Strategy Note: Getting specific in 2017

1. Global equity markets will peak in 2017, and this peak will not be surpassed until 2018/9

Quite simply, there are plenty of risks around, and we think one of these risks will become a catalyst for the market to correct significantly at some point, preferably after making one more meaningful high. US equities have rallied ~250% since the depths of the GFC in a classic bull market advance. We simply believe this rally is extremely mature and when it's complete, we will see a decline back to the lows of early 2016, around a 25% fall. This sounds impressive/scary; however, it's hardly a blip compared to the advance since the lows of 2009 - the interesting question is what will be the catalyst?

One thing for sure is markets have priced in an abundance of good news during the recent rally after Donald Trump's surprise victory in November which leaves plenty of room for disappointment. Importantly, this is not something to shy away from; it's periods like this that create opportunities for the informed.

2. Gold will trade higher in 2017 in a volatile manner with a target of $US1,450. A top for gold is likely to correspond with a low in the $US

In a scenario where markets peak, gold would traditionally do well. Our thinking around gold is heavily dependent on our view for the $US. At this stage, the ‘long $US’ trade has gained considerable momentum and is now the consensus call. US interest rates are going up with the strengthening economy; therefore, the currency ‘must’ track higher!

Consensus calls scare us, and we think there is now a high chance that the $US retraces lower in the short term – it’s simply too well owned - which would be supportive of gold for now. However, the building realisation that the US Federal Reserve has waited too long to raise interest rates leaving them ‘behind the curve’ is likely to see more rate hikes than is currently predicted. That would eventually see gold trade lower on the back of $US strength all else being equal. Above all, we believe it will be a volatile year for both gold and the $US – certainly not a buy and hold environment.

Long Term Monthly Gold Chart

Gold Stocks We're Watching In 2017

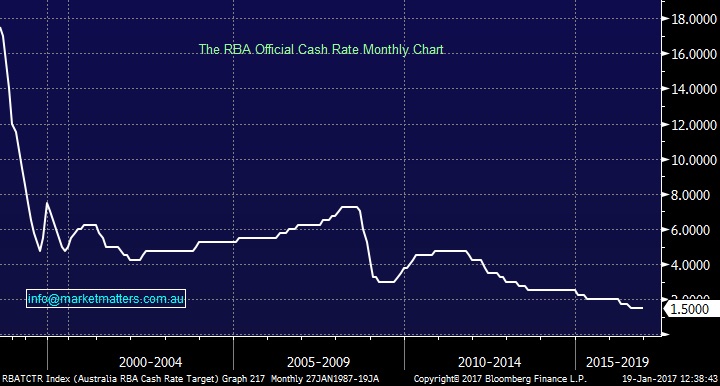

3. The next move for Australian interest rates will be up

The US economy will be key in 2017. This week we saw President Elect Trump inaugurated as the 45th President of the United States. On the face of it, the policies (or rhetoric!) laid out during the election campaign mean higher US growth, higher inflation, higher interest rates, more confidence, spending, wage growth, and investment but historically a president delivers on under 70% of his election promises.

The US economy is likely to be the driver of global growth in 2017; however, the obvious risk lies in the policy response from the Federal Reserve. Right now, the market is pricing in at least three rate hikes in the US during 2017, following Fed guidance, taking the benchmark interest rate to 1.5%, still relatively low. Locally, this will mean the RBA is unlikely to cut rates in 2017, and the low for local interest rates and borrowing costs are likely behind us. In our opinion, this leaves only one direction for interest rates to go.

RBA Official Cash Rate Monthly Chart

4. Banks will trade higher by mid-2017 which will present a good selling opportunity.

Banks are at an interesting juncture now. Between January and February last year, the banks declined by nearly 20%. The list of negatives was as long as your arm;

- capital raisings required

- zero growth

- cash rates on track to go sub 1%

- margin pressure

- concerns over bad debts especially around a housing price collapse

Banks got very cheap relative to historical averages on the expectation that earnings would collapse. They didn’t, and we saw a strong rally in the sector from the lows. The top performer in the sector was ANZ putting on 45% to now trade at around $30 after almost hitting $32. Higher interest rates which will ease some margin pressure, plus more clarity around capital will see banks remain supported in the near term, however, if interest rates move higher at a rate above current market expectations, concerns around bad debts will emerge, and banks will start to struggle.

ASX200 Banking Index Monthly Chart

5. Resources will have a very choppy year tracking underlying commodity prices. Buy weakness, sell strength will be the mantra for resource stocks in 2017

Resources have been in vogue throughout 2016, and this was a trend we successfully highlighted in our 2016 outlook. BHP, for instance, had a low in 2016 of $14.06 and a high of $26.70 – a very big range. We think money will continue to flow into commodity stocks in the near term as global growth starts to gain momentum, in part due to Donald Trump's policies but more a result of an improvement in Chinese economic indicators which few economists predicted. However importantly after stocks have rallied so hard e.g. RIO up 75% from its 2016 lows volatility is likely to increase noticeably. Any sign that economic growth will not be strong is likely to lead to a savage correction within the sector after such huge gains.

Livewire readers can receive 14 days’ free access to our Platinum level membership by registering here: (VIEW LINK)

6. Iron Ore will peak in Q1 and track lower in a choppy decline targeting ~$60 by year end while Oil will range trade between $40 & $60 presenting good trading opportunities throughout 2017.

