10 most tipped big caps: Fundies' deep dives

On the 24th April, I published a quick update on the progress of the 'Most tipped big caps', the ten stocks that got the most votes in our reader survey at the start of the year. At the time the stocks had more than an 8% lead on the market.

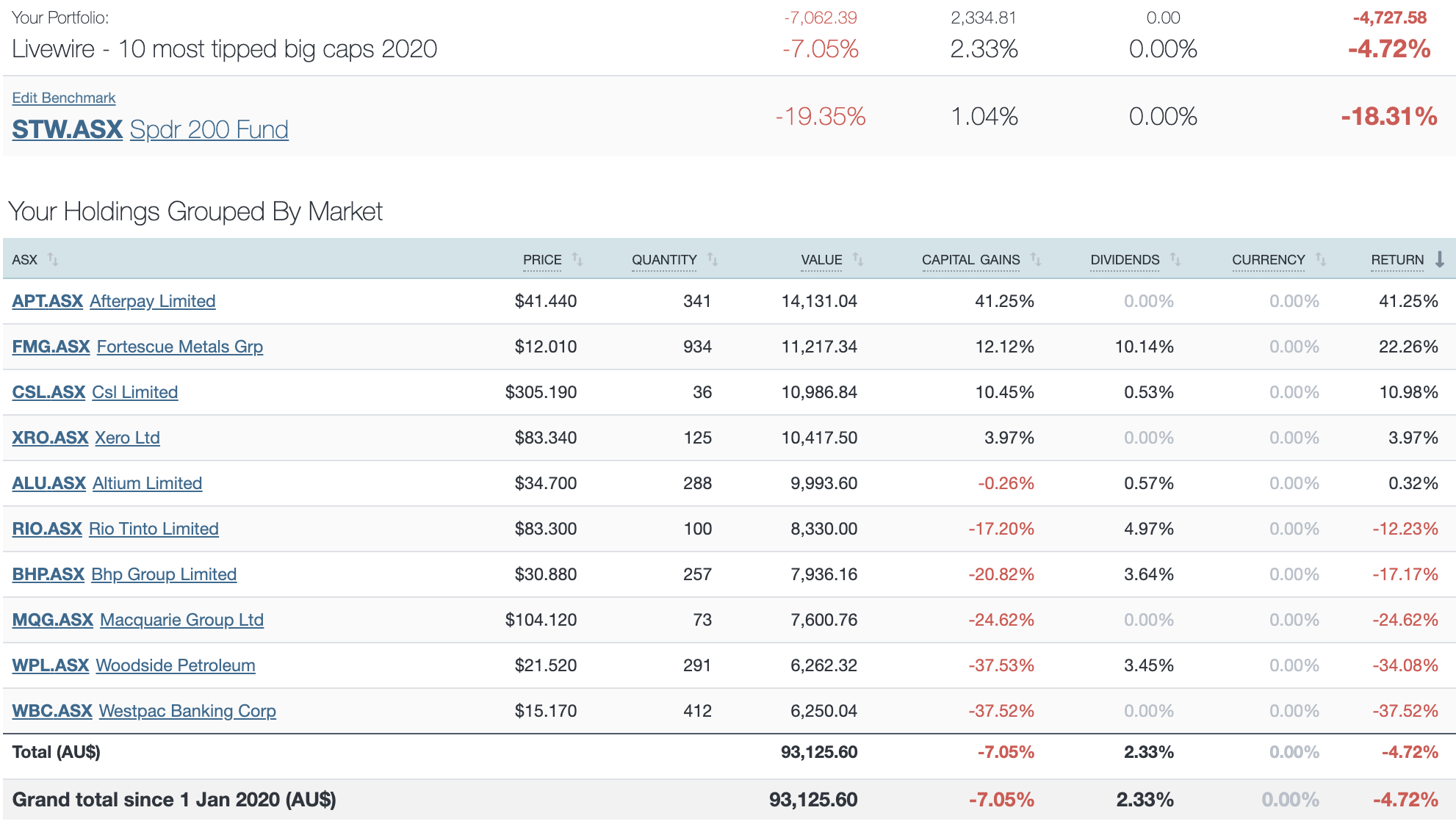

Less than a month later, this lead has opened up to 13.6%, with the total return year-to-date now at -4.7% versus the benchmark at -18.3%.

