Screening the ASX for Income

Wilsons Advisory

Dividends are a significant driver of returns for most Australian equity investors. We understand many investors are looking for yield to provide passive income, especially when you include the benefits of franking credits.

Dividend stocks have many benefits, such as:

- Dividend-paying stocks give investors a way to earn returns during rocky market periods.

- When they grow over time, they may provide some protection against inflation.

- Income from dividends is tax-advantaged compared to income from fixed income investments.

- On average, dividend-paying stocks are less volatile than non-dividend-paying stocks.

- Over time, dividends, especially when reinvested to take advantage of compounding, can help build wealth.

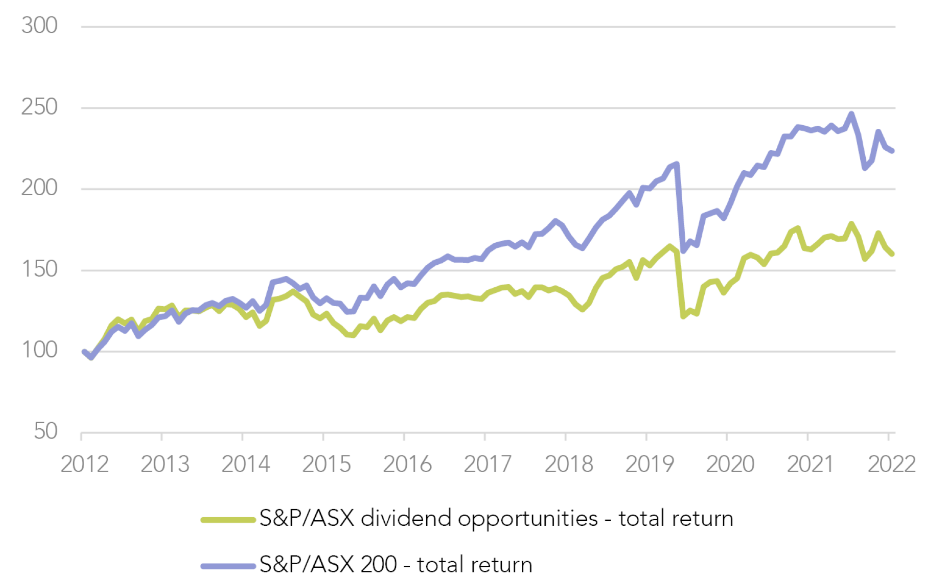

However, high yield stocks have proven to underperform the market on a long-term view. We therefore believe a dividend strategy cannot solely rely on high yielding stocks to be successful.

Figure 1: Simple high yield strategies have not been successful at generating outperformance

Looking for Yield Growth

We look for dividend-paying companies that can deliver growth year over year, continuously compounding cash flows each year. This is the template for companies we consider when thinking about income investing.

These companies typically increase the dividends they pay to shareholders due to their cash flow growth. However, market yields may be lower as investors are already pricing in some of the future capital returns into equity prices.

We think selecting a dividend strategy by its initial yield is a poor choice because the growth of the dividend over time ultimately determines the income payouts in future years.