Iron Ore and Oil are two key commodities that fulfilled our predictions laid out in early 2016. For Iron Ore, we predicted a move up from below $US40 /tonne to ~$US70 /tonne, and we now sit ~$US81/tonne, so this has clearly surpassed our very bullish expectations. Meanwhile, our call for Oil to trade up to ~$60 during the year when it was nearer to ~$30 certainly went against the grain at the time - with Oil hitting a high above $US55 /bbl. The risk/reward on both trades simply does not stack up at this juncture.

Iron Ore Monthly Chart

Crude Oil Weekly Chart

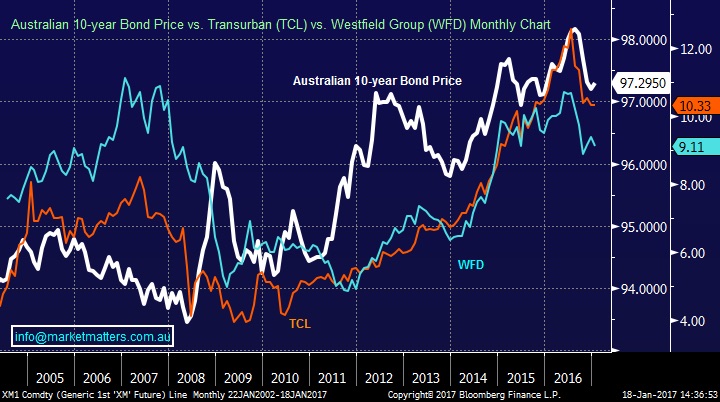

7. The ‘yield play’ will significantly underperform the market over the next 12-24 months

If we think interest rates are going higher globally, the sectors that have benefited the most from low rates will clearly feel the pain in a relative sense as interest rates track to more normal levels. This is not a difficult call to make given the high degree of correlation ‘yield stocks’ typically have to bond prices. Bond yields increase when bond prices decline. As inflation becomes more obvious, we think bond yields will move higher which will put pressure on the 'yield trade'.

10-year bonds v TCL / WFD Monthly Chart

8. Australian house prices and particularly apartment prices will plateau/decline in 2017, but will not ‘crash’

The housing market has been hot in many parts of the country with prices in Sydney up by 15.46% in 2016, Melbourne added 13.68%, while the much-maligned markets in Tasmania and Canberra were up 11.24% and 9.29% respectively. Rising interest rates and a substantial increase in apartment supply in some areas may see prices decline this year, enough to yet again see alarming headlines posted on most major newspapers. In reality, though, the declines will be a fraction of the growth we’ve seen over the last three years and will only impact sentiment towards the banks for a short period of time, most likely later in 2017. Previous moves by APRA to kerb investment lending and beef up eligibility criteria of borrowers we believe will bear fruit, and a housing ‘crash’ as some are predicting will be avoided.

Australia House Price Index quarterly chart

9. We believe the EU will not exist in the future BUT when and how it collapses remains hard to predict.

Europe will continue to dominate headlines throughout 2017, with right wing / anti-establishment parties gaining further momentum. These will range from populist and nationalist to far-right neofascist parties presenting an alternative to the status quo. Migration will continue to be arguably the main issue, accompanied by sluggish economic growth and growing disillusionment with the European Union (EU).

Even if the EU survives BREXIT plus major votes in Italy, France and Germany, there will undoubtedly be some huge emotional, and hence market swings as investors try and second guess any economic ramifications. However, ultimately this is now a situation that the market has had time to contemplate and we remain bullish European stocks into 2017, targeting over 10% gains from current levels.

German DAX Monthly Chart

10. Investors that have an open mind and are willing to be more active in 2017 will reap the rewards

Our overarching view as outlined above is that 2017 will be a very choppy year for markets. There will likely be periods of extreme optimism followed by extreme pessimism, and this will ultimately create a major top for equity markets at some stage. Donald Trump will outline some credible plans for the US economy, but he’ll also have some gaffs. Expectations around interest rates will change throughout the year, and this will ensure a volatile year in the currency markets which also impacts equity valuations. Commodities will likely feature in our portfolio throughout the period but in shorter bursts, while the ‘yield trade’ has rising interest rates working against it and we’ll give it a wide birth in 2017.

This brings us to highlighting some of our preferred large-cap exposures going into 2017, and importantly, the stocks that we would NOT be holding and more active traders could look to short sell. This is clearly more difficult in an environment that we think will be volatile with a major top for equities playing out at some stage this year. Importantly, we feel that investors who have an open mind and are willing to be more active in 2017 will reap the rewards – so bear this in mind when considering our suggestions below.

BUY

- Henderson Group (HGG) <$4.00 targeting $4.50+

- QBE Insurance (QBE) <$12.00 targeting $15.00

- Rio Tinto (RIO) <$59.00 targeting $70.00, however this will be choppy as Iron Ore peaks early this year.

SELL

- Carsales (CAR) >$11.00 targeting $9.00

- Wesfarmers (WES) >$41.50 targeting $35.00

- The Russell 3000 >1450 targeting 1100 i.e., US stocks to correct 25%.

Livewire readers can receive 14 days’ free access to our Platinum level membership by registering here: (VIEW LINK)

3 topics

8 stocks mentioned