This table, kindly provided by our friends at Sharesight tracks the capital gains and dividends paid so far in 2020. You can click on it to enlarge the image.

Quite remarkably, on a total return basis, 7 out of 10 stocks are ahead of the market, and 5 out of 10 are in the black.

I also flagged that we had asked some of Australia's leading fund managers to provide deep dives on the stocks in this group. You will probably have seen some of these wires since then.

In this wire, I wanted to pull their excellent research together for you into one wire and flag some of the highlights from each report. Please click on the links in the text to access the full piece for each stock. Thanks to our partnering funds that have contributed to this valuable series.

Afterpay: What the market is missing

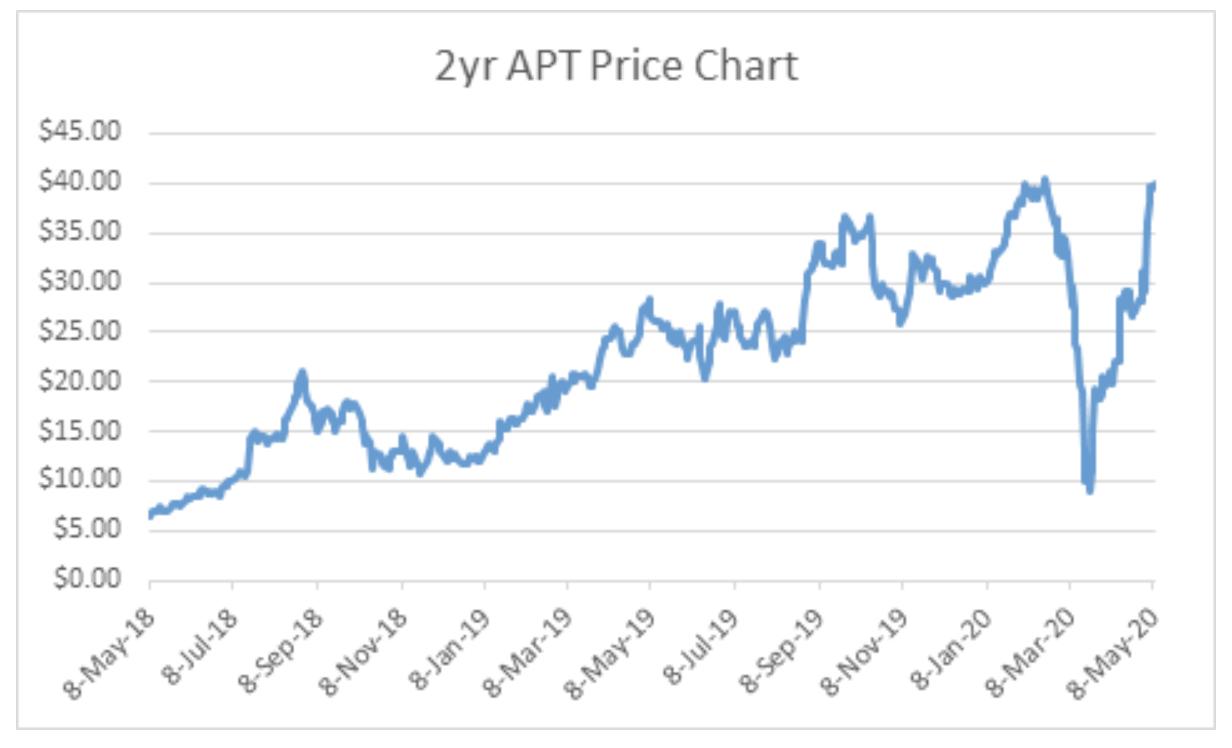

Shane Fitzgerald at Monash Investors Limited rounded off the series with his wire, Afterpay: What the market is missing.

