Most-tipped large-caps: How did they fare in Q1?

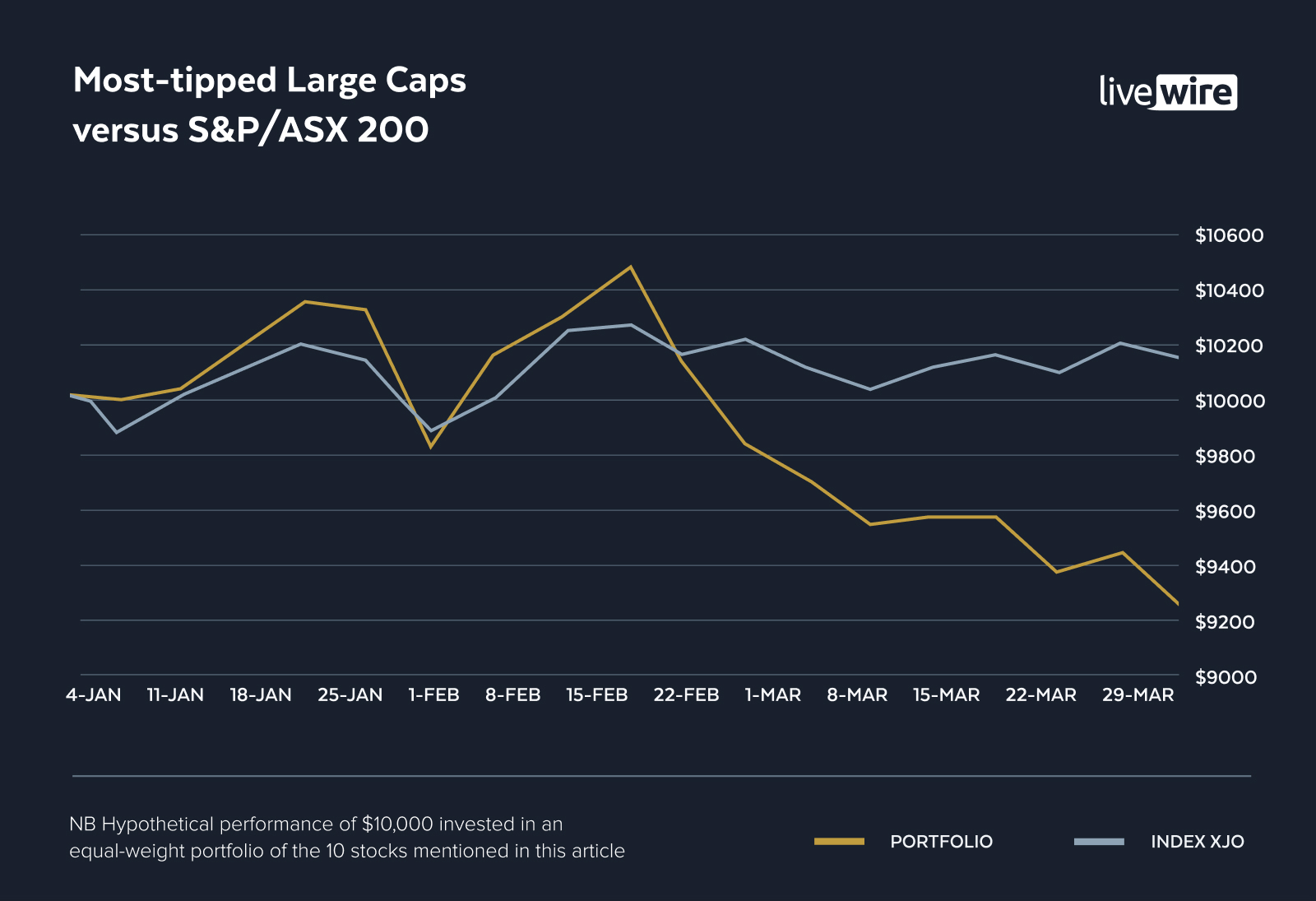

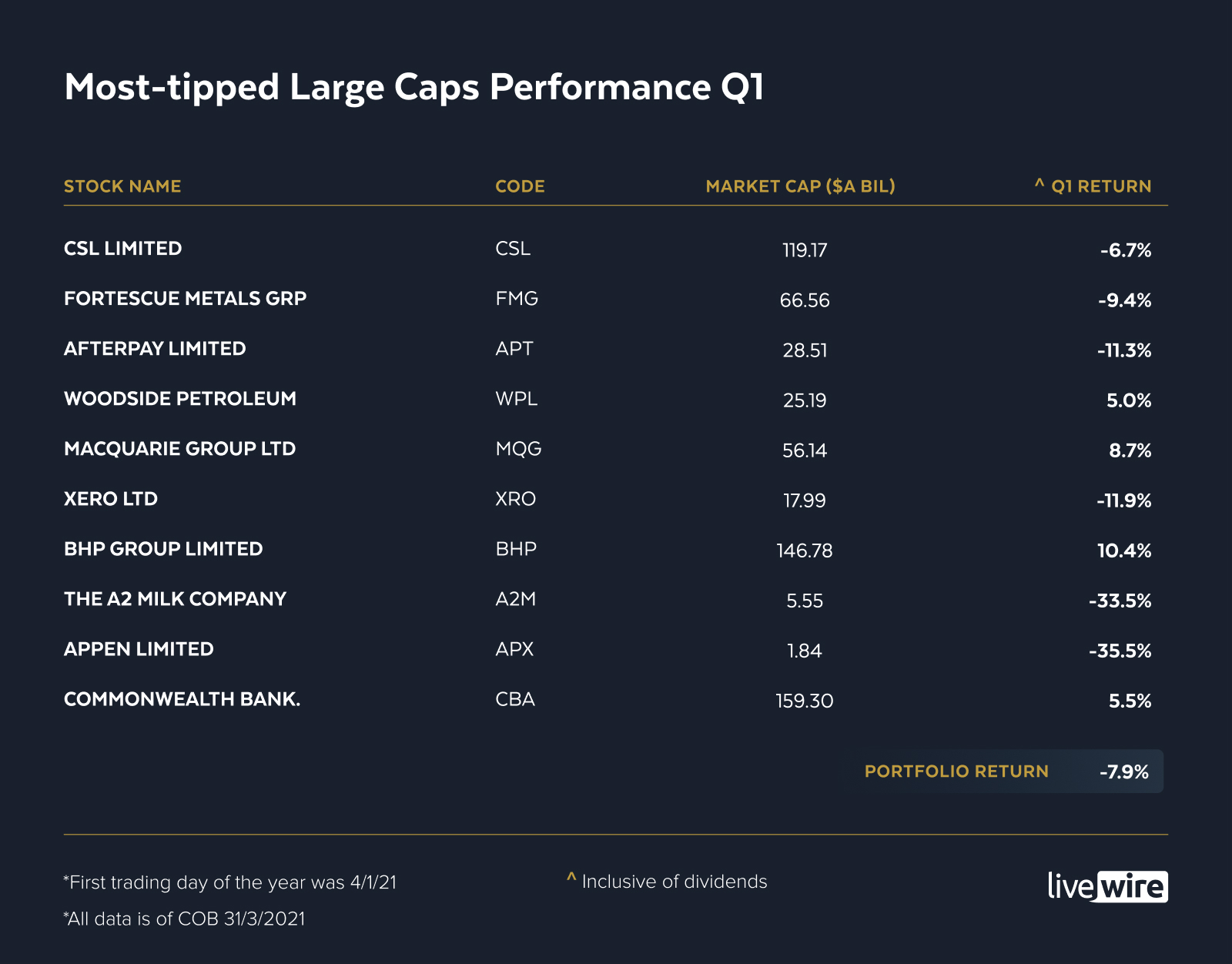

It’s safe to say that after racking up two consecutive years of 50%+ returns, expectations were high for this year’s most-tipped large caps, which looked strikingly similar to last year’s. But proving the adage "past performance is no guarantee of future results", this year’s most-tipped large caps have stumbled at the gate, falling 7.9% in the first quarter. The falls were broad-based, with six of the 10 stocks finishing in the red.

.jpg)

The much-lauded pivot to value stocks can be seen clearly in the results, with the biggest losers coming from the ‘growth’ side of the market, while the winners were the cyclical and ‘value’ stocks from the financials and resources sectors.

The biggest drags on the group were A2 Milk and Appen, while Macquarie and BHP were the best performers.

For an update on each of the stocks, as well as some recent commentary, read on below.

Disclaimer: This article is for informational and educational purposes only, it is not a recommendation to buy or sell any of the securities mentioned. The data on the stocks below was sourced from Sharesight.

