Off The Charts! $384m Aussie mining SPAC, Boral's big booster and AusSuper's farewell

Another bumpy ride this week. The positive economic recovery data was overshadowed by the latest Melbourne lockdown, the extension of Sydney's and increasing concerns for Queensland as COVID cases start to show up.

But, the show must go on! We have more weird and wondrous stories from the world of investments for you. Buy now pay later was surely the story of the week, as market darlings, Afterpay (ASX: APT) and Zip Co (ASX: Z1P) found themselves facing off against none other than Apple.

Come and join the M&A party: it seems we might have a new one in the works. Seven (ASX: SVW) meets Boral (ASX: BLD) for a sneaky acquisition that's been a big stock booster for both.

Plus, Aussie resources heavyweights come together for a SPAC targeting $384.3 million ahead of its listing on the NYSE.

Let's jump in ...

#1 David vs Goliath goes digital: A huge entrant into the BNPL sweepstakes

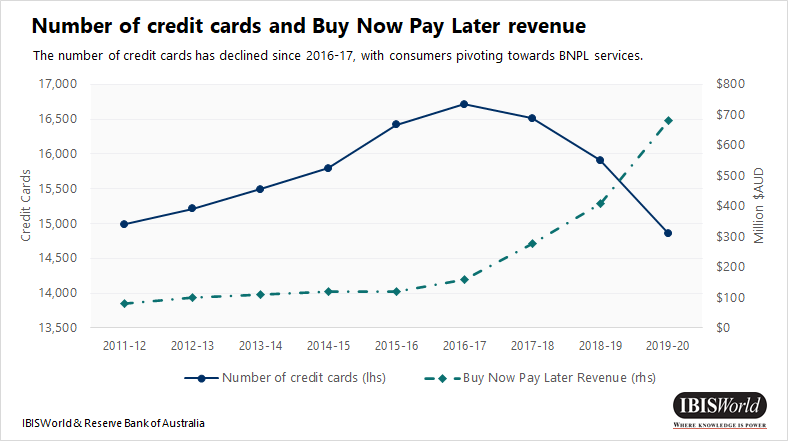

The way we make payments is constantly evolving. Only a decade ago, the possibility of paying through your phone would have been unthinkable, yet here we are. The most recent fad sweeping through Australia has been BNPL, led by Australia’s biggest enigma Afterpay on its mission to disrupt traditional credit forever.

As the company has looked to grow into the United States, BNPL services have inevitably pipped the radar of some of the biggest tech companies in the world. Late in 2020, it was announced that PayPal would be entering the space with its ‘Pay in 4’ product, which sent incumbent BNPL players into a spiral before a rapid recovery.

“Last August PayPal announced their intention to enter our BNPL space but after an initial knee-jerk lower, Afterpay (ASX: APT) and Zip Co (ASX: Z1P) proceeded to double in price (although they are now well below their February highs).” - James Gerrish

It was only a matter of time before the next big story, and here it is: Apple Pay Later.

On Wednesday, AfterPay and Zip both tanked around 10% as Bloomberg revealed Apple's plans to enter the instalments space, with loan facilities provided by Goldman Sachs.

Apple will offer interest-free packages on fortnightly payments and charge interest on longer-term plans, providing another revenue source from its 507 million Apple Pay users.

Commentators noted that this adoption by big tech confirms BNPL as a legitimate service offering for years to come; and boy, it has huge potential.

“Cornerstone estimates that BNPL-related retail purchases in the US will grow from roughly $24 billion in 2020 to roughly $100 billion in 2021.” - Forbes

Afterpay has always viewed itself as being more than a transaction processor through its ability to generate leads for its retailer clients. With several giants stomping around in their backyard, they better hope that is more than just marketing-speak.