Afterpay's share price has had the most remarkable year as Shane's chart testifies, and no doubt caused a few skipped heartbeats as its share price fell 75% in a single month, wiping around $7 billion off its market cap. Yet, in the 2 months that followed, the stock nearly quintupled recovering all of its ground and more.

As it has been for each of the last few years, Afterpay is the outlier in the list of the most tipped stocks. With an incredible +42% performance year-to-date, whilst the market is still down close to 20%, this one stock is the main reason the average performance of the 'most tipped stocks' looks so good.

Click on the link above, or here, to get Shane's full view on the stock. While many are clearly bullish on this stock, a few things he said the market is still under-appreciating about it are that:

"Firstly, the market continues to under-appreciate the increase in existing customer usage of the service over time, and what this will do to underlying sales growth and the associated benefits to operating leverage. The market also under-appreciates the implications of APT’s targeting of small size transactions of on average $150. It has implications for regulatory risk as mentioned above, but it also has implications for competition as a number of buy-now-pay-later players have commenced operations but are tending to target higher market segments".

Incidentally, if you want to be notified next time someone publishes commentary about Afterpay on Livewire, scroll to the bottom of this wire and click on the stock code/s of interest, and hit follow, as per this screenshot.

Fortescue up 10% year to date for good reason

In his wire, Stephane Andre at Alphinity Investment Management started off with a pretty compelling argument:

"A company like this, with a rock-solid balance sheet combined with reasonable valuation and further earnings upside, seems to us to be a good place to have exposure in a market environment where earnings downgrades abound".

As per his headline in the wire, Fortescue up 10% year to date for good reason, the stock had at the time bucked the trend and gained a very respectable 10%. In the three weeks since then, the stock has gained further and, as per the table above, is now up 22% year-to-date.

Stephane sees further upside from here though, arguing a non-consensus valuation of $14 in his wire, nearly $2 ahead of today's price. Given its earnings outlook and robust dividend yield, it should also be on the radars of income investors.

CSL still a solid long-term proposition

CSL still a solid long-term proposition, summarising to say:

Despite the amazing run the share price has had, CSL remains a solid long term investment proposition. It operates in a global growing industry and occupies a strong position within it. It is well managed, earns a high return on capital due to its numerous competitive advantages and has plenty of opportunities to reinvest which should drive growth for many years to come. Whilst not excessively cheap based on near term earnings, high-quality companies like CSL have the propensity to surprise on the upside - time and time again

As I mentioned in my last wire about this group, the most tipped stock of the entire survey was CSL with nearly 10% of all 7,000 tips. This majority has called it right so far, with the CSL share price brushing off minor issues, such as an impending global recession, to put in an 11% total return so far in 2020.

Two-year chart for CSL: South-West to North-East...

Source: Sage Capital

Source: Sage Capital

Why Xero is a strong buy

Camille Simeon at Aberdeen Standard Investments covered Xero in her very popular wire on this very popular stock, writing Why Xero is a strong buy:

The business is highly cash-generative in its incumbent markets and scalable and we expect it to continue enjoying operating leverage. The management team is disciplined in capital allocation and has more than NZ$100 million in cash, which it can allocate as opportunity arises. This business is really set up for the next level of growth.

The stock has crept higher since Camille's wire to put it into the black for the year by 4%, which is a remarkable result for any stock given the market remains so heavily in the red. Xero was new to this year's 'most tipped' list and has so far been a shrewd move by the 92 readers (for 1.3% of the ~7,000 tips) that called it.

Altium: A circuit breaking stock with a bright future

Jun Bei Liu at Tribeca Investment Partners sent a great write up on Altium, which has now bounced 50% from its March lows to break even for the year on a total return basis. As Jun Bei said in her wire:

Altium operates in an attractive market. The total PCB tools industry has enjoyed rapid growth for the past decade underpinned by the extraordinary growth in everything electronic – from consumer electronic devices to electric vehicles to military and aerospace applications – just to name a few categories. The company is well-positioned to ride the strong secular growth trend in demand for products containing PCBs over the coming decades. In our view, this makes it more defensive than many other growth stocks.