Total return as of March 31: -7.9%

ASX 200 YTD: 4.8%

The #1 most tipped large-cap: CSL Limited (ASX:CSL)

- Percentage of votes in the top 10: 24.2%

- Market Cap: $120 billion

- YTD return: -6.7%

For much of the past 10 years, CSL has enjoyed a largely unbroken run of share price appreciation, rarely pausing for more than six months without a new all-time-high. But after peaking above $340 per share in February last year, it's never quite managed to regain its lustre.

Recently, FNArena's Rudi Filapek-Vandyck wrote an analysis on the company, proposing a number of answers to explain how it went wrong for Australia's number one business success story. The first of these hypothesises that there were simply no buyers left, asking the question:

Can an investment ever become too popular?

Despite the ASX darling beating expectations in the last reporting season, the market remained hesitant on the company's outlook, as identified by Alphinity's Stuart Welch:

The key concern for people is that, despite the strength of the first half result, CSL has kept the full-year guidance. That means that having delivered 80% of the guidance in the first half, implies a pretty week second half.

The #2 most-tipped large-cap: Fortescue Metals (ASX:FMG)

- Percentage of votes in the top 10: 17.2%

- Market Cap: $63 billion

- Return: - 9.4%

Despite a fat dividend of nearly 9% paid in February, Fortescue still couldn't manage a positive return in the quarter. This is all the more surprising when you consider that iron ore prices are within 5% of all-time highs.

Peter Gardner of Plato Investment Management believes that the market may be overestimating the speed at which it takes ore prices to return to normal.

Our view is that these cycles take longer to go through when the demand increases. It takes longer to increase the supply again, so the prices stay higher. We don't expect them to stay this high in the medium to long-term, but we think that the market’s probably underappreciating the strength of these iron ore miners and just how strong the iron ore price can stay.

With the global economy beginning to wake up, Brazilian capacity slowly coming back online, and a management team focused on returning capital, the party times might not be over yet for Fortescue.

The #3 most-tipped large-cap: Afterpay Limited (ASX: APT)

- Percentage of votes in the top 10: 11.1%

- Market Cap: $34 billion

- Return: - 11.3%

Afterpay's share price has appreciated by over 100x since listing five years ago, minting a few millionaires (and even a couple of billionaires) along the way. It should come as no surprise then that the stock needed a breather after another big run in 2020.

In an increasingly crowded space, Afterpay's size and first-mover advantage is proving its worth. Dean Fergie - who invested in the Afterpay IPO - said that despite the "valuation gap", he'd still own Afterpay over its competitors.

When CBA announced its BNPL competitor product to the market, it caused some nervousness among investors. But Emanuel Datt was unfazed, thinking that CBA had missed the mark with their offering:

Australian BNPL users span the full demographic spectrum as the industry has matured and hit the mainstream ... Commbank BNPL fails in the sense that it focuses too heavily on the supply (merchant) side of the equation without any compelling proposition for the customer themselves. As a CBA executive is quoted saying: "We are going to treat it like it is credit”.

As more players enter the sector, that dual value proposition - to both the merchant and the customer - could become increasingly valuable.

The #4 most-tipped large-cap: Woodside (ASX:WPL)

- Percentage of votes in the top 10: 10.7%

- Market Cap: $23 billion

- Return: 5.0%

Woodside has never been a stock that set investors' hearts racing, so I admit I was more than a bit surprised to see it feature so highly on this year's, especially after a shocking year in 2020. Despite missing analyst earnings expectations in February, and attracting a "Sell" rating from both James Gerrish and Jun Bei Liu on Buy Hold Sell in January, it's one of just four stocks on the list that managed a positive return in Q1.

Michelle Lopez from Aberdeen Standard said recently that she's bullish on the energy sector, believing that the Woodside retains robust growth projects to execute on which are not reflected in the current stock prices.

The #5 most-tipped large-cap (ASX: MQG)

- Percentage of votes in the top 10: 9.7%

- Market Cap: $54 billion

- Return: 8.7%

Despite not having reported any results yet this year, Macquarie Group has managed to eke out the second-best performance of the group in Q1.

In a recent instalment Expert Insights, Andrew McKie identified Macquarie Group as one stock that has been undervalued by the market.