#2 An unlikely, and sneaky acquisition

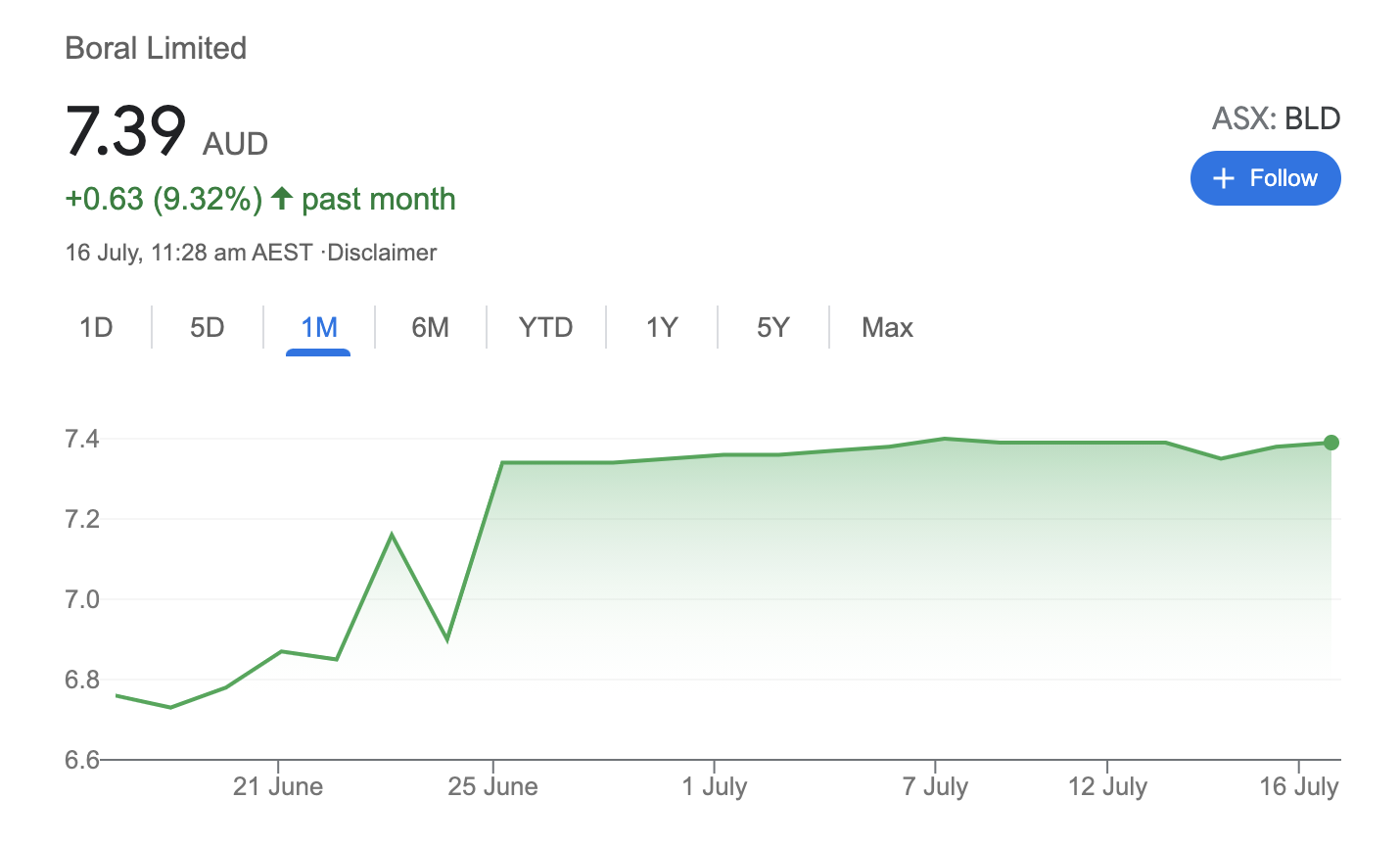

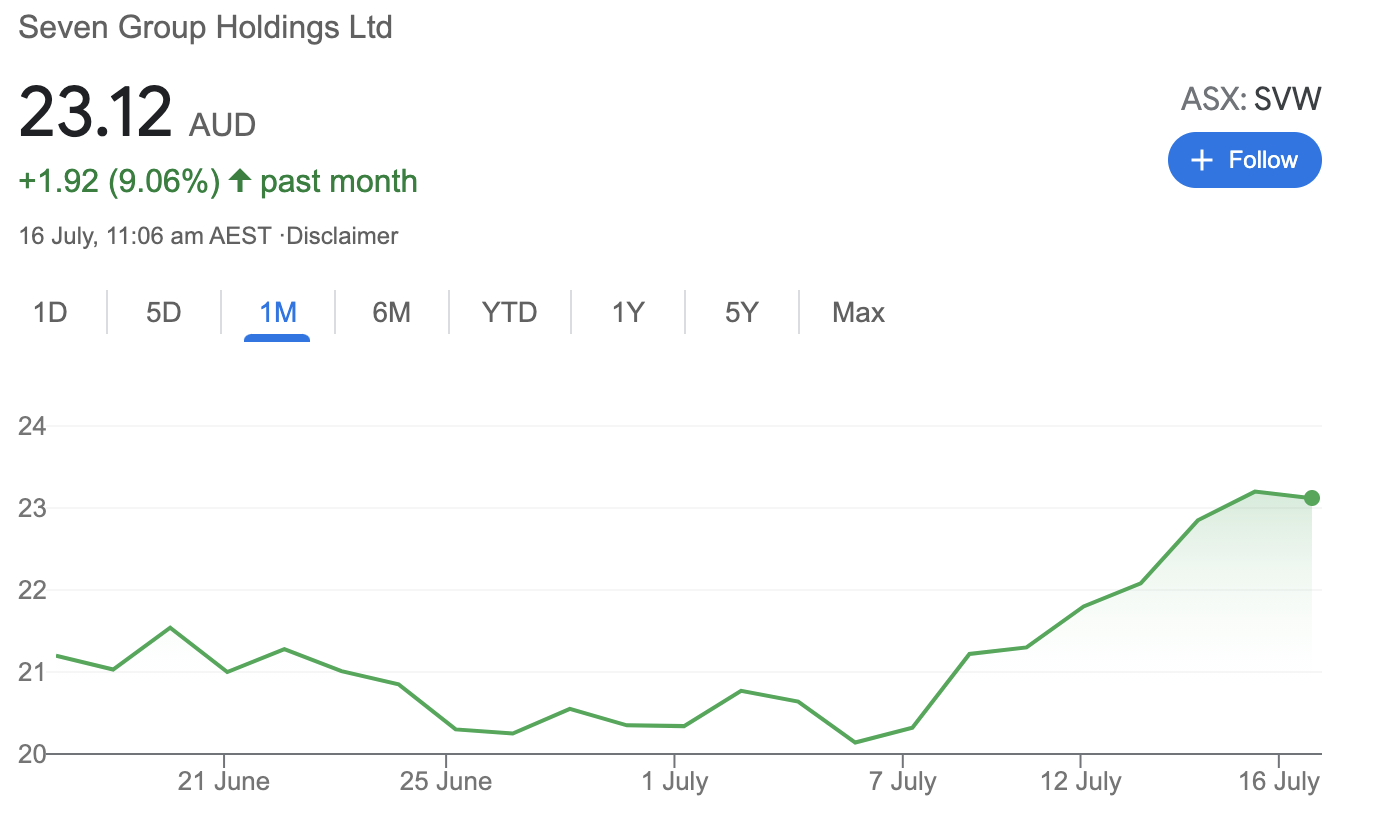

Another week, another acquisition – it quite simply wouldn’t be Off the Charts! without one! And this week, we’re pulling apart Seven Group’s takeover bid of building materials group Boral.

Seven Group has been slowly but surely upping its stake in Boral since March last year but has just reached the 50% threshold required for a two-week extension of the $7.40 a share takeover offer. Given this milestone has been passed, Seven has officially taken control of Boral. And luckily for Kerry Stokes and his team at Seven, given the takeover has been gradual, the company has avoided paying a premium for the company, saving themselves a pretty penny.

But - I hear you ask - "What does Seven Group, an entertainment group, want with a building materials company, eh? EH?"

Well, now that Seven has taken control of Boral, it will be able to select the next chairman and ensure that the strategy is continuing to move towards a transformation of the business. Its voting power on the board will also move to 50%, meaning the ball is well and truly in Seven's court. CEO of Seven Group, Ryan Stokes, has said that he plans to demand additional board seats, ensure that Boral’s Australian business is overhauled and the capital is managed effectively.

Shareholders have reaped this reward of the takeover bid as both Seven Group and Boral’s share prices shot up by over 9% over the previous month. But investors be warned, S&P Global analysts have predicted that the Seven acquisition could result in a downgrade.

Source: Google Stocks

Source: Google Stocks

Friends, I imagine we’ll be back next week with another update on an upcoming takeover bid. Who said M&A was boring!

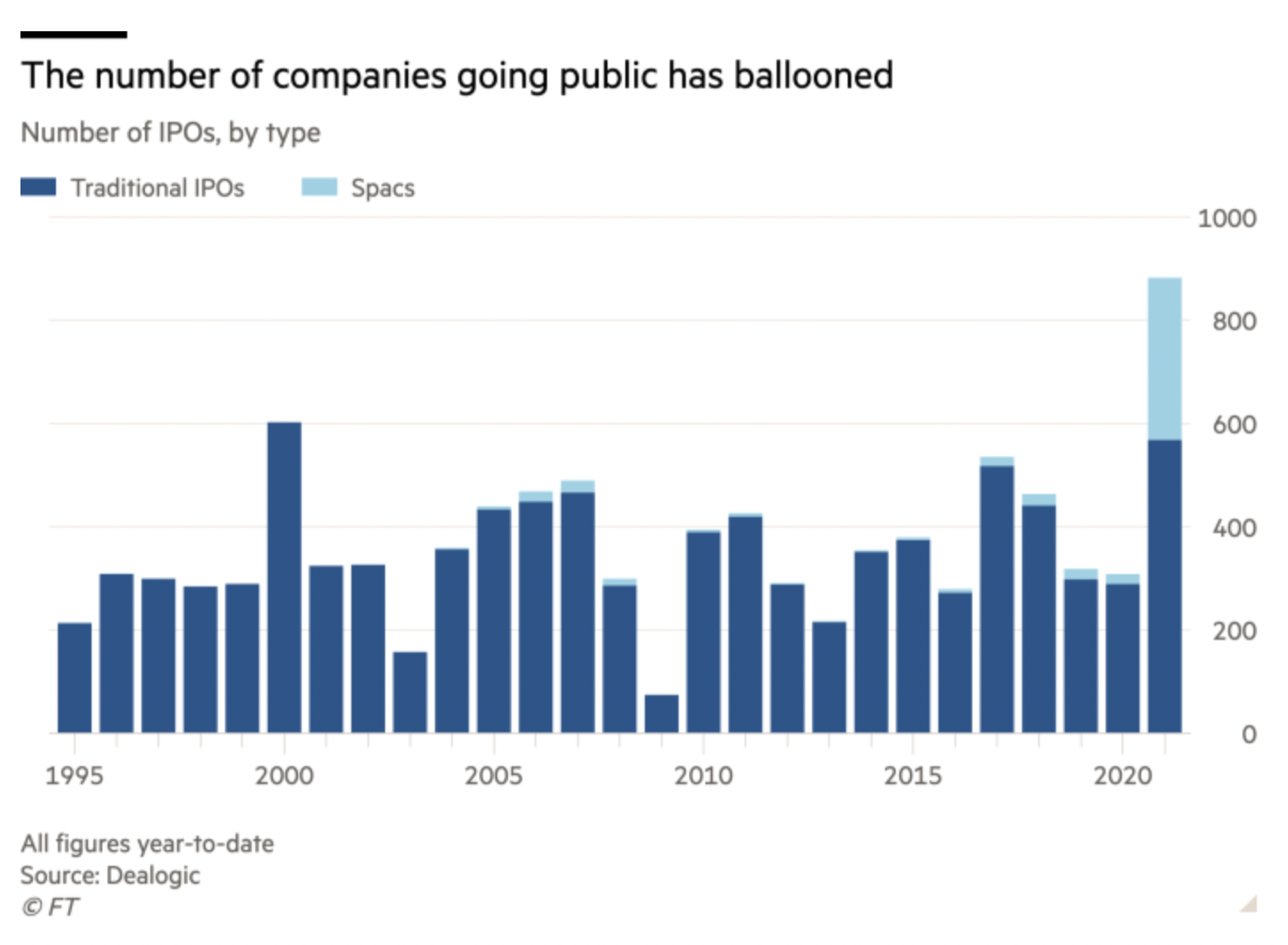

#3 MINING MAGNATES LAUNCH FIRST-EVER AUSSIE RESOURCES SPAC

This week, the SEC received the prospectus for a new SPAC backed by some of the largest Aussie names in the resources game. Former Fortescue (ASX: FMG) CEO Nev Power and former Northern Star (ASX: NST) Chair Bill Beament join the star-studded cast of mining magnates launching the first-ever Australian resources SPAC. Power will direct the company alongside Glencore (LON: GLEN) Director Patrice Merrin and Black Mountain Metals founder Rhett Bennet. Venturex (ASX: VXR) Director Mick McMullen will lead the vehicle and Beament will advise the board.

This team-up almost sounds like the plot of a B-level action movie:

This summer ... five former heads of Australia's biggest mining companies come together for one last job...

As a refresher, a SPAC or a special purpose acquisition company is a shell corporation listed on an exchange with the purpose of making acquisitions. They provide an alternative method for private companies to be taken public and avoid many processes which slow the traditional IPO process. 2021 has been a hot year for SPACs, with the number of SPAC-driven IPOs beating the number of total IPOs in many years.

The SPAC, named Metal Acquisitions Corp, plans to acquire copper and battery minerals assets to take advantage of the "once in a century” opportunity created by the decarbonisation of the world’s economy. The special company plans to raise $384.3 million ahead of its listing on the NYSE. The directors will have two years to execute an acquisition, if that can not be achieved, the funds will be returned to investors or they can vote to push back the liquidation date, a decision normally encouraged by directors adding more funds to the pool as a sign of confidence. The vehicle is not required to name with any more specifics what company or assets it has its eyes on but with names like these behind it, my money is on the first-ever Aussie resources SPAC shooting the lights out.

#4 To rent or to buy, that is the question

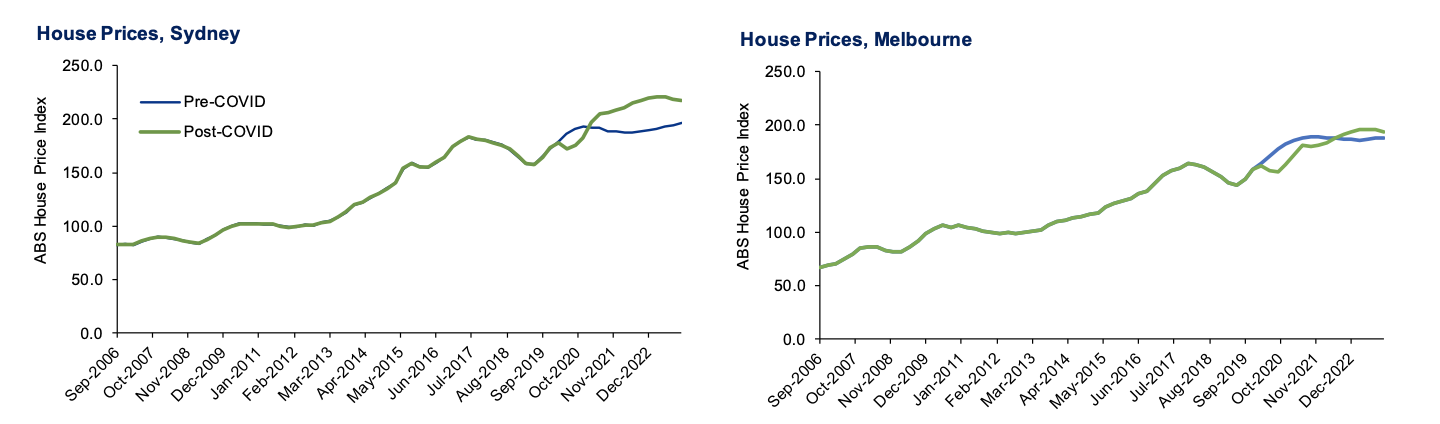

We all know housing prices are hot. First home buyers are in one of the toughest markets on record, and new research from KPMG Economics shows that COVID-19 had a big role to play in that.