In the wire, she highlighted her price target of $42, which is a good 20% above where we are today.

Rio Tinto well placed for stimulus

Anton du Preez at Pengana Capital argued in his wire, Rio Tinto well placed for stimulus, that global stimulus should drive increased demand for commodities in the short-term. He laid out the reasons he likes Rio as follows in his wire:

- This company is a portfolio of world-class assets, in particular iron ore mines in the Pilbara.

- Rio is one of the lowest-cost producers of iron ore with a strong safety record. It also should benefit from post-COVID stimulus of the Chinese economy with longer-dated growth in Japan and Europe.

- Growth optionality in aluminium, copper and the robust pipeline of exploration.

- A robust business model that can flex its capex profile to adjust to changing conditions. Invested heavily in technology and innovation e.g. automation of trucks and rail.

- Very strong margins (iron ore) and free cash flow generation. Consistent ROCE of mid-teens during the past 10 years.

- It is run by a high quality and focused management team with a proven track record of sensible capital allocation.

- Strong ESG credentials

- From a valuation perspective, it stacks up as well, with a 10% cash flow yield and a 6% dividend yield.

BHP: World-class assets at a world-class price

Matt Williams at Airlie Funds Management wrote about the Big Australian, saying that:

"At the heart of BHP lies a world-class asset. Strong financial discipline in the good times has put the company in a very healthy financial position to navigate whatever lays ahead. In our experience, market dislocations like the one we are experiencing throw out some rare opportunities to buy high-quality businesses at very attractive prices. For us, BHP is one of several of these opportunities on offer at present".

You can access Matt's wire here, World-class assets at a world-class price, to read his thoughts in full.

A key point about BHP he makes is just how strong the company is financially these days. The peak-of-the-cycle misadventures of last decade have been cleared up in recent years, and the balance sheet and cashflow today look great, with Matt arguing here that it is a compelling investment proposition today.

Macquarie: How to value one of Australia's great success stories

David Poppenbeek at K2 Asset Management wrote a great note on Macquarie, sharing one approach to valuing the silver doughnut. The stock has crept higher since then and has now bounced 50% in total from its March lows.

This company has always been able to evolve to prevailing conditions, and David wrote here that:

One of Macquarie’s key strengths has been its ability to adapt to the changing nature of asset markets. Macquarie has always seemed to be a step ahead of the competition; it was an early adopter of quantitative applications, was one of the pioneer investors in global infrastructure and has been an early embracer of digitalisation. We are therefore confident that Macquarie will once again re-position itself for the post-COVID-19 world, and continue to be one of Australia’s great success stories.

David concluded to share that he still believes that $130 is a reasonable target within the next 3 years.

Westpac: Why I'm now a buyer

James Gerrish from Market Matters / Shaw and Partners is bullish on Westpac, which is a pretty contrarian view right now:

The market remains bearish & underweight the banks and this sets up the opportunity. While valuations are rubbery short term, the consistency of underlying bank earnings over time is high. Furthermore, the fact only one major bank has raised equity here is testament to how well capitalised they are. The case to buy banks into current weakness with a medium-term mindset in my view is strong. For WBC, a recovery back to $25 has every chance, which is a +60% gain from current levels.

The stock is trailing at the back of the pack for now, down nearly 40% ytd, but as James pointed out in Westpac: Why I'm a buyer, that just means there is more upside if it recovers its ground.

