nominated Nanosonics as the one stock they'd love to own at a cheaper price.

Nanosonics, the innovator of ultrasound probe disinfection practices, missed on market expectation in August reporting season. However, Jun Bei Liu of Tribeca thinks that whilst the company's results were disappointing and missed expectations, given the current environment and the focus on COVID-19, the results are understandable.

"We still believe Nanosonics is a solid business with a large market opportunity ahead of it."

Could this be the next CSL?

Over the last few years, Paradigm Biopharmaceuticals (PAR) has grown from an unknown small cap to a $600 million dollar drug developer. With trials and approvals moving along at a steady pace, Scott Williams from Fiftyone Capital thinks Paradigm has a very bright future indeed.

"Our view is that Paradigm could be the next big Australian biotechnology success story - think CSL type success."

After a positive result, Scott Williams is confident that the company can only continue to perform. In this wire, he explains his conviction behind the company, and their exciting long-term outlook.

Does Appen still appeal?

It's been a big year for artificial intelligence giant Appen, rounded off by their disappointing results over earnings season. After acquiring tech company Figure 8 in March, the company’s growth prospects looked positive. Additionally, given the strong tailwinds to come out of COVID-19 for technology and AI, the market was eager for solid results and Appen’s share price ran hard.

Olivia Salmon of Lennox Capital Partners thinks that investors should not become too fixated on the result, and rather look at the long-term prospects for the company.

"While the lack of upgrade disappointed and that was reflected in the share price movement on the day, there were some positives in the result that means the underlying story for Appen hasn’t changed."

Nearmap down, but not out

Nearmap is one of the laggards among the most tipped small caps. Its stock price is down 7% year to date, versus the 12% gain for the readers’ picks. Jason Kururangi of Aberdeen Standard Investments thinks that despite the rocky outlook for the company, it’s worth having in your portfolio.

“Whilst it is one not without risks, we are optimistic it can deliver significant value over three years as the market grows, they increase market share and the business matures into a cash flow breakeven set of results.”

The aerial imagery technology and location data company has had a volatile year with a fluctuating share price and near-term risk, yet it could be good to have on your radar.

Cashed up small cap looks to make amends

Laser guidance manufacturer Electro Optic Systems (EOS) had an incredible run in 2019, but as with all companies, COVID-19 haltered that progress, resulting in a share price drop of 50%.

Despite this, and the volatility that seems to follow the stock, in this wire Henry Jennings of Marcus Today outlines why now could be the time to reconsider this small cap.

"It fills a void in the Australian market as a defence contractor with good exposure to not only terrestrial defence, but also now moving into the space race. That is always important to for diversity."

Still looking slightly expensive, Henry analyses the results of reporting season, and sets out what it would take for him to consider buying the stock.

Pointsbet: You've got to be in it to win it

After a cracking 2019, sports betting company Pointsbet was the second most tipped stock for our readers. And for those who have continued to hold the stock, the payout has been lucrative. After the company announced a new media deal with NBC, and their positive earnings results, the share price jumped 86%.

James Marlay spoke with fund managers Chris Prunty and Gary Rollo to discuss this soaring stock and its future prospects. Both fundies agree that this company has a large runway for growth as it begins to expand to the US, and it's worth watching its progress.

EML – So much growth optionality

EML is down a third since the beginning of the year and was significantly impacted by the onset of COVID-19. While it was able to ride the wave in the move to digital payment methods, stay at home orders affected the company’s Gift and Incentive business.

The stock was by far the most popular small-cap in our survey, taking 2.5% of all tips, and had a stellar 2019 with the price more than tripling.

According to Shane Fitzgerald of Monash Investors, EML’s rough patch is only temporary, and the company will return to its former glory.

“While it is obviously very difficult to forecast the near-term outlook for this segment, and it is for this reason that EML is not providing guidance, there is no doubt in our minds that it will recover. The world is opening back up and at the end of the day there will always be people who will demand gift cards either for their ease of use or more often because they have no idea what present to buy.”

Reporting season webinar

To round out reporting season, Livewire will be hosting an exclusive webinar for our subscribers. Join myself, and two equity managers on September 15 as we discuss the highlights of reporting season for both the big caps and the small caps. You can register for the webinar here. Register now to ensure a spot as the webinar will be open to 500 Livewire readers only.

For an update on the ten most tipped big cap stocks from our annual survey, you can follow my colleague Vishal Teckchandani as he evaluates Australia’s biggest and boldest.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

10 stocks mentioned

10 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.