KPMG's report, The Impact of COVID on Australia’s Residential Property Market, compared current market prices with the pre-COVID trajectory. This revealed housing prices are 4-12% higher as a result of COVID-19. Units are up to 13% more expensive.

Source: KPMG

This has been brought on by record-low interest rates, extra household savings and income support as well as rampant property-specific stimulus with programs such as HomeBuilder.

“It appears these short-term positive factors have swamped the longer term-negative factors associated with the housing market, such as lower population due to the fall in migration.” - KPMG via the AFR

So what alternative is there for home-seekers? Well, in many places it doesn’t look like renting is much good either.

A recent report from CoreLogic showed that taking out a mortgage was in fact more favourable than renting in 3,411 suburbs around Australia. This country has a total of 3800 “statistically reliable” suburbs.

Admittedly, this is biased towards regional areas given the explosive supply growth experienced in capital cities. CoreLogic reported 60% of regional properties are currently cheaper to "buy" (that is, service a mortgage) than rent. This is compared to about 25% of properties in capital cities.

Ultimately, the report revealed 36.2% of Australian properties would be cheaper to buy than rent, marginally higher than the pre-pandemic figure of 33.9%.

Maybe we all ought to go back and live with our parents.

#5 Waving goodbye to an industry legend

This week superannuation got another shakeup as the long serving CEO of AustralianSuper, Australia’s largest pension fund, announced his resignation. Ian Silk, known for his stellar performance over the period and his sublime moustache (have a look below), has been in the top job at AusSuper for 15 years. He will be replaced by Paul Schroder, previously the Chief Risk Officer of AustralianSuper.

Source: The Australian

Schroder will have a tough act to follow. During his tenure, Silk has grown the assets under management from $21 billion to $220 billion. He also managed to double the membership of AusSuper to 2.4 million members and increase the workforce from 50 to 1000 employees. And that’s all in 15 years!

While they are some big shoes to fill, Schroder is being entrusted to further this incredible growth. According to CIO Mark Delaney, he's aiming to grow the fund to $500 billion of assets under management in the next five years.

AustralianSuper Chairman Don Russell paid tribute to Silk during the week commending him on an outstanding job and assured investors that the road ahead is full of growth. He even hinted towards new international growth plans including a new office in New York and expansion of its London offices (when the pandemic is over, that is). He says the fund will spend the next few years focusing on this expansion alongside private equity investments and infrastructure.

I'd say the road ahead looks (oh go on then) super for AustralianSuper!

Contributor stories of the week

Martin Conlon writes about how greed and liquidity are fuelling market growth, but he asks the all-important question: When will the music stop?

A deep understanding of what drives a company’s business and its markets is crucial to long-term success as a growth investor, and Francyne Mu breaks down How to choose growth stocks here.

This week, James Gerrish gives his take on the latest move from ApplePay into the Buy-Now-Pay-Later (BNPL) space - competing with the likes of Afterpay and Zip, in: Will the BNPL stocks follow the lithium path.

Shane Oliver writes about how the risks around investing seem to receive ever higher prominence with the rapid dissemination of news and opinion. The danger is that all this noise is making us worse investors. Find out his Five ways to turn down the noise and stay focused as an investor.

In this article, The trend is still our friend, Rudi Filapek-Vandyck tell investors why they should never bet against a market that is supported by continuous upgrades to profit (and dividend) forecasts.

Coming up next week...

- Coming up next week on Buy Hold Sell, Stockspot's Chris Brycki and VFS Group's James Whelan take a lens to some of Australia's most popular LICs and ETFs.

- Glenn Freeman will be providing an update on what Hamish Douglass thinks of current stock valuations, the risk outlook and rising inflation expectations as he covers the Magellan head's latest webinar.

- And Patrick Poke is cooking up the latest episode of Rules of Investing featuring legendary investor Peter Morgan.

What did we miss?

- Angus Kennedy, Bella Kidman, Nicholas Plessas, and Mia Kwok

1 topic

3 stocks mentioned

8 contributors mentioned