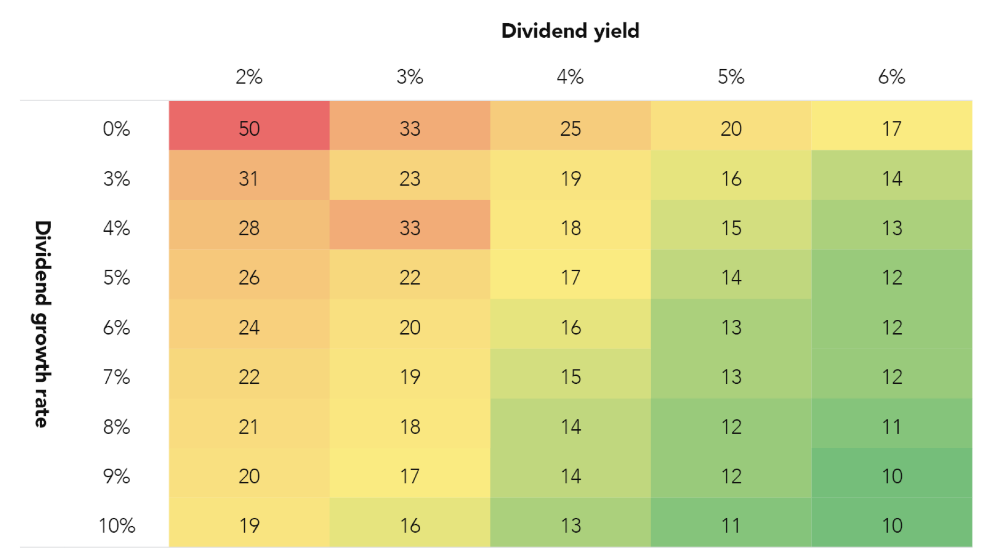

Although a simple concept, the payback matrix lays out a simple methodology for considering yield stocks. The payback of a stock indicates how long (in years) it would take for the dividend payments from a company to pay off the initial investment. Figure 2 shows how dividend growth can substantially accelerate the payback on an investment vs a stock that has little growth.

Figure 2: Dividend payback matrix – growth income strategies should payback an investor’s initial investment quicker than high yield alone

Case Study – APA Group (APA) vs GPT Group (GPT)

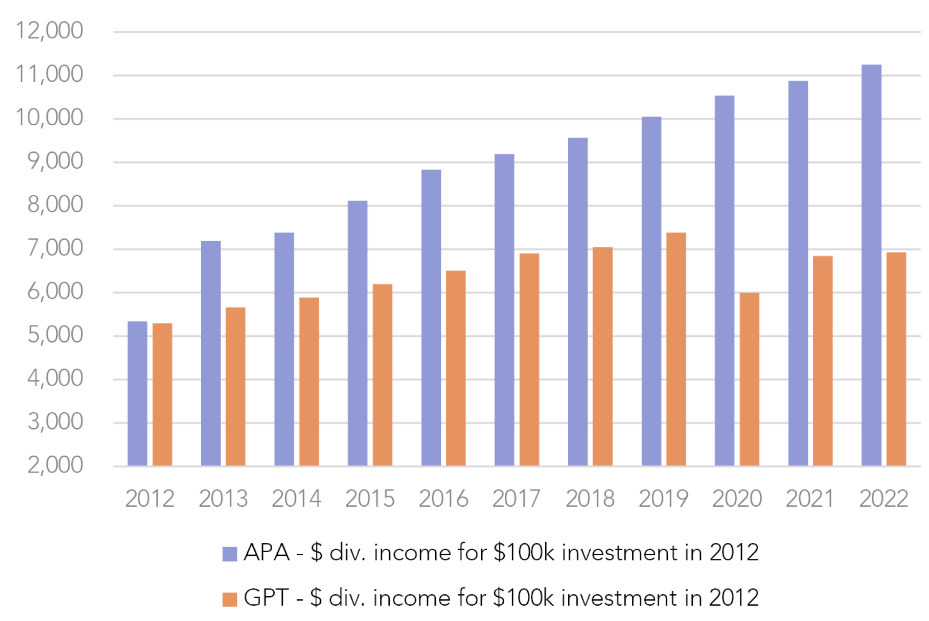

We take APA (ASX: APA) and GPT (ASX: GPT) as an interesting case study to demonstrate how important growth is for dividend investing.

If we invested $100k into APA and GPT in 2012 we would have received a 5.3% yield, so around $5.3k in income for the year for both stocks. By today, the 2012 ($100k) investment in APA would be generating an income of $11.2k or 11.2% yield vs GPT which would be generating $6.9k of income or a 6.9% yield.