10 most tipped small caps

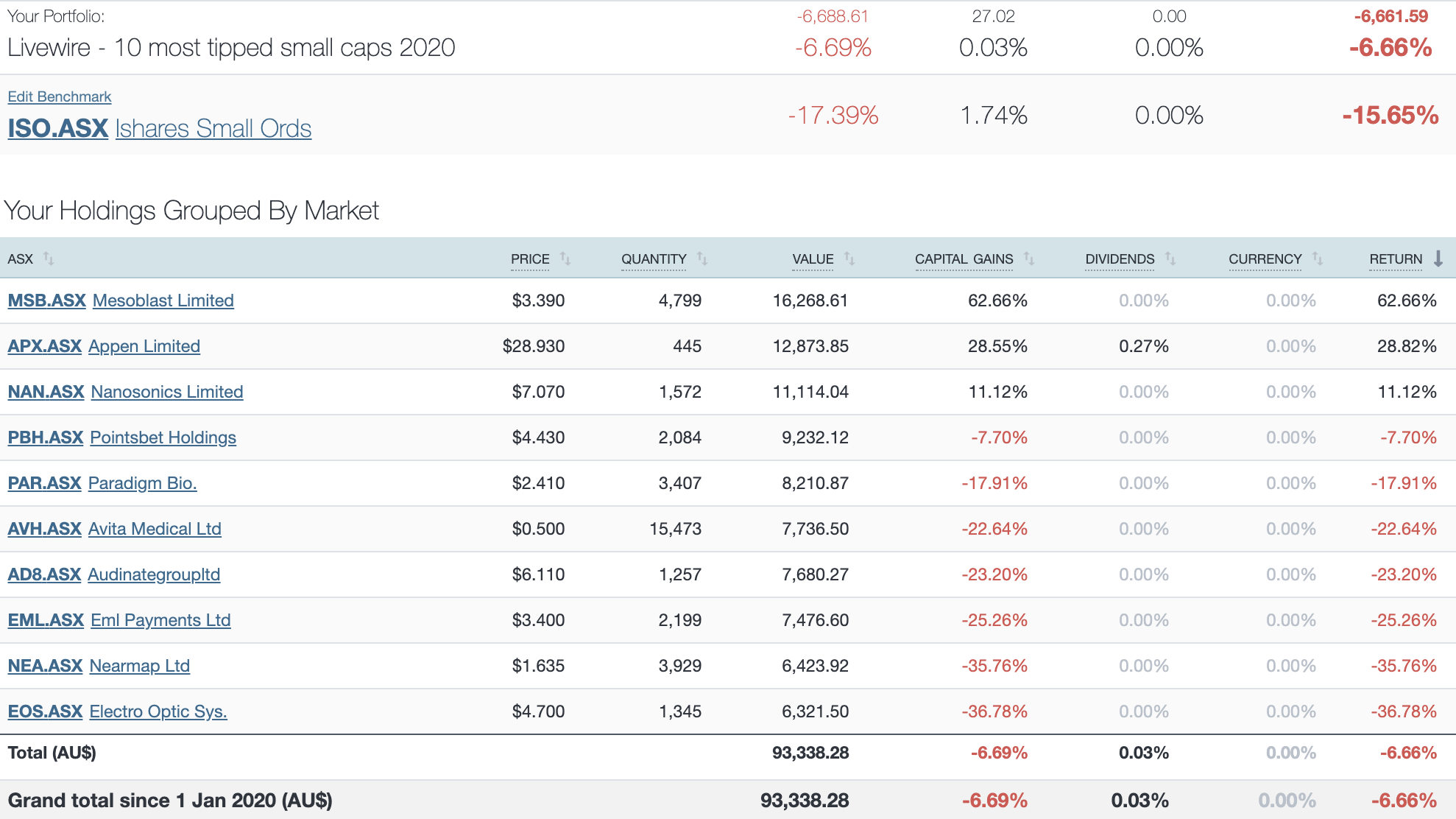

You may recall I also published the list of the ten most tipped small caps from the survey.

The table below, also from our friends at Sharesight provides a quick recap on how these stocks are faring.

As with the big caps, they are ahead of the market on average, however, only 4 are ahead of the index, and just 3 are in the black, with one stock, Mesoblast, doing most of the heavy lifting.

Please hit like on this wire if you are interested in seeing deep-dive coverage on each of these small caps, in the same style as the big caps coverage above. Please hit follow to receive my future wires like this.

10 stocks mentioned

10 contributors mentioned

Alex happily served as Livewire's Content Director for the last four years, using a decade of industry experience to deliver the most valuable, and readable, market insights to all Australian investors.