Over the last 10 years, there has been a lot of market noise and people have been in and out of Macquarie for various reasons. But if you look at the broader strategy for that business over the last 10 years, they have dramatically improved the quality of that business.

In the absence of any news of significance, I'm left with no choice but to chalk this one up to the 'value trade' - though on a PE of 24, it's hard to call Macquarie a 'value' stock.

The #6 most-tipped big-cap: Xero Ltd (ASX:XRO)

- Percentage of votes in the top 10: 7.3%

- Market Cap: $20 billion

- Return: -11.9%

Like Macquarie, Xero has yet to report a result in 2021. However, it has had some news of significance.

In March, Xero announced the acquisition of Planday, a workforce management platform. At a $286m (184m Euro) price tag, it's hardly a company changer, but it appears to be a useful bolt-on acquisition for Xero's software suite.

T. Rowe Price's Randal Jenneke is bullish on Aussie equities and sees an opportunity in some of the oversold ASX-tech companies right now. He identifies Xero as one of the Australian stories that will continue to make a global name for itself as cloud accounting becomes the norm internationally.

The #7 most-tipped big-cap: BHP Group (ASX:BHP)

- Percentage of votes in the top 10: 6.9%

-

Market Cap: $229 billion (combined across all listings)

- Return: 10.4%

The Big Australian is back on top. The biggest company on the list is also the best performer, being the only one to crack a double-digit return - though nearly half that return came in the form of a (fully franked) dividend.

BHP is another beneficiary of high iron ore prices, though why it's done so much better than Fortescue remains a mystery to your author. Both companies beat analyst expectation in February and followed that up with big dividends.

Market Matters' James Gerrish said in late March that he was bullish on BHP after breaking through a major technical support indicator. He liked the miner from a risk/reward perspective including it on its list of "Building stocks poised to rally".

The #8 most tipped big-cap: The A2 Milk Company (ASX:A2M)

- Percentage of votes in the top 10: 5.4%

- Market Cap: $6 billion

- Return: - 33.5%

Another shocking quarter, making it three in a row for this former market darling. After briefly touching $20 per share at the end of last financial year, it's been nothing but pain for shareholders since then.

After initially holding up well during the COVID selloff, the damage from lockdowns, closed borders, and 'pantry de-stocking has become increasingly apparent.

Martin Conlon from Schroders draws on the fall of A2 milk as "salutary reminders of the implicit dangers in pricing unwarranted certainty on the distant future ... forecasting the future as an unbroken path to riches is wrong far more often than it’s right."

At just 26 times trailing earnings though, this is as cheap as A2 Milk has been in a long time.

The #9 most tipped big-cap: Appen Ltd (ASX:APX)

- Percentage of votes in the top 10: 3.7%

- Market Cap: $2 billion

- Return: -35.5%

At the most recent reporting season, Appen missed analyst expectations due to business slowdowns in Q42020 business and FX-related headwinds. And it was punished for the result - down 12% on the day of the report.

Mason Willoughby-Thomas from Ausbil Investment Management said:

...their outlook remains uncertain with guidance disappointing.

Perhaps a victim of its own success, Appen remains a high-priced growth stock, with a PE over 40 and growing around 20% p.a. based on management's most recent guidance.

Equal #9 most-tipped big-cap: Commonwealth Bank of Australia (ASX:CBA)

- Percentage of votes in the top 10: 3.7%

- Market Cap: $153 billion

- Return: 5.5%

While CBA's entry into the BNPL sector likely made more news in the quarter than the rest of its business combined, at this stage, it has no notable impact on the company's fortunes.

Of greater impact, however, is Australia's booming housing market. A combination of low rates and additional household savings has seen first home buyers enter the market in a big way.

Alphinity's Andrew Martin sees the macro and micro signs suggesting to stay overweight on the big banks.

In our view the recipe is right for the positive trend to continue for some time driven by positive earnings revisions this year and a more favourable macro environment, topped off by better dividend potential and the possibility of capital management.

Other Q1 most-tipped stocks reports to watch out for ...

That's it for the most-tipped large caps for this quarter, but keep an eye out for Glenn Freeman's update on your most-tipped global stocks, and Mia Kwok's coverage of the fundies’ top stocks for 2021.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

Disclaimer: This article is for informational and educational purposes only, it is not a recommendation to buy or sell any of the securities mentioned. The views of the authors were current at the time of their original publication and may have changed since then.

11 stocks mentioned

11 contributors mentioned