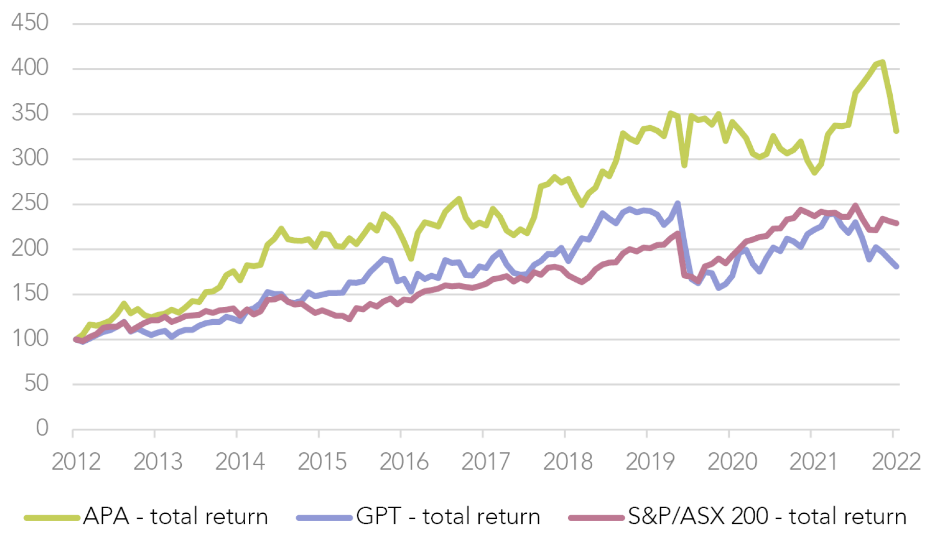

The actual market yields of APA or GPT have not diverged significantly over the last 10 years; both stocks are expected to generate a ~5-6% yield if you invested today. However, the share price of APA has appreciated inline with the income growth and this has led to a significantly higher total return than GPT. The key here is to take a long-term approach when it comes to dividend investing.

Figure 3: APA would have generated more income than GPT with the same theoretical $100k investment in 2012

Figure 4: Market yields for APA and GPT have remained very similar for the last 10 years; market yields at a given point in time don’t show the whole story

Figure 5: APA has outperformed the market and GPT over the last 10 years on a total return basis

Low dividend-yielding stocks aren't inevitably low-income investments (in the long-run)

Over the long-term, high-dividend-yield stocks do not guarantee higher dividend income. Dividend yield and share price appreciation join forces to deliver attractive returns over time. A good example of this is Cleanaway (ASX: CWY), the ASX 100 waste management company.

The consistently low dividend yield of CWY causes income-focused investors to overlook this stock, and other stocks like it. Nevertheless, a dissection of shareholder returns shows strong earnings and dividend growth have contributed to long-term income growth. CWY has outperformed its benchmark as a result over the past decade. Furthermore, the actual income on a $100k investment in CWY in 2016 is expected to be $6.3k by 2025.

Figure 6: Lower-yielding CWY is expected to grow its dividend (and income) 4x over 2016-2025E

Seeking sustainable businesses

Over the last decade, the average dividend yield of the ASX 200 is around 4.5%. However, it is worth considering that dividends are paid at the discretion of the company board, not the shareholders. Even profitable companies cut their dividends due to uncertainty, prioritising balance sheet strength over capital returns.

As a result, we believe it is worth focusing on companies that should generate income, regardless of the macro backdrop. These tend to be sustainable, high-quality businesses.

A high-quality, sustainable dividend stock should also grow its dividend as it is likely to have stable, growing earnings and solid fundamentals. Consequently, they are better positioned to weather potential slowdowns or exogenous shocks.

Conversely, some high-dividend yield stocks tend to be lower quality with less flexibility during tougher times. They often carry more debt and devote more cash flow to paying dividends, leading to higher share price volatility during periods of market turmoil.

Keeping the portfolio diversified

An equity income strategy that uses this growth approach is better equipped to offer a diversified portfolio that can potentially withstand market volatility. Many high yield income strategies have a high concentration on resource companies and the banks. We think a growth strategy should also lead to less concentration risk.

Holistic approach to returns

Overall, we think it is worth taking a holistic view of total return when considering a dividend strategy. Investors should adopt a total return approach when selecting stocks for their portfolios by thinking long-term and understanding that earnings growth will support long-term dividend income.

Screening the ASX for Income

It is important to look beyond just ‘spot’ yields when constructing income-oriented portfolios.

This simplistic approach can lead to a selection of companies with weak or deteriorating outlooks, which – counterintuitively - can result in relatively weak dividend-based returns in the fullness of time.

Therefore, we think it is also paramount to consider companies based on their competitive positioning and industry backdrop, their earnings quality, and their long-term growth outlook.

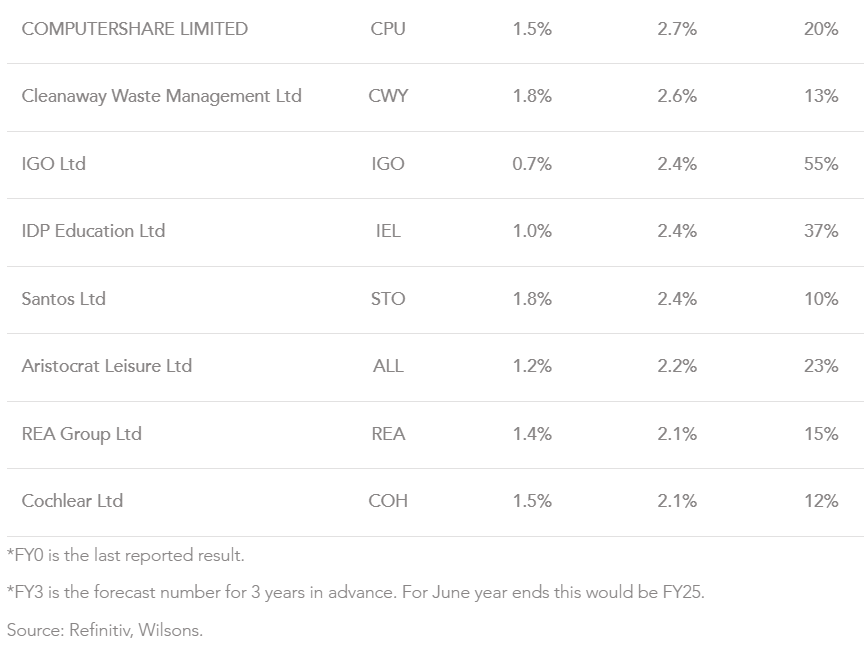

Accordingly, below we have screened the ASX 100 based on:

- FY25 dividend yield > 2%.

- 3-year forecast DPS CAGR – ideally this should be positive or at least flat. Long-term earnings growth is the main driver of investment income over time (not the current dividend yield).

- A balance between growth and yield. I.e. a high yield stock can have lower growth but a low yield stock (2-3%) needs significant growth (>10% DPS CAGR).

- Earnings quality – a qualitative assessment of earnings cyclicality/defensiveness. Our preference is towards companies with predictable earnings underpinned by relatively defensive demand through the cycle.

- Competitive moat / industry backdrop – we favour companies with strong positions in attractive industries that are benefiting from structural tailwinds (or at least, not plagued by disruption/structural headwinds).

- In resources, we have screened out the high-yielding iron ore miners who we believe are in structural decline, and kept the oil & gas and lithium miners who we believe are in a structural uptrend.

Figure 7: Wilsons Dividend Screen

Learn more

WILSONS think differently and delve deeper to uncover a broad range of interesting investment opportunities for their clients. To read more of our latest research, visit our Research